With the collapse of FTX, many users have been increasingly wary of Centralized Exchanges (CEXs). Rightfully so, the implosion of a $1 Billion a year firm has led to a mass exodus of crypto withdrawals, to either self-custody solutions, or simply off-ramped into FIAT.

The # of $ETH withdrawals on Gemini reached an all-time high today.https://t.co/npj2GXGQvj pic.twitter.com/ARL8SB2mp4

— Ki Young Ju (@ki_young_ju) November 16, 2022

While many believe that the tide has likely fully receded, and all those swimming naked have been exposed, one twitter user has called out Kucoin, a popular CEX, as the next target for a bank run.

Will Kucoin Face a Bankrun?

The user, going by @otteroooo on Crypto Twitter (CT), recently wrote a thread calling out both Kucoin and NEXO, another crypto savings and lending platform.

who is otter?

— otteroooo (@otteroooo) November 29, 2022

otter has called every single large crypto bankruptcy this year, sometimes hours before, some months before

otter has a network of insiders feeding inner workroom secrets

otter has called the bankruptcy of

LUNA UST

3AC

Celsius

Finblox

Blockfi

Voyager

Babel

FTX pic.twitter.com/uTBis8XOaI

According to him, Kucoin had been exposed to the collapse of $LUNA to the tune of approximately $500m.

translation (1/2) :

— otteroooo (@otteroooo) July 23, 2022

hi, i am a Kucoin employee.

lately Kucoin has been raising funds which has been suspicious to a group of Kucoin employees, since Kucoin has been operationally profitable

according to the leader (director or CEO), the LUNA blow up has cost Kucoin $400-500m.. pic.twitter.com/Zx2YDHOoZh

He also showed in a previous thread that Kucoin likely rehypothecated user funds, or took user deposits and tried to earn additional yield through depositing it in Anchor Protocol, which famously gave users 20% returns on stablecoins.

Accordingly, Kucoin also had a $10 million raise following the $LUNA collapse, after raising $150 million just prior to it.

Otteroooo has also received insider tips that Kucoin has been laying off multiple rounds of lay offs, likely to preserve the remaining capital at hand.

Kucoin CEO Denies Rumors

Since the allegations have been floating around, Kucoin Founder, @Johnny_KuCoin has come out to address the FUD surrounding the exchange.

Not only has he denied rumors that they have been retrenching employees, but states that the exchange is instead hiring a large fleet to add to its tech, compliance and marketing departments.

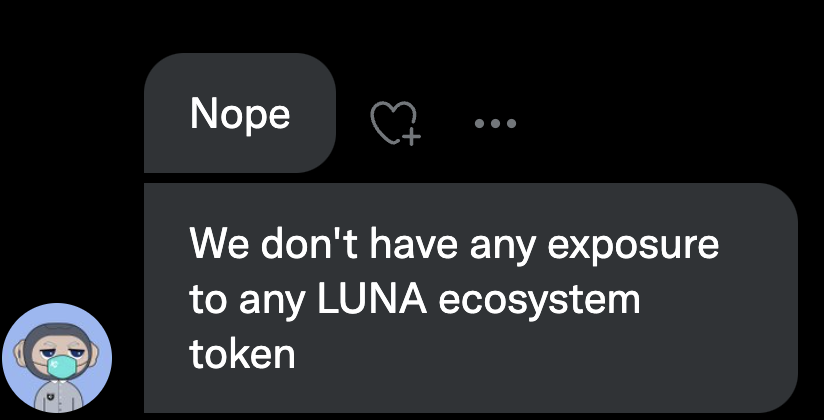

Furthermore, he has previously mentioned that KuCoin did not have any exposure to the LUNA ecosystem themselves.

Be aware of FUDs!

— Johnny_KuCoin (@lyu_johnny) July 2, 2022

Not sure who's spreading these sheer rumors, and what their intentions are, but #KuCoin does not have any exposure to LUNA, 3AC, Babel, etc.

No “immense suffer” from any “coin collapse”, no plan to halt withdrawal, everything on KuCoin is operating well.

Their CEO has also come out, addressing the otter both directly and indirectly, and claims that they are not at risk of insolvency or at a bank run.

Instead, they have publicly stated the source of their yield , especially their “Dual Investment” high yield products, which offers up to triple digit APRs.

Closing Thoughts

While it is unclear whether Kucoin had or did not have exposure to $LUNA, $UST, 3AC, FTX, etc, one thing is clear – CEXs are not the best place to be right now.

While CEXs are essential to on-ramping crypto for many users, they have also been shown to be untrustworthy, unless a pure “proof-of-reserve” is shown, and holdings are made transparent.

Yield platforms, especially, are something to avoid in the current bear market. With liquidity crisis after liquidity crisis in centralized platforms, holding your crypto on anything other than a self-custody solution is highly unrecommended.

Also Read: Signs The FTX Crash Was Bound To Happen

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: KuCoin