Currently, most NFT sales occur on Ethereum which has popular marketplaces like OpenSea and Rarible.

Stargaze is Cosmos’ dedicated zone for NFTs that seeks to solve scalability issues while retaining its marketplace to be secure, decentralized, transparent and flexible.

What is Stargaze?

Stargaze is a fully decentralised NFT marketplace on the Cosmos Ecosystem. Its first round of token supply was “fair-dropped” to early ATOM and OSMO stakers, who are also Stargaze’s validators and delegators on Cosmos and Osmosis.

Stargaze has also activated Mainnet Phase 2, where delegators will have the opportunity to earn staking rewards for securing the network.

Stargaze will go fully-live with its decentralised NFT marketplace as part of Mainnet Phase 3 in Q1 2022. This would change the economic freedom of creators, bring better incentives for curators and yet, maintaining high security for NFTs.

Tokenomics

Other than being the first interoperable Layer 1 for NFTs, Stargaze’s Tokenomics is no shy from utility. It possess an array of functionalities which boast the strong utility of the coin.

- NFT Launchpad

- NFT Marketplace

- Community-owned

- Zero Gas Fees

- Carbon Neutral using proof of stake

- Scalable with over 10,000 trades per second

- Secured by over 100 validators

- Programmable by CosmWasm

- Interoperable via Cosmos IBC

- Ethereum Interoperability via gravity bridge

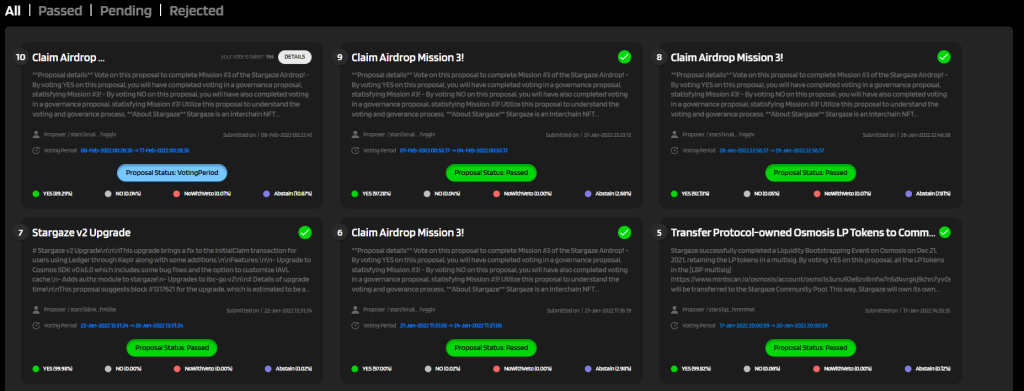

As a governance-based token, Stargaze allows holders to vote on proposals relating to airdrops and upgrades as seen above.

A proof-of-stake network built on the Cosmos Zone, it gives users maximum flexibility in protocol design, interoperability and scalability.

The governance-driven development process would also allow rapid development and iteration required for a consumer social protocol.

With IBC (inter-blockchain communication) and Gravity Bridge (a bridge between Cosmos to Ethereum), Stargaze is able to interoperate with every other blockchain including Terra, Ethereum and its Layer 2s.

Token distribution

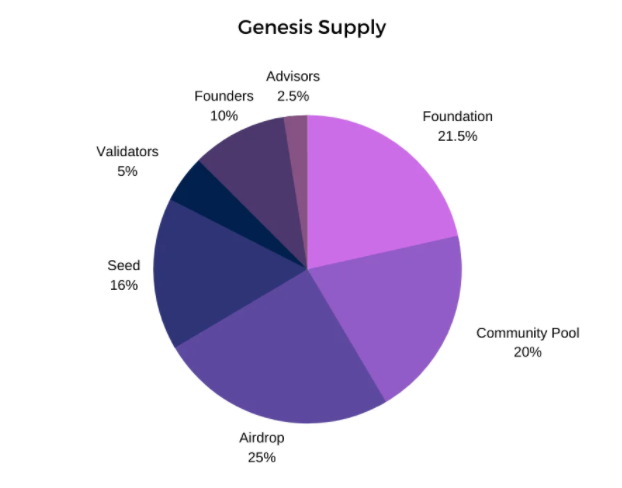

Stargaze started off decentralized on day one with a genesis supply that distributes the majority of the tokens to community members.

The Foundation will hold a strategic reserve of tokens, and will drive adoption of the protocol by delegating to validators, onboarding creators, and providing grants for ecosystem development.

Tokens for seed investors, validators, founders, and advisors are locked up for a year, and linearly vest after that for another six months to a year.

This helps align values with the the development team and early stakeholders.

Airdrops

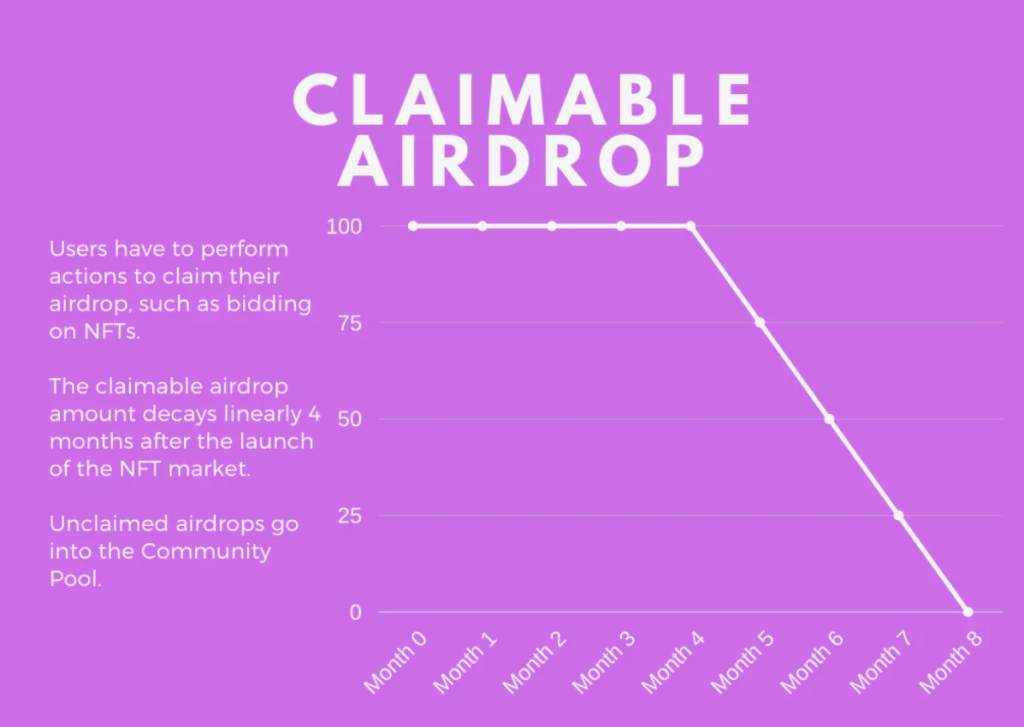

The goal of the Stargaze airdrop is to reach the most active participants in the Cosmos ecosystem. Stakers and liquidity providers are more likely to be more active than just token holders.

Therefore, Stargaze is giving its airdrop to a mix of network participants:

- ATOM stakers

- OSMO stakers or liquidity providers

- Stargaze validator stakers on Cosmos Hub

- Stargaze validator stakers on Osmosis

- Stargaze validator stakers on Regen Network

Some minimums were put in place to prevent dust accounts and those attempting to game airdrops:

- ATOM staker: 5 ATOM minimum staked

- OSMO staker: 50 OSMO minimum staked

Snapshots were taken on 11 October, 2021 from Cosmos Hub, Osmosis, and Regen Network.

(Check your airdrop at: https://stargaze.zone/airdrop)

Staking and DeFi

As Stargaze social tokens are used as a staking reserve asset, the social tokens themselves can be staked for yield. When staked, the underlying reserve asset, $STARS, is delegated to validators and earn rewards.

This makes Stargaze social tokens productive assets. A portion of staking rewards go to the token holder, and the rest to the creator. So when staking a social token, you are supporting a creator while securing the network at the same time.

There are two ways you can earn rewards with STARS:

- Staking (Delegate a single asset (STARS) to validators)

- Bonding Liquidity on Osmosis (Provide liquidity with two assets (STARS + OSMO, or STARS + ATOM), and bond LP tokens.)

(Also Read: Osmosis: A Guide To Staking And Farming On This AMM Protocol For The Cosmos Ecosystem)

OSMO and STARS incentives are distributed once a day at 12:15pm ET. They will show up in your Assets tab.

How Stargaze shines brighter than its competitors

Current problems that exist in other NFT marketplaces

There are a number of issues that exist in NFT marketplaces today such as centralised curation, bad security, difficult upload workflows, limited flexibility, high gas fees, scams, lack of transparency in marketplace contracts and royalty restrictions.

In September 2021, the Head of Product at OpenSea used internal information to buy NFTs before they were featured on the homepage and ‘flipped’ them once featured for a profit.

The critical security vulnerability detected in OpenSea involved attackers airdropping SVG files to OpenSea users, which if signed by a user upon opening (even if opened on the OpenSea domain ingenuously) would give an attacker full access to a user’s funds in the wallet.

Lest we mention that at current ETH gas prices (124 gwei), it costs around US$200 to buy or sell an NFT on OpenSea, which prices out a majority of retail.

However, high gas prices on Ethereum for buyers and sellers can minimise scam collections, which are more commonplace on cheaper blockchains like Solana.

Finally, many existing NFT marketplaces are not open-source, which increases risks when interacting with the native smart contracts (as users have to rely on one auditing party.

How Stargaze gets it right

1. Security – As Stargaze is its own sovereign chain, it also has 100 reputable validators securing it, all of which are specialised solely on verifying transactions that occur in the zone and can react quickly to upgrading the network to enhance security of it.

Separately, the Stargaze NFT marketplace is built using CosmWasm, which is orders of magnitude more secure than the Ethereum Virtual Machine (EVM).

CosmWasm: CosmWasm enables smart contracts on the Cosmos SDK. This provides a safe, highly performant runtime for your contracts, and the ease of using mature tooling and test frameworks in well-established languages with large developer communities.

2. Flexibility – The Stargaze marketplace has a built-in feature that gives NFT projects the flexibility to choose what type of launch they would like to have (e.g. first-come-first-served mint, auction over t periods, etc).

This allows NFT projects to satisfy demands of their community by working closely with them to determine what type of launch is fairest.

3. Low transaction fees – Fees on Stargaze are negligible compared to what can be seen on Ethereum, so the network is accessible to all types of users. Fees in an NFT marketplace enable more growth and innovation as buyers have greater purchasing power and projects can release more NFTs without transaction fee concerns.

Closing Thoughts

To conclude, Stargaze is a marketplace that exemplifies security, decentralisation, transparency and flexibility, which differentiates it from any existing competition from NFT marketplaces.

The potential of Stargaze might be enormous. With the NFT craze currently booming, Stargaze’s value proposition to users are unmatched in the current NFT Marketplace.

Accompanied with the gravity bridge and IBC compatibility from building on the Cosmos ecosystem, Stargaze would able to utilize new or existing projects in in a safer and flexible manner.

Featured Image Credit: Chain Debrief

Read More: An Introduction To The Cosmos Ecosystem And Its ATOM Token