After a long time coming, a new era of staking has finally arrived for Chainlink. By staking LINK tokens, you can help increase the security guarantees of oracle services and earn rewards in return.

.@chainlink staking v0.1 has officially gone live today.

— Delphi Digital (@Delphi_Digital) December 6, 2022

Over the past 2 weeks, nearly 17.5M $LINK has been moved off exchanges in anticipation of this catalyst. pic.twitter.com/9fYg9MNYpH

According to Delphi Digital, over 17.5M $LINK has been moved off exchanges in anticipation of the new staking mechanism.

Even during the winter chills, Chainlink, as seen with the statistic below, embodies “the bear market is the best time to build” perfectly.

But what does this all mean? And what does staking v1 look like?

Staking

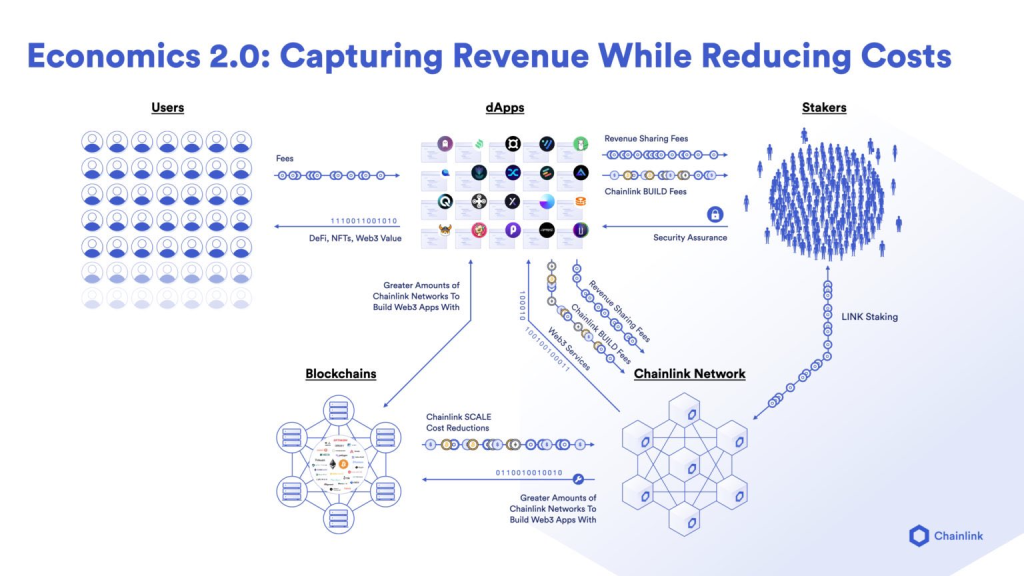

Think staking like web3’s version of dividends. It is a mechanism where smart contracts lock up tokens to increase the protocol’s security.

Specifically for Chainlink, it consists of its native token $LINK being locked up as collateral to back the performance of decentralized oracle networks.

Why you may ask, is that precisely the business Chainlink is in. They provide data and information from off-blockchain sources to on-blockchain smart contracts via oracles.

While Chainlink networks are already secure, staking adds additional incentives to the system.

The entire staking will be rolled out across different stages, beginning with the v0.1 beta release. This will not be set in stone, as more functionality will be added over time.

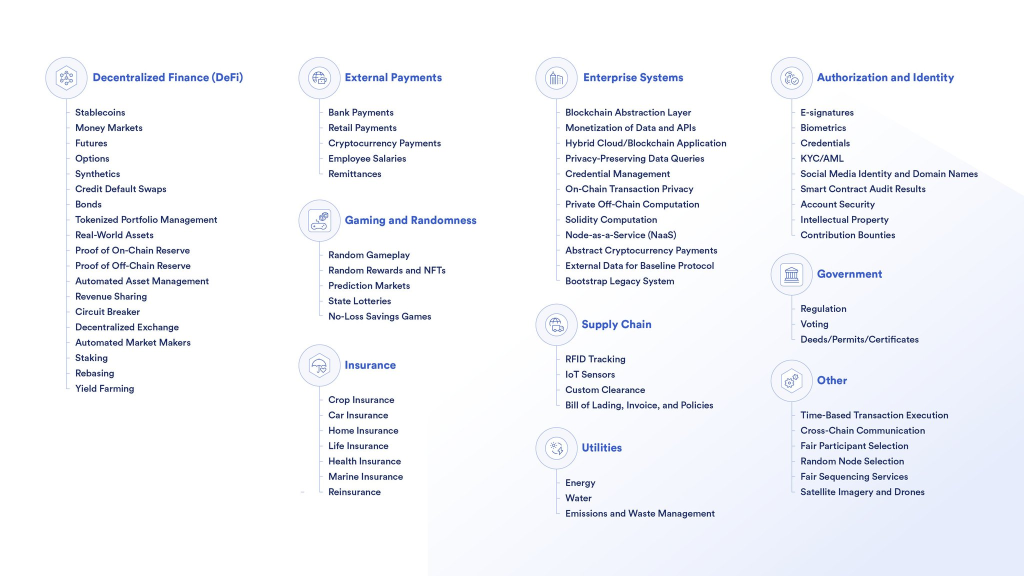

Ultimately, their goal is to unlock these new use cases via oracles.

