Over the past 1 year, one of the biggest things I did for my personal finance was selling off all of my Singapore equity holdings and investing them into crypto.

Since making that decision, my finance world view has changed completely. Besides the minor financial gain, here are some reasons why I sold all my Singapore equities and some of my US stocks to move them into crypto.

1. Higher risk reward ratio

Although Singapore is known for being a global financial hub, its stock market unfortunately has not been world class in terms of attracting investors.

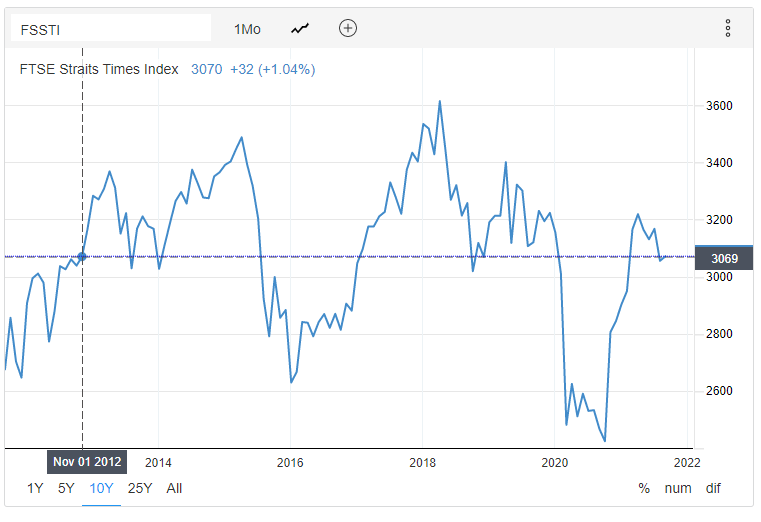

Over the past 10 years, the returns of the Straits Times Index (STI) has been flat — an investor who invested in the index 10 years ago would have zero returns excluding dividend gain.

While the STI recovered from October 2021 until the time of writing and registered a gain of ~50% from its low, the returns of the STI has always been notoriously low for long term growth investors.

On the other hand, dollar cost averaging into cryptocurrency has yielded me two to three digit gains on crypto projects that are solving real problems with a fast growing user base.

While volatility is very common in cryptocurrency investment, crypto has been known for providing upsized returned because of its fast technology adoption.

Crypto is also able to provide a higher return because it has a global target audience in a rapidly growing space, while investing in Singapore’s stocks may just be investing in local companies with a local market or at most a regional market.

The risk and reward ratio for investing in cryptocurrency is too high to ignore.

2. Crypto provides dividends

I was heavily exposed to the Singapore market back in 2018 while actively building up a dividend portfolio. The goal was to have the dividend portfolio providing a dividend passive income that could sustain my expenses, and allow me to live off my dividend portfolio.

This method is also commonly known used as a method to retire early by many FIRE (financial independence retire early) financial bloggers.

What I realized about cryptocurrency is that it also provide dividends on top of the potential capital gain. Depending on your risk appetite, the dividend can be up to two to three digits annual percentage yield.

Earning dividends is usually done via staking or providing liquidity in liquidity pool.

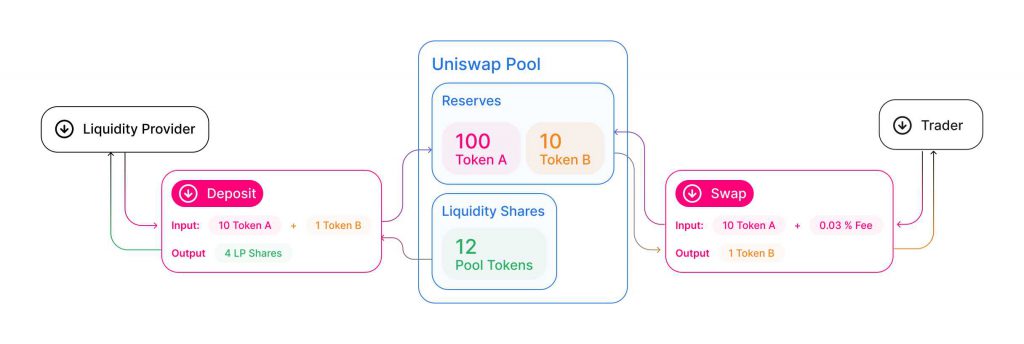

Decentralized exchanges such as Uniswap have built in smart contracts that creates liquidity pools that traders can trade against. These liquidity pools are funded by liquidity providers.

Anyone can be a liquidity provider and deposit an equivalent value of two tokens in the pool. In return, traders pay a fee to the pool that is then distributed to liquidity providers according to their share of the pool.

It is therefore also possible for crypto investors to be dividend investors too by building up a dividend portfolio.

Also Read: What Is An Automated Market Maker (AMM) Like Uniswap

3. Stablecoin provides dividends

Many investors might be worried that crypto might crash overnight, and even if crypto gives you a high yield, you might lose everything and the earned interest would be worth nothing.

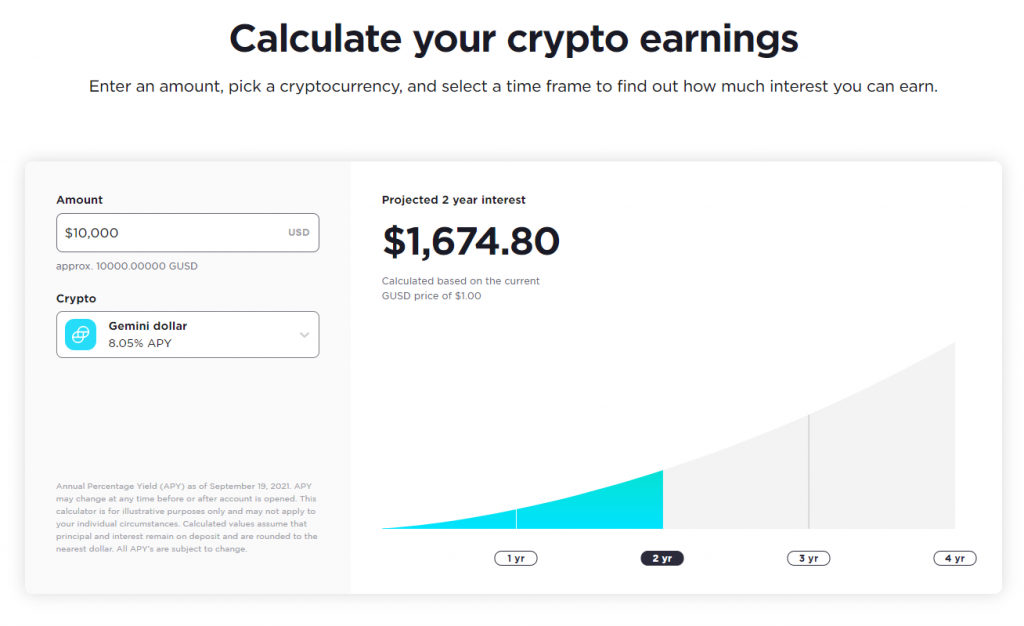

If you are worried about that, you will be happy to know that stablecoins like USDT, which is pegged to USD, can also provide you interest.

What this means is that you can convert your USD 1000 to USDT 1000, and simply put it in your Binance account (or Nexo) and earn 5% a year, with interest credited daily.

There are also decentralized exchanges that gives you double digit interest rate on your stablecoins. Even if bitcoin crashes in value, 1USDT will always be worth USD1 (in most cases).

So USDT is actually a good currency to move your money to to earn up to 5-6% interest rate per year. This is actually even better than putting your money into CPFSA which locks you up for a lifetime.

| USDT | CPFSA | Bank Savings |

| Earns >5% APY | Earns 4% APY | Earns 0.05 – 2%APY |

| Withdraw anytime | Withdrawal at age 55 | Withdraw anytime |

| Interest creditted daily | Interest creditted annually | Interest creditted monthly |

4. Vested interest to learn

I learnt more and more about this new financial world as I began investing in cryptocurrency more heavily. This also led me to have a more vested interested to learn about the space.

Cryptocurrency is the fastest growing technology adoption in history, and is set to define who will win the technology race in the next decade.

Also Read: The Crypto Supercycle Is Here: What Is It, And Why Should You Be Part of It?