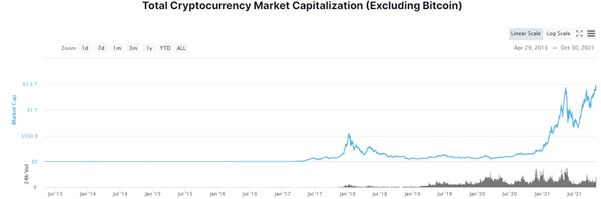

Market cycle tops are when the entire cryptocurrency market capitalization peaks, often following a Bitcoin price peak.

This usually corresponds with most alt coins reaching their peak prices as well and being able to identify them means you can cash out your bags for maximum profit before the inevitable dips.

Currently, as altcoin market peaks still firmly following Bitcoin’s, using $BTC indicators to identify possible in the whole market is still the most reliable method.

Though there are various on chain and trend indicators for you to choose from, a combination of both may be ideal, depending on the type of investor you are.

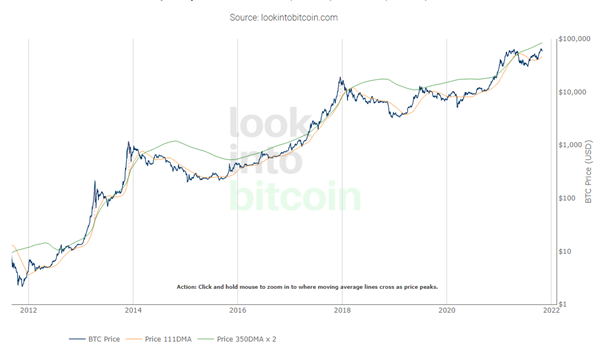

Pi Cycle Top indicator

The Pi Cycle indicator has historically managed to predict market cycle or local tops to within three days using the 111 day and 350 day long term moving averages (MA).

The Pi Cycle Top indicates that Bitcoin is overheated when the 111 day moving average has reached a 2x multiple over the 350 day.

Previously, the crossing of the 350 day MA x2 and the 111 day MA has led to 70-80% corrections in Bitcoin and the rest of the market. Cashing out in anticipation of their cross can help you secure your bags at peak profits for market tops.

It can also be noted that the previous Pi Cycle Top on April 12 this year led to about a 50%, not 70%,correction in Bitcoin with a larger correction on the rest of the crypto market, probably thanks to better education in the space and institutional investors coming in to purchase Bitcoin at lower levels.

Being able to establish a general price floor post correction can also help you find better entry points for the next cycle.

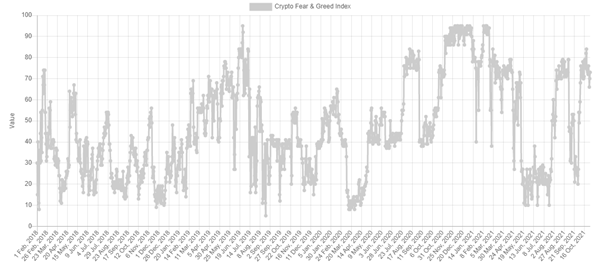

Market sentiment trackers

The crypto Fear and Greed Index tracks volatility, market momentum, social media and google trends, Bitcoin Dominance, and survey results to create an indicator on cryptocurrency market sentiment.

The index has four levels — extreme fear, fear, greed and extreme greed on a simple scale of 0 to 100 and can reflect when markets are bullish or bearish overall.

DCAing (Dollar Cost Averaging) out when the market reaches extreme greed has shown to be historically profitable.

However, the indicator is not great at telling exactly when market cycle tops are approaching and is usually used by investors to indicate when extreme greed is present, to DCA in instead.

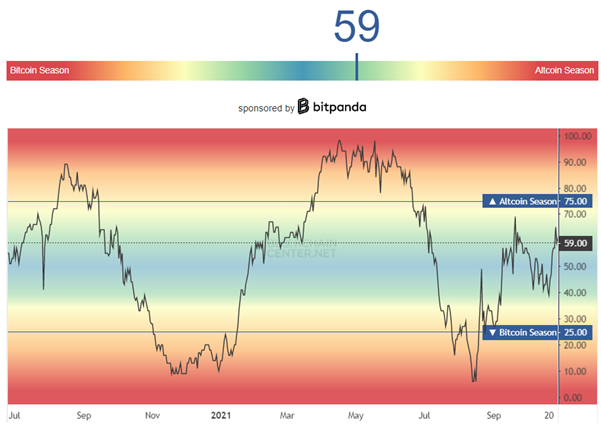

To make more accurate decisions based on the Fear and Greed Index, the Altcoin Season tracker can also be used as a measure of market sentiment.

The tracker indicates it is Alt season when 75% of the Top 50 coins outperformed $BTC over the last 90 days, and usually indicates a large inflow of new retail traders entering the space thanks to mainstream media coverage.

As altcoin season usually occurs towards the end of a $BTC market cycle, it can be a good time to start moving your cryptocurrency allocation to blue chips, stable coins, or simply cashing them out.

Bitcoin supply on exchanges

While retail traders can speculate on cryptocurrency prices all they want, the market capitalization of Bitcoin has grown so large that it usually takes millions, if not billions of dollars to have any price impact.

This price impact is usually caused by large sell-offs by whales, institutional investors and miners, looking to cash out their $BTC holdings at a the top and usually wipes out leveraged longs as well, leading to a correction in the market.

While these large wallets can be tracked by financial reports and on-chain data, the easiest way to do so would be to track the amount of $BTC or your preferred crypto being moved to exchanges in anticipation of a large sell-off.

Despite $BTC breaching All-Time Highs recently, $BTC supply on exchanges has been on a downward trend and are currently at a 3 year low, signaling confidence in the asset.

While the above two indicators may be able to give you a sense on how the general market feels, the transparency of Blockchain technology means that we can actually use empirical data to track smart money moves and make decisions with respect to that.

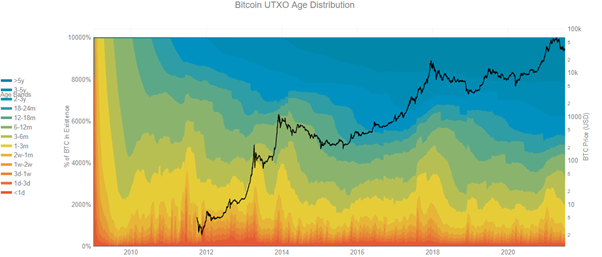

The supply on exchanges can be viewed alongside the UTXO age distribution, also known as HODL waves. Simply put, the graph shows the amount of “HODLers”, or those who keep $BTC in their wallets for an extended period of time without realizing capital gain.

$BTC being increasingly HODLed and repurchased in the short term not only helps to identify a lack of potential sell-offs, but also the price impact if a sell-off were to occur. With $BTC being increasingly moved to cold storage, we can be assured that in the near future, any $BTC sell off will not have too large of an impact on the cryptocurrency market.

Why you should take profits

While there are many metrics to identify market cycle tops, being able to identify the exact date every cryptocurrency hits their all-time-high is impossible. For those of us with a diversified portfolio, keeping track of five, 10, or even 20 or more cryptos makes it even harder.

While taking profits for $BTC at US$100,000 may leave you looking foolish if it goes to US$200,000 being left holding the bag when there’s a sell-off can feel even worse. To manage risk-reward, it always pays to secure at least some profits when the market is heated.

How to take profits

DCA (Dollar-Cost-Average) is an excellent entry strategy and can be an equally good exit strategy especially when we are still expecting major gains in the space.

By setting price targets at which you can take out a percentage of your portfolio, you not only secure most of your bags at solid ROIs, but also set yourself in a good position to re enter the market if there’s a flash crash, which are common in the space.

Having said that, i've composed a simple Google sheet which can help you determine a way of taking profits during this cycle.

— Daan Crypto Trades (@DaanCrypto) March 27, 2021

Copy the sheet so you can make it your own and edit it. Let me explain further below.https://t.co/DrARPYIASS pic.twitter.com/LrHHJu0vDG

You can use various online spreadsheets to calculate the opportunity cost of DCA-ing out which can help your set your price targets, unique to everyone based on their risk tolerance and cost basis.

Being able to DCA out to re-enter trades is especially good if you are based in a country with no capital gains taxes, such as Singapore.

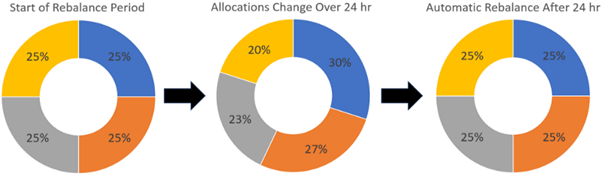

If you are still bullish in the mid to long term outlook of the market but are looking to cut down on the diversity of your portfolio, rebalancing may be a better option.

A simplified version would be: if you hold four cryptocurrencies in an equal distribution and one or two of them start to spike, you can take profits to the other assets in your portfolio, rebalancing them.

This can also be done to stack blue chips, where you take short term gains in lower cap alt coins and redistribute them purely to $ETH, $BTC and your other more bullish projects to hold long.

Doing so helps you “buy low sell high” in a sense, always making sure you are in profit when you sell – but may come at the opportunity cost of losing out on potential rallies.

Featured Image Credit: Analytics Insight

Also Read: Understanding Tokenomics: How To Avoid Rug Pulls And Identify The Next 10x Crypto