Heard of Fractionalized NFTs? Well, the team at LABS group is offering something similar – Tokenized Real Estate.

LABS, short for Liquifying Asset Backed Securities, was founded in 2018 with the goal of digitizing real estate assets and making it accessible to the masses, or what they call: Making ‘Wall Street’ investments ‘Main Street’.

Since then, LABS has gained strategic partnerships in both the blockchain and real estate spaces globally.

Let us take a deeper look at the team, the project, and future developments that make LABS potentially attractive to investors.

Meet The Team

The core members leading the team of over 30 people are:

- Mahesh Harilela (Chairman) – From the prominent Harilela Family in Hong Kong who owns 19 hotels around the world through the Harilela Group. Also CEO of M. Harilela Global Investments

- Yuen Wong (CEO) – Former Managing Partner at Bitmart and Ayana Properties, held management-level positions at various blockchain/web3 companies.

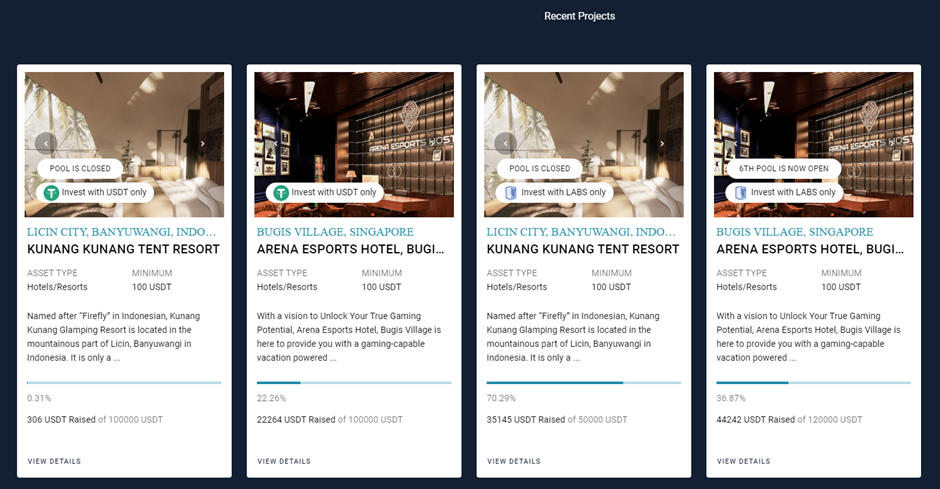

Arena Exports hotel, the first in Singapore and more to come.

— Yuen Wong (@Yuenwonglabs) July 8, 2022

Powered by GEMS Gamefi and Esports 3.0 Platform and invested by LABS Group.

See you there soon.@gemsgg_official @labsgroupio @arenaesportsho https://t.co/B0fXcgAZuT

Some of their key partners include Oriental Pearls (real estate development), RioDeFi (Blockchain), GCA (Financial services), Universal Pacific Ltd (Property Developer in Laos), etc.

Hence, the LABS team is made up of a healthy mix of experts and partners in real estate, blockchain, venture capital, and capital markets.

What Does LABS Group Do?

LABS aims to provide retail and accredited investors access to real estate investment opportunities with higher liquidity through secondary markets with the help of tokenization.

You might be asking: “Can’t I do the same by purchasing traditional REITs?”. Although both options allow investors to invest in smaller sums, tokenizing the property allows investors to trade them, hence providing greater liquidity compared to traditional REITs.

LABS does this by issuing NFTs to represent the physical assets, similar to fractionalized NFTs.

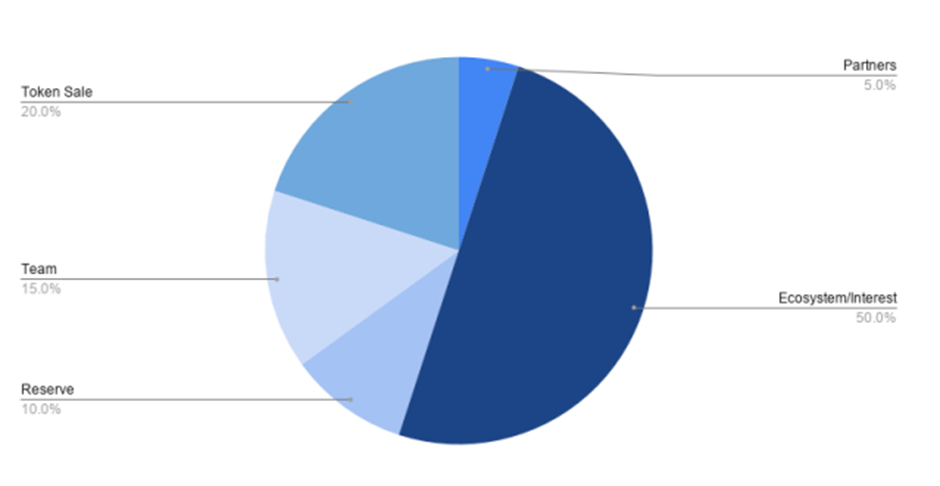

Labs Tokenomics

$LABS tokens are currently issued on the Binance Smart Chain, and according to their whitepaper, the token allocation is as follows:

- Token Sale – Public and Private sale with a lockup period

- Team – Tokens issued have a 24-month lockup, first released after 6 months

- Reserve – Used as an emergency fund for the business

- Partners – Used for partnerships that need to use $LABS tokens for their upcoming ecosystem

- Ecosystem – Used to incentivize users of LABS tokens and partners or projects in the LABS ecosystem.

Growth And Roadmap

At the moment LABS has made multiple strategic partnerships and are working on various projects that could make them a key player in “decentralized real estate”.

LABS will be building its own ecosystem on Riochain, a Polkadot Substrate. Substrates are simply frameworks for building customized blockchains.

Parachains, or parallel chains, on Polkadot allows for greater interoperability between blockchains such as ERC-20 at a lower cost and faster speed.

LABS intends to launch its very own licensed security token exchange to provide greater liquidity for their fractionalized assets. Liquidity is something traditional REITs do not offer, and is what LABS is trying to create to make real estate investing more accessible and liquid for retail investors.

Like traditional REITs, LABS issues dividends on real estate that people invest in. These dividends will be distributed either in USDT or in LABS’ native stablecoin, USDL which is a “real estate collateralized stablecoin” pegged at 1 USD by using Security Tokens as collateral.

Using USDL will grant users benefits when interacting with LABS future ecosystem.

Security Tokens represent ownership of assets, and by participating in their projects, investors are entitled to double dividends in the form of USDT or USDL payouts along with a payout in the form of $LABS utility tokens which can be sold or staked in their ecosystem. These tokens however would be locked for 1 year.

LABS VIP Club

Like owning a traditional NFT such as a Bored Ape, you get access to their exclusive membership community. Owning LABS Security tokens and Utility tokens similarly grants you benefits in their ecosystem such as:

- Early access to new property investments

- Timeshares (Allows owners to have access to the property for a certain period of time)

- Enhanced dividend payouts

Closing Thoughts

Like every project, there is always the risk of overpromising with roadmaps.

LABS has a lot of potentially game-changing projects in store, a very strong and diverse team, and strong partnerships that could make LABS a huge player not just in DeFi, but also in the real estate scene.

What’s more is that they own 2 other companies:

GEMS Esports – An “esports 3.0” platform hosting competitions in both traditional web2 esports and web3 games.

Arena Esports Hotel – A gaming hotel with co-working, co-living and co-playing facilities to host esports teams. Their flagship hotel is located at Bugis Village, spanning 25,000 sqft.

With these 3 companies, they not only have a foot in DeFi and real estate, but also in esports. LABS can be used as a platform for crowdfunding to purchase properties like hotels parked under Arena Esports, and GEMS can host esports teams at these hotels for international tournaments.

Amidst the bear market, they are looking to open a new hotel in Singapore, one in Kuala Lumpur, and even one in Cambodia. They may very well survive the crypto winter and take the real estate market by storm.

Also Read: CEO Of BlueJay Finance Left Google To Pursue Crypto, Offers Financial Inclusion To The Underbanked

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chaindebrief