If you heard of the Mango Market exploit, the “profitable trader” is back. This time he has his sights on AAVE and Curve. The trader is presumed to be Avraham Eisenberg, also known as Avi on crypto Twitter. He shared his story on the Mango Market manipulation on an Unchained Podcast with Laura Shin.

We try to unpack everything that happened between Avi, Curve and AAVE and show why DeFi may be a viable alternative to centralized entities.

TLDR

- Short CRV

- Borrow CRV against USDC on AAVE

- Dump CRV for max slippage

- Withdraw max USDC collateral, manipulate oracle price for favourable DeFi loans

- Close CRV shorts, AAVE left with bad debt

- CRV announce plans for the new stablecoin, CRV pumps

- A short squeeze puts Avi’s shorts in danger, gets liquidated

- Avi’s liquidation pump did not go as intended

Avi has his eyes on CRV and AAVE

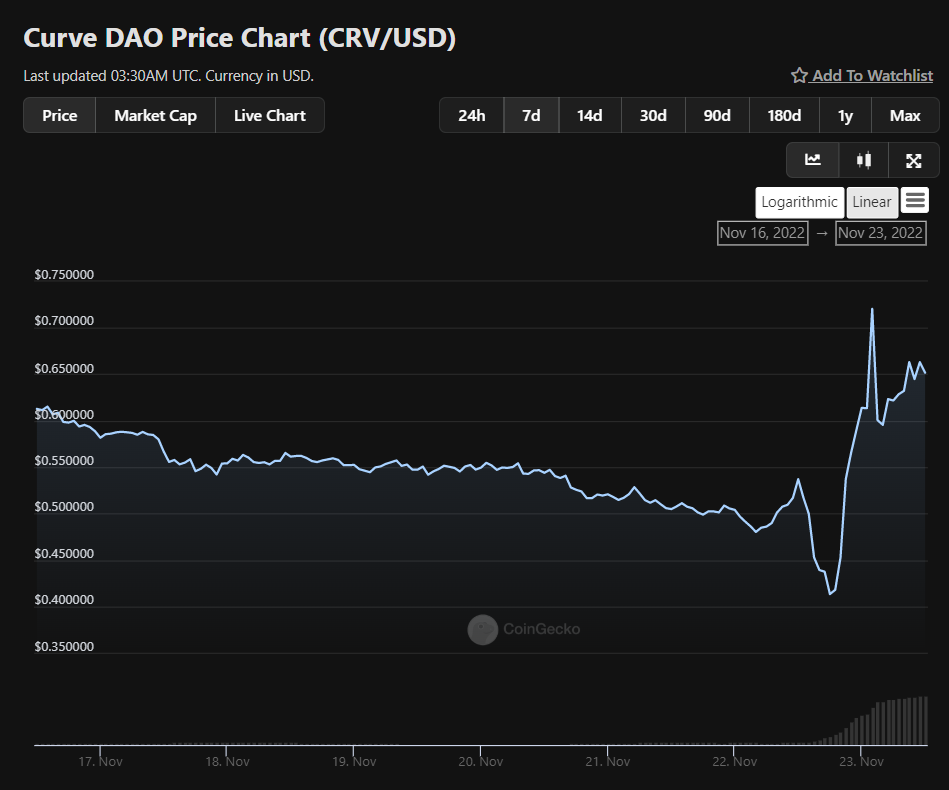

This episode started when Avi first swapped $40M USDC into AAVE to borrow CRV for selling. This caused the price of CRV to fall from $0.537 to $0.407, a drop of 24%.

At the same time, Avi took a short position, leveraging the downward pressure of selling CRV on a CEX platform.

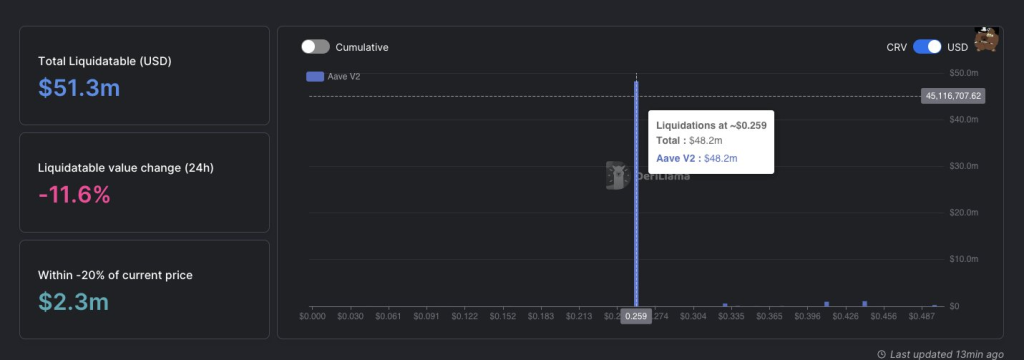

On the surface, it seems like Avi is attempting to liquidate Curve’s founder, Michael Egorov, after the CEO took a 9-figure position, amounting to $48M of CRV supplied on AAVE with a liquidation price of $0.259.

The attacker planned to take favourable leverage positions, targeting the liquidation price of the position Curve CEO took. Avi will do this by manipulating the price of CRV for the market to dump CRV till the liquidation price of $0.259 is reached.

With the size, he is attempting to accomplish this feat, leaving AAVE with a ton of bad debt.

A TLDR of what could have transpired, if Avi gets liquidated, AAVE has to buy 80M CRV on-chain, potentially bringing the price up.

If Curve’s CEO Michael gets liquidated with his $50M CRV position, CRV will bottom indefinitely. Disaster and all hell break loose.

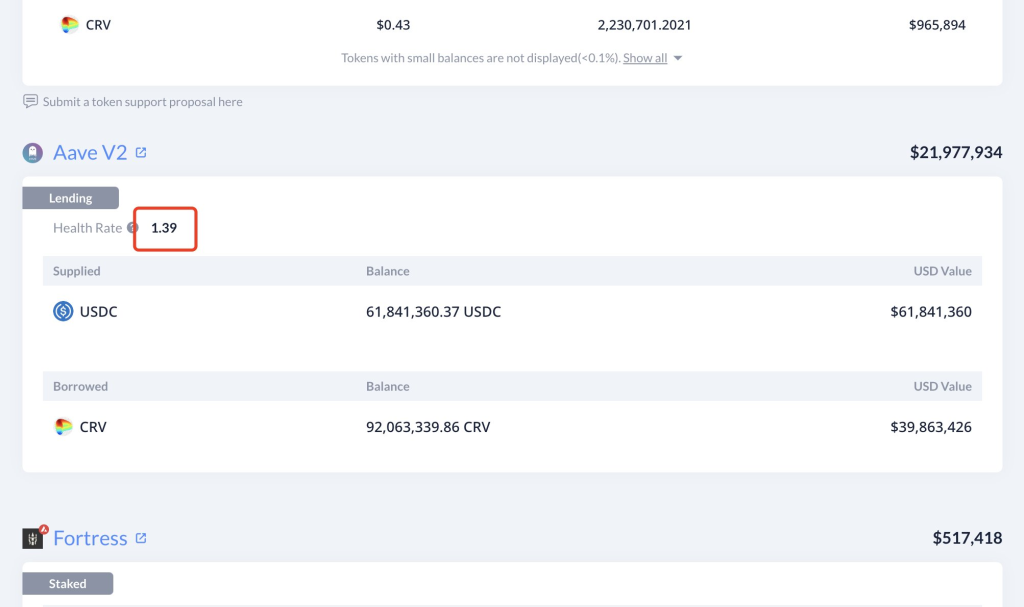

Furthermore, Avi borrowed another 30M CRV from AAVE through two transactions. At this point, Michael’s position stands at a health rate of 1.62. Assets will be liquidated if the value falls more than or equals 1.

This trade was conducted to drive down the token price of CRV, resulting in those who used CRV as collateral facing liquidation risks.

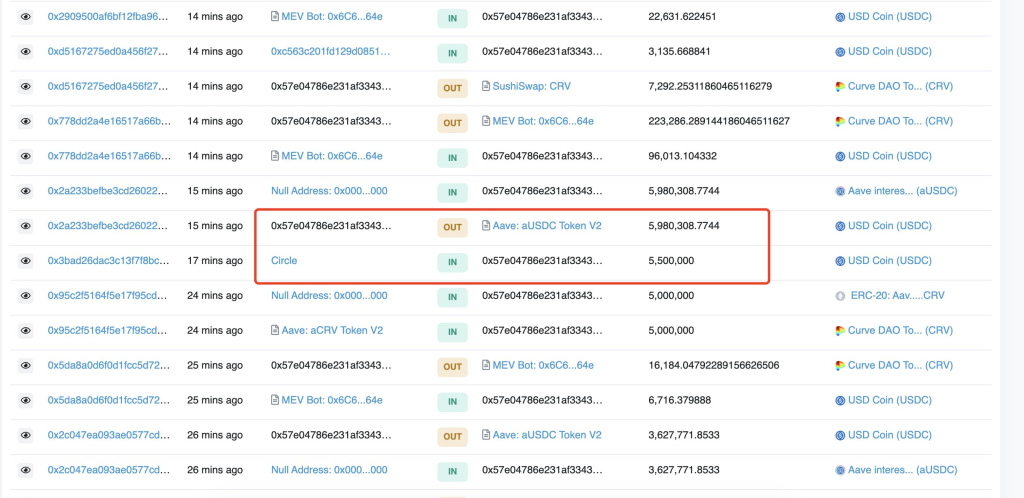

What Avi did next was add USDC as collateral and continue to borrow CRV from AAVE to keep up the downward pressure.

In total, he borrowed 92M in CRV, equivalent to $39.86M, forcing the health rate of Michael’s position to 1.39.

Avi even used MEV bots to dump CRV to drain CRV’s liquidity.

The result of the downward pressure will likely encourage Curve’s founder to add $20M more in CRV collateral. Apart from the back and forth between Avi and Michael, it was hypothesised that the real target was AAVE.

Using $40M to borrow $50M of CRV could leave AAVE with severe bad debt.

This bad debt would amount to millions; at this point, Longing CRV / shorting AAVE’s token could be ways traders can profit.

The argument around Avi trying to liquidate the CRV whale @newmichwill was probably psyops.

— Arkham | Crypto Intelligence (@ArkhamIntel) November 22, 2022

The real target here was AAVE's vulnerable looping system, which Avi mentioned last month.

Using $40 million to borrow almost $50 million of CRV could leave AAVE with severe bad debt. https://t.co/a7l1TcKe16

With the real target being AAVE and Curve is just collateral damage, Avi wanted to force a liquidation on this position, where AAVE liquidators would have no way to buy back all the CRV he borrowed.

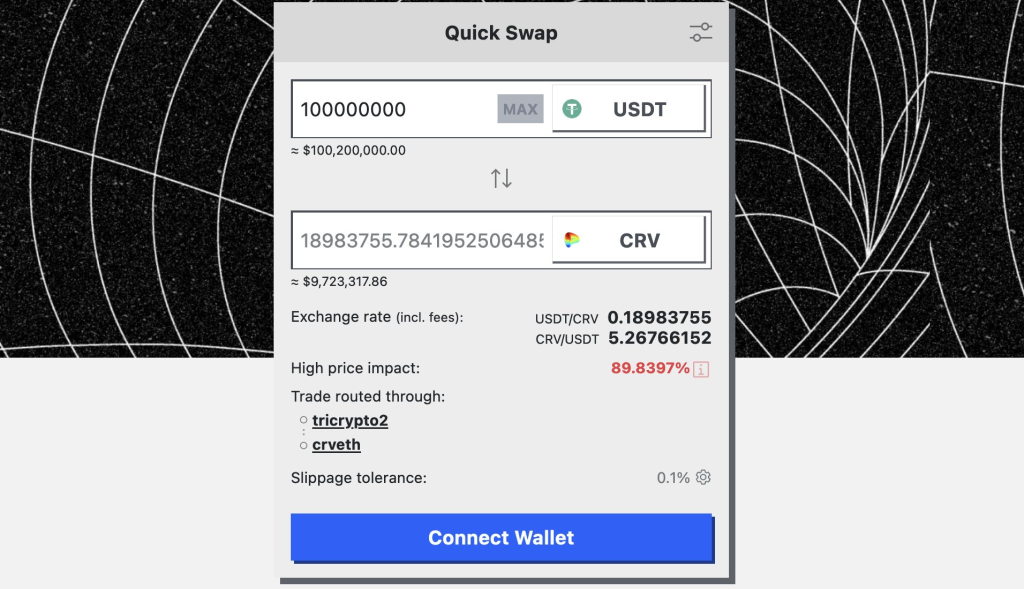

AAVE will then have to sell significant tokens from the safety module to cover its losses. The screenshot below shows an 89% price impact for the swap between USDT and CRV for a $100M position.

Avi’s goal was to create a scenario with limited CRV on-chain liquidity, which will pump the CRV token with the $50M repurchase from Avi’s USDC collateral.

The saving grace

We all know what UST did to the entire crypto industry. This time, a particular stablecoin could be our saving grace. Coincidentally, the release of CRV’s new stablecoin white paper happened on the same day.

The white paper reveals the stablecoin design of LLAMMA, a Lending-Liquidating Automated Market Maker Algorithm, which converts between collateral and the stablecoin.

For instance, if the price of a collateral ETH dips, the AMM will convert deposits to a stablecoin. This model prevents positions from being liquidation and has no risk of bad debt.

This new release came at an interesting time, causing a sharp rise in the price of CRV, putting the collateral for the trader’s loan in danger.

With the pump in CRV, Michael did not need to cover his position as there was enough liquidity in the system.

This also meant that Avi’s intended long/short squeeze was not as violent as intended, but it could have worked if Avi had borrowed a bigger size.

2 hours ago, ponzishorter.eth had 3.9M $USDC liquidated on #Aave to buy $CRV to repay the debt.

— Lookonchain (@lookonchain) November 22, 2022

ponzishorter.eth doesn't seem to add margin anymore.

His health rate is 1.03 now.

If the price of $CRV rises by 3%, it will face another liquidation.https://t.co/dEA8wwuFaA pic.twitter.com/tZhIkkOzwj

Eventfully, this left to Avi, having $3.9M USDC liquidated on AAVE to buy CRV to repay the debt. With a health rate of 1.03, if CRV rises by 3%, it will face another liquidation.

The aftermath, however, still had implications for AAVE. Even with the liquidations being successful, the size of the position made by Avi left excess debt within the protocol.

AAVE’s tweet states, “A large CRV borrow that had been building up for the last week was mostly cleared by the protocol liquidation process. However, the position was not covered entirely & 2.64M CRV (≈ $1.6M at current value) remains. This represents < 0.1% of the borrows on the protocol.”

Closing thoughts

Having bad debt is never pleasant. The $1.6M hole AAVE has to cover is a cheap lesson than if things took a turn for the worst. Especially in prolonged market downturns, liquid assets may be prone to higher risks, and such parameters should be adjusted accordingly.

However, it also showed one thing, liquidations work flawlessly. Trust the code, they say, and even during crunch times like these, the code turned out the clutch.

Love him or hate him, what Avi did with Curve and AAVE has a silver lining. Some say his attempt to drain Curve liquidity was stress-testing DeFi, “forcing even blue-chip protocols to consider every possible attack vector.” But it also shows the vulnerability of big protocols, being exposed to manipulation, a good lesson for all other projects to be cautious about.

While FTX is cracked under pressure, DeFi functioned perfectly. This, however, is not to be contrasted to market conditions; with stronger Macro factors in play, the credibility of DeFi after this incident should be taking positive steps forward.

If we draw a comparison to centralized entities, everything on-chain was transparent. The transactions were traceable and auditable on-chain, providing users and the community transparency, and eventfully, enabling crypto Twitter to join the front lines to defend Curve.

AAVE ended up with $1.5M in bad debt, and everyone on crypto Twitter knew immediately. DCG’s Genesis ended up with $1.5B in bad debt, but no one knew after six months??? This itself gives me a reason to say DeFi reigns supreme.

Also Read: If You Thought FTX’s Fall Is Huge, Genesis Crashing Would Cripple Crypto

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief