NFT projects and collections have exploded in popularity over the past few months mainly due to two wildly popular projects — play-to-earn NFT game Axie Infinity as well as NFT marketplace Opensea. Both projects recently surpassed US$1 billion in transactions processed.

@AxieInfinity is the first #NFT game to surpass $1 billion in sales. https://t.co/REGv5y8oct

— Chain Debrief (@ChainDebrief) August 10, 2021

OpenSea has officially surpassed $1 billion in gross market volume after a record few days.

— Oliver Isaacs (@oliverzok) August 14, 2021

More impressively @opensea facilitated $1 billion in volume in 2021 alone!

2018 – $473k

2019 – $8 million

2020 – $24 million

2021 (YTD) – $1.02 billion

Absolutely insane growth. pic.twitter.com/NjTSxp0sqR

Even the big players are getting into the NFT game. Digital payments giant Visa revealed that on August 18, it had spent US$150,000 to purchase its first non-fungible token (NFT) — CryptoPunk 7610.

There are tens of thousands of NFT projects on the market, and the rate of new NFT projects being minted has also increased significantly.

At this point, even seasoned investors might be wondering how to value NFT projects before deciding which one to invest in. According to Variant Fund co-founder Spencer Noon, here are some metrics that can be used to evaluate NFT projects.

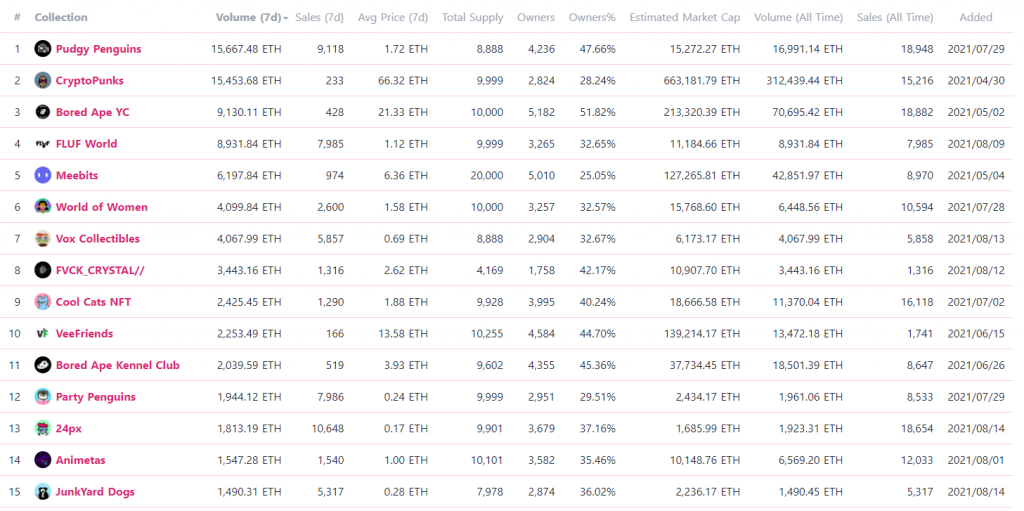

1. Estimated market cap

The first metric to evaluate a NFT is its estimated market cap. This can be calculated by multiplying its 7-day average price by its total supply.

NFT markets are generally less liquid and move a lot slower than cryptocurrencies (fungible tokens) as you’d need to find a buyer that is willing to purchase your NFT. A high estimated market cap means that there are more owners of the tokens and they may be willing to pay for a higher price to acquire the NFT collection from one another.

A good tool to measure the estimated market cap is rarity.tools.

