A meteoric rise

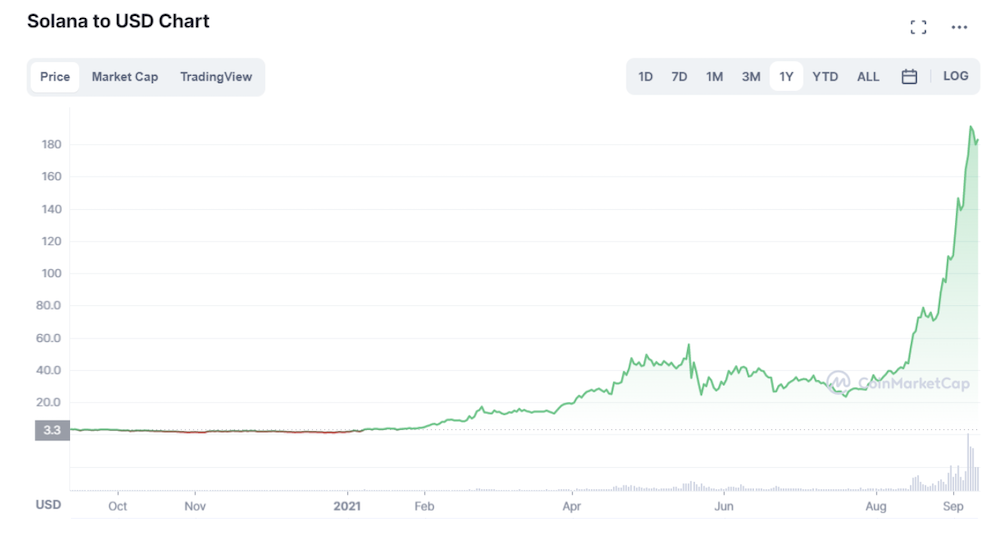

The recent skyrocket price rise in Solana’s native token, SOL, has captivated the attention of the entire crypto community.

On 9 September 2020, SOL hit an all-time-high (ATH) of USD214.96. Just a year ago, SOL was trading at a value of just USD0.50 per token, representing 430x returns in the time period.

Much of the price appreciation in SOL has occurred over the past 30 days, which saw SOL surpass the previous psychological barrier of USD100 per token, before breaching the USD200 mark recently.

We take a closer look at the factors that have driven up the price of SOL in the past month, and analyze whether SOL is potentially overheated.

SOL overtakes more established tokens, catching up to BNB

Solana is currently ranked #5 out of all the cryptocurrency tokens by market capitalisation. The market capitalisation refers to the total market value of all tokens in circulating supply.

The price surge has led to Solana trading at around ~USD180 at the time of writing. It has also overtaken more established cryptocurrencies such as Ripple and XRP, and is catching up to Binance Coin (BNB), which has a USD69 billion market cap.

It is interesting how SOL’s total market value is only around 22% lower than that of BNB, especially since BNB is the utility token of both the Binance centralized exchange and the decentalized Binance Smart Chain (BSC).

Comparing DeFi ecosystems alone, the BSC ecosystem is also more mature than that of Solana, with over 800+ decentralized applications and total transaction volume of over 1bn on BSC (over the past year), compared to ~300+ dApps on Solana.

With Solana still very much in a phase of rapid growth, the question of whether its valuation is overheated would depend heavily on one’s view of Solana’s future growth prospects, given that the current volumes and dApp ecosystem on Solana have not yet matched other more mature blockchains.

Is SOL’s price surge the result of event-driven momentum?

The recent spike in SOL’s price has arguably been driven by high-profile NFT launches on Solana.

One of the most significant and hyped launches was that for Aurory, with NFT sales (denominated in SOL) launched on 31 August and selling out almost instantly.

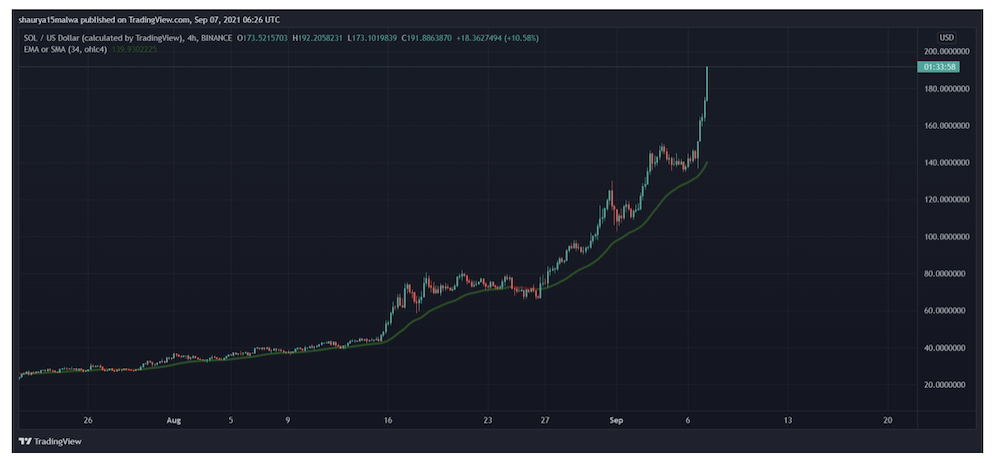

As seen in the price chart from 25 August to 1 September, the price of Solana surged significantly up to the day of the Aurory NFT sale, hitting a then-ATH of ~USD130, before correcting sharply post-sale.

The price run-up prior to the much-awaited Star Atlas Galactic Asset Offering was also significant. As shown in the chart above, despite hitting an initial ATH of ~USD130 in the run-up to the Aurory launch, the price of SOL surged to a new ATH of above USD200 on 9 September.

While correlation does not imply causation, many observers and analysts have argued that the rapid price appreciation of SOL is intrinsically linked to the recent proliferation of NFTs and the launch of NFT-based projects on Solana.

Solana is also widely seen as a credible competitor blockchain to Ethereum (offering higher throughput and lower transaction fees), where the majority of NFT trading continues to be concentrated on.

The strong buying pressure on SOL has had the result of forcing significant short liquidations, which have led to strong upward price spikes for the token.

According to on-chain analytics platform Bybt, a large majority of short positions (76% of total shorts, or ~USD58m) against SOL were liquidated on 6 September alone.

Should I be buying SOL now?

With the strong price momentum of SOL leading to new ATHs, it is difficult to call where the price of SOL is headed to on a short-term basis.

SOL remains very much in a price discovery phase. As recently as mid- August, analysts were calling for a top of SOL at ~USD100, with this price estimate already blown out of the water over the past few weeks.

It would be more prudent to focus on the core value proposition that Solana offers over rival blockchains, and the overall growth, expansion, and long-term potential of the Solana ecosystem.

What is certain is that potential buyers of SOL will need to be prepared for significant volatility (above and beyond general volatility in crypto) in the short-term, given the recent trends in token price.

Featured Image Credit: CNBC

Also Read: An Introduction To Solana – Why It Is The Hottest Blockchain Right Now