2/ The hackathon brought together developers, designers, and business operators from around the world to develop new #Web3, #DeFi, #Gaming, and Digital Art & Collectables #NFTs applications leveraging Solana's speed, low fees, and scalability. https://t.co/kYXSolxPna

— Solana (@solana) October 29, 2021

4/ The Grand Prize Award Winner is @Katana_HQ, an asset management protocol building investment products across the risk spectrum! Katana will receive $75k + 2 tickets to @SolanaConf. https://t.co/KGio9KERO3

— Solana (@solana) October 29, 2021

The Solana Ignition Hackathon is a competition where projects are pitted against each other and evaluated by judges to win cash prizes and seed funding.

Katana emerged as the grand champion, beating 568 other promising projects to win the grand prize of US$75,000 and 2 tickets worth US$2,000 to Solana conference.

So this begs the question of what is Katana, and how is it better than the other projects?

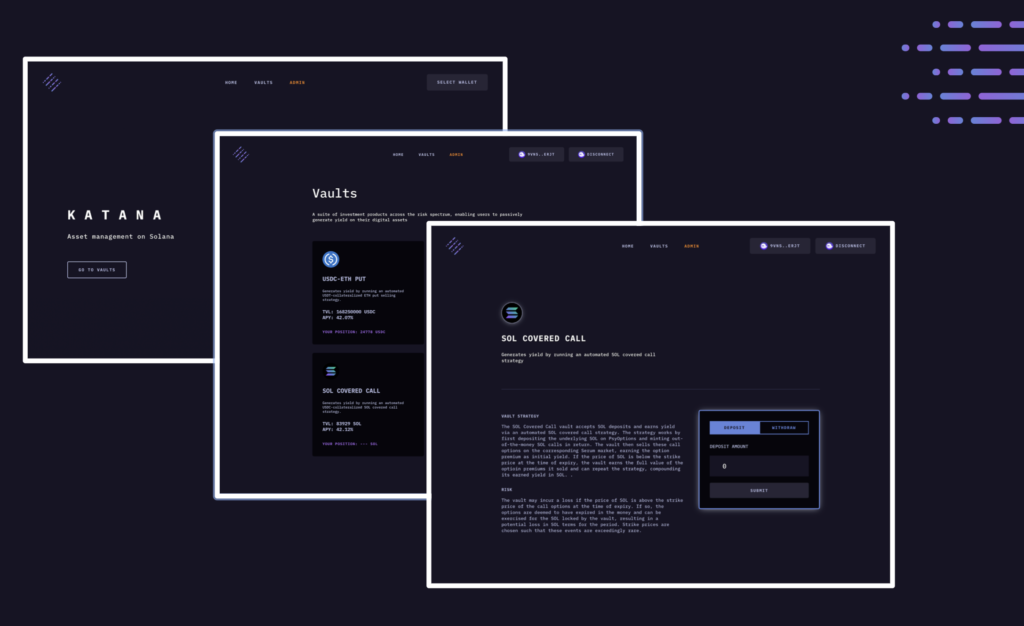

To start off, Katana is a yield generation protocol running on the Solana blockchain. It is building a comprehensive suite of packaged products that generate sustainable yield.

Its aim is to make yield generation simple for its users by automating all the complex strategies. Users would be able to earn lucrative yields from derivatives without the hassle of employing the strategies.

Innate issue of regular yield farms

Those who are familiar with yield farming would know the fundamental issues accompanied by those lucrative DeFi farms.

Yield farms derive value from the emission of the native token. The yield is unstainable in the long run because it is highly dependent on the price of the token. Once the price of the token start falling, the yield would get eroded in the process.

Furthermore, there is also the risk of impermanent loss. It’s a common oversight by DeFi players as they are lured in by the insane APY provided by the farm.

At the end of the day, users might be exposed to so much impermanent loss that they are better off not participating in the farm.

Actual sustainable yield

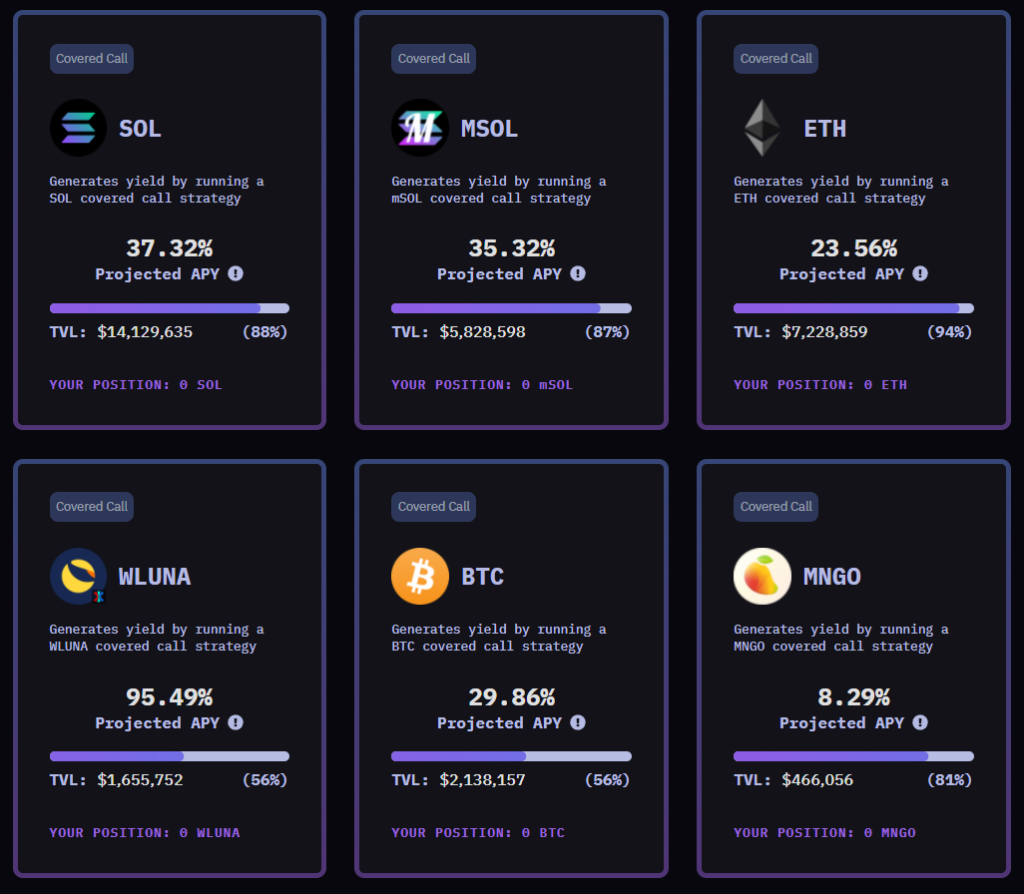

At the time of writing, Katana offers about 11 different covered call option vaults and 3 put selling option vaults. It covers a range of assets from the OG, Bitcoin to the most hyped layer 1, Luna.

The covered call option vault is the hottest product of Katana. It involves selling the call option of an asset in exchange for the option premium. The yield is sustainable in nature as it is derived from the option premium and is not dependent on token emissions.

When an investor buys an option, they have to pay a fee for the options contract and the fee is known as the option premium. The option premium makes up the base yield of the option vault and is sourced from large external options market.

The Samurai can sleep tight knowing we've hit caps at 100k SOL

— Katana 🥷🏽 (@Katana_HQ) January 6, 2022

GN and sweet dreams 🥷 pic.twitter.com/q1jNvzGPBw

This enables the vault to produce high organic yield that is not dependent on token distribution to achieve high APYs. It captures value from the underlying market structures rather than relying on token emission to generate value.

This yield generation model is also sustainable in the long run which allows yield farmers to farm in peace and not have to constantly worry about the problem of diminishing return.

While there are many benefits of using the covered call strategy, the caveat is that the user will lose out on the “upside” potential of the asset.

The beauty of Katana compared to the other option vault protocol is that no fees are charged for using its vault. Users get to keep all the delicious yield and do not have to share it with the protocol.

Good for both bulls and bears

Katana’s products are very versatile, and can be used for different market conditions no matter bullish or bearish.

If you’re bullish about a particular asset, you can use the put selling vault to earn yield. When the asset moons, the vault would earn the full value of the option and start compounding yield over time.

A bearish investor would just have to use the covered call vault instead of the put selling vault. Even if you’re neutral and think the market would just trade sideways, you can just leave the asset in the vault and earn that yield.

What if you’re unsure if the asset would moon or crash? You can split the portfolio 50-50. Doing this would essentially hedge your covered call position with a put selling position.

The team

Ayush Menon

Ayush is the brain behind the award-winning project Katana. Not only a seasoned Solana developer, but he is also a two-time Solana hackathon winner. He previously won the Raydium prize for his hackathon project Laguna Finance. He was also a former software engineer at Delphi Digital where he worked on the Mars Protocol.

Eric Nie

Graduated from Carnegie Mellon with a Bachelor in Computer Science, Eric is the founding engineer of Katana.

He is an experienced DeFi developer who has the capability and experience to turn an idea into a working DeFi product. Previously he worked as a software engineer in one of the best high-frequency trading firms, Jump Trading.

Planned roadmap

There is no fixed roadmap yet as the team is still finalizing the small details and would release a detailed roadmap in the near future.

But here are some exciting stuff the team is working on:

- Exotic products that uses different strategies for user with different risk profiles

- Custom stratgies for treasuries & DAO

- To be fully decentralise and allow the commuinity to shape the future of the project

$40 million in TVL 🔥

— Katana 🥷🏽 (@Katana_HQ) January 12, 2022

Looks, like the Samurai like big numbers

More big numbers coming soon 🥷 pic.twitter.com/61neErli2B

The main benefit lies in its ability to simplify complex strategies so just about anybody can participate and earn sustainable yields that were once only available to those with the technical knowledge and expertise.

It is still too early to judge Katana given the fact that it is still in the infancy stage. With a solid team behind the project that is able to build revolutionary products, it wouldn’t take long for it to gain the traction it needs to be the number one DeFi yield generation protocol.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Katana

Also Read: Here’s The Full List Of Yield Farms On The Solana Network And The Top 3 To Look Out For