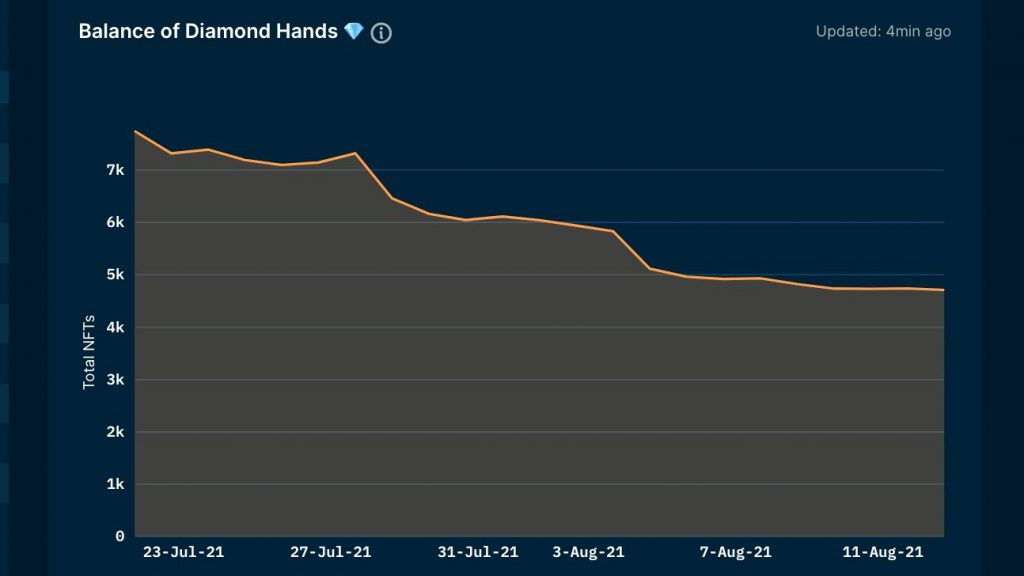

2. Diamond hand balance

The second metric to measure a NFT collection is the number of owners who have not sold their first NFT collection. This is a useful indicator for identifying projects with true long term believers.

A tool that you can use for this is Nansen Analytics.

Crypto investors use Nansen to discover opportunities, perform due diligence and defend their portfolios with our real-time dashboards and alerts.

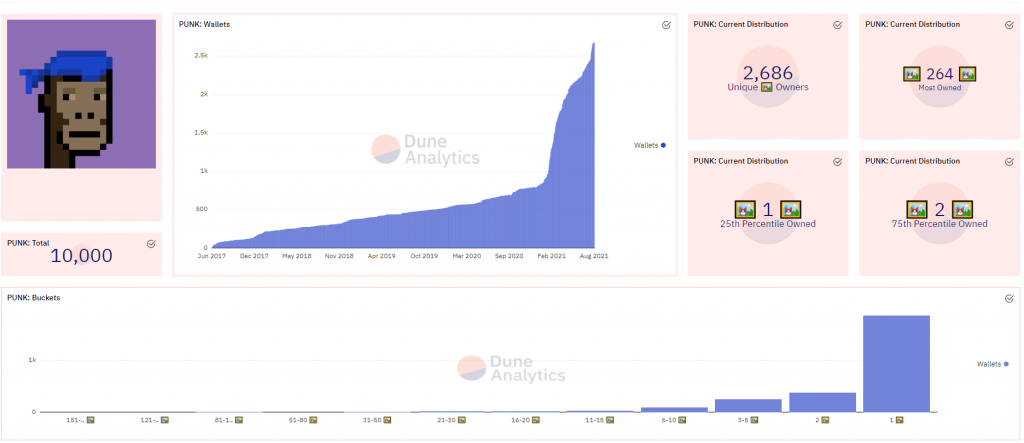

3. Number of unique holders

The third metric to measure the value of a NFT is the number of unique holders. This indicator is used to understand the size of a project’s community. The larger the community, the more word-of-mouth it attracts, and this subsequently helps to market the project to more potential buyers.

This can be measured using an existing Dune Analytics dashboard: NFT Comparison (dune.xyz)

4. Volume traded

The fourth metric you can use is the volume traded of the NFT collection. This shows the overall demand for the collection.

This metric is available on both Opensea and Rarity.

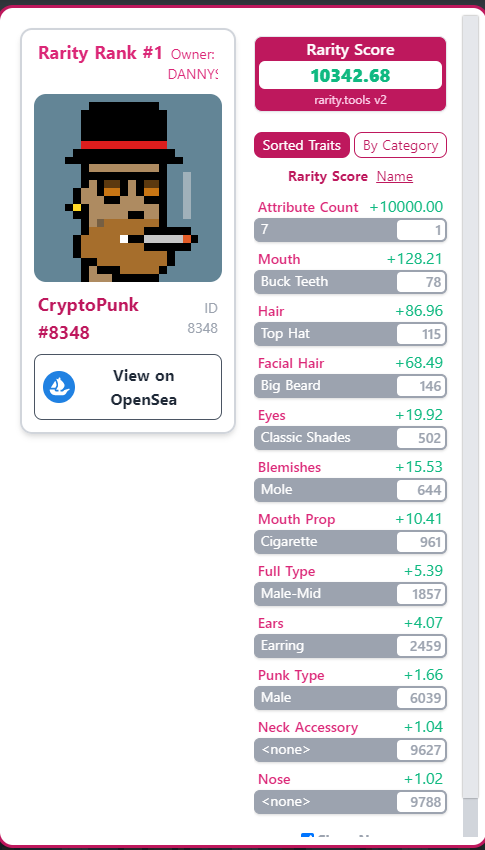

5. Rarity score

Probably the most useful metric on this list will be the rarity score, a metric created by Rarity to measure how valuable the NFT collection can be.

All things being equal and if you don’t have a preference on aesthetics, NFTs with higher rarity scores are usually more valuable than those with lower rarity scores.

Rarity.tools is a website dedicated to ranking generative art and collectible NFTs by rarity. Rarity is one of the most important factors in determining the value of an individual NFT.

With this info, NFT collectors can more easily value and compare relative value of individual NFTs against each other.

On Rarity, each trait of an individual NFT is given a Rarity Score, and the Rarity Score for all traits of that NFT are added up to provide an overall rating. Below is an example:

According to rarity.tools, each NFT community values their NFTs differently, and rarity.tools customizes the ranking for each project by adding additional ‘derived traits’.

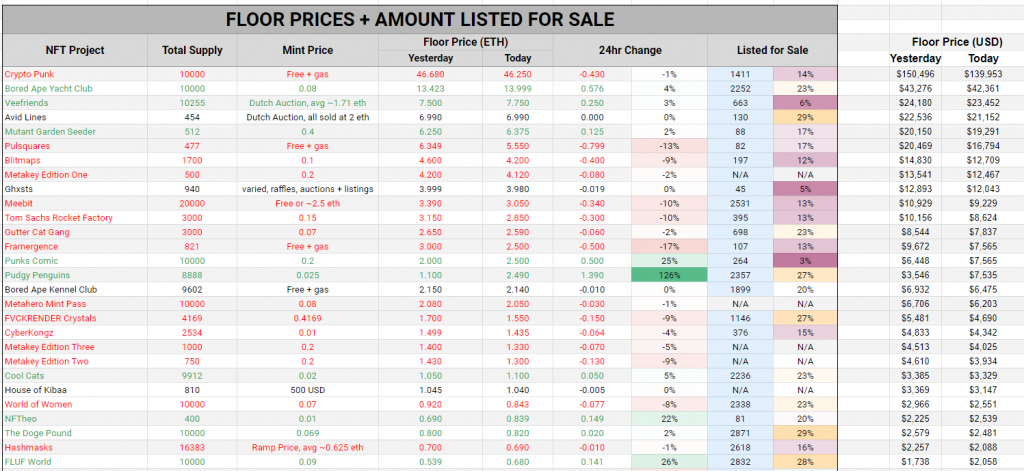

6. Floor price

Another useful metric that can be used is the floor price of NFT collections. This is a useful metric to monitor how easy a new NFT user can join the NFT collection.

Here’s a handy excel sheet that can be used to check the floor price of the latest NFT collections.

The six metrics above can used to evaluate and navigate the thousands of new NFT projects being minted every day. With Opensea growing at an exponential rate, these metrics will become more and more important.

Featured Image Credit: Art Net News

Also Read: On Chain Metrics You Can Use To Value Chainlink And Why They Are Important