Today, crypto decided to host its very own 3.3 sales across all crypto tokens. The position pump over the recent weeks seems to have finally lost its steam, with Bitcoin down 4.7% on the day. Many altcoins follow in varying impact, some falling harder than others.

As with all other crashes, the main question is why? This largely contributed to prominent players in the space cutting ties with Silvergate, a California bank mainly dealing with cryptocurrencies. This was instigated by Coinbase announcing that it no longer accepts or initiates payments from Silvergate.

[DB] Coinbase Drops Silvergate as USD Banking Partner for Prime Customers, Moving to Signature: Memo

— db (@tier10k) March 2, 2023

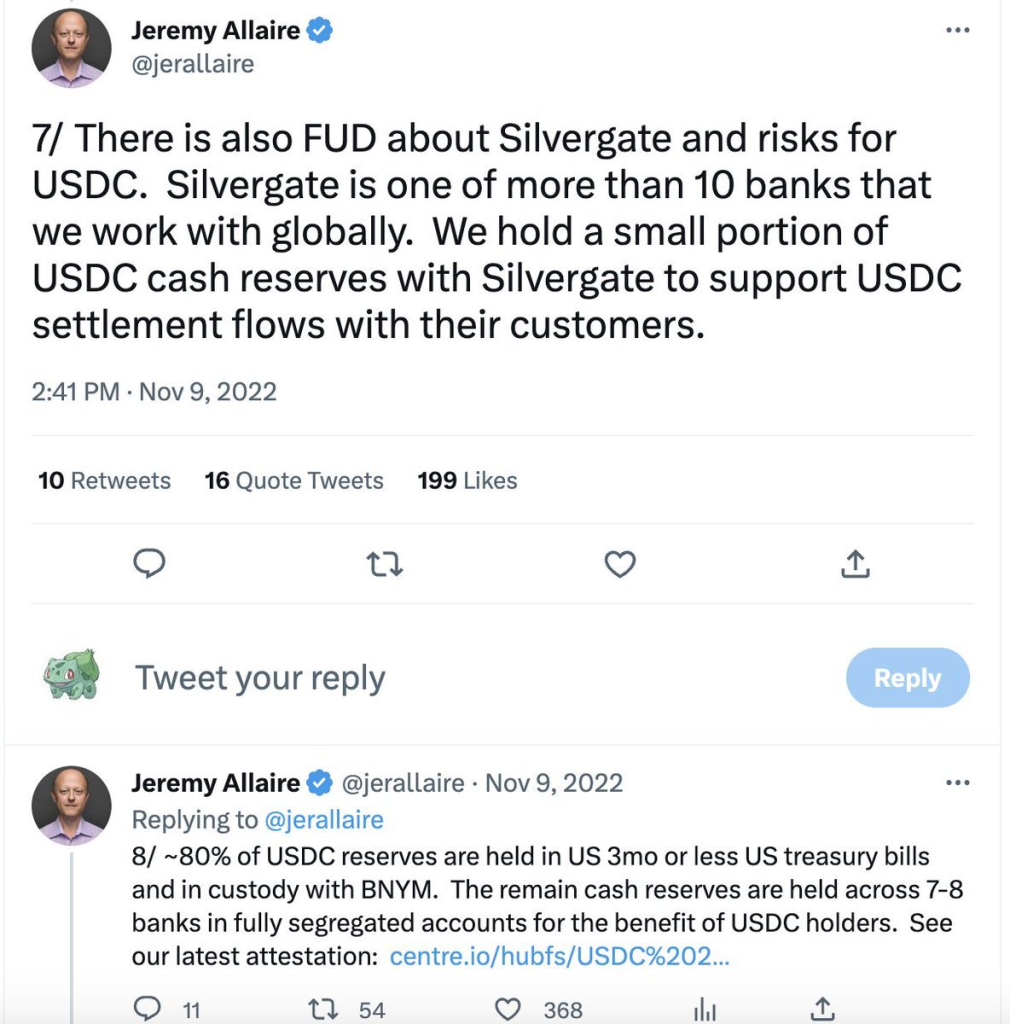

This news caused a contagion of its own, with other crypto partners cutting ties with the bank. Circle, the creator of the popular stablecoin $USDC, is in the process of unwinding services with them. Galaxy capital has stopped accepting and initiating transfers with them, and other big players such as Bitstamp, Crypto.com, and Gemini are issuing the same statements.

Coinbase, https://t.co/a0VsMsMoRA, Gemini, Galaxy Digital and Other Crypto Companies each issued statements saying they have cut ties with crypto-friendly bank Silvergate. pic.twitter.com/DMii5839W8

— CryptoCurrency News (@CryptoBoomNews) March 3, 2023

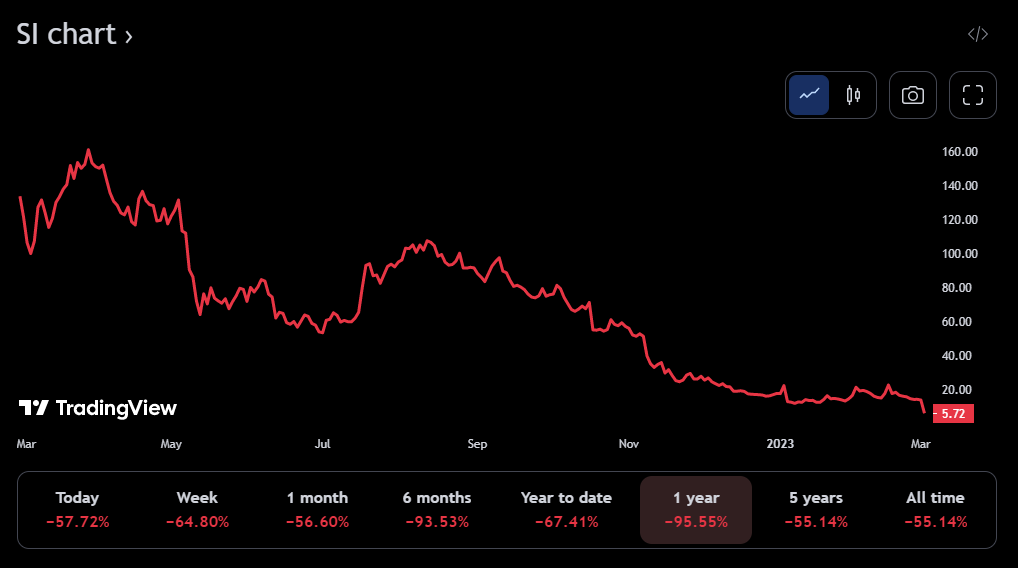

This series of crypto companies distancing themselves from Silvergate was made after they were “unable to meet an extended March 16 deadline for submitting its annual report.” Silvergate’s stock price is currently at an all-time low, 55% down on the 24-hour chart and 95.55% down on its one-year chart.

Silvergate is likely to go bankrupt but…

$USDC exposure is expected to be low. This was confirmed with Jeremy Allaire, the CEO of Circle, who discussed only a small portion of USDC cash reserves being held with Sivlergate to support the $USDC settlement flows with customers.

Will the implication of Silvergate’s death spiral be evidently seen in the drip in the market, North Rock Digital mentioned its impact might not be as meaningful as we think it would be. They further added that”this bankruptcy is not due to crypto. It’s due to bank banking practices.”

Y'all do also realize Silvergate going bust is irrelvant right? Their assets are tiny now as everyone has moved to Signature. Also they are FDIC insured and their assets will just be moved to another bank. Bankrupt? likely. Meaningful? no. https://t.co/nJYlDMQMZA

— Hal Press (@NorthRockLP) March 2, 2023

This sentiment was also shared by the Co-founder of crypto exchange BitMEX on how Silvergate is being run by “a bunch of muppets”.

.@silvergatebank must be run by the biggest bunch of muppets ever.

— Arthur Hayes (@CryptoHayes) March 2, 2023

Step 1: Take USD deposits from crypto firms and pay no interest

Step 2: Buy 3mth US treasury bonds yielding 4.78%

Step 3: Assume $10 billion of deposits, make $478mio a year

That's all you have to do. Muppets

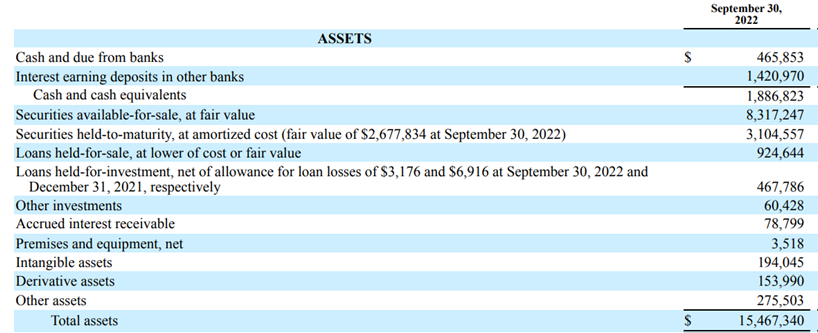

According to Reflexivity Research’s look into Silvergate’s balance sheet back in December 2022, Silvergate Silvergate was “holding $15.4 billion in assets, and of this value, $8.3 billion is made up of securities marked to market that are redeemable for cash proceeds at any time.”

They further added that the crypto-friendly bank “does not hold crypto.”

They also talked about how Silvergate “stated in the letter that its FTX exposure was limited to deposits, and no loans were made to the entity. Regardless of FTX/Alameda exposure, Silvergate has faced much scrutiny around allowing transfers, presumably co-mingling FTX customer funds.”

While direct contagion impact seems overblown, no crypto assets are on their books might be positive news for the crypto market. But then again, the visibility on this was in Q4 of 2022. Until we see their latest annual report, their balance sheet changes could have been made.

Did Silvergate have a bank run all this time? While we ride the temporal high of the 2023 market performance, darker shadows loom in the backgrounds. The fall of Silvergate spells danger for crypto on-ramps, and accompanied by strict regulatory direction by the US government bodies, crypto seems to get higher walls to jump by the day.

Not forgetting new reports by WallStreetJournal on how “FTX Says $8.9 Billion in Customer Funds Are Missing”.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief