Sometime back, we had the opportunity to speak to Martin, a Crypto Data Journalist at Nansen. Nansen is a blockchain analytics platform that enriches on-chain data with a massive and constantly growing database containing millions of wallet labels.

The Nansen team started building Nansen in 2019 to address the need of wallets that are transacting on chain, and have quickly become a leading data provider and analytics for Ethereum.

They label wallets using a number of ways, including heuristics and algorithms, smart contract parsing and analytics, research, user contributions, and many more.

Making sense of data

Based on on-chain data, one key metric to look at is the percentage of stablecoin in a “smart money’s” portfolio. Smart money commonly refers to the “whales” we know it crypto, those who can potential move markets.

This data should not be the only metric you look at, but instead a general guideline. Compared to the crypto crash in 2017-2018, there were a lot less of the “smart money” and percentages could be skewed quite heavily by larger funds in the space.

Martin also mentioned that 2021 was the year they saw magnitudes of venture capital funds flowing into the space and as of current day, smart moneys are not as afraid as they used to before.

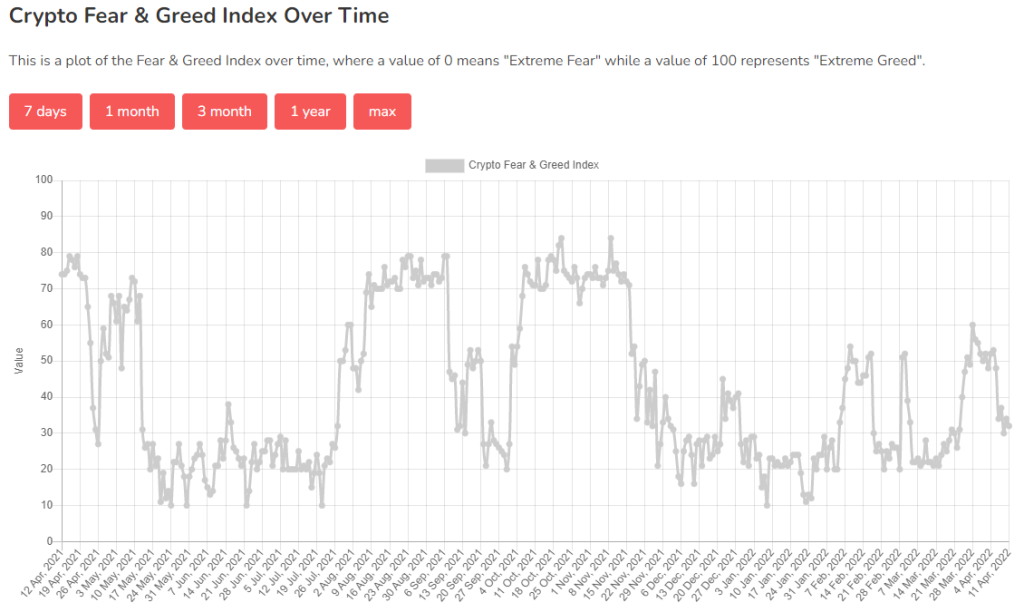

There is also a inverse relation between the percentage holdings in Stable Coins with the Crypto Fear and Greed index.

When the percentage of stable coin holdings is high, the crypto fear and greed would reflect signs of fear in the market. Peak fear is estimated to reflect the % of stablecoin holdings of 12%.

Inversely, peak greed could reflect low percentages in the percentage of stablecoin holdings. Peak greed is estimated to reflect the % of stablecoin holdings of 2%.

Read Also: Trading Crypto with Nansen Smart Money by Nansen

Catalysts in the crypto market

Catalysts in bull markets are important. In a euphoric moment, any announcement that is made might pump a certain coin immensely. This gives birth to the commonly known acronym “FOMO”.

However, in a bear market and when things are not so smooth, any amount of catalyst might see negligible price action in the market. If a tree falls in the forest, and there’s no one there to hear, did the tree really fall?

Maybe the only catalyst that would pump the market is non crypto related news. This could be a macro level news or something completely unexpected. Imagine the price of Bitcoin when US start accepting Bitcoin as legal tender.

On the flipside, those macroeconomic factors might pose a threat in the crypto market. Prices of the digital assets would likely be easier to price in for FED tapering and the rising interest rates, but the scary thought comes amidst geo-political fears like russia-ukraine when it would be difficult in valuating assets.

Bitcoin may rise through these cracks as an aid for developing countries during uncertain times. A probable hedge to the “chaotic world” but unlikely for bigger economies to accept like US/Singapore as it would be something they cannot control over their own fiat currency.

Blockchain activity

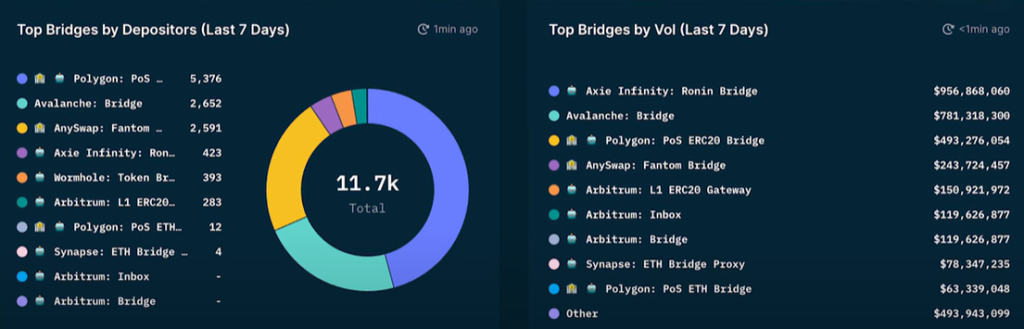

Nansen has a dashboard called the bridge builder. This view shows the flow of funds from the Ethereum network to other ecosystems based on networks and chains they support.

Chains they support are Ethereum L2s like Arbitrum, Optimism and other EVM compatible blockchains like Avalanche and Fantom.

One way to beat the sideways market is to DeFi. The dashboard provides visibility on which chains are the popular ones for yield farming etc which users may adopt.

Why NFTs?

DeFi brought in the Capital, but NFTs brought in the people.

Somehow there’s an inverse relation between the the NFT market and the broader crypto market. Few potential reasons may come to fruition,

1. NFTs traded in ETH, but priced in USD

When there is a fluctuation in ETH prices, NFTs either increase or decreases in ETH’s terms. But this might not be the case in its USD value.

For example, BAYC broke its floor price of 100ETH when prices of ETH was at US$2K, but recalibrate its floor price to 50ETH-ish when ETH’s price was at US$4K. It might be an insane number priced in ETH, but shows similar value in terms of USD. These changes might just be a market repricing in terms of USD currency.

2. Speculative upside

When we think speculative, we think of the DOGE, SHIB and SAFEMOON. But those coins have yet to made huge moves in a really long time.

So where would do these speculators go when meme coins are not as exciting as before? They turn to NFTs where projects which does well could generate them 10-100x.

The lack of liquidity in NFTs also makes it more exciting for speculators, especially with narrative swings in the NFT space, eg. Anime narrative like Azuki.

Read Also: NFTs As Investments – How Are They Performing?

Closing thoughts

It is important to understand time frames before your invest. For crypto, the longer it plays out the more bullish I get. If you are in it for the long run, continue to accumulate and always have cash on the side.

Coming from the POV of the current market (total crypto mcap downtrending for a few months and currently -35% of ATHs), by most measures we are already in a down trending market. However, that’s not to say that there’s no chance of a recovery, we can have a huge green candle and we’re back at ATHs.

On a longer time horizon, crypto still presents the best asymmetric upside of any asset class. Tons of parallels to the early days of the internet and while it isn’t up only, the upside far exceeds that of any other industry.

A sideways market also presents many opportunities. Crypto has many verticals and we’ve seen over the past 6/8 months that certain sectors can move independently – metaverse, games, NFTs, alt L1s. Be nimble, agile and always keep an eye out for opportunities. Of course none of this is financial advice and always DYOR!

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: Why Do Gamers Hate NFTs? Are NFTs Out To Extort Gamers Or Liberate Them?

Was this article helpful for you? We also post bite-sized content related to crypto of the latest news and bite sized threads on Twitter, and you can follow us here!

This week in crypto:

— Chain Debrief (@ChainDebrief) April 8, 2022

– Bitcoin most traded asset on Robinhood in 2022

– Starbucks will release NFTs and accept #BTC as a form of payment

– Shopify announces BTC payments integration

– Paypal co-founder: Bitcoin is most honest & efficient market

– Solana NFTs go live on Opensea