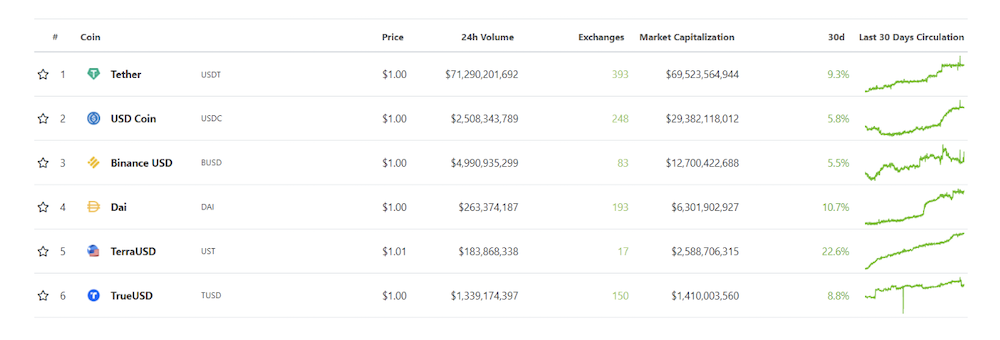

To most, top market cap stables like USDT and USDC are familiar and valued the equivalent of ~1USD when paired with other coins on listed exchanges or swaps.

Whether you are new to cryptocurrency, or a stable coin maximalist, this article is for everyone to maximise gains on their stockpile of USD stables.

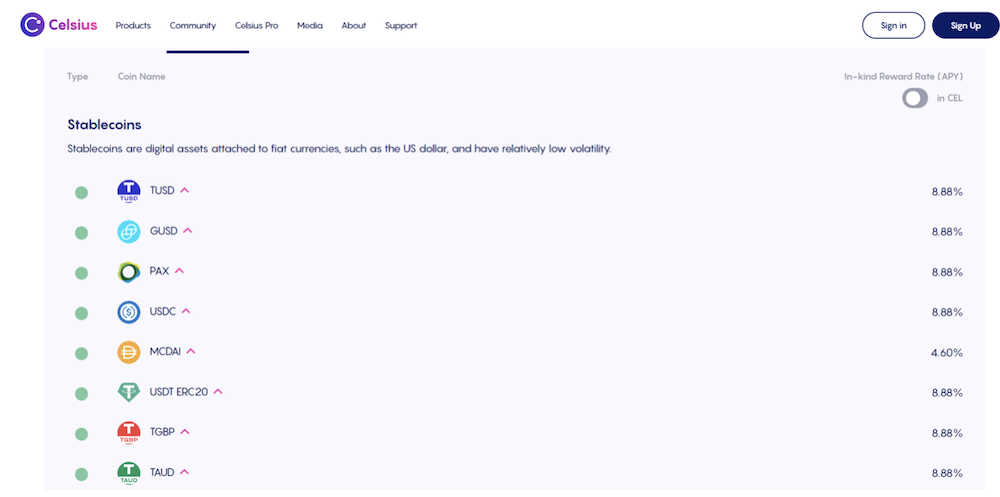

1. Celsius

Celsius offers 8.88% APY in rewards for most USD stables if you lock that with them, and adds on an additional 2.33%, bumping stables APY to 11.21% if you are willing to accept some volatility by getting your rewards in their $CEL tokens instead.

They also do accept a variety of other coins ($ETH, $BTC, etc) which might come in handy if you’re looking to lock up your tokens for some interest.

The great thing about cryptocurrency as compared to deposits offered by local financial institutions is the flexibility and terms. There is no minimum sum to commit, which balances the field even for new players who are looking to kickstart their financial journey.

Rewards at Celsius are paid out every Monday which offers users more flexibility in the period they could choose to lock in their stables with Celsius.

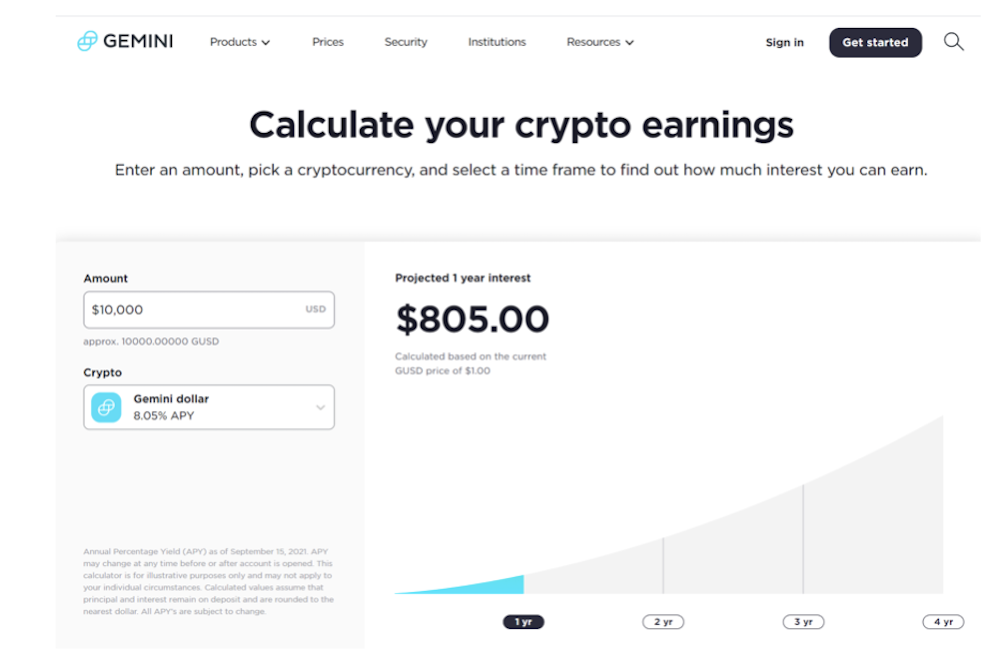

2. Gemini Earn

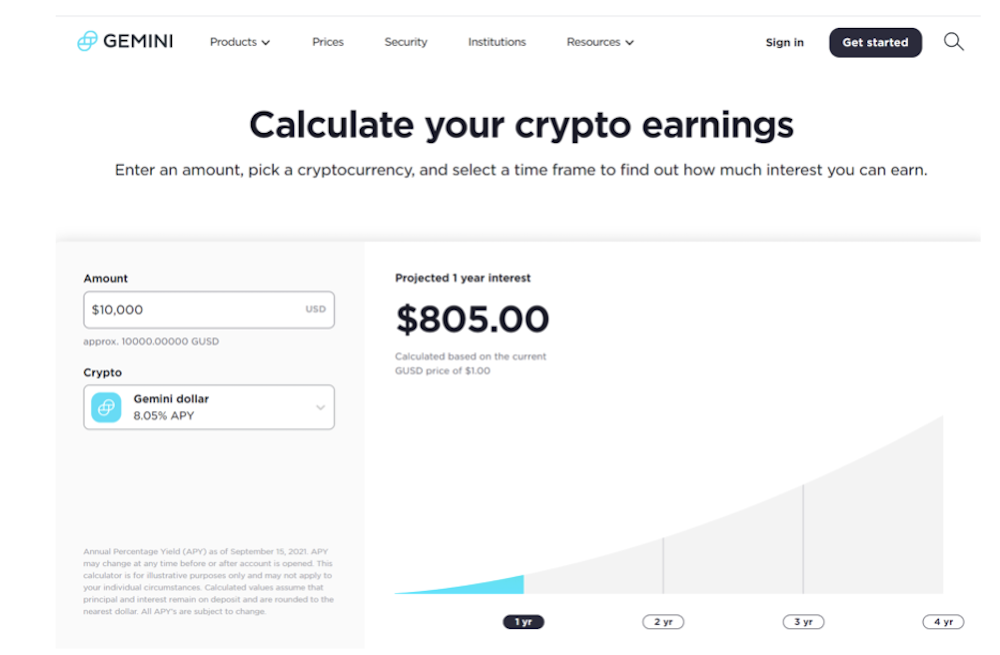

Gemini is an exchange where one can buy, sell and store crypto.

As the world’s first cryptocurrency to be SOC 1 Type 2 and SOC 2 Type 2 compliant, they are regulated, licensed and audited, which makes it safe for storing your crypto assets and deposits.

They also support multiple fiat and cryptocurrencies in Singapore with Xfers supporting Gemini’s on and off ramp for users, making it easy for Singaporeans to purchase cryptocurrencies and stake them at Crypto Earn.

The great thing about this is Gemini Earn works on a daily interest being paid out to you, there is no minimum amount or period, with no fees for withdrawal or deposit as well.

P.S. Gemini offers first time users $10 worth of bitcoin if you use our referral link here!

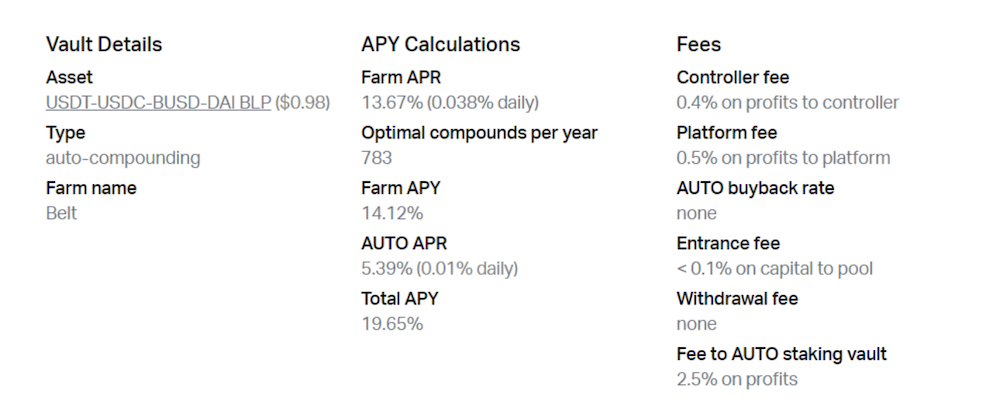

3. AutoFarm (Binance Smart Chain)

For those who are willing to venture into DeFi protocols for higher yields, doing LPs of stable coins would allow for higher yields. AutoFarm is the top few projects with over US$900M in their total vault liquidity under the Binance Smart Chain.

#Autoswap

— autofarm.network (@autofarmnetwork) September 2, 2021

?? pic.twitter.com/WkoSbxD4Jy

As one of the top yield aggregator protocols in BSC, they aggregate liquidity from 11 DEXes on Binance Smart Chain. On average, it optimally compounds about 600-700 times a year for you depending on the vault you choose so you could sit back and enjoy the yields.

Do note that rewards are paid out in $AUTO and there are minimal fees which are all shown at the deposit page. Everything is automated for you, giving them the true name of an efficient auto-compounding yield maximiser.

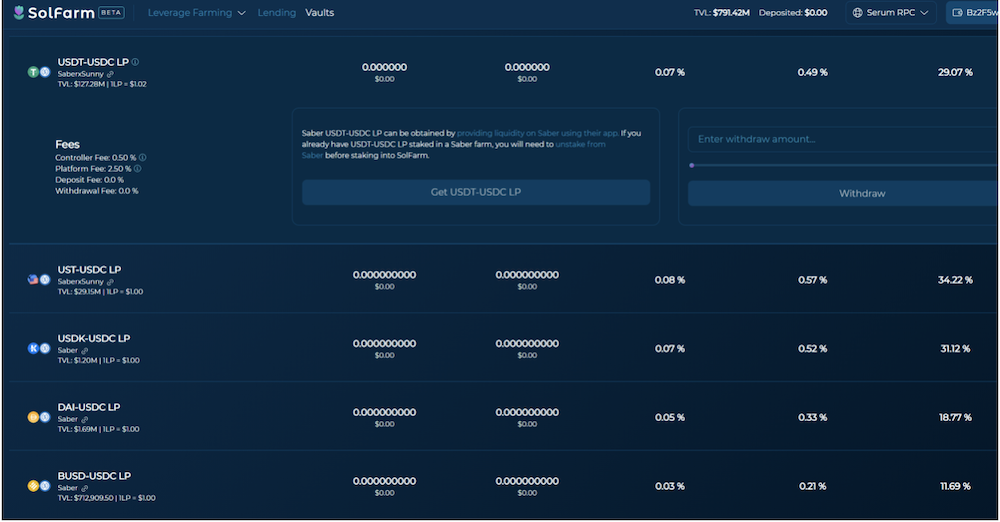

4. Solfarm (Solana)

Solfarm is a Solana yield aggregator, and also a prize winner of the 2021 Solana Hackathon. Their native token $TULIP has recently been launched and in general did over US $500million in their total value locked.

What a day! FTX listing, $570M+ TVL (Vaults + Lending).

— SolFarm (@Solfarmio) September 8, 2021

Raydium Vaults – $400M+

Saber Vaults – $150MM+

$70M in lenders and $50M borrowed!

Thank you SolFarmers, we'll keep on farmin'! pic.twitter.com/sX9gyWSNKR

Every vault has different fees which should be taken note of, and the total fees range between 1.5-4%. The LP pairs for stables range from 11.69% to 34.22%. Similarly, there is no minimum sum for the staking, nor a minimum time frame to lock your funds in.

We hope everyone has a good time with getting great yields on their stables!

Featured Image Credit: Coinsfera

Also Read: What Are Stablecoins And What You Need To Know About Them