What is Kujira?

Kujira is a layer1 platform built on Cosmos with its native token, $KUJI.

Since witnessing the fallout of Terra Classic collapsing at ground zero, the Kujira team has redoubled their efforts resulting in the launch of a sovereign Cosmos layer 1 blockchain 6 weeks after.

📢 We're incredibly proud to announce 'Kujira Labs', Kujira's first accelerator program 👇https://t.co/uoGS2NounF

— Kujira (@TeamKujira) August 15, 2022

Full details to come soon, but any teams keen to join, please follow the Google link in the article 📰

Can't wait for the next wave of shippers 🚢

$KUJI $USK pic.twitter.com/Wgu9xgsdWn

With the objective to create cost-effective and accessible tools for both beginners to advanced crypto traders, apps built on Kujira are designed to provide an efficient secure and risk-free environment.

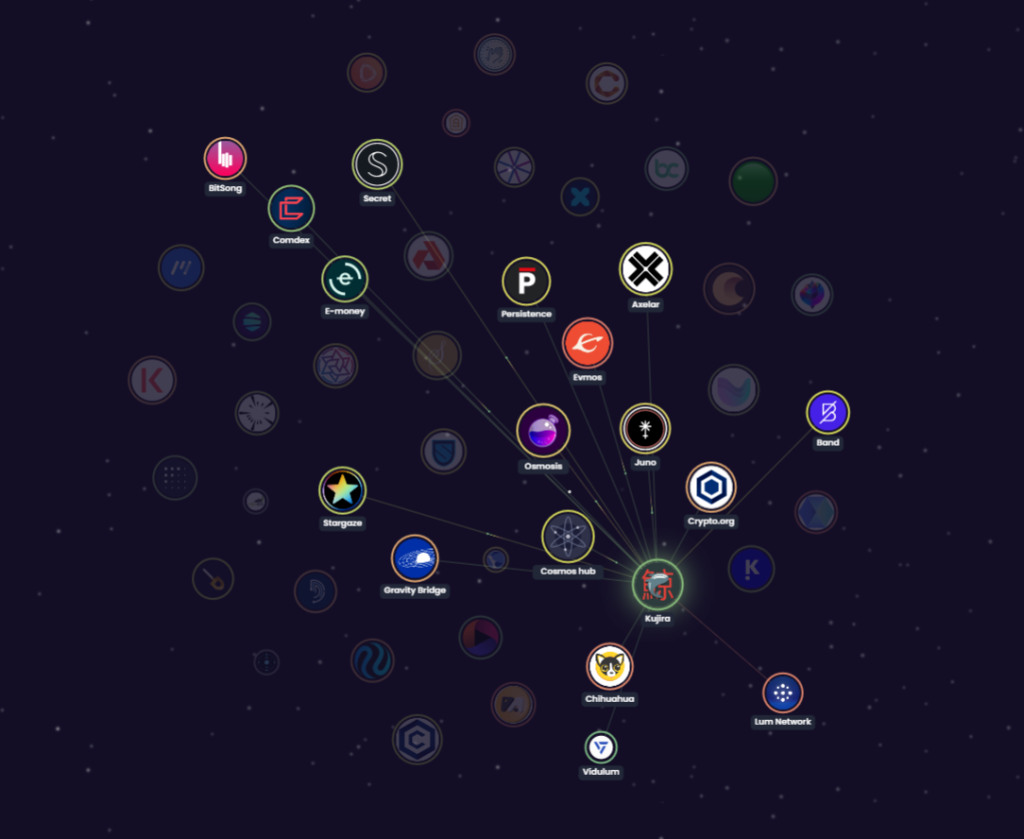

Below is a map for Kujira and its interoperable map with other networks within the Cosmos ecosystem.

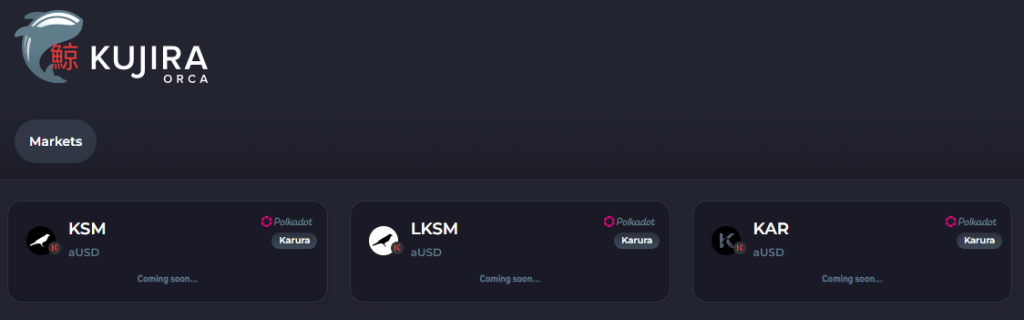

Kujira currently has 3 main applications. ORCA – a marketplace for liquidated collateral, FIN – a fully decentralized, permissionless and 100% on-chain DEX and BLUE – a Kuji dashboard to vote, swap, bridge and claim rewards.

1. ORCA

Especially in crypto, leverage and loans have risen in popularity in the compound growth of the individual’s wealth. And ORCA operates within this niche.

They take loans that exceed a certain percentage, automatically assets and automatically liquidate these positions and sell them. Those who participate in these, are automatically rewarded with a liquidation, fee.

If you were familiar with how Kujira played a part in the LUNA, UST and Anchor mechanic here is a quick TLDR;

Imagine Kai has some LUNA, he mints $100 of bLUNA on Anchor and then deposits it. He is eligible to borrow $60 US; which he may use however he likes.

His good friend, Viraj, has $100 in UST, of which he bids 30% on ORCA.

LUNA tanks. Now Kai’s LUNA is worth 95$, his loan is at risk.

ORCA comes into play, and Viraj’s bid will be enacted. Now Kia’s bLUNA is liquidated and Viraj receives the bLUNA at the premium he bid on.

In this case (1) Anchor protocol, as the lender, will get back the $60 UST they had loaned out to Kai back by selling the bLUNA Kai bonded.

Viraj now has $95 worth of bLUNA (liquidated from Kai which he only paid $66.5 (because Viraj bids at a 30% discount on Orca, $95 x 30% = $66.5) while Kai has the $33.5 left in the ORCA contract should any other risk liquidation pops up.

As Kurjia continues to introduce itself as a new layer1 platform, they basically have to restart the application within ORCA itself. Stay tuned to their latest Twitter here.

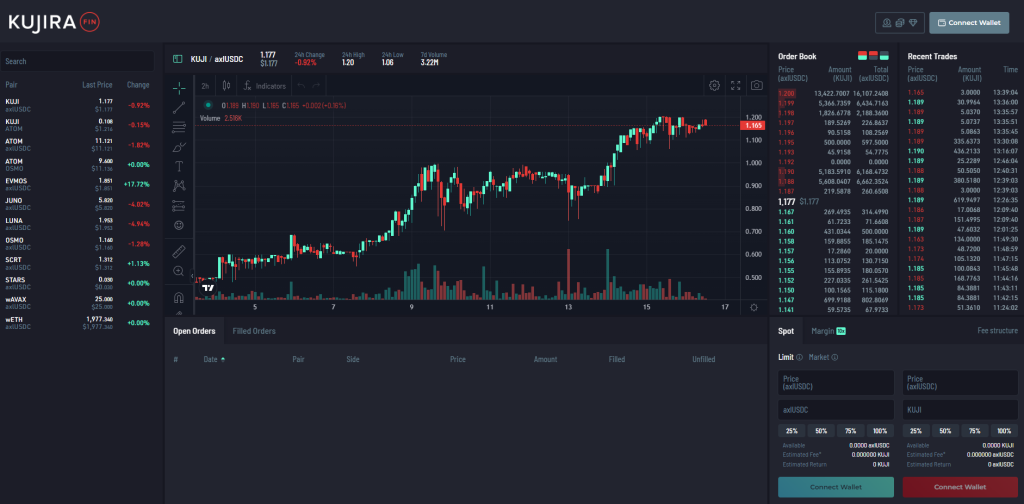

2. FIN

With FIN, there is no need for inflationary token incentives. This makes it more capital efficient, and farmers can deploy their capital elsewhere. Think Kucoin, but 100% decentralized and on-chain.

There’s no reliance on money to execute trades, and no need for additional fees to incentivize them. In short, it’s much cheaper, there’s a risk of a trade being missed, and it leaves no opportunity for bias in which trades bots choose to exwork.

So what’s in it for protocols? Well, a whole lot, actually.

You now have no need at all for a liquidity pool, which brings about three main points:

1) You don’t need to give away millions of printed / inflationary tokens just to keep people in an LP.

2) Your community faces no risk of impermanent loss just for to support your project.

3) You can reallocate your protocol-owned liquidity to something more productive.

And last but not least, forget about the first in first out model. All orders on FIN are executed fairly.

3. BLUE

BLUE is the, the heart of the Kurjira ecosystem. It is a dashboard which enables users to bond and swap their $KUJI, vote on governance, bridge to the Kujira Network and claim rewards, all in one place.

$USK Stablecoin

📢 Our biggest ever announcement to date 👇👇

— Kujira (@TeamKujira) August 8, 2022

"KUJIRA $USK STABLECOIN LAUNCH "https://t.co/LMiBKXTNfm

Please read the Medium in detail as it's jam packed with all the info you need. Welcome to the start of something beautiful 🐋💙$KUJI

In creating a more sustainable DeFi model to set a foundation for decentralized money, the Kujira released that stablecoin $USK, which is an over-collateralized Cosmos stablecoin soft-pegged to the USD and initially backed by $ATOM (with $KUJI to follow soon after).

They are employing a trusted, theoretically sound system employed by Maker DAO. And on top of it all, as a native Cosmos stable, $USK gives $ATOM another use case driving value accrual.

A hard pegged stablecoin is directly exchangeable for a specified quantity of the asset it is pegged to. It maintains a permanent, fixed ratio. In contrast, a soft pegged stables in value within a range based on well-designed incentives.

For example, when Ethereum fell from $1400 to $90, $DAI fluctuated between $0.96 and $1.04 per coin (at the extremes) though it was centred around $1. As can be seen, this is a battle-tested model.

Much like the gold standard, $USK, a soft-pegged stable coin would have $ATOM collateral sitting in reserve in the Kujira blockchain which could in theory be used to buy back $USK thus guaranteeing its value.

Unlike with fiat, money is, not printed out of thin air and fractional reserved ponzinomics is not at play here in this model. $ATOM is insufficient by itself to guarantee $USK stability but still plays an essential role.

Find out more on $USK Stablecoin in their medium article here.

$KUJI Price action

Imagine losing the main network you started building on, losing the bulk of their audience and losing the majority of your liquidity. Kujira remains stronger believers in their project with the product offering they have to the mass market.

They are up 40% on the 7-day and 163.8% on the 14-day charts. Where to get your hands on $KUJI? you can get them through FIN, but make sure you have a keplr wallet ready and loaded.

Also Read: Getting Started With The Keplr Wallet: The Leading Wallet For the Cosmos Ecosystem

Driving Real Value

At the end of the day, the best investment in DeFi is the ones that expose you to the upside. A common problem is inflationary farming APYs that dilute the value of a token which disadvantages the investor.

Why should you farm tokens of a DEX that gives you reckless APYs through inflation which eventually results in non-valuable tokens? It’s unsustainable and risky.

In contrast to a lot of DEXes and AMMs, in my opinion, Kujira does a better job in accruing long-term value and rewarding ownership of its $KUJI token.

They operate with no slippage and impermanent loss and are all about real revenue generation.

Kujira is currently a liquidation market ORCA and a decentralized orderbook FIN which provides users with real sustainable yield through the re-allocation of network fees to their users

$KUJI provides perfect investor tokenomics. It grants you exposure to

— Jpeg Jerk 🌖⚡ (@AverageMount) August 12, 2022

💡 Real yield by staking: no substitute, not artificially inflated.

Think dividends but bigger

💡Price action: no lockup for yield. Withdraw anytime. High demand through real yield exposure@TeamKujira

They are no longer an application, previously only a dAPP built on Terra, but now an entire ecosystem, one in my opinion will continue to thrive.

Furthermore, they are attracting more builders to the space through the launch of their accelerator programme which is inspired by Near’s “Open Web Collective”, Binance’s “Most Valuable Builders” program and Polygon’s “PolygonLeap” program.

📢 We're incredibly proud to announce 'Kujira Labs', Kujira's first accelerator program 👇https://t.co/uoGS2NounF

— Kujira (@TeamKujira) August 15, 2022

Full details to come soon, but any teams keen to join, please follow the Google link in the article 📰

Can't wait for the next wave of shippers 🚢

$KUJI $USK pic.twitter.com/Wgu9xgsdWn

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: ChainDebrief

Also Read: “I Bet Big And I Think I Lost” Do Kwon Tells All In Exclusive Interview