As covered in Chainlink’s recent blog on Chainlink economics 2.0 and Staking v0.1 details, stakers will participate in a decentralized system to flag if the data feed has not met predefined performance requirements.

The v0.1 staking pool will be capped at 25M $LINK at the point of writing 5% of the current circulating supply.

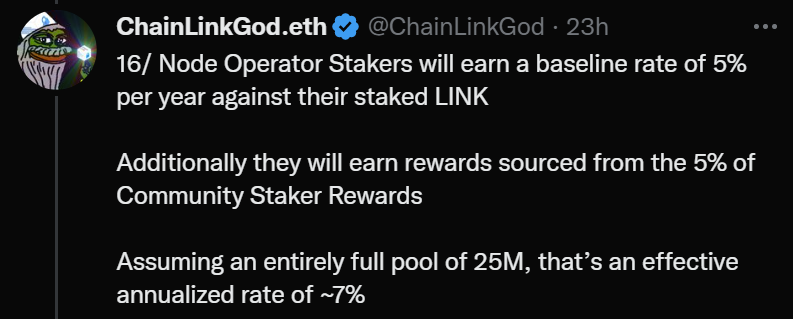

Mainly, there will be two types of stakers, 1) Node Operator stakers and 2) Community stakers.

Each Chainlink node operator actively serving data feeds will be able to stake up to 50 thousand $LINK, with a minimum of 1K LINK.

Community stakers can stake up to 7 thousand $LINK, with a minimum of 1 $LINK.

#Chainlink Staking v0.1 Early Access is now live on Ethereum mainnet!

— Chainlink (@chainlink) December 6, 2022

The initial 25M staking pool is available for early access, so stake your LINK today to secure your spot and earn rewards for securing the Chainlink Network & larger #Web3 ecosystem👇https://t.co/Ee65mcHHPX

Due to the security parameters of v0.1, staked $LINK and rewards during v0.1 will be locked until the subsequent release of Staking Staking v0.2 is planned to release in 9-12 months, at which point v0.1 stakers can unlock their stake/rewards or migrate to v0.2.

Chainlink’s staking v0.1 functionalities

Alerting. Stakers can now raise an alert on the ETH/USD data feed if it’s been more than 3 hours without an on-chain update. It’s a little different for node operator stakers as they have a 20mins priority period to raise alerts.

The first valid alert of a faulty can earn a staker up to 20% of their stake amount or 7K $LINK, whichever is lower. This incentivizes and further strengthens the network, bolstering a stronger community.

Secondly, auto delegation. Staked LINK from node operators serves as a direct, quantifiable commitment to their performance, while community stake adds a layer of incentivization.

Community Stakers will see their stake automatically delegated equally across all actively staking node operators. This way, node operators’ stakers will earn a small portion of community staker rewards.

In the future, this can be turned into a dynamic mechanism where stake is delegated to nodes based on their reputation, e.g. performance, number or LINK staked etc.

Rewards. To incentivize early participants for their contribution, staking and alerting rewards will be supported by LINK token emissions. Their long-term goal is for rewards sourced from non-emission-based sources like user fees.

According to ChainLinkGod on Twitter,

Furthermore, community stakers will earn a baseline rate of 5%; from those rewards, 5% will go towards node operator stakers, resulting in an effective rate of 4.75%.

Closing thoughts

Chainlink has always been that individual, working tirelessly in the background without much recognition. The newly added staking mechanism will help secure the network and bring more utility for $LINK holders.

The staking v0.1 is to be reminded as an initial beta release to Chainlink staking; this will continue to evolve.

Chainlink will play a pivotal role in expanding this entire space and pushing the boundaries of what is possible. They will likely unlock innovations of intelligent contracts and blockchain technology which has yet to be invented.

Staking is just the beginning. Soon with Cross-chain interoperability protocol (CCIP) will enable an open standard for developers to build secure applications that can send messages and transfer tokens across multiple networks. Game changer.

Also Read: I Asked OpenAI 22 Questions About Blockchain, Here Are The Answers

Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief