The Ukraine-Russia Crisis

If you are wondering how the Ukraine-Russia crisis started and how it is in present day, here is a brief summary of how this crisis arose.

Ever since Ukraine’s independence in 1991, it started forging closer relationships with countries of the west, notably those countries in the alliance of NATO (North Atlantic Treaty Organization).

President of Russia, Vladimir Putin, did not like this idea of Ukraine being a part of NATO and made a list of security demands to the United States to prevent the Ukraine-NATO alliance from forming.

Putin did not want the eastward expansion and demanded NATO to roll back on troop deployment along the Ukraine-Russia border.

Furthermore, Russia does not want any NATO drills near its boarder and demanded NATO to withdraw from Eastern Europe.

US and NATO rejected those demands and “Ukraine became an informal member of NATO without a formal decision” said by Ruslan Bortnik, director of the Ukrainian Institute of Politics.

The continual tension between the two countries contributed to Russia’s action in ordering military operations on Ukraine.

BREAKING: Russian forces attack cities across Ukraine after President Vladimir Putin ordered an operation aimed at demilitarizing the country, prompting Ukraine’s foreign minister to warn of a “full-scale invasion” https://t.co/g4MVUB3BMB pic.twitter.com/FIQSEbs5Vn

— Bloomberg (@business) February 24, 2022

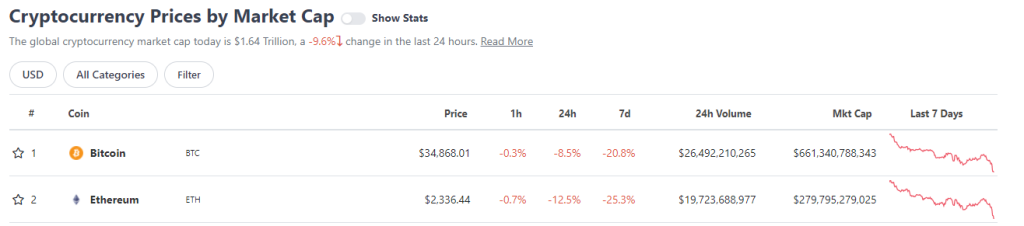

Crypto market bleeds

So what does this mean for crypto investors?

The fear, uncertainty and doubt was proven to be relevant as the crypto market bled.

BTC and ETH took a plunge head first falling 8-13% within the release of Russia’s actions. You can imagine what followed in the rest of the crypto market. Across the market consistently showed the top 100 crypto falling 25-35% in price prior to the news.

Why does the prospect of war affect crypto markets?

It is also worth noting that crypto investors are largely made up of two groups of investors. Fundamental investors who believe in blockchain and how it’ll change the world, and then there are speculative or algorithmic investors, as FTX chief Samuel Bankman-Fried explained on Twitter.

Speculative investors aren’t that interested in the fundamentals of crypto and see it more as a higher risk higher reward bet compared to equities, which is why there’s such a strong correlation between stocks and crypto.

Uncertainty and fear amongst investors

Wars like this generally create an overall sense of uncertainty, and uncertainty generally leads to risk averse behaviour. If investors are unsure what the short term future looks like, many may opt to liquidate first and hold cash or move to less riskier assets. While these decisions might seem rash in hindsight, in that moment, it makes the most sense.

We can see the effect of these in the flight to safety happening right now, where investors are flocking to safe-haven plays.

Inflation

Most of Europe gets a significant portion of its gas supply from Russian pipelines. As countries move to cut Russia off from the world, these countries will look elsewhere for alternatives causing a surge in prices.

That will affect everyone as energy and fuel prices will soar, and if prices are expected to rise, retail investors may decide to hold more cash if they’re expected to spend more in the coming months.

Businesses are also affected as the cost of production will increase, and so the economic outlook for businesses is going to be less rosy than it was pre-war, causing stock prices to drop. Given the correlation we spoke about, crypto prices follow in tandem.

Its is safe to safe logistics and supply chains eastern Europe provides to the rest of the world will be disrupted, shaking the global economy.

Potential regulatory risks

While it hasn’t really been discussed broadly yet, there is a potential risk towards crypto as nations continue to cut Russia off from the world. An option that is being heavily considered, although not yet imposed on, is to cut Russia off from SWIFT, the financial system that enables global payments.

Ukraine has already urged the US to bar Russia from it, which will prevent Russia from taking international profits from gas sale — 40% of its revenue — plus from getting supplies from friendly nations.

If the SWIFT barring takes place, it may lead to Russia to turn to crypto as a way to transact. Doing so may lead Western nations to take a hard stance on crypto to further cripple Russia.

Gold soaring at the expense of Ukraine

As the crypto market continues to bleed, an opposing asset class, Gold seems to take a more positive turn. the US$12.1T market (more than 8x the current global crypto market cap) soared 2% as Russia attacks Ukraine.

As liquidation continues to grow popular in the crypto space, investors look toward the traditional store of value asset as the safe heaven plays.

During uncertain times, Gold is considered a safe store of value and a hedge against the equity market. Currently, as the geo-political feud continues to unfold, it heads towards its best monthly performance since July 2020.

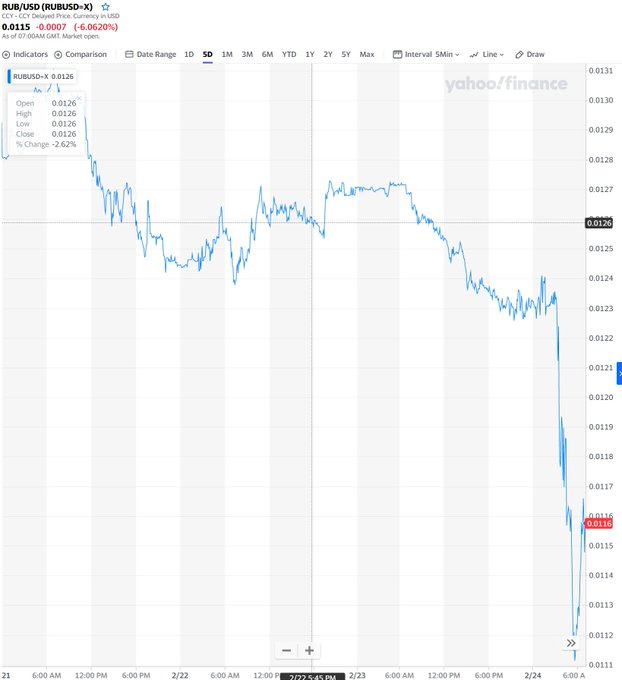

Soaring of gold comes at the expense of eastern European currencies and its financial systems.

Bitcoin as digital gold?

Image Credit: CryptoQuant

There is also a stronger correlation between Bitcoin and traditional equities as they start to move in tandem as investors seek safe havens from the choppy market.

Bitcoin’s correlation with the US equity market (S&P 500 index) has recently seen a multi-year high. This could be largely due to the mass adoption of Bitcoin by many US traditional institutions. Crypto adoption in 2021 grew 2300% since 2019 and 881% in the previous year.

The strong correlation also means that Bitcoin can no longer be viewed as a safe haven against the equity market. As Bitcoin is crashing in the present time, global markets will all experience negative price action until the dust settles.

So can we still consider Bitcoin as digital gold?

While Bitcoin and Gold have significant advantages over fiat currencies (neither would be diluted or debased), the correlation of BTC with the equity markets beg a differing utility.

Tips on surviving the bear market

1. Dollar Cost Averaging

DCA is to Continually invest money over time and in roughly equal amounts. This helps smooth out your purchase price over time, ensuring you don’t pour all your money into a stock at its high (while still taking advantage of market dips).

2. Converting to Stable-farms

Volatility is crazy in the crypto market, almost to the point where it is normalized. One way to avoid the volatile nature of the market is to look into stable farms. Consolidating a portion of your portfolio into stables might be a defensive strategy and prepare for the incoming market recovery. At the same time you put your stables to work.

(Also Read: Earn Yield From Stablecoins: Where you can stake them and how much interest you can earn)

3. Setting your sights for the long term

Bear markets are a test for all investors, a test to shake off investors who are less convicted in the market. In my opinion, the crypto market space will only get stronger and stronger, with smaller percentages of sell offs each time the market crashes, we are still building the foundation.

While it is difficult to endure, history in the crypto space has shown recovery to breaking formers all time highs. At this moment, it is wise to take the time to plan for an exit strategy when the market recovers. We all have been in the position of being greedy and not taking profits when we can and regret what we should have done when the market takes a turn. Of course, it all also depends on the level of conviction you have in the crypto space. Hang in there everyone!

The recovery

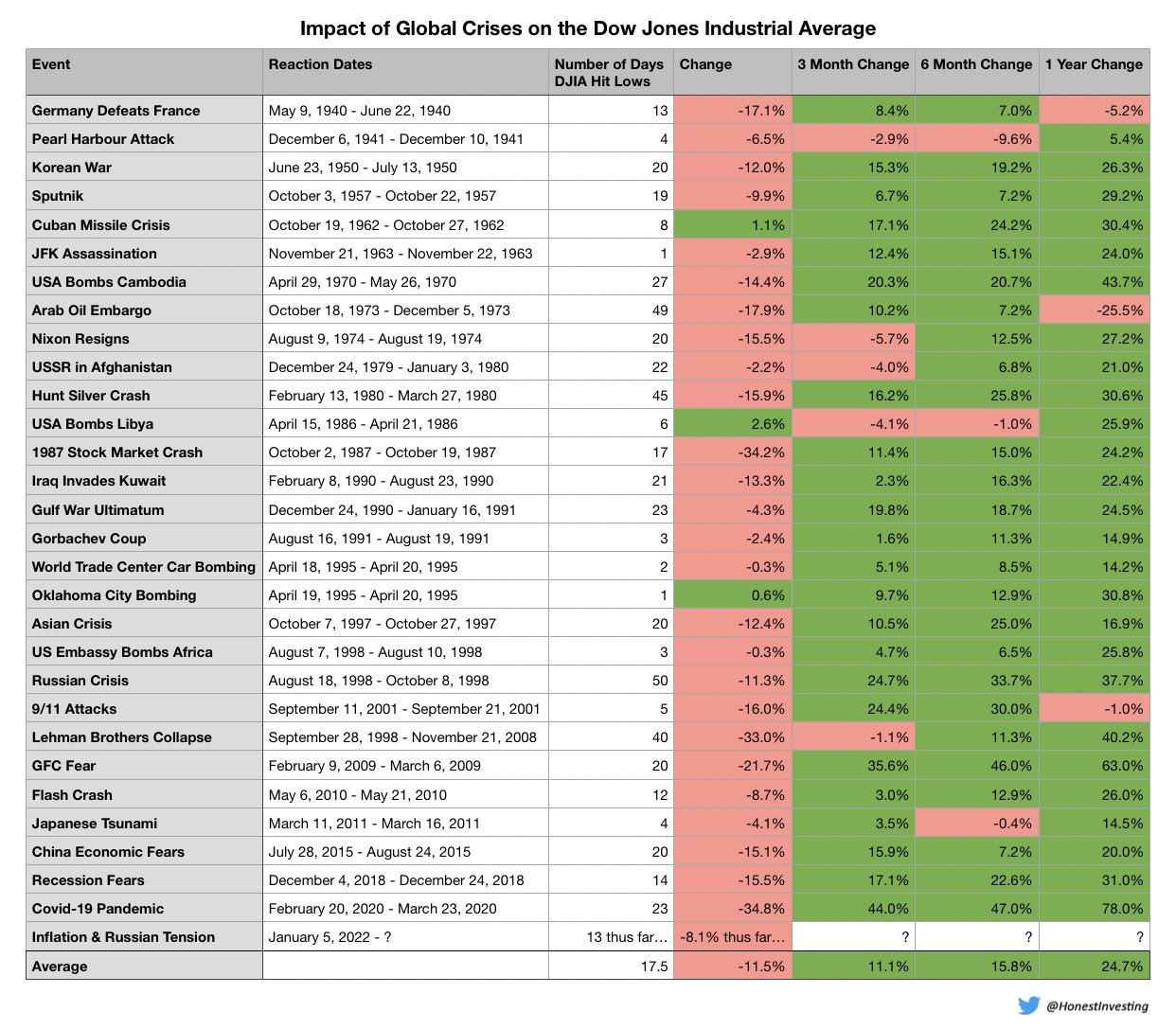

The strong correlation between the crypto market and the Dow Jones already showed how markets react to geo-political news.

The main reason for this correlation could be monetary policy. The moves in expectation of inflation and interest rates change USD and other fiat currencies. Basically, the higher the inflation, the higher crypto and equities will go up against USD.

On average, the change in price amidst all global crisis since 1940 saw a 11.5% draw back. What comes three months later is a push of 11.1% upwards, 15.8% in the six-month change and 24.7% in the one-year time frame from the crisis occurring.

But think long term, this gap will continue to shorten in making a more battle tested crypto market. I am bullish in the crypto space and these “tests” are priming crypto to be stronger in the distant future and serves as a benchmark for all future crashes and all time highs.

What position are you taking amidst the chaos happening in the world?

Closing thoughts

Do remember to manage your risks and portfolio accordingly. While indicators have shown that the markets do recover significantly, no two situations are the same, and it is impossible to accurately predict what exactly will happen.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief