Welcome to Market Debrief, where we summarise some of the notable events that happened throughout the week.

The crypto landscape is ever-changing with new innovations and regulations popping up every day.

It is very hard and time-consuming to keep track and filter all the latest news in this space, and so the Chain Debrief team decided to compile it into an easy-to-digest article.

Is the market still uncertain?

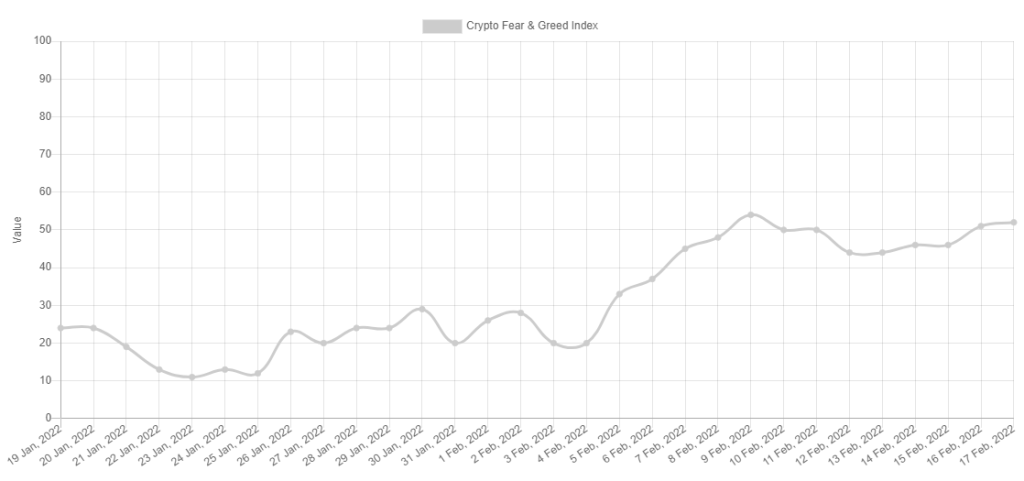

At the time of writing, the crypto fear and greed index was pointing at 52 as the market consensus was neutral. Currently at a neutral index, the crypto market is neither in extreme fear (where it could be a potential buying opportunity) nor too greedy (where the market is due for correction).

The neutral sentiment of the market was completely different a month ago of extreme fear when the index was at 12.

Nice break over the red region overnight- I suspect we head back up to 45-47k from here. $BTC https://t.co/FCamfo7iQr pic.twitter.com/bHfbpIUxHt

— Credible Crypto (@CredibleCrypto) February 15, 2022

Bitcoin is currently trading at US$44,000, and is moving sideways with a possibility of breaking toward the US$46,000-US$48,000 range.

Since the crash in January, Bitcoin has broken out of the US$40,000 range and “healthily” hovered around the US$42,000-US$44,000 range. This level, however, is a crucial one.

Cracking the floor might see a plunge in price causing the crypto market to revert back into extreme fear.

Bouncing upwards, however, might be an indicative signal on the journey back to its all-time highs. It will not happen overnight, BTC being the juggernaut of an asset it is, will require the strong rally of investors.

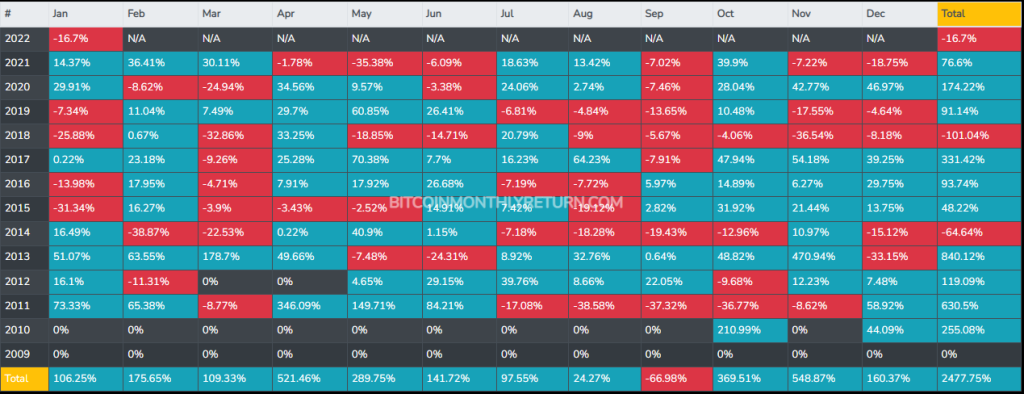

The monthly historical Bitcoin chart also showed that the month of February has always been a good one.

Russia/Ukraine conflict -> Spike in energy prices -> Higher inflation -> Global recession -> Financial asset repricing -> Flight to quality

— Barry Silbert (@BarrySilbert) January 28, 2022

Equities = down

Fixed income = down

Real estate = down

Cash purchasing power = down

Bitcoin for the win

The founder of Digital Currency Group Barry Silbert believes that Bitcoin will be the “winner” amidst any macroeconomic tension.

Don't wait until you lose 93% of your wealth to buy #bitcoin.https://t.co/qQiODbWDrl

— Michael Saylor⚡️ (@saylor) February 2, 2022

Microstrategy CEO, Michael Saylor, who has been accumulating thousands of Bitcoin over the past year still believes that Bitcoin is a “ticket to freedom” and retains bullish sentiments on the cryptocurrency regardless of the current market conditions over the past month.

GALA price shoots up over 20% amid news of NFT expansion

Gala games is a blockchain gaming platform that features a play-to-earn element. The platform also allows players to retain true ownership of their in-game assets through the use of non-fungible tokens (NFTs).

Gala games native token GALA surged over 20% after the announcement about plans to inject US$5 billion to expand its NFT and Metaverse presence. It was in the limelight as it outpaced the other major metaverse token as well as Meta’s stock.

According to the report, US$2 billion will be spent on gaming, US$1 billion on movies, US$1 billion on music and the remaining US$1 billion would be used to develop a theme park.

End of $LOOKS?

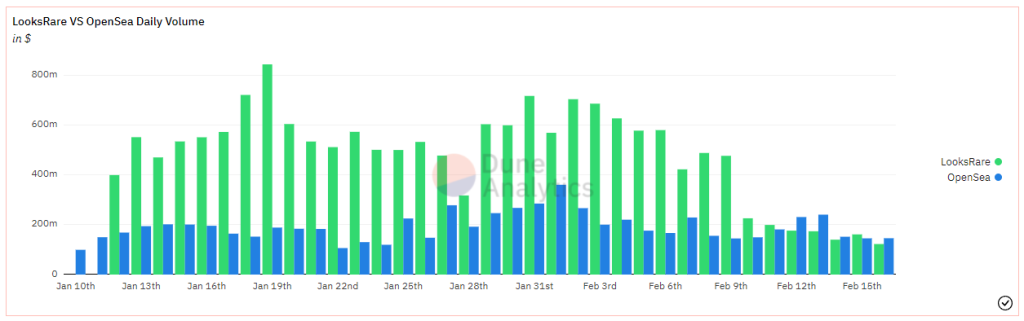

LooksRare was one of the most promising OpenSea competitors. When it launched, it gained lots of traction, and the total trading volume far surpassed OpenSea’s trading volume. One thing that was clear is that the majority of trading volume was driven by wash trading.

As expected, trading volume plunged after trading rewards was halved on 9 February 2022. The community-driven NFT marketplace was unable to attract genuine trading volume as OpenSea still hold 90% of the market share.

(1/6)

— Zodd 👀💎 (@ZoddLooksRare) February 14, 2022

To address this:

First off, the amount is incorrect: it’s closer to 10,500 ETH and we have 10+ full-time team members.

You can verify the amount on the blockchain by checking ETH transfers sent out on the analytics tab from the team address.https://t.co/Z4Qkv5T02a

$LOOKS token price is on a major downtrend and have fallen more than 60% in the past 14 days. The team behind the project also cashed out over US$30 million in Ethereum and sent it to Tornado Cash.

This sparked a mass sell-off as $LOOKS dipped 15% within hours after the team’s actions were publicized.

The community were unhappy and thought it was inequitable for the team to be earning so much and wanted them to purchase back $LOOKS. At the time of writing, the price of $LOOKS is still dipping and there is no sign of it stopping.

Twitter Digest

Will NYSE beat OpenSea to be the number one NFT marketplace?

The @NYSE has filed an application with the U.S. Patent and Trademark Office for its own NFT marketplace.@mikeybellusci reports https://t.co/BnUii4iNdO

— CoinDesk (@CoinDesk) February 15, 2022

New OpenSea challenger in town

We're live! ⭕️ 🥳 💖

— X2Y2 ⭕️ | NFT Marketplace (@the_x2y2) February 15, 2022

✅ Release of the X2Y2 #NFTMarketplace

✅ #Airdrop for all @opensea users

✅ NFT & $X2Y2 staking

✅ Only 2% trading fees

Claim your free $X2Y2 on 👇https://t.co/vz8IxrOQDU

Is Ftom the next big rug?

🚨Hard Rug alert: https://t.co/jA5ZPacCnn 🚨

— Rugdoc.io (@RugDocIO) February 16, 2022

Tomb Finance fork ftom contains hard rug code within the genesis contracts.

Genesis contract: https://t.co/HQ3hGlrNJf

$500k+ at risk: These users should withdraw ASAP! @FantomFDN @tombfinance @TombForkWatch @Forgiving15 pic.twitter.com/BXUUmw4mOa

Illicit activities in the crypto space jumped 80% to US$14 billion

Illicit transactions jumped nearly 80% to $14 billion, an all-time high, in 2021, according to blockchain analytics firm Chainalysis https://t.co/XbXqzPYtBB

— Bloomberg Crypto (@crypto) February 17, 2022

This article was written by Gabriel Sieng and Joel Zhao.

Featured Image Credit: Chain Debrief

Also Read: Hot Vs. Cold Wallets: Key Differences, And Why It’s Important To Own A Cold Wallet