Motivation Behind Interoperability

As a nascent industry, the blockchain space frequently sees new chains being established, each proclaiming that it is faster, more secure, and more decentralised than other chains. And this is not only restricted to L1s.

The omnipresent growth in sidechains and L2s such as rollups consequently contribute to the high degree of fragmentation, with each network operating as an individual, self-contained silo.

Without inter-blockchain communication to foster interoperability, inefficiency arises due to the need to wrap and bridge tokens between disparate chains.

Given this pressing issue, it is evident that protocols which are able to promote interoperability and composability among blockchains successfully will unleash the full potential of blockchain technology in enabling the efficient facilitation of transactions on a global scale.

And this is where LayerZero, an omnichain interoperability protocol, comes into the picture.

How Interoperability Can Be Achieved

As a generalisable and trustless protocol, LayerZero seeks to enable cross-chain communication between decentralised applications (dApps) built across multiple blockchains. There are 2 main techniques for facilitating cross-chain communication – leveraging either a central chain or Light Nodes.

Both have their pros and cons, but LayerZero strives to attain the best of both worlds by going one step further with Ultra Light Nodes.

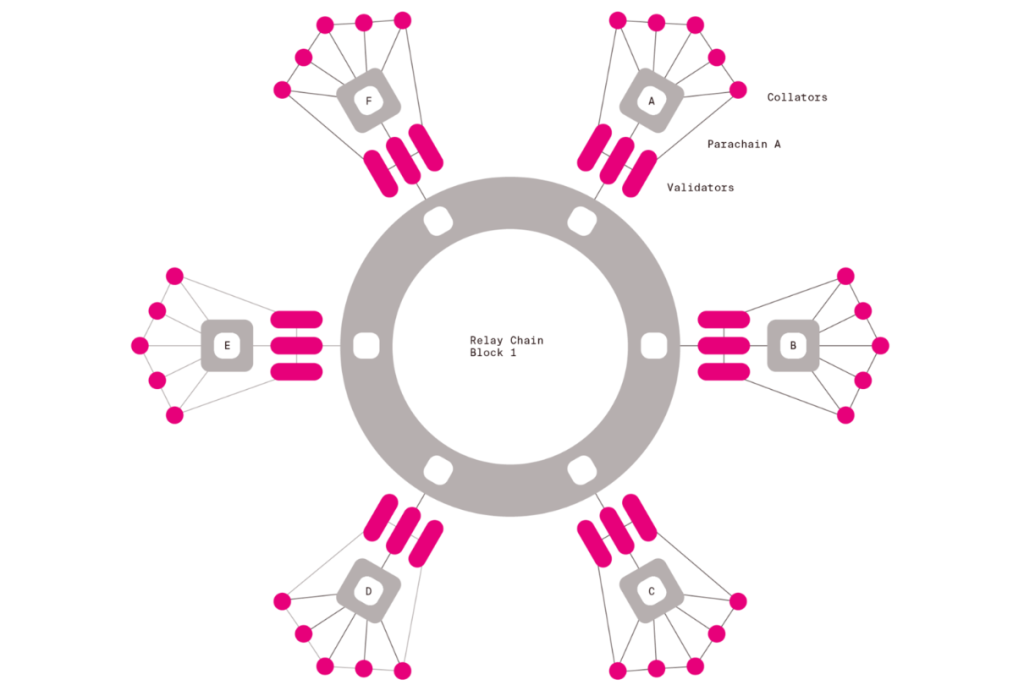

To understand what this entails, we shall first examine the 2 traditional methodologies for interoperability, starting with the central chain scheme. This architecture relies on a main ‘root’ chain that provides the consensus mechanism and validates the transactions between the other chains.

While easier and cheaper to implement, this leads to a single point of failure underlying the implied higher degree of centralisation.

On the other hand, Light Nodes are part of a system where the nodes do not store the full transaction history of the chain, which is what a full node traditionally does. Instead, only the relevant parts are stored; specifically, in the case of cross-chain communication, the Light Node validates the incoming transactions from the other chain.

Implementing Light Nodes imply that the decentralisation will be inherited from the underlying architecture of the blockchain and there is thus no single point of failure. However, to keep all Light Nodes up and running, operational cost becomes non-trivial.

LayerZero’s Technology

Building on the aforementioned techniques, LayerZero’s Ultra Light Nodes are effectively a streamlined version of Light Nodes, similarly inheriting the decentralisation of the underlying chain while keeping its running costs low.

This is accomplished through the introduction of a Relayer and an Oracle. Basically, once the transaction from one chain to the next has been initialised by the source chain, the Oracle moves the header of the block containing the transaction from the source chain to the target chain.

Meanwhile, the Relayer submits the proof of transaction, which will be validated on the target chain. The simplicity and ease of execution behind this implementation thereby minimise operating cost as opposed to the initial concept of Light Nodes.

Competition In The Interoperability Race

With a clearer understanding of the underlying technology, we can now evaluate LayerZero against its other competitors such as Polkadot and Cosmos. Evidently, LayerZero punches above its weight with its Ultra Light Nodes integration, as compared to the central chain scheme in Polkadot’s Relay Chain and Cosmos’ Cosmos Hub, which undermines the general thesis of decentralisation as ascribed above.

Investment Rationale

Now that we have established how LayerZero supersedes its competitors in the race for interoperability, we shall next investigate if LayerZero is worth investing in.

If you ask any blockchain-native user what the rationale behind interoperability is, the universal answer, as delineated in the abovementioned problem statement, will be cross-chain liquidity.

At present, to move one’s assets from one chain to another, one would have to swap the asset to a supported asset, bridge it over, and swap it back to the desired asset. The number of transactions to be signed to make this happen is unbelievable in the current age of efficiency.

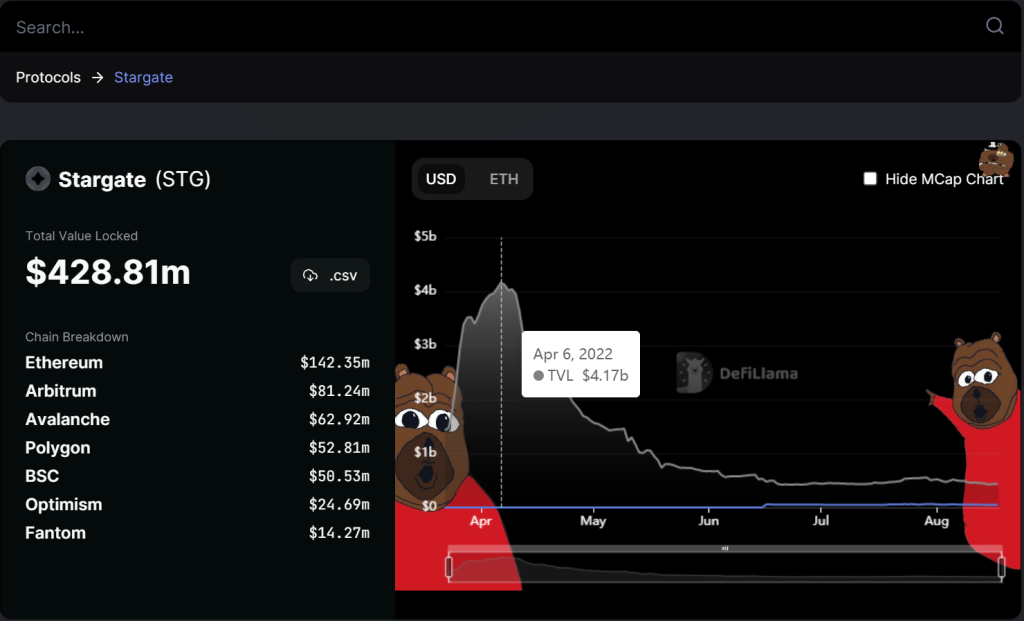

Thankfully, LayerZero has launched Stargate, an Automated Market Maker that is built atop LayerZero’s cross-chain communication protocol. Stargate strives to facilitate seamless liquidity transfer across major blockchains such as Ethereum, BNB, Avalanche, Polygon and other L2s!

The ability to swap between native assets across chains by using 1 single click, demonstrates the sheer level of convenience Stargate and LayerZero bring about for Web3 users, and this is evidenced by its TVL of $4 billion just 2 weeks after it launched.

Risks

However, when there is a reward, there will always be risks. During this crypto market slump, the TVL on Stargate has dropped by approximately 90% and it is presently at $430 million as can be seen above, and this was accompanied by an over 90% drop in the price of $STG.

Also Read: Solving The Bridging Trilemma: Here’s Everything You Need To Know About Stargate Finance

Conclusion

Nevertheless, this is expected given that the current risk-off mentality leads to fewer people transacting in cryptocurrencies and using DeFi applications in general.

Given that LayerZero has not imploded yet, one may see it as a good sign too, as the Terra implosion led to a loss in confidence in the entire Cosmos Network, a prominent competitor to LayerZero.

It was indeed a pity that LayerZero’s launch was immediately precipitated by a crash in the crypto market, but this is exactly the ripe time to develop and finetune its technology further.

This is especially pertinent in the blockchain industry as technological advancements occur at breakneck speed. To ensure LayerZero’s future relevance, it is salient that the team keeps working hard during this crypto winter.

Knowing the professionalism of LayerZero’s management team, I have absolute faith that the grind will not stop and we will see further improvement in LayerZero’s protocol.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief