There is no doubt in anyone’s mind that Bitcoin is the king of crypto.

While some have argued that the lack of smart contract support and functionality relegates Bitcoin in comparison to Layer 1s like Ethereum, it’s simple, yet unique architecture has allowed it to perpetually dominate in terms of market capitalization.

However, the resurgence of Bitcoin-Native NFTs, called “Ordinals”, has kick-started conversations on the possibilities of Bitcoin should it get smart contract support.

Bitcoin L2s are good for Bitcoin.

— muneeb.btc (@muneeb) June 20, 2023

L2s like Lightning, Stacks, Rootstock is how BTC reaches a billion people 🟧

Enter Stacks, a Bitcoin Layer 2 that could just unlocked the largest cryptocurrency’s full potential.

Also Read: NFTs Are Exploding … On The Bitcoin Network

What Is Stacks?

Stacks is an open-source layer-1 blockchain anchored to Bitcoin that enables smart contracts dAPPS, without changing any of Bitcoin’s functionality.

Instead, Stacks extends Bitcoin with new functionalities.

DApps built on Stacks can interact with Bitcoin state, using the Bitcoin network as a secure and robust layer where all transactions are settled.

Welcome to #Stacks 💜 👇

— stacks.btc (@Stacks) February 21, 2023

⭐ A #Bitcoin layer for smart contracts

⭐ Enabling smart contracts and decentralized applications to trustlessly use $BTC as an asset

⭐ Settling transactions on the #Bitcoin blockchain

⭐ Unlocking #Bitcoin Decentralized Finance, NFTs, BNS, and more pic.twitter.com/VoHnypE1dx

In 2017, Blockstack was co-founded by two Princeton alumni – Muneeb Ali and Ryan Shea, eventually rebranding to Stacks in 2020. The company secured $50 million through a token offering and used 2018 to develop its mainnet.

In 2019, Blockstack had its public sale and became the first-ever US Securities and Exchange Commission (SEC) controlled token sale (STX), multiple leading crypto asset exchanges also listed STX in 2019.

Today, protocols on Stacks have a combined TVL of over $28m with it’s largest dAPP by TVL, ALEX, having a 91.53% dominance on the blockchain.

Understanding The Technology Behind Stacks

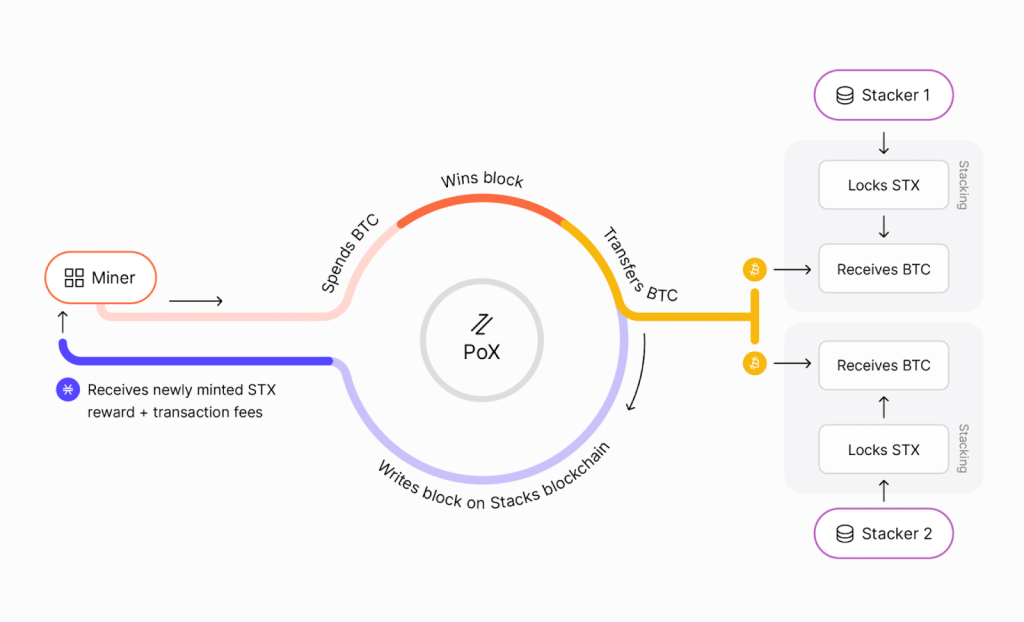

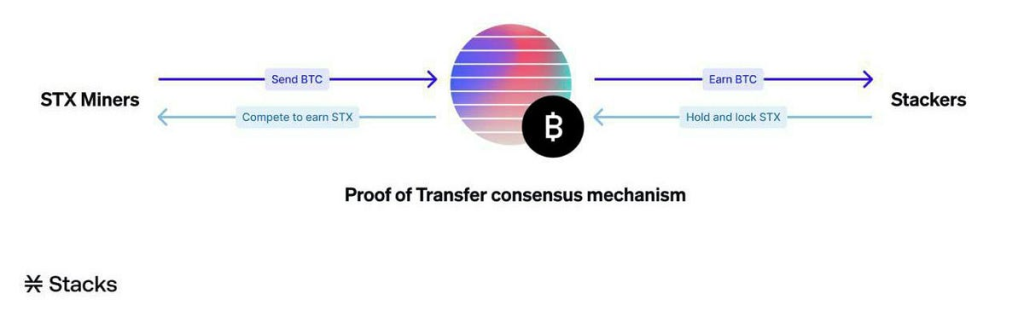

The fundamental concept behind the Stacks blockchain is the interplay between miners and stackers, governed by a unique consensus mechanism called Proof of Transfer (PoX).

Unlike traditional mining practices, miners do not actually mine anything in the Stacks blockchain. Instead, they exchange previously mined BTC from the Bitcoin blockchain for a shot at earning STX coins this is known as “Stacking”.

It is essential to note that each block in the Stacks blockchain records user identity and transaction metadata, allowing it to interact with all the applications in the Stacks ecosystem.

The connection to Bitcoin ensures that any alterations made to Stacks’ IDs or wallet balances are verifiable on the Bitcoin blockchain.

To fully understand how Stacks work we shall take a look at Proof of Transfer(PoX), Clarity smart contract which is what Stacks uses to implement PoX, Stacking, STX which is Stacks’ native token and BNS(Bitcoin Name System) as these are some of the features that make Stacks unique.

Proof Of Transfer

To secure a blockchain, consensus algorithms rely on either computational or financial resources.

Decentralized consensus is typically achieved by making it practically impossible for any individual actor with malicious intent to amass sufficient computing power or ownership stake to attack the network.

Modern blockchains employ various consensus mechanisms to secure the network, with proof of work and proof of stake being the most commonly used.

In Proof of Work, nodes dedicate computing resources whereas, in Proof of Stake, nodes dedicate financial resources to secure the network.

Learn more on Proof of Work and Proof of Stake here.

Another less widely used consensus mechanism is Proof of Burn, in which miners compete by ‘burning” (destroying) a proof of work (PoW) cryptocurrency, as a proxy for computing resources.

Proof of transfer (PoX) is an extension of the proof of burn mechanism. PoX uses the Proof of Work cryptocurrency of an established blockchain to secure a new blockchain.

However, unlike proof of burn, rather than burning the cryptocurrency, miners transfer the committed cryptocurrency to other participants in the network.

This allows network participants to secure the PoX cryptocurrency network and earn a reward in the base cryptocurrency. Thus, PoX blockchains are anchored on their chosen PoW chain, with Stacks using Bitcoin as its anchor chain.

The Proof of Transfer (PoX) mechanism offers several advantages for the Stacks blockchains, including:

- Stacks can leverage the high level of security provided by Bitcoin’s blockchain. This means that applications built on Stacks can easily interact with Bitcoin’s on-chain state and data.

- PoX(Proof of Transfer) does not require any specialized hardware, enabling anyone to participate in the network as a miner.

- PoX allows miners to reuse the energy that Bitcoin has already expended through its Proof-of-Work consensus mechanism.

The Proof of Transfer functionality is implemented on the Stacks chain via the Clarity smart contract.

See more on Proof of Transfer here.

The Clarity Smart Contract

Smart contracts allow developers to encode essential business logic on a blockchain. Clarity is a decidable smart contract language that optimizes for predictability and security, designed for the Stacks blockchain.

What makes Clarity different is that it is secure by design the design decisions behind Clarity were based heavily on taking lessons learned in common Solidity exploits and creating a language that has been purpose-built for safety and security.

Some of the merits of The Clarity smart contract are:

- Clarity is interpreted, not compiled

- Clarity is decidable

- Clarity does not permit reentrancy

- Clarity guards against overflow and underflows

- Support for custom tokens is built-in

- Clarity adopts a composition over inheritance

On top of all of that Clarity smart contracts can read the state of the Bitcoin base chain this means you can use Bitcoin transactions as a trigger in your smart contracts.

Clarity also features a number of built-in functions to verify secp256k1 signatures and recover keys.

Learn more about the Clarity smart contract here.

Stacking

Stacking is locking your STX temporarily to support the Stacks blockchain’s security and consensus mechanism.

As a reward stackers (people who lock their STX) earn Bitcoin that miners transfer to them as part of Proof of Transfer mining.

The duration of time stackers lock their tokens up for is called “cycles”. Each cycle lasts for 2100 blocks, which is equivalent to 2100 Bitcoin blocks. Each cycle lasts for around two weeks.

Stackers can either stack independently or collectively if an STX token holder has 130,000 or more they can stack independently via the Stacks wallet.

Don’t worry if you are an STX holder and you don’t have up to this amount of STX you can participate in Stacking collectively with others(stacking pools) on Xverse Pool.

Please note that Stacks (STX) token holders don’t automatically receive stacking rewards. Instead, they must commit to participation before a reward cycle begins

- Commit the minimum amount of STX tokens to secure a reward slot, or pool with others to reach the minimum.

- Lock up STX tokens for a specified period which is known as “cycle”

- Provide a supported Bitcoin address to receive rewards (native segwit is not supported).

See here for more on Stacking.

STX – Native Token

STX is the native token of the Stacks network. STX is used to pay transaction fees and can be locked directly on the network to earn BTC rewards.

The total supply of STX is 1.82 billion tokens, with 1.37 billion in circulating supply as of the time of writing STX has a market cap of over $1.6B, trading at $1.2 and the total STX supply will reach 1.82B by the year 2050.

The price of STX surged in February 2023 due to the hype around Bitcoin Ordinals, a type of quasi-NFT that recently became popular in Web3.

In March STX saw over 70% surge within 7 days this surge was as a result of Stacks launching Stacks 2.1 a new update that improves the entire ecosystem up to the Clarity smart contract

🚨 #Stacks 2.1 Activated 🚨

— stacks.btc (@Stacks) March 19, 2023

Strengthening The Connection to #Bitcoin

⭐️ Stacking Improvements

⭐️ New Clarity Functions

⭐️ Better Bridges

⭐️ Decentralized Mining

⭐️ #Bitcoin-native Assets

Find out more 👇 1/7

The price of STX started to pick up in the days leading to the launch of Stacks 2.1 and got to a yearly high a day after the update went live and since then it has been on a roll.

The Sracks 2.1 unlocked the ability to directly send Stacks assets to Bitcoin addresses and added the ability for miners to mine using a native SegWit or Taproot UTXO, this reduces the Bitcoin transaction fee by around 25%.

See all the updates on Stack 2.1 here.

Bitcoin Name System (BNS)

The Bitcoin Name System (BNS) is a network system that binds Stacks usernames with off-chain state, without relying on any central points of control. It enables anyone to create a namespace and customize its properties.

Namespace creation is based on a first-come, first-served approach, and once a namespace is created, it is permanent.

BNS names have three defining features:

- They are globally unique and do not allow for any name collisions.

- They are chosen by the creator and are human-meaningful.

- They are strongly owned, and only the owner of the name can alter the state it resolves to. Specifically, a name is owned by one or more ECDSA private keys.

Now why BNS? well let’s see names in DNS and social media are both globally unique and human-readable, but they lack strong ownership.

The system operators have the final authority on what each name resolves to. The problem here is that this necessitates that clients trust the system to make the correct choice in resolving a given name, including trusting that only system administrators can make changes.

In Git, branch names are human-readable and strongly owned, but they are not globally unique. As a result, two different Git nodes may associate the same branch name with distinct repository states, causing conflicts.

Developers have to utilize other methods to resolve these ambiguities. In Git’s case, the user must intervene manually.

In PGP (Pretty Good Privacy), names are known as key IDs. These IDs are both globally unique and cryptographically owned, but they are not human-readable.

PGP key IDs are generated from the keys they reference. However, the issue here is that these names are challenging for most users to recall since they do not convey any semantic information relating to their use in the system.

Now BNS has all these properties with none of their problems, which makes it a powerful tool for building all kinds of network applications. With BNS, we can do the following and more:

- Build domain name services where hostnames can’t be hijacked.

- Build social media platforms where user names can’t be stolen by phishers.

- Build version control systems where repository branches do not conflict.

- Build public-key infrastructure where it’s easy for users to discover and remember each other’s keys.

Mining Stacks

Due to its reliance on BTC to facilitate STX minting, the Stacks platform requires the services of miners.

These miners do not directly mine STX; instead, they contribute pre-mined BTC to generate new STX tokens.

Participating in mining requires miners to commit BTC, with the chances of mining STX being partially random and partially linked to the amount of BTC committed.

The profitability of this operation depends on two critical factors. The first is whether a miner is granted the right to mine a block of STX, which is more likely for those who commit larger amounts of BTC. The second factor is the relative value of STX compared to BTC.

Miners run Stacks nodes with mining enabled to participate in the PoX mechanism. The node implements the PoX mechanism, which ensures proper handling and incentives through four key phases:

- Registration: miners register for a future election by sending consensus data to the network

- Commitment: registered miners transfer Bitcoin to participate in the election. Committed BTC are sent to a set of participating STX token holders

- Election: a verifiable random function chooses one miner to write a new block on the Stacks blockchain

- Assembly: the elected miner writes the new block and collects rewards in form of new STX tokens

The issuance of STX tokens follows a halving schedule that mirrors that of BTC. As a result, a miner’s reward per block will decrease from the current 1,000 STX in the first 4 years of mining to 500 STX during the following 4 years, 250 STX during the following 4 years and finally, 125 STX indefinitely.

What’s Building On The Stacks Ecosystem

The Stacks ecosystem is quite busy with a lot of DeFi, DApps, NFT protocols and more coming up in the space, let’s highlight a few.

⭐ #Stacks is a truly decentralized ecosystem with over 100 entities building on #Bitcoin

— stacks.btc (@Stacks) March 18, 2023

DeFi:

A decentralized launchpad, ALEX is where projects on stacks and other projects can launch tokens to meet their financing needs through liquidity bootstrapping pools.

Use native #Bitcoin in every Decentralized Finance function 🧡

— stacks.btc (@Stacks) June 4, 2023

⭐ @RuleBasedInvest on the current state and future of @ALEXLabBTC 👇 pic.twitter.com/rTkd1ycbN5

ALEX has an advanced DEX, where they combine the best of two worlds: Automated Market Making and Orderbook DEX. ALEX offers Fixed and variable rate lending and borrowing of Bitcoin, without liquidation risk.

Arkadiko is a decentralized, non-custodial liquidity protocol where users can collateralize their STX tokens and borrow a stablecoin called USDA.

Use native #Bitcoin in every Decentralized Finance function 🧡

— stacks.btc (@Stacks) June 4, 2023

⭐ @RuleBasedInvest on the current state and future of @ALEXLabBTC 👇 pic.twitter.com/rTkd1ycbN5

Lnswap is a decentralized swap protocol that provides a fast, private way of swapping Bitcoin for digital assets on the Stacks layer and vice versa.

Our goal at LNSwap has always been to provide rapid and seamless swaps between Bitcoin and Stacks digital assets. We have also always stood by our mission to give users direct control over their funds and complete privacy.

— LNSwap ⚡ (@LNSwap) February 17, 2023

Our vision has never been more relevant today.

All on-chain and Lightning Bitcoin wallets are supported by LNSwap also LNSwap ensures that digital asset swaps not only happen seamlessly but also with more privacy assurances than other alternatives.

NFTS:

Gamma is a platform built to become a hub for the world’s Web3 social identity, centered around NFTs.

Gamma's mission is to help creators earn, connect with their communities, and preserve their legacies.

— Gamma.io (@trygamma) June 20, 2023

To help creators jumpstart their entry to Bitcoin, starting later this week, all collections that launch with Gamma get 0% marketplace fees on their collection for 30 days. pic.twitter.com/Hq4yBsTVIn

Gamma aims to serve as the home for collectors, creators, and investors to come together to explore, trade, and showcase extraordinary NFTs through the Bitcoin ecosystem.

Thinking of putting "nft.btc" up for auction… or would it be better to wait for the next bull run?

— Boom Wallet (@boom_wallet) January 25, 2023

Boom is another NFT marketplace where you can mint custom NFTS

DAOs:

Lydian Dao is a democratized treasury management protocol on Stack, that uses the best techniques DeFi has to offer, such as protocol-owned-liquidity, staking and bonding.

"Lydian is able to persevere during these difficult times. The results of our efforts speak for itself and show a bright ray of hope for the future." ☀️🌾

— Lydian (@Lydian_DAO) August 27, 2022

Check out the results here: https://t.co/3qvYhZRk12#lydian #Stacks #YieldFarming

Explore the Stacks ecosystem click here to discover more apps and DAOs building on Stacks.

Closing Thoughts

Stacks’ 2023 is indeed a busy year for the blockchain, after Stacks 2.1 of March 2023, the next big update on the Stacks roadmap is the Nakomoto release in Q4 2023 which will introduce Clarity language updates, faster transactions and sBTC.

sBTC itself is another update on Stacks roadmap also scheduled for Q4 2023 this will allow Bitcoin to become the foundation for a more secure Web3 by enabling trustless writing to Bitcoin and the movement of Bitcoin in and out of Bitcoin layers.

Explore the Nakomoto release and sBTC whitepapers here

✅ #Stacks 2.1

— stacks.btc (@Stacks) March 21, 2023

⏳ The Nakamoto Release

⏳ sBTC

↪️ Fast transactions, secured by #Bitcoin finality, using #Bitcoin natively in applications, 2023 is the year of Bitcoin layers 💜

What Stacks set out to achieve is nothing short of revolutionary, Bitcoin to many is the king of crypto, now watch Bitcoin become the God of crypto if the full power of Bitcoin is unleashed.

And that is exactly what Bitcoin layers like Stacks are doing adding all these use cases to Bitcoin making it not just a financial asset.

Also Read: Could Conflux (CFX) Still Be The Best Trade of 2023?

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Stacks

This article was written by Godwin Okhaifo