In capital markets, the act of selling a security at a given price without owning it is known as shorting. This is also termed as short selling.

Short selling is a trading strategy that speculates on the decline in a security’s price. It is an advanced strategy that is usually undertaken by experienced traders and investors.

Shorting is done with the motive of earning profits by purchasing the security at a lower price than entry later on. This method can be extensively capitalized during a bear market where the decline in price for assets are prevalent in the market.

In short selling, a position is opened by borrowing the security that the investor believes will decrease in value. The security must be borrowed because you cannot sell a security that you do not own. To close the short position, the investor buys the security back on the market with the hope that it is cheaper than the price they borrowed the security at before returning them to the lender.

Investors may choose to open a short position as a hedge against the downside risk of a long position in the same security or a related one.

Example

For example, suppose an investor thinks that Bitcoin (BTC) is overvalued at USD $30,000 and will decline in price.

The investor could borrow 1 BTC from their exchange and then sell 1 BTC for the current market price of USD $30,000. If BTC goes down to USD $25,000, the investor can then buy the 1 BTC back at this price, return the borrowed BTC to their exchange, and net USD $5,000 ($30,000 – $25,000) in profits.

However, if BTC price increased to USD $40,000, the investor would lose $10,000 ($30,000 – $40,000).

Here is why you can see short selling is extremely risky as the risk of loss on a short is theoretically unlimited since the price of the security can climb to infinity.

How To Short On FTX (mobile)

In this example, I will be going through how to short crypto on the perpetual futures market on FTX Pro mobile app. The theory here is slightly different as compared to the example mentioned above because in the perpetual futures market, the buyer purchases a contract without an expiration date as opposed to borrowing the underlying asset.

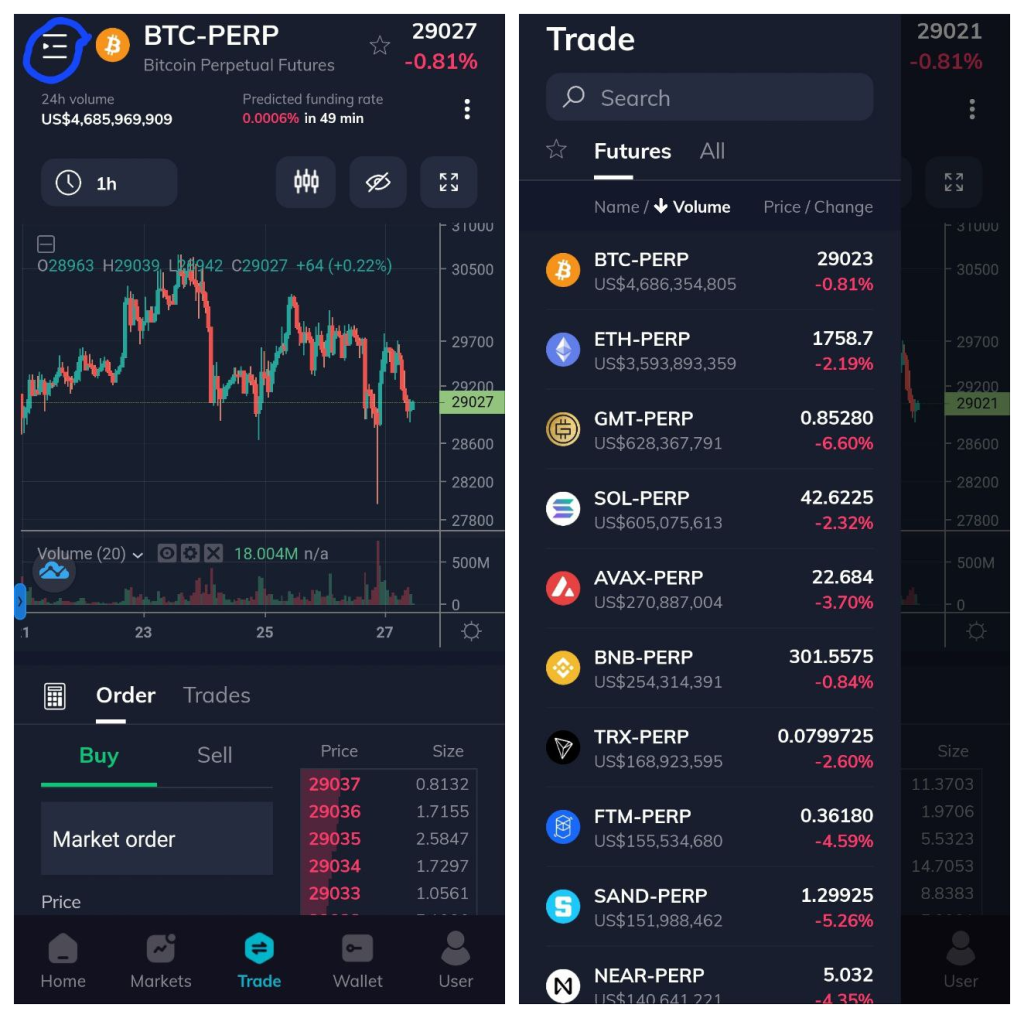

Choosing the asset

Starting off, toggle to “Trade” tab at the bottom. Next, tap the 3 lines at the top left hand corner as circled and search for the crypto that you want to go short on.

I will be using BTC in this example.

Setting an entry

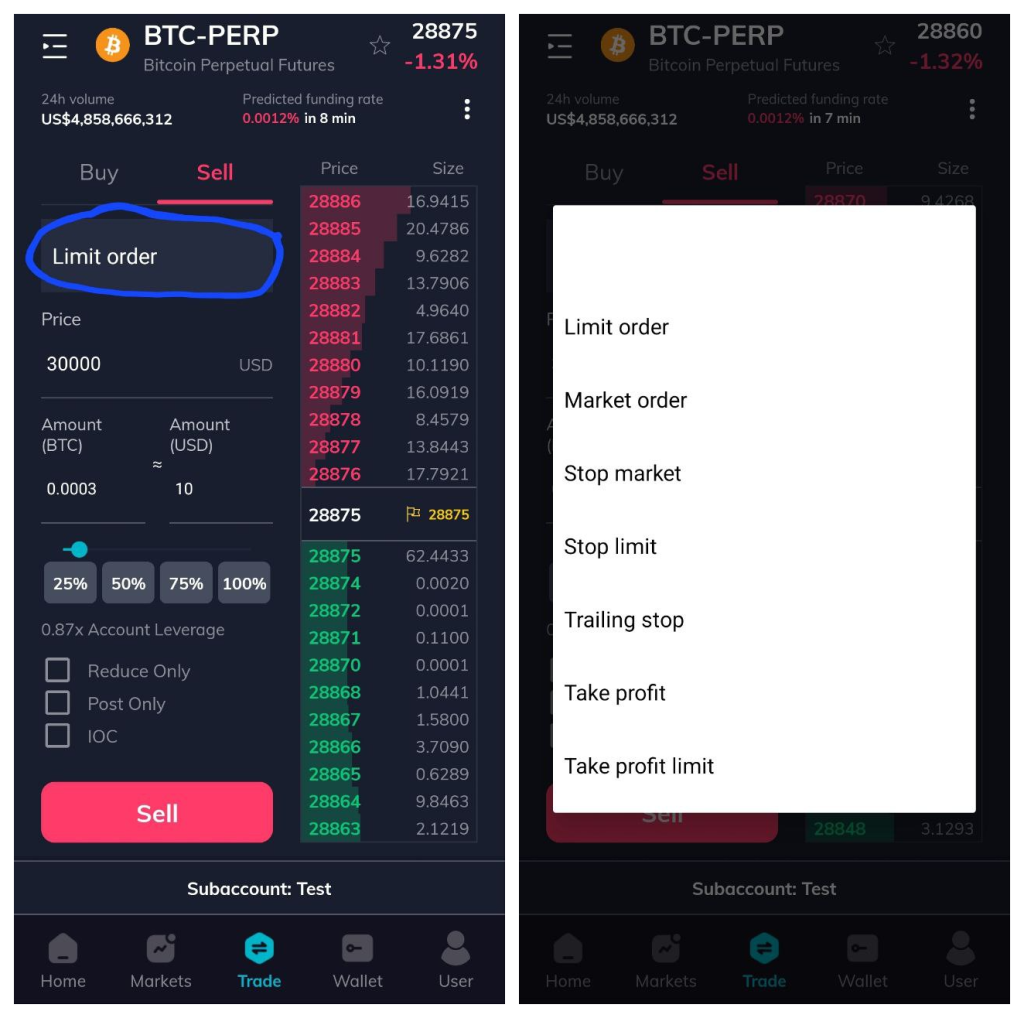

After selecting BTC-PERP, click on “Sell”. There are seven different ways you can choose to place a short order on FTX as shown. However, I will only be going through “Market order” and “Limit order” in this article.

Find out more on the other ways to short here: FTX Advanced-Order-Types

A market order is an order to buy or sell immediately at whatever the best possible transaction price is.

A limit order is to buy or sell at a specified price or better. For sell limit orders, the order will be executed only at the limit price or a higher one. While the price is guaranteed, the filling of the order is not, and limit orders will not be executed unless the price meets the order qualifications.

For example, BTC is currently trading at USD $30,000 and you place a sell limit at USD $30,500. If BTC increases in price to USD $30,500, your sell limit will trigger at that price or better.

In the picture above, you will only enter a short position without a stop loss or a take profit. Here are the steps:

1) Set the price you want to enter short

2) Set the amount of BTC or USD you want to short

3) Click the red button “Sell” and wait for your sell limit to trigger

For market order, it’s exactly the same except without step 3 as your order will be executed instantly.

Setting an entry, stop loss and take profit

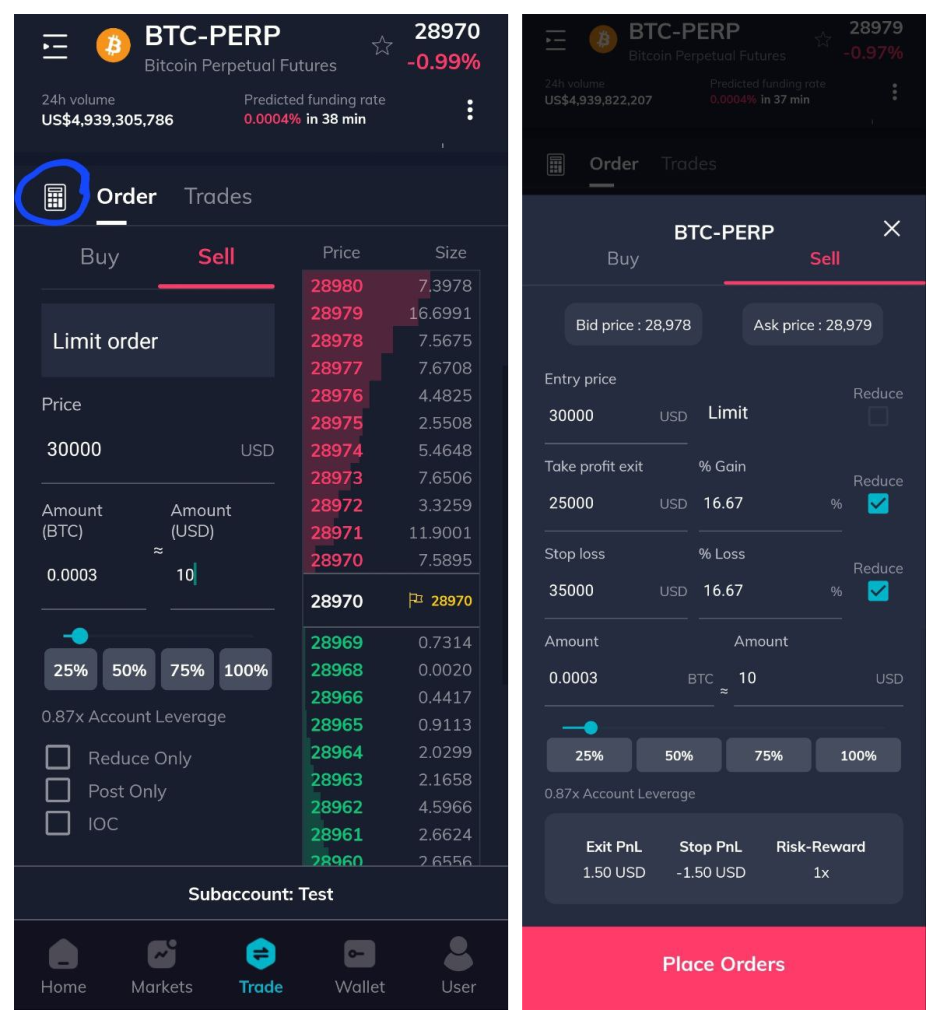

If you would like to input a stop loss and take profit to your short position, click on the calculator as circled and a pop up will appear.

In the picture above, you can enter a short position with a stop loss and take profit. Here are the steps:

1) Set the price you want to enter short

2) Set your take profit level or % gain that you would like to close your position for a profit

3) Set your stop loss level or % loss that you can afford to lose

4) Set the amount of BTC or USD you want to short (you can use the percentage boxes underneath it for quick toggling)

5) Click the red button “Place Orders” and wait for your sell limit to trigger

For market order, it’s exactly the same except without step 1 as your order will be executed at market price.

Conclusion

Shorting is an advanced strategy that is very high risk and newcomers should not try it without first understanding it.

Shorting can be profitable if you have a trading strategy and proper risk management in place. It can also be used as a hedge in this bear market if you know what you are doing. However, more often than not, it is the opposite and can blow your account if you do not know how to do it properly.

Find out more on the complete guide on the FTX platform and trading fees here.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Read More: Are All Stablecoins Doomed To Crash? Stablecoin Fundamentals You Have To Know