Disclaimer: The following article has been syndicated from its original source, The BUSD Bust — Are Stablecoins Dead?, with the permission of authors Ivan Hong and Sherry Jiang.

The latest shocking news in cryptoland comes from the SEC serving a Wells Notice (a threat to sue) to Paxos, the issuer of the popular BUSD or Binance USD stablecoin.

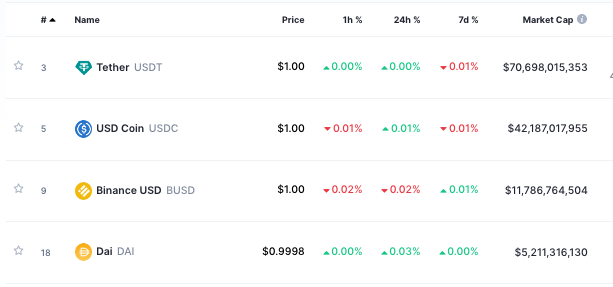

Despite the tumult, it currently stands at $12B in market capitalization, making it the 3rd largest stablecoin (at the time of this publication).

So why go after Paxos & BUSD now, and what does this mean for stablecoins and the broader crypto industry?

In this article, we will cover:

- The SEC’s possible motivations

- Explanations for the SEC’s puzzling moves

- Five ramifications for the crypto industry

The SEC’s possible motivations

Firstly, the SEC appears to be regulated by litigating, or what the military might call “reconnaissance by fire”. Like the game of Battleships, where two players take turns guessing where each player’s fleet of warships is by bombing suspected grid coordinates. If you can’t see where your enemies might be hiding, shooting in their suspected direction may force them to reveal their presence.

The SEC seems to be specifically hunting for companies who offer yield or interest-bearing products — through means it suspects may meet the Howey Test’s four criteria of a security. This is the latest in a string of efforts by the SEC, including going after Kraken for its staking-as-a-service program.

In other words — we’re not sure, but we’ll sue you to find out. Presumed guilty until proven innocent.

Secondly, this renewed regulatory vigour comes off the back of FTX’s collapse. Ponzi schemes often find friends in high places — especially among regulators — which is not a good look for an agency tasked with protecting the American public. Bernie Madoff sat on SEC advisory committees while running a multibillion-dollar Ponzi scheme. Gary Gensler is feeling the heat over his meetings with Sam Bankman Fried while being the presiding SEC Chair.

This is not to say that the SEC has been inactive prior to FTX’s collapse. But it may have certainly compelled the agency to put the pedal to the metal. In legal circles, there is a common aphorism: “Justice must not only be done, but must also be seen to be done”. This dictum was laid down by Lord Hewart, the then Lord Chief Justice of England in the case of Rex v. Sussex Justices, [1924] 1 KB 256.

Optics matter to a regulator’s credibility, and their egregious failure to prevent or prosecute scandals like FTX could have them scrambling to make up for their dented reputation. Though, Lord Hewart could have scarcely intended for the appearance of “doing” justice, to make up for the lack of actual justice being done.

The idea that a regulator, eager to save face, is lashing out wildly may seem implausibly petty. But consider the following puzzles that seem to point toward inexplicable inconsistencies in the SEC’s latest action against BUSD.

Explanations for the SEC’s puzzling moves

There are three mysteries in this case:

- Why target the issuer (Paxos), and not the company offering staking yields on the stablecoin (Binance)?

- Why hasn’t the SEC gone after Paxos for offering yield to MakerDAO for holding USDP?

- Why not go after “dodgier” stablecoins like USDT?

Why target the issuer, and not the company offering staking yields on the stablecoin?

The SEC charges BUSD with being an “unregistered” security. As if that weren’t bizarre enough, the agency has gone after the stablecoin issuer, Paxos and not Binance: the one offering yields on BUSD.

In March 2022, Binance DeFi launched a new high-yield program, allowing users to stake BUSD to earn up to 13.33% APY. That product currently offers 3.5% on BUSD deposits. But it also has another “Simple Earn” product offering 6% yields.

Recall that the SEC also served a Wells notice to Coinbase in September 2021, over its proposed lending product, which would’ve offered up to 4% interest on USDC deposits. USDC is managed by a consortium called Centre, which was founded by Circle, and is currently jointly managed with Coinbase.

The SEC didn’t charge Circle for issuing USDC as an unregistered security then, but instead went after Coinbase — the yield provider. So why Paxos now, and not Binance? It would have made perfect sense if the SEC had served a Wells notice on Binance US instead. Yet Binance is not the subject of the SEC’s current action against BUSD.

There are two possible explanations. One is that the SEC, desperate to make up for its humiliation in the wake of FTX, is shooting wildly and hoping something hits. The other explanation we can offer is that the SEC is deliberately taking aim at a key revenue stream for Binance.

Binance is headquartered in multiple locations, many of which are outside the US, and sufficiently decentralized to a degree that the SEC may have limited power over what they could actually do. On the other hand, Paxos is a New York State-chartered trust company regulated by the New York State Department of Financial Services. So it’s easier to go after the players who are within the jurisdiction of the United States, than ones that are jurisdictionally decentralized.

To continue the military metaphor, the SEC may be going after Paxos to get to Binance, in the same way that the United States government agencies deliberately sought to destabilise entire countries to deny the spread of Soviet communism. If they were willing to condemn entire populations in South Vietnam, and Iran to the heel of despotic, corrupt regimes — crushing a few good actors on dubious grounds is a footnote in their crusade against crypto.

Why hasn’t the SEC gone after Paxos for directly offering yield to MakerDAO for holding USDP?

Secondly, it is equally curious that the SEC’s Wells notice did not target USDP; Paxos’ other stablecoin. Recall that Paxos has openly offered yield to holders of USDP — in no uncertain terms. In January 2023, Paxos proposed paying a steady fee to MakerDAO for holding up to $1.5 billion of USDP, offering an annualised yield of around 4.3% at the time. That would make a far more compelling argument for USDP being an unregistered securities offering. Yet USDP is conspicuously absent from the SEC’s Wells notice.

Again, we can either interpret this as the blind rage of a humiliated regulator — or that the SEC’s ultimate intention is to degrade Binance’s ability to attract more users through offering yield on Paxos’ stablecoin. In the case of MakerDAO, USDP being offered as a reserve asset does not touch as many of the US “retail” users that Binance would with its DeFi staking products.

Why not go after “dodgier” stablecoins like USDT?

USDT, ironically, may be safest from SEC action despite its other troubles with the CFTC over fraud. Tether Limited, the issuer of USDT is owned by the Hong Kong-based company iFinex Inc., which also owns the Bitfinex cryptocurrency exchange.

But of all the tokens Bitfinex offers staking or yield-bearing services for, USDT is not on the list of eligible tokens. This might explain why USDT is not in the crosshairs of the SEC, despite the elevated risks it presents to consumers and the investing public.

Five ramifications for the crypto industry

The SEC has yet to lose a suit against a crypto company. If the SEC’s interpretation of the Howey Test is successfully applied to Paxos’ BUSD, it could lead to the classification of other stablecoins as securities, and thus subject to SEC regulation. This could impact the stablecoins issuers, but also more broadly DeFi players.

We think there are five ramifications for the crypto industry:

- Crypto innovation may shift out of the US

- Non-USD stablecoins may see growing demand a hedge against US regulatory risk

- Decentralized stablecoins may continue to grow

- Stablecoin issuers may renew focus on non-speculative use cases

- Stablecoins may grow in tandem with tokenized assets

1. Crypto innovation may shift out of US

The perverse outcome of the SEC’s willingness to take aim at convenient targets is signalling to players that compliance is penalised. Companies make themselves a convenient target when they base themselves in the US, with the intention of following US laws and regulations.

What has transpired with BUSD may have implications for other Circle, and may set the precedent that all USD stablecoins that are domiciled in the US will now have to register as a security.

If the US continues to have limited opportunities to innovate (e.g., provide ways for users to earn yield), players may start looking elsewhere to domicile and build their companies like Singapore, Hong Kong, or Dubai. Both Paxos and Circle have regulatory approval in Singapore, where stablecoin regulations are underway. Hong Kong has taken a step in elevating itself as a crypto hub, proposing rules that would let retail investors trade tokens on licensed exchanges.

The competition for web3 talent and capital is global. Investors, companies, and developers in the space have shown that they are not opposed to moving to jurisdictions with friendlier regulatory environments. If the US — or any other country decides that it does not want to take the lead in crypto innovation, others can and will steal their lunch.

2. Non-USD stablecoins may see growing demand a hedge against US regulatory risk

The upshot of this is that the crypto industry is rediscovering the wisdom of the ancient adage on eggs and baskets.

Non-USD stablecoins can now offer large crypto players like Binance a way to diversify their exposure to regulatory risk. If only 10% of your assets are domiciled in the US and the rest are spread across different jurisdictions, then it makes it much harder for the SEC to have a material impact on your operations.

Following the SEC’s crackdown on BUSD, Binance’s CEO, Changpeng Zhao (“CZ”) noted that they would explore non-USD based stablecoins to de-risk their exposure to regulatory hostility from any one jurisdiction. Additionally, CZ further opined in a Valentine’s Day Twitter Spaces that “…we will probably see more Euro-based or Japanese yen, Singapore dollar-based stablecoins.”

The non-USD stablecoin is still infinitesimally small compared to the USD stablecoin market. However, the SEC’s action against BUSD may just be the catalyst for that to start changing in a meaningful way.

3. Decentralized stablecoins may continue to grow.

In the same Twitter Spaces, CZ also noted that: “…given the current pressure and current stances taken by the regulators on the US dollar-base stablecoins I think that the industry will probably move away to a no-US dollar-based stablecoin, and maybe also back to algorithmic stablecoins.”

DAI, Frax and other decentralized stablecoins offer more censorship resistant alternatives to centralized stablecoins. We can also expect to see newer players as well to make a play here — recently, two decentralized applications Curve and Aave will be releasing their own stablecoins.

However, important to note is that most of these still have some level of connection to centralized stablecoins — i.e., Frax and DAI both have substantial amounts of USDC in their reserves — but cannot be immediately shut down the way that USDC, BUSD, and others can.

4. Stablecoin issuers may renew focus on non-speculative use cases

SEC Chair Gensler famously pilloried stablecoins for being little more than “poker chips” for retail investors to gamble in the casinos of DeFi. This alone would explain much of the SEC’s action against BUSD.

The silver lining in all of this is that stablecoin issuers may now place a premium on driving “real world” adoption. We may see more large stablecoin issuers, and project teams reallocate their energy and resources towards growing the adoption of stablecoins for non-speculative use cases like cross-border payments for e-commerce, remittances, or trade settlements.

A research paper published in January by Circle and Uniswap Labs estimates that stablecoins could reduce remittance costs by as much as 80%, saving unbanked and underbanked individuals $30 billion per year. That, in addition to the potential to eliminate the estimated $118.5 billion annually in the cost of failed payments in fees, labor and lost business due to challenges with the fragmented patchwork of legacy correspondent banking rails today.

In a Working Paper published by the International Monetary Fund (IMF) in February this year, the authors noted that “stablecoins have become financial lifelines” for citizens desperate for digital solutions to banknote shortages, and to mitigate the impact of high and persistent inflation in emerging markets like Argentina, and Venezuela.

For instance, amid the Bolivar’s sharp depreciation in Venezuela, local startup, Reserve, allows users to protect the value of their remittances through its RSV stablecoin, which can be swiftly converted into local currencies when needed, or pay directly to merchants that accept it. The company’s blog says that its RPay app sees more than $300 million in payments each month.

On a more global scale, crypto payments startup, Request Finance says that its app has processed over $286 million in payroll, expenses, and invoices — of which 61.5% was in stablecoins.

5. Stablecoins may grow in tandem with tokenized assets

Investors’ hunt for yield is a tale as old as time — especially after centuries of secular declines in interest rates globally. But the dubious source of those DeFi yields lies at the heart of crypto’s critics — and rightly so. We may see a shift towards DeFi protocols aiming to generate yield from traditional asset classes that have greater ties to capital markets and real economic activity.

Few people today would argue that US dollars are merely poker chips for “degens” to gamble their life savings on the casinos of Wall Street, or for foreign investors to ape into financing reckless government spending via Treasury Bills. Today, we consider capital markets as critical engines of economic growth.

Yet that wasn’t always the case. In her brilliant book titled “Virtue, Fortune, And Faith: A Geneaology Of Finance”, political scientist and professor Marieke de Goede, traces the history of regulatory opposition to speculation in financial markets in the United States and England. In under 300 pages, de Goede takes us through a journey of how gambling went from being seen as chaotic evil, to investing as being a lawful good.

Similarly, we may also see the increased use of stablecoins as a means of democratising exposure to regulated, tokenized assets like private debt, venture funds, private REITs, and more. For instance, companies like Credix and Goldfinch have paved the way in bridging emerging market SME credit with stablecoin holders around the world that want to earn attractive yields based on sustainable, productive capital allocation.

As stablecoins become increasingly used to facilitate investment into capital markets — the “poker chips” narrative may become increasingly hollow. Just like it once did in the history of equities markets. Perhaps someday, scholars will similarly write books on how ludicrous it once was that regulators sought to ban the very technology that ushered in an era of truly global finance.

Concluding thoughts

That sums up our long thesis on how the SEC action against BUSD will impact stablecoins and their adoption. Stablecoins aren’t dead. Far from it.

Perhaps in the years to come, industry observers will look back upon this moment as the catalyst we needed: (i) to design censorship-resistant organisations, (ii) drive real-world use cases like payments, (iii) allocate DeFi liquidity towards capital markets, and (iv) the emergence of a multipolar crypto economy.

Disclaimer: The following article has been syndicated from its original source, The BUSD Bust — Are Stablecoins Dead?, with the permission of authors Ivan Hong and Sherry Jiang.