With the persistent inflation affecting the US economy due to 2 years of easy credit (low benchmark interest rate of 0 to 0.25%), the Federal Reserve has pivoted from its stance of inflation being “transitory” to taking a more active approach in bringing down inflation through rate hikes.

In this article, we will explore how Fed’s monetary supply and interest rate works, how it affects the crypto markets and Fed’s future policy direction.

How Fed’s Monetary Supply and Interest Rates work

This refers to the rate at which banks and other financial institutions lend to one another. When the Fed increases the interest rate, it lowers monetary supply as it increases the cost of borrowing which decreases demand in the overall demand in the overall economy.

A higher interest rate results in higher mortgage loan rates, credit card APRs and other consumer and business loan rates. Businesses will not be able to borrow as cheaply and often they pass off these costs to consumers by raising prices.

Consumers have less disposable income to spend as their home loans and bills would have increased thus decreasing business revenue/profits. This results in a decrease in demand across the economy.

Any impact on the stock market to a change in the interest rate changes is generally experienced immediately, while, for the rest of the economy, it may take about a year to see any widespread impact.

To summarize, a rise in interest rates leads to:

- Increase in cost of capital for businesses

- Lowers consumer spending

- Decreases business revenue and cash flow

How this affects the Crypto Markets

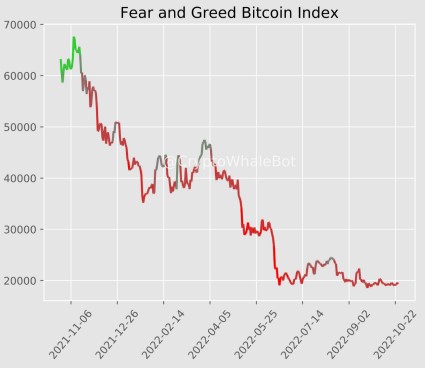

As Crypto is seen as a “tech stock” and a speculative asset, it has tumbled dramatically as the Fed’s stance turned more hawkish since November 2021. As interest rates have steadily increased since March 2022, so has US 10-year treasury yield.

The US 10-year treasury yield represents the “risk-free” rate that investors are able to park their money. US 10-year treasury yield is currently at 4%, it offers returns that investors find attractive in the current Marco-economic environment.

This causes a sector rotation from high-risk assets such as growth stocks and crypto, to safe-haven assets such as bonds, cash and financial stocks. Since June 2022, Bitcoin has hovered between 18k USD to 25k USD.

When interest rates rise, there’s a spillover effect on crypto that causes crypto prices to decline. This spillover effect is motivated by slowing economic activity, less business investment and activity, and a negative macroeconomic backdrop not conducive to crypto.

The below table shows the past 5 hikes so far this year.

| Fed Rate Hike Date | BPS Rate Change |

| March 17, 2022 | +25 |

| May 5, 2022 | +50 |

| June 16, 2022 | +75 |

| July 27, 2022 | +75 |

| September 21, 2022 | +75 |

Due to continued high inflation numbers, the Fed became more aggressive in rate hikes with 3 consecutive 75 basis points rate hikes.

This rattled the crypto markets causing a sharp decline in prices. This is in contrast to when interest rates were near 0% in 2020 and 2021, it was a huge factor leading to Bitcoin’s ATHs and helped cryptos become more mainstream.

Future Fed Policy Direction

In his message in September at Jackson Hole, Jerome Powell reiterated that “The FOMC is strongly resolved to bring inflation down to 2%, and we will keep at it until the job is done.” Fed officials have signalled that they will increase the rate to 4.6% which is their terminal rate or endpoint in early 2023.

Thus the Fed will continue to increase the interest rate by 100 to 125 basis points by the end of December 2022. The market expects a 75 basis point increase in November’s Fed meeting while a 50 basis point increase in December’s Fed meeting.

Projections show the Fed’s key rate easing to 4% by the end of 2024. The Fed also introduced rate guidance for 2025, the key rate is seen falling to 3% then.

With the US unemployment rate dropping to 3.5% in September from 3.7% previously, this gives the Fed more room to manoeuvre and to increase interest rates further as their target unemployment rate is 6-7% before pivoting and dropping interest rates.

Closing thoughts

As mentioned earlier in the article, it will take 1 year for the Fed interest rate hikes to be felt in the wider economy and also for it to be reflected in economic data. This could trigger a wider recession and raise unemployment meanwhile.

In 1982, when then Fed chair Paul Volcker indicated a Fed pivot, this led to double-digit returns in the S&P 500 that trading day. Markets are now eagerly anticipating when the Fed will pivot and become Dovish again as when that happens, we are off to the races.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief