The MetaJam Web3 Summit is happening from the 26th to the 28th of July 2022. It is a phygital summit that will showcase a line-up of keynote speeches, debates, and sharing workshops hosted by leading personnel and speakers from the region’s Web3.0 space.

On the topic of why venture funds are rushing into the world of crypto, we have one of the most stacked lineups in the whole event. Speakers include Derek Lim, Head of Research in Spartan Labs, Gwendolyn Regina, the Investment Director in BNB Chain, Ben Wee, Vice President in Crypto.com Capital and Lai Yuen, Founder of CCC NFT as the moderator.

Crypto is a nascent space

Crypto is so new that there is a lot of opportunity for people with the right skill set and knowledge to come in and shape the space to their vision. This very attractive opportunity is not widely available in other markets due to their maturity.

Crypto is also generating more and more interest by the day. The crowd can be categorised into two main spheres:

- Those who are here for the money

- Those who think that there is a lot of potential in Web 3.0

This is an evolution with more and more people realizing that this space has the opportunity for immense wealth. It is clear that those who are in the Web 3.0 space now are early and that it is just the beginning.

Web 3.0 investments are different from TradFi

Fundamentally, Web 3.0 VCs (Venture Capitalists) function similarly to traditional ones.

Some key metrics that both Web 3.0 VCs and TradFi VCs look at:

- Product

- Team

- The team track record

- Product roadmap

- GTM strategy (go-to-market)

- Fund Raising details

- Valuation

One of the big differences is that Web 3.0 VCs invest in tokens instead of equity. Tokens have different types of utility so there is an additional layer of analysis needed for tokenomics.

Another big difference is the exit strategy. Traditionally VCs can only exit their investment through liquidity events like IPO or additional funding round where they can sell down their equity.

Web 3.0 liquidity events come very much sooner where VCs can exit through IEO or IDO. In essence, Web 3.0 investment is more liquid and VCs can usually see upsize returns of 10x or even 100x depending on their entry and exit.

Issues with current token economic designs

Some of the projects in the current space lack a clear plan on what their token is supposed to do. Typically what happens post IDO or IEO is that the token trading volume would drop substantially after the initial pump because users have no reason to hold the tokens.

Other than that we are also seeing a shift in model from liquidity mining to exploring a new model with creative game theory. The old bootstrapping liquidity first and think later model is over as now we are seeing that mercenary liquidity does not even stay until the end of bootstrapping event.

More thoughts are put into newer token economic design, moving away from ponzinomics and into a more reliable profit model. While there is no clear winning token economic design right now, we can expect to see a more creative model with new game theory in the months to come.

What areas are you currently looking at?

Ben: In the bear market we are looking at projects that will do well in the bear market like an infrastructure type of project. Projects like Serum on Solana or UniSwap V3 are projects that will do well in both bear and bull markets. Besides that, also looking for new DeFi project that is building innovative things.

Gwendolyn: As an ecosystem player, ecosystem growth is more important than financial gain. Currently looking out for new innovations that would help with ecosystem growth. Also looking into DAOs tooling and SocialFi/MusicFi.

Derek: The first one is the next wave of GameFi. The current Web 3.0 GameFi is still very early and there are many elements that can improve and learn from Web 2.0 games.

Secondly is the next wave of DeFi. DeFi projects are moving away from mercenary capital, into building a moat where it doesn’t have to rely on high APRs.

The third highlights the importance of aligning incentives and needs between stakeholders. Interestingly, move-to-earn or play-to-earn were strong examples of this.

The fourth one is NFTs. Moving beyond just profile picture and looking into the use cases of phygital (physical + digital) and soulbound tokens.

The last point is the infrastructure layer. The current value on the application layer would shift back to the infrastructure layer as recent incident showed that crypto is still very reliant on the infrastructure layer.

Is Futarchy the answer to governance?

There is an issue with governance where attacks are very easy to execute even on major protocols. The issue of governance is very hard to tackle as it is a social issue and if you combine that with decentralization, it becomes even harder to solve.

“A concept I’m peronally looking at is Futarchy. It is concept that ties in with governance. To me that can be the next thing to really ensure that there is true governance beyond just the token power.”

Derek Lim, Head of Research in Spartan Labs

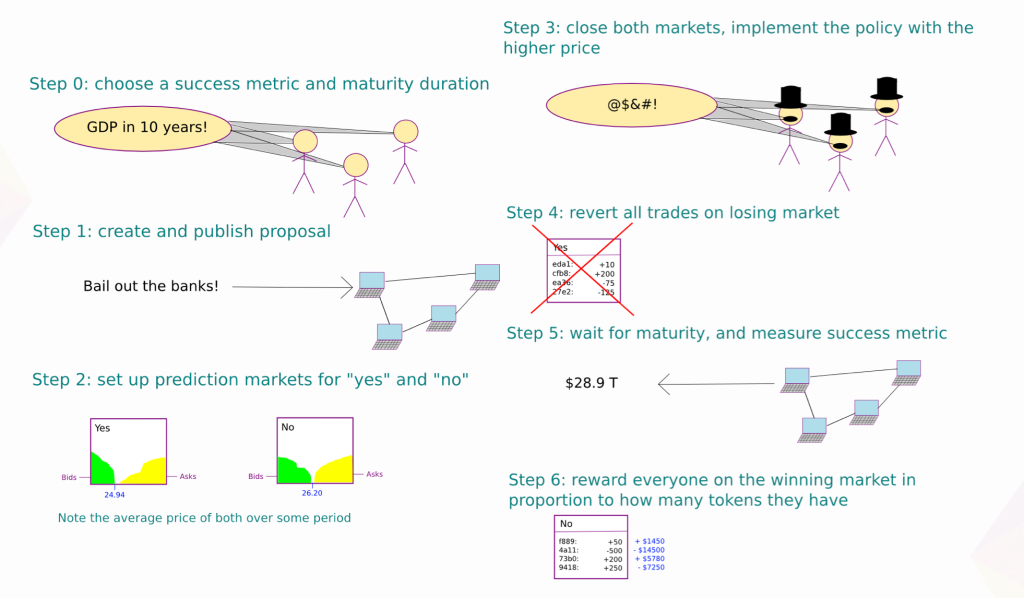

Futarchy is a form of government proposed by economist Robin Hanson. It is a futuristic form of governance where individuals would vote on metrics to determine national wellbeing, and then prediction markets would be used to determine which policies have the most positive effect.

Vitalik Buterin, the co-founder of Ethereum, also posted his research on Futarchy on the Ethereum foundation blog. This form of governance effectively helps to make it harder for individuals to act on their self-interest and also makes governance more open and transparent.

Ps: Derek will be sharing his research on Futarchy in the near future so keep a lookout for it!

Also Read: MetaJam Summit: Will the Next 10 Million Users Come From GameFi?

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief