The crypto market is known for its volatility and unpredictability, yet one thing is sure: bull and bear cycles will come and go. Over the past decade, the crypto market has undergone several bull cycles, each providing valuable insights for the next one.

These cycles not only reveal patterns and trends but can aid us in (possibly) predicting what may come in the next bull run. Today we explore lessons from historical market cycles, what will come in the future cycles and how you could prepare for it.

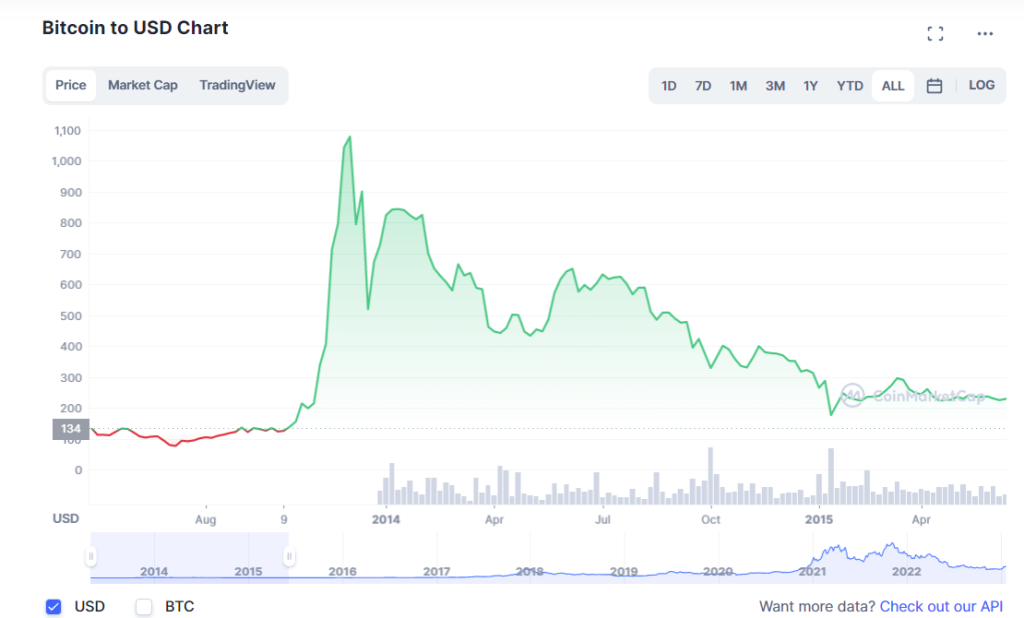

The 1st Cycle, 2012-2014

Bitcoin today is commonly regarded as a store of value, but in the first Cycle, it was first recognized as a medium of exchange. This recognition spurred the first bull cycle in the crypto market, boosting the digital currency 158x over the two years. Bitcoin is truly the solo carry.

The introduction of crypto exchanges like Kraken in the US and Mt.Gox as a Bitcoin exchange grew popular. They aided the inflow of retail investors buying into this bitcoin/crypto narrative, resulting in the total crypto market cap surge from $75M to $12B, a 160x in two years.

Nothing S&P500 could possibly give you.

With that came the 1st bear market in crypto. With the massive price, run-up came 90% drawbacks, sending the crypto market into pure fear.

A correction S&P500 would unlikely give you.

While many believed Bitcoin would go to zero, a young genius named Vitalik Buterin dropped a whitepaper on an idea of new technology, one which involves fundamental principles of smart contracts and what we know today as Ethereum.

The 2nd Cycle, 2016-2018

The 1st crypto correction lasted a little more than two years; at the same time, growth in tech stocks cast a greater shadow over what remains of the crypto market.

As mentioned earlier, whatever went up, went down. So rightfully, whatever goes under will emerge. This came in the form of the 2nd crypto bull run, smashing the price ceiling of previous highs in the market.

BTC made a 93x, while Vitalik’s ETH made a 2664x. That is some serious money.

As the Ethereum ecosystem continued to lay the groundwork for smart contracts, the dawn of the centralized exchange boom arrived to meet the demand of retail investors’ adoption. The rise of stablecoins and the ICO boom all lifted their weights in pushing the market to its new all-time highs.

That brought the total crypto market cap from $4B to $802B. At this point, space seems invincible, but as with every financial asset, whatever goes up, must come down.

This was taught through the ICO crash and China banning crypto in 2018. In dramatic fashion, BTC’s price crashed from its high of ~$19.7K to a low of ~$3.4K.

Despite the 2nd bear market in crypto serving drawbacks in price, it came with what I would like to call the greatest ideation phase in crypto. This was where the idea of multi-chain, DeFi, NFT, and Play 2 Earn gaming started in their respective early stages.

The 3rd Cycle, 2020-2022

This Cycle saw the first trillion dollars committed to crypto. This was achieved with the fruition of multi-chain, DeFi, NFT and play 2 earn concepts. Here was also where stablecoins flourished along with adopting Bitcoin as an institutional asset class.

Crypto was starting to become mainstream, and blockchain use cases were diversified.

Among the two other cycles, the third came with what I would think is the most significant impact. After the two peaks, in the huge 3rd bull run, the bear came harder with the LUNA-UST crash, Celsius bankruptcy, 3AC fund liquidations, FTX bankruptcy and the DCG liquidity risks.

And better still, they all happened in the same year. 2022 is a year to remember.

Who will be the winners?

Historically, products built in the bear market tend to become the following narratives of the next bull run. We see ETH being built in the 1st bear, then becoming the narrative of the next bull market. Multi-chain, DeFi and NFTs are being built in the 2nd bear, then becoming narratives of the 3rd bull run.

Which begs the question, what are the potential catalysts of the 4th bull run? While there are many narratives to handpick and choose from, here are some potential picks for the next Cycle.

The new king, Ethereum

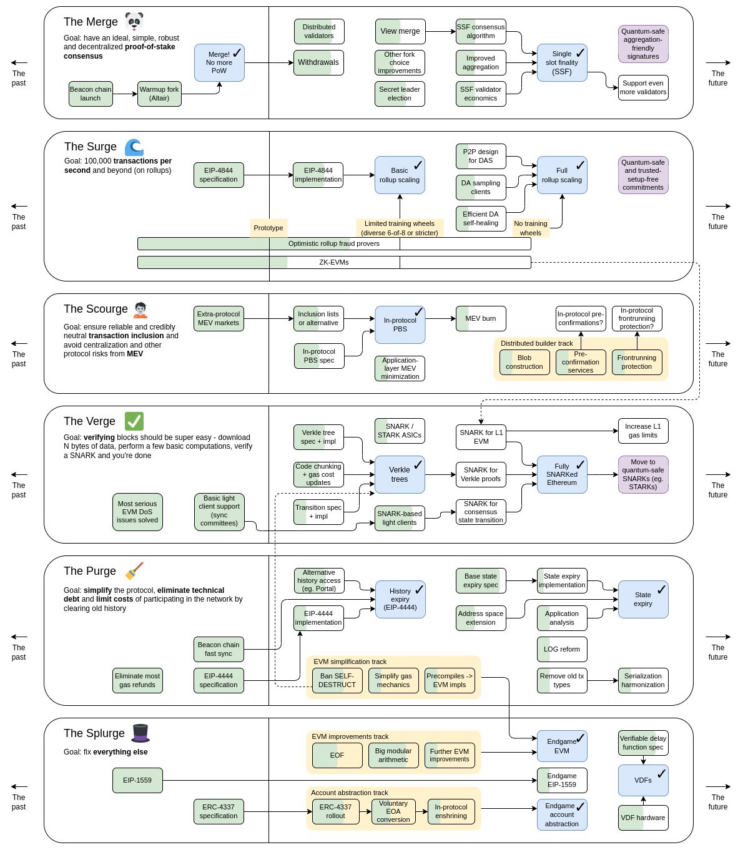

The success of the Ethereum merge is only the beginning of a new era; with the journey of becoming deflationary complete, there are only five more components left for Ethereum before complete success.

Ethereum has become a dominant force in crypto. I would see it as the orchestrator of the entire space, where new narratives are born around new DeFi, NFT and stablecoin products. It has been a long time since its inception, and it took Ethereum close to 8 years to complete the Merge, but the road ahead is exciting.

EIP-4844, Eigenlayer and Zero-knowledge EVM are ones to watch.

They are taking meticulous steps to ensure long-term success. If you are in it for the long game, no other competitors have come close.

Alternate layer1s

As mentioned above, no competitor to Ethereum really moved the needle. Yet, layer 1s rotation was the primary rotation of the 2020-2021 bull market.

We have yet to see its full potential, though, especially with new chains revolving their value proposition around the flaws of Ethereum; the block space economy could be one to watch in the coming bull run.

<Aptos vs. Sui: Heir of Diem>@AptosLabs launched their mainnet this week. @Mysten_Labs will launch mainnet before the end of 2022. Both projects claim themselves as the heir of @DiemAssociation

— alphanonce Intern (@alphanonceStaff) October 19, 2022

Qualitative/Quantitative analysis on Aptos and Sui pic.twitter.com/yNdbYgHCWC

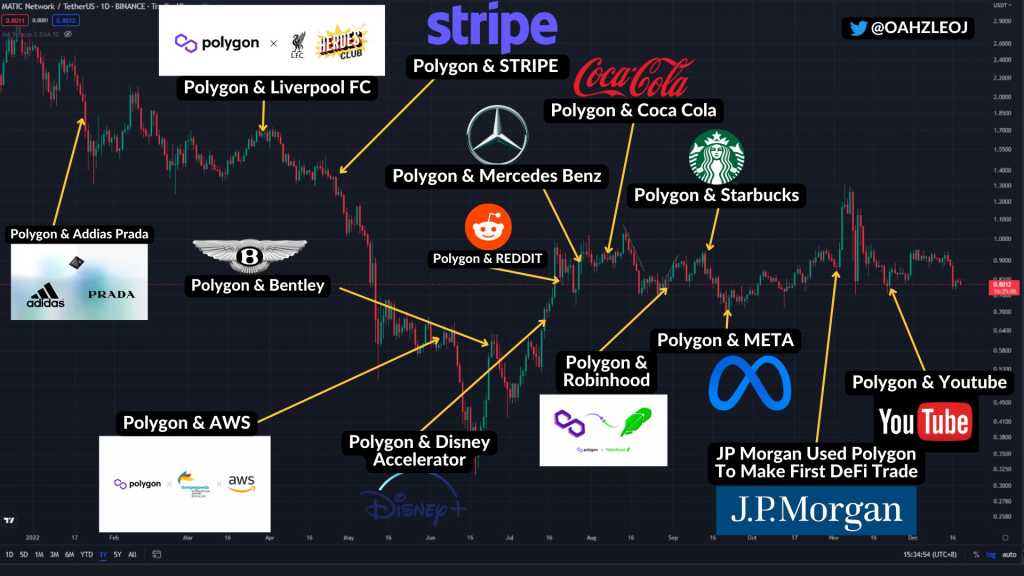

Web2 adoption of web3 via NFTs

In this department, Polygon seems to be leading the charge. With Instagram and Meta adopting NFTs into their platforms, web2 companies are looking towards web3 as the primary instrument for monetization.

X-2-EARN

Axie infinity and STEPN, both X2E models, saw huge traction. But when it came down to questions of tokenomics, many concerns about sustainability were raised.

<Is X-To-Earn Ponzi?>$AXS ignited the Play-To-Earn rally in 2021. $GMT pioneered Move-To-Earn in 2022. $AXS and $GMT outperformed $ETH by 821% and 1672%, respectively in July-2021 and Mar-2022. Is the X-To-Earn (“X2E”) a savior of crypto?

— alphanonce Intern (@alphanonceStaff) May 31, 2022

Thread on X2E🧵

1/ pic.twitter.com/i2WV8EOPrb

However, this concept seems to meet no boundaries at the peak of it all—a good idea with execution yet to be perfected.

Also Read: Everything You Need To Know About The Upcoming Ethereum Shanghai Upgrade

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief