Daily NFT (Non-Fungible Token) trading volume has fallen 99% on Opensea since record highs in May.

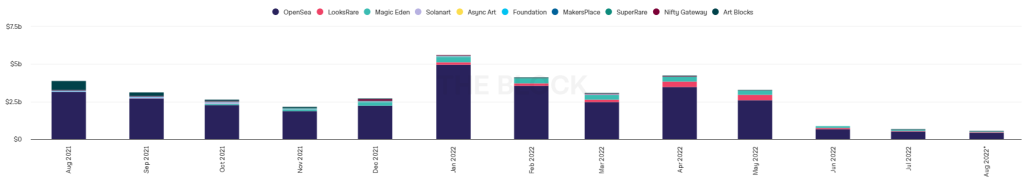

According to The Block, overall trading volumes across all major marketplaces have also seen an approximately 80% decrease in the last 3 months.

With Opensea still holding the lion’s share of trades, the total amount exchanging hands has fallen from the peaks reached earlier this year. Since January, volumes fell roughly 25% every month, before a sharp fall from May to June.

Since then, trading volume has been floating at a tenth of the months prior.

The fall could be associated with two leading factors – an overall market downturn, as well as a drop in the price of Ethereum.

With $ETH being the predominant medium of exchange for NFTs, being 68% from its highs does not bode well for the statistics.

Opensea Monopoly

More interestingly, we can see that other marketplaces such as LooksRare have started to chip away at Opensea’s market share.

Since peak NFT mania, the percentage of trading volume hosted on Opensea has been falling steadily.

This is thanks to innovations and incentives by new platforms, such as LookRare rewarding users with tokens. While some may be worried about data skew due to wash trading, this data set filters out such activity.

Furthermore, Opensea has not established itself outside of Ethereum.

The burgeoning activity on chains such as Solana has granted platforms like Magic Eden a head start on their native blockchains.

Crypto natives have also been critical of Opensea in the past, especially when it decided to IPO, instead of release a token to users.

Users have also previously had trouble with the marketplace, with NFTs being blacklisted due to compliance issues.

Wind In The Sails

While Opensea’s competitors are catching up, they are still far away from competing with the NFT behemoth.

In fact, it has continued building heavily during the bear, and has plans to establish itself in Solana as well as Polygon.

Starting today, we will begin using Seaport for all new listings and offers on Polygon! We’re excited to start using Seaport across multiple blockchains to improve the experience for everyone on OpenSea.

— OpenSea (@opensea) August 30, 2022

Here’s what you can expect with this move to Seaport ↯

Their latest development, Seaport, allows it to operate more safely and efficiently as a marketplace.

By lowering gas costs, removing account initialization fees, and letting users bid on entire collections, Opensea is looking to steadily expands its moat.

In an update dated 30th August, they also announced that they would be adding support for more EVM-compatible chains such as Klaytn.

Despite their rival’s efforts, Opensea’s first mover advantage has established its monopoly status, with all others attempting a long-winded game of catch-up.

Also Read: One Unlikely Country Is Leading The World Into Web3.0

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chaindebrief