One of the strongest bottom signals just flashed. The hash ribbon indicator, which uses the 1 and 2 months SMA (Simple Moving Average) for Bitcoin’s Hash rate, has historically been a good buying opportunity.

However, the past is not always a good indicator for the future.

And while Bitcoin prices are at historic lows, the overall conditions of the crypto market seems to still be screaming bear.

1. Markets Are Fragile

With thinning liquidity and lower open interest, speculators are looking for signs everywhere. As such, they are looking towards macroeconomics indicators to trade around.

CPI YoY: 8.5%

— Chain Debrief (@ChainDebrief) August 10, 2022

Est. 8.7%

Inflation rates have been a strong gathering point, with crypto markets moving up or down several hundred basis points with the news.

With even the slightest indicator of bullishness or bearishness, the markets become severely lopsided.

And with macroeconomic outlooks worsening for the foreseeable future, there is likely more bearish than bullish news coming.

2. On The Technical Side

When the crypto markets came crashing, pundits speculated that the bottom would be in the 20k range.

However, the series of liquidations from both traders and institutions caused a massive free fall across most major cryptocurrencies.

Since then, Bitcoin has yet to find a proper bottom, and formed a rising wedge pattern. This form of technical analysis indicates a bearish reversal pattern, especially since it has already broken to the downside.

If we follow the indicator, we could see a further drop of almost 30% in the near future.

On a macro level, $BTC and the rest of the market has failed to reclaim, or even come close to, any key levels of support.

Instead, the retest in March led to a 50% fall in price, as bulls failed to break through it.

Given that the crypto markets are still trending downwards, it may be wise to be bearish or flat till better opportunities come.

3. Where’s The Money?

prices are a product of supply and demand, and while the term “crypto” has broken into mainstream headlines, it still remains relatively niche.

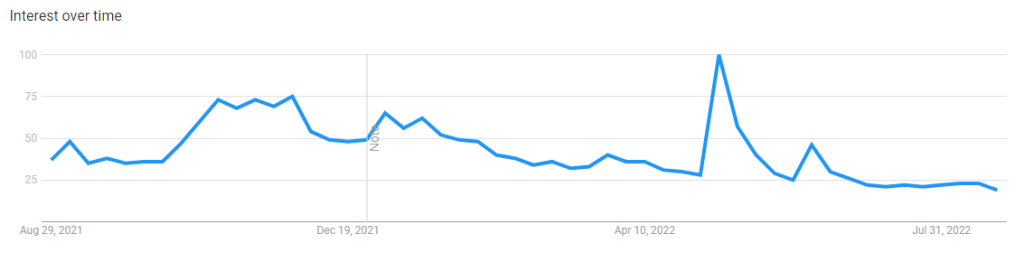

A quick look at google trends shows that crypto has long exited normal conversations, and interest is at a 12-month low. Furthermore, hopes of “institutional demand” and “new money” coming in have all but vaporised.

YTD, $BTC has crashed ~67% compared to the S&P 500’s ~8%.

Despite the risk off environment, the tech-heavy index has managed to outperform $BTC to the downside. Imagine what a 30-40% drop in equities would do to crypto.

Closing Thoughts

Even with bullish narratives, the trust and confidence in the space has been shattered.

Hacks, exploits, rugs, and all sorts of negative news were swept under the rug during the bull. However, the bear market have dug out the ugly side of Web3.0, showcasing them to the world at large.

Even with the upcoming merge, it is hard to be bullish on fundamentals in these conditions. The silver lining, however, is that projects are still building, and the underlying technology still remains sounds.

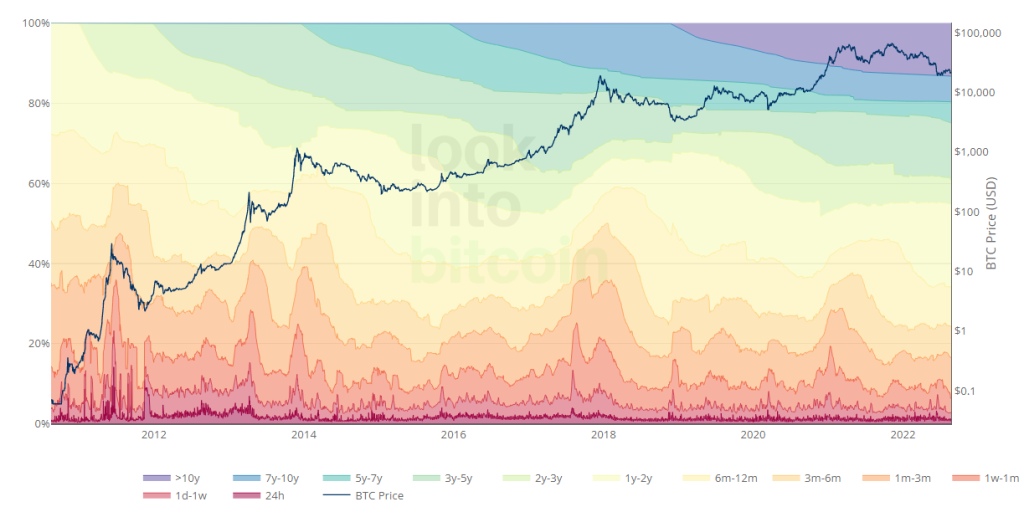

Hodl waves also show a deepening of long-term investors, with weak hands exiting the market. As the crypto space grows wiser, we may see a stronger rebound from the bottom this time, compared to previous cycles.

Also Read: One Unlikely Country Is Leading The World Into Web3.0

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: ChainDebrief