dYdX announced its plans for v4 last year, with co-founder Antonio Juliano stating that it “will be open source and that dYdX will not be involved in the operation of the protocol” – making it fully decentralized in the hands of the community.

In this article, we’ll dive into why they have chosen to build in the Cosmos ecosystem and what this means for dYdX’s future.

Core Problems with dYdX: The Gap in Decentralization

The promise of decentralization by dYdX has long been a subject of debate within the community. While dYdX has branded itself as a decentralized exchange, there were key components of its structure that challenge this notion.

Firstly, a significant concern arises from the front-end of the decentralized exchange (DEX), which serves as the user interface connecting users to the underlying blockchain.

While the blockchain itself may be decentralized, the front-end can still be controlled by a single entity. This is often due to the complexity and resource-intensive nature of developing and maintaining a front-end, leading to its control by the main organization.

This situation leads to various problems, such as the potential for misuse, a single point of failure, compromising user data privacy, and the ability to exercise censorship…

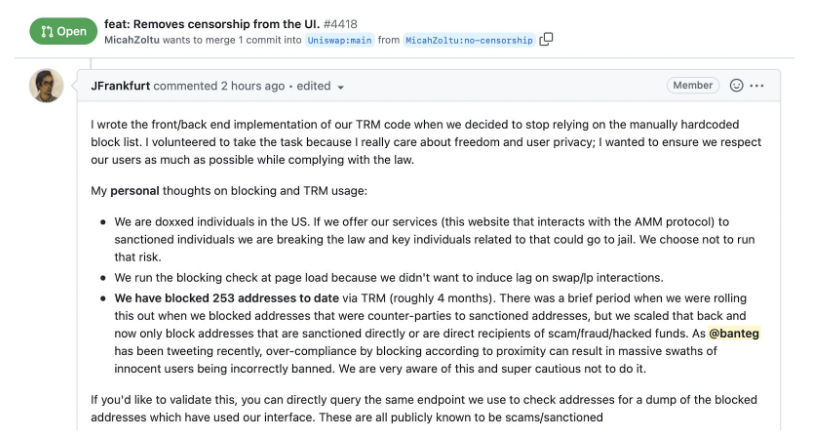

A cautionary example can be observed in the case of Uniswap.

In 2022, they experienced issues due to the centralization of their front-end. Notable incidents included the implementation of a policy that raised concerns about data privacy, periods of downtime affecting trading volume, and the censorship of specific tokens and addresses due to US sanctions.

While the Uniswap Protocol itself remains autonomous, the front-end is controlled by developers, resulting in a degree of centralization that is far from ideal and sets a dangerous precedent for the future of DeFi.

Secondly, another issue lies in the execution layer of the platform: the order book and the matching engine.

Despite being built on Ethereum smart contracts and STARK rollups – which support full transparency and self-custody of funds and positions, the exchange’s reliance on a centralized matching engine hinders its complete decentralization.

Although this enables dYdX to handle tens of millions of orders daily with minimal latency and become one of the most liquid exchanges in the DeFi landscape, the question remains: Can dYdX truly claim to be decentralized when its order book and matching engine are controlled by a central entity?

I’m not sure how many times people need to be surprised that dYdX is not fully decentralized right now

— Antonio | dYdX (@AntonioMJuliano) August 11, 2022

We run a hosted matching engine on which we, like basically every other central operator, run compliance checks

We are building V4 which will be fully decentralized https://t.co/V0aLbXkPch

Founder Antonio Juliano acknowledges this conundrum on Twitter, stating that dYdX is not currently fully decentralized due to compliance checks performed on their hosted matching engine.

This raises broader concerns within the community regarding the platform’s messaging and transparency, alongside an endeavor that poses its own set of challenges and questions around scalability and efficiency.

Also Read: Exploring Cosmos’ Security Solutions for App-Chains

Building on Cosmos For Scalability

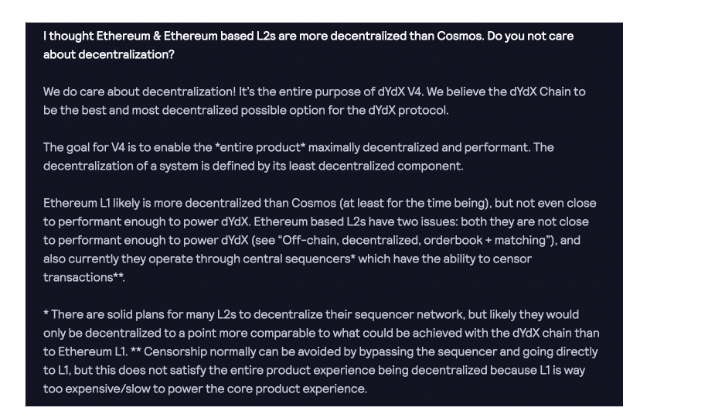

In their FAQ section, dYdX stated that “Ethereum-based L2s are not close to performant enough to power dYdX, and also currently operate through central sequencers which have the ability to censor transactions.”

From the above, we understand that their viewpoint suggests that Cosmos is superior in terms of scalability. Continuing with the Ethereum L2 network implies that there may always be potential for transactions to be censored, contradicting their decentralized ethos.

As such, the team decided to build their sovereign chain using Cosmos toolkits. dYdX would be able to build their own chain almost seamlessly with Cosmos Infrastructure (Tendermint, CometBFT, Inter-Blockchain-Communication Protocol), especially for a scale of their kind.

This will help them achieve their goal of building the best fully decentralized protocol while ensuring high throughput and customizability.

Yes we did. We just wanted to develop a standalone L1 for reasons mentioned and then found Cosmos SDK to be the highest quality option for that

— Antonio | dYdX (@AntonioMJuliano) June 22, 2022

Building on Cosmos will also facilitate the seamless porting of many multi-chain assets through the Inter-Blockchain Communication Protocol (IBC), allowing the trading options to grow ever-more.

While blockchains developed on top of Tendermint may have distinct application layers, their shared networking and consensus layers through the core engine make it easy for them to connect.

This implies that IBC can be utilized to create a wide range of cross-chain applications that extend beyond oracle data feeds, interchain accounts, and token transfers. For instance, it is simple to transfer your assets from JUNO to OSMOSIS with just a few clicks.

What should we expect for v4?

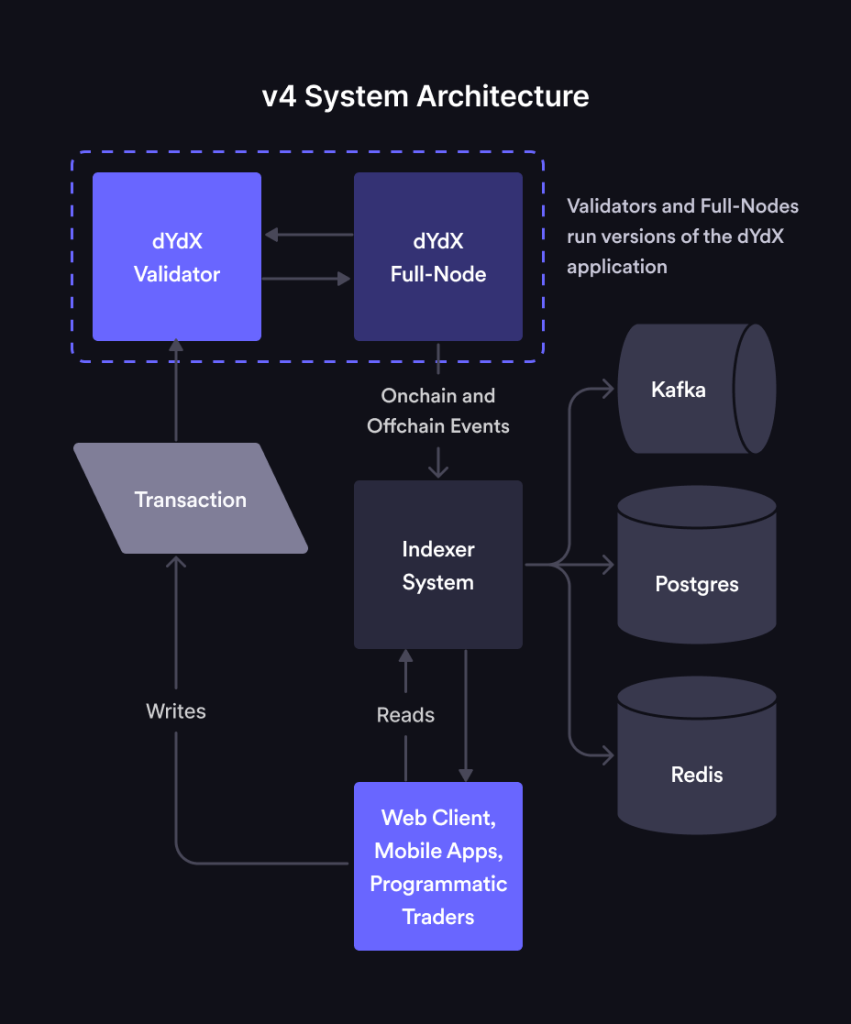

With the introduction of dYdX v4, the central points of failure will become a thing of the past, as the community can easily gain access to the protocol attributed to its fully open-sourced nature.

Here’s what to expect:

- Currently, dYdX’s off-chain system is capable of handling around 500 orders per second, which is significantly higher than the number of trades executed per second. However, with the upcoming v4 update, dYdX has set its sights on further increasing its order capacity.

- dYdX is committed to preserving the rapid response of the current off-chain matching engine while transitioning towards a decentralized architecture.

- Introduction of a range of trading products: spot trading, margin trading, and a variety of synthetic products, catering to different trading styles and strategies.

- Enhancements to the margin and collateral options are available.

Open-Source Front-End Development and Decentralization

In order to tackle the issue of centralization in the front-end, dYdX v4 has taken a proactive approach by refraining from operating a front-end, indexer, or validators. Instead, the focus is on developing open-source code to promote transparency and encourage community involvement.

To cater to the diverse needs of its user base, dYdX is working on multiple front-end options, including a web application for browser access and two mobile applications for iOS and Android. Additionally, advanced users and institutions can utilize software development kits in Typescript and Python.

All front-end codebases and deployment scripts will be open-source to enable individuals to deploy their own instance of the dYdX front-end on their servers. This will inevitably lead to multiple deployments, enhancing decentralization, and providing resilience against censorship or downtime.

The dYdX private testnet was held in Q2 among selected validators, and the mainnet can be expected sometime in 2023!

The dYdX Private Testnet is planned to begin on 3/28/2023 and will last 2-3 weeks. Now that we have completed the technical implementation of this milestone, a limited number of validators will verify the functionality of this initial external testnet.

— dYdX (@dYdX) March 27, 2023

Conclusion

dYdX’s upcoming release of v4 signifies a major leap towards true decentralization and transparency. By adopting an open-source approach and relinquishing control over key components now, dYdX actively involves the community in shaping its future.

Additionally, Cosmos technology allows dYdX to benefit from increased interoperability and seamless integration with other protocols and networks. With the forthcoming of dYdX, existing partners can leverage network effects from incorporating dYdX, and allow users to truly access Decentralized Finance throughout the interchain.

Also Read: Neutron: Cosmos’ Key To an Interchain Future?

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief

This article was written by Jowella and edited by Yusoff Kim