Blend is probably where NFT meets DeFi! Blend is unlocking the liquidity of NFTs!

Crypto Twitter is abuzz with how Blend is making inroads to pioneer the future of NFT lending.

Blend loans have introduced liquidity into the NFT market. As a result, the floor prices of popular NFT collections such as Azuki, Cryptopunks and Miladies that can be pledged as collateral in exchange for a loan on Blend have risen.

However, are things as rosy as it seems?

New innovations often bring about both opportunities and risks. In this article, we shall examine how this new NFT lending platform Blend works, its unique value proposition and risks.

Also Read: NFTs Are Exploding … On The Bitcoin Network

What is Blend and How Does It Work?

Blend is a peer-to-peer perpetual lending protocol for NFTs that was conceptualized by researchers at crypto investment firm Paradigm and implemented by developers at NFT marketplace Blur.

There are no oracle dependencies or expiries with Blend, users can now borrow ETH against their NFT holdings without having to sell their digital collectibles.

The loans will remain open until they are repaid or liquidated. Loan interest rates are based on the prevailing market rates. This is a unique approach as market forces determine the loan interest rate and borrower liquidations.

A sophisticated off-chain offer protocol facilitates the matching of lenders with borrowers based on the most competitive rates.

Borrowers benefit from making loan repayments as and when they wish to while lenders can initiate a Dutch auction to find a replacement lender with a different loan rate.

In the event of an unsuccessful Dutch auction, the borrower gets liquidated and the lender assumes ownership of the NFT pledged.

Lenders, on the other hand, can earn Lending Points on the Blur platform on top of a regular yield.

A lender appraises the NFT and determines the maximum amount of ETH that can be borrowed as well as the loan APY.

As soon as a borrower accepts the loan offer, the lender starts to accrue interests in ETH and the NFT is locked up.

The lender reserves the right to close out the loan at any time to collect the accrued interests. The borrower will have to repay the loan within 30 hours or refinance the loan with another offer. If not, the lender assumes custody of the NFT.

How do you construct a lending protocol that supports arbitrary collateral, has no oracles, and has no expirations?

— Dan Robinson (@danrobinson) May 1, 2023

Read the whitepaper to find out: https://t.co/wZAXKjQh1x

(hint: when in doubt, try Dutch auctions)

Blend’s Unique Value Proposition

Besides the borrowing functionality, what sets Blend apart from its competitors is the Buy Now, Pay Later (BNPL) feature that it provides.

5/ BUY NOW, PAY LATER

— Blur (@blur_io) May 1, 2023

On the flip side, if you want a punk, you can now use BNPL to buy a Punk with only 8 ETH up front. The rest is borrowed. pic.twitter.com/Q7709m6rQN

From the onset, Blend will support three NFT collections – CryptoPunks, Azuki and Milady Maker – with more digital collectibles to be added in time to come.

The BNPL feature works like a mortgage-like system where users can purchase an NFT with an initial down payment upfront and take a loan from Blend for the remaining outstanding amount. Users can then repay this loan over time.

How Blur Is Incentivizing The Use of Blend

The launch of Blend introduces further utility of the $BLUR token, solidifying Blur’s position as a top NFT marketplace.

The higher the maximum borrow value, the higher the Lending Points earned.

The lower the APY that a lender is willing to lend at, the higher the Lending points earned.

For selected collections, the Lending Points that can be currently earned have been doubled.

8/ POINTS

— Blur (@blur_io) May 1, 2023

Lending points have replaced listing points on Punks, Azuki, Milady, and are now visible.

Select collections will still receive 2x points. All others now earn 1x points.

From now on, points may change on a per collection basis. Learn more https://t.co/Q9nl67ri8e pic.twitter.com/YVl3XvBQ5d

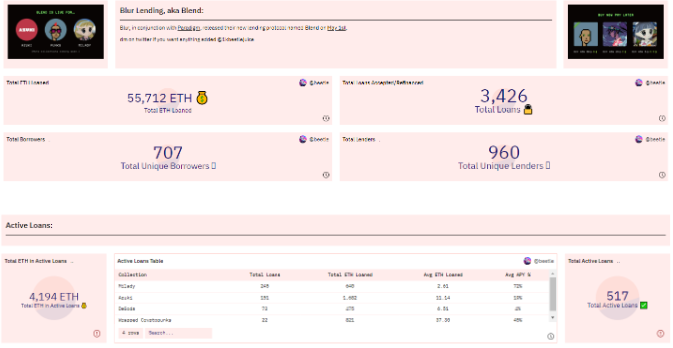

Blend is off to an impressive start, with more than 55K ETH loaned out and total loans exceeding 3.4K.

However, critics have also expressed concerns that regular NFT users should stay away from Blend given the risks and complexities. Many of them also lack the basic understanding of leverage and liquidations.

With such a significant amount of ETH borrowed against volatile NFTs, it can be a cause for concern.

Final Thoughts

The concept and design of Blend is indeed novel and may spur other DeFi projects to avoid oracle dependencies in their core protocols as well.

However, there are risk factors to consider and Blend is not suitable for everyone as it involves leverage. This is especially so if users lack a firm grasp of basic financial concepts such as leverage and liquidations.

Lenders can trigger a refinancing auction at any time, typically when there is a fall in the price of these NFTs that serve as collateral as there is a higher risk of the loan becoming undercollateralized.

In short, Blend is probably not suitable for the average NFT collector.

Also Read: A Cross-Chain Future? Learning Lessons From History’s Global Superpowers

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief

This article was written by Clarence Lee and edited by Yusoff Kim