I’m sure everyone’s wish for Christmas and the New Year is that no more centralised entities go bust and that we start seeing higher prices. Well, we can’t control both, but at least we can limit our exposure to the former and be advocates of self-custody.

A centralised exchange (CEX) holds custody of your money. If a CEX abuses this custodial relationship, you can potentially lose everything that you have inside, ahem FTX. It’s not the end of the world without CEXes because there are fiat-to-crypto onramps for topping up your wallet and getting right into non-custodial DeFi without ever having to store a single cent on those arcane exchanges.

Today, we will look at how users can get into crypto without ever entrusting their funds to the hands of a CEX. Here’s our guide to crypto on-ramping without a CEX.

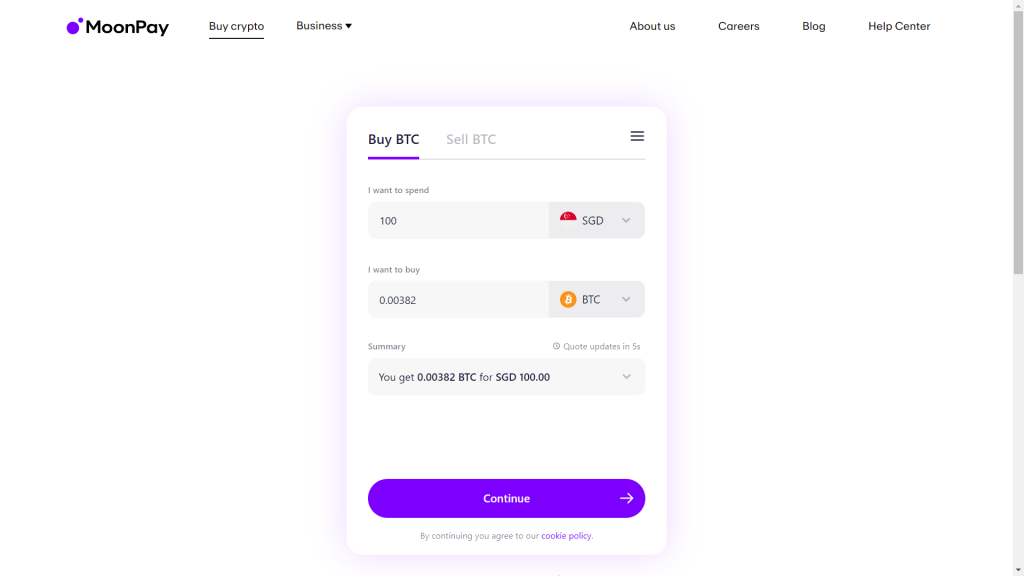

1) MoonPay

MoonPay is a financial technology company that builds payment infrastructure for cryptocurrencies. Their suite of on-and-off-ramp products provides a seamless experience for users to convert between fiat currencies and crypto using all major payment methods, including debit and credit cards, local bank transfers, Apple Pay, Google Pay, and Samsung Pay.

MoonPay is active in more than 160 countries and is trusted by 300+ leading wallets, websites, and applications to accept payments and defeat fraud.

MoonPay offers 23 different crypto coins for users to easily swap with a fee of 1% for bank transfers. For more information on their fee structure, you can click here.

1/ Go direct to DeFi 🚄

— Uniswap Labs 🦄 (@Uniswap) December 20, 2022

Starting today, you can now purchase crypto on the Uniswap Web App using a credit/debit card or bank transfer at the best rates in web3 thanks to our partnership with @moonpay! 💸https://t.co/YVyk8e6d2h

2) Transak

Transak is an onramp and offramp service that supports 130 cryptocurrencies on 75+ blockchains via cards, bank transfers and other payment methods in 125+ countries.

Transak sources liquidity from over ten exchanges to offer the best price for their customers and offers a robust risk engine with less than a 0.05% fraud rate thus far.

Making crypto more accessible for millions of users via @CoinbaseWallet!

— Transak (@Transak) December 2, 2022

We are excited to announce @Transak's integration with @CoinbaseWallet🚀

🇵🇭 Buy Crypto from the Philippines

🇹🇭 and Thailand

🤩Pay with 10+ local payment methods

👉https://t.co/3c2TaXnNya pic.twitter.com/Cugvd7VPvx

For more information on their fee structure, you can click here.

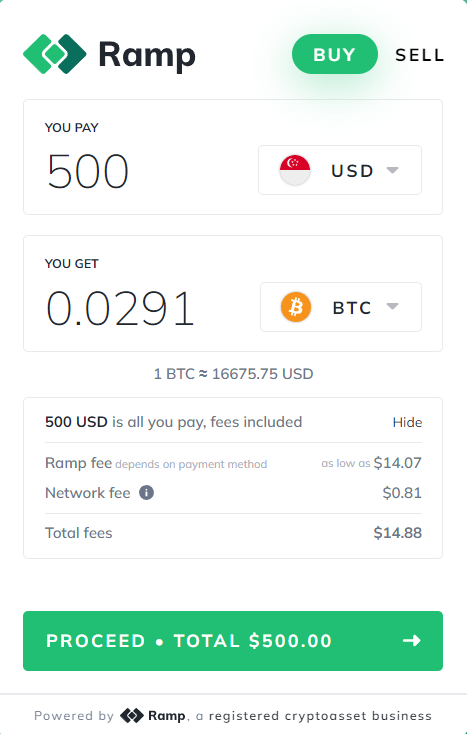

3) Ramp

Ramp is a crypto onramp and offramp service that specialises in facilitating in-app crypto purchases for web3 projects. Ramp aggregate multiple local payment methods to offer the best price, UX, and broadest coverage. Users can purchase crypto using debit and credit cards, bank transfers, Apple Pay and Google Pay, with local payment methods in the works.

Why Ramp?

- Security: Ramp is fully non-custodial and audited by an expert at Quantstamp. Registered as a crypto asset business by the FCA.

- Ease of use: Experience the state-of-the-art onboarding process for newbies and pros.

- Smart KYC: Get verified most easily – connect your bank and get your crypto in seconds.

- Competitive rates & fees: The more you buy, the less you pay. Fees start from a mere 0.49%.

- Fastest fiat-to-crypto: Ramp’s instant verification and settlement get your crypto in minutes.

Finally, @RampNetwork also announced the release of one of the fastest and cheapest off-ramps in crypto, with support for 34 assets across 17 different blockchains.

— Optimism (✨🔴_🔴✨) (@optimismFND) December 16, 2022

Optimism users in the US can use it to off-ramp $DAI and $ETH.https://t.co/M0vCT4BabW

For more information on their fee structure, you can click here.

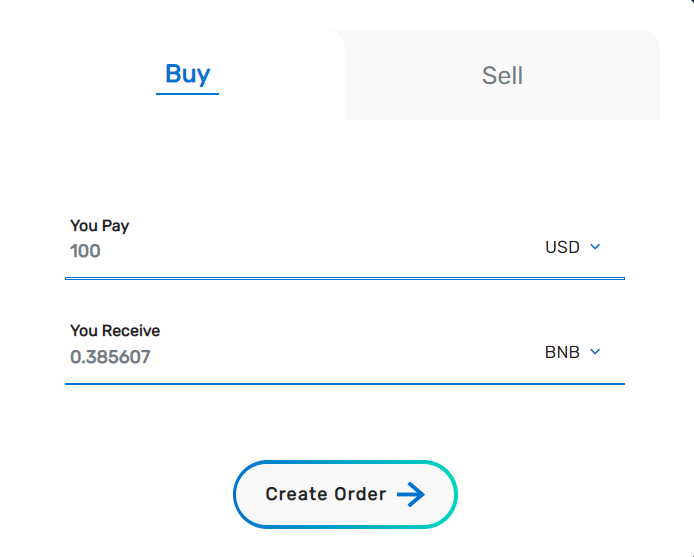

4) Banxa

Banxa is a financial technology platform that provides fiat-to-crypto onramp services plus off-ramping services for stablecoins. Banxa offers more global and local payment options than any other on-and-off-ramp solution resulting in conversion rates up to three times higher than credit card-only solutions.

With Banxa, users have access to 79 different cryptocurrencies, including lesser used stablecoins such as USN, SUSD and CUSD.

Banxa announces its partnership with @1inch to create greater access to DeFi assets by tapping into Banxa's global/local payments options. Read more here: https://t.co/C1Vxw6Ukha

— Banxa (@BanxaOfficial) November 29, 2022

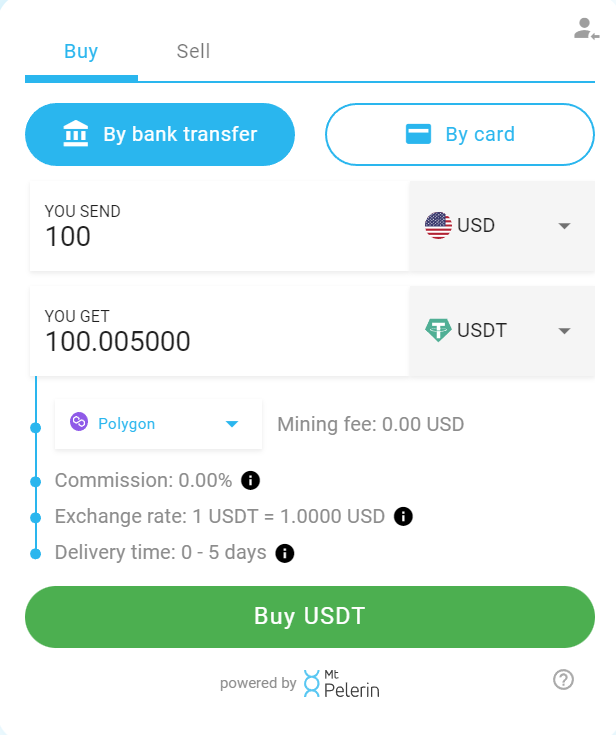

5) Mt Pelerin

Mt Pelerin is a non-US, no-KYC crypto onramp based out of Switzerland.

Mt Pelerin offers an ultra-competitive and attractive rate compared to all the other fiat-to-crypto platforms out there. Users get live market prices and the lowest fees with no hidden costs. On top of that, no identification is required, and anyone can purchase their preferred crypto instantly by card or bank transfer.

Users also have the ability to withdraw them at any time in 14 different currencies back to their bank account in one of the 171 countries supported.

Mt Pelerin offers users a feeless purchase for their first CHF500 or equivalent in a year. Above that, a small percentage fee is charged, which can be discounted if you own their native token MPS.

For more information on their fee structure, you can click here.

Conclusion

While centralised exchanges are popular because they provide easy venues for fiat-to-crypto and crypto-to-crypto trading, they can mishandle customers’ funds. Such ease comes at the cost of a custodial relationship where the exchange ultimately controls any funds you choose to store with them.

By the basis of virtue, a CEX should always maintain customer holdings 1:1. The nightmare scenario is a situation like the FTX debacle where SBF’s trading arm commingled customer funds.

Hence, engaging in a fiat-to-crypto platform allows you to have custody over your assets from the get-go. These onramps are compelling because they offer users ways to quickly go from cash to crypto and right to their personal wallets without giving up control of their funds.

It is important to note that these fiat-to-crypto platforms still have centralised elements, and many require to Know Your Customer info. These platforms are great alternatives if you want to get your crypto directly without touching a CEX.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief