Not to be confused with the exchange who pumped millions into getting the naming rights of a particular famous NBA stadium, Chronos Finance is creating a name for itself. We find out how Chronos is revolutionizing the world of decentralized exchanges by innovatively incorporating components.

Also Read: Here’s How Steadefi Will Make Yield Farming Simple, Yet Effective

A trip down the DeFi memory lane

DEXs have been a cornerstone of decentralized finance since the early days of DeFi. By incentivizing users to provide liquidity; DEXs make it possible for trades/swaps to be executed permissionlessly without the need for any centralized entities.

If we have to bring it back, the very first DEX, Uniswap, was launched in 2018 and still is a major player in the industry today. Users are incentivised to provide liquidity in exchange for LP tokens which earn trading fees on the DEX.

Twp years later, Sushiswap launched something new and innovative (at that time) way for users to provide liquidity to the table – the “MasterChef” contact. Users can stake their LP tokens to earn $SUSHI rewards and trading fees. They kinda upped Uniswap back then and saw the “MasterChef” contract being forked hundreds of times by protocols looking to incentivize liquidity.

With rewards will come the opportunity to take profits, and when people start dumping their tokens for gains, repercussions will incur the entire protocol, potentially draining the liquidity. To help convince users not to sell their rewards, users were given the option to stake their tokens to earn more rewards over time.

Then, the introduction of Curve’s “ve” (vote-escrow) model explored how users can protect the value of their tokens and make them more useful as an incentive.

Here, users will lock up their tokens over a pre-determined period (ultimately reducing sell pressure) in exchange for the right to vote on the platform as to how incentives will be distributed to each liquidity pool on the DEX. Lockers earn trading fees from the LPs and “bribes” to convince them to vote for particular pools.

Since its inception, the vote-escrow model has been very effective, but some may be hesitant to lock up their tokens over a long period. The original Solidly fixed this problem by using the user’s LP positions with tradable NFTs. Users can exit their locked positions by selling them on the secondary market.

How time will be money, literally.

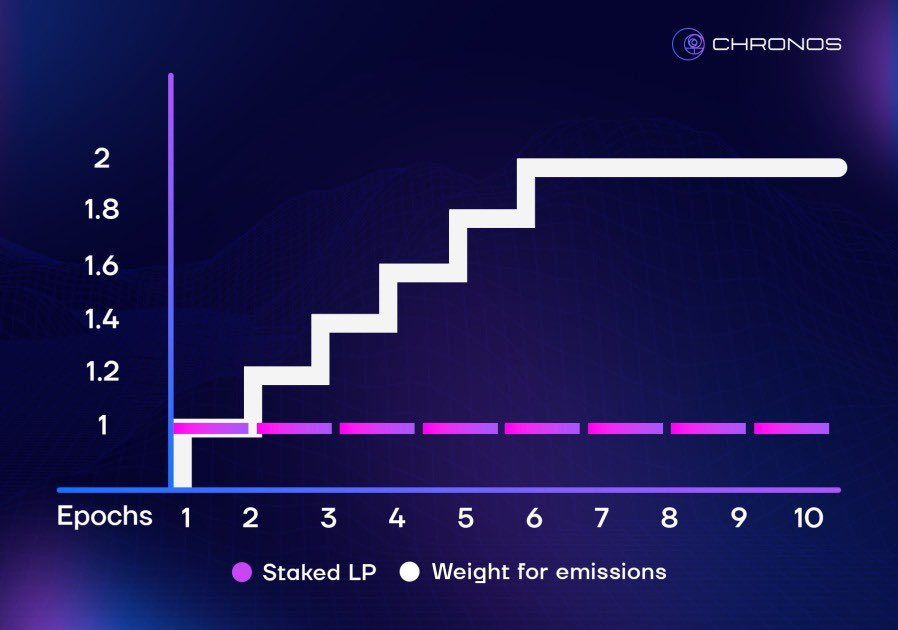

Chronos uses a modified version of the “MasterChef” contract that increases the rate users earn their rewards relative to the amount of time their LP has been staked. The longer the LPs remain staked in the contract, the more $CHR users will receive.

Like all other DEXs, Chronos incentivise users to provide liquidity in exchange for LP tokens that can be staked to earn $CHR emissions over time. Furthermore, the amount of $CHR the user can make scales in proportion to how long their positions are being staked.

Look at the chart below in reference to the weight for emissions.

For each epoch LP the position remains staked, LP will earn a boost on their emissions before reaching the full maturity of 6 epochs. After six epochs, LPs will earn $CHR at the capped-out boosted rate until they decide to unstake their positions.

Selling the underlying LP position on the secondary market would mean that the $CHR emissions boost earned with that position will also be sold along with the position. You can expect a higher priced maNFT whose LP positions are at the 6th Epoch mark.

Time, in this case, is literally money.

Partnerships, partnerships and more partnerships

By leading this DeFi revolution on Arbitrum, Chronos has since made an impressive collaborative effort with its ecosystem players (crazy list). Their innovative way of incentivizing liquidity makes them stickier than most other DEXs, making it more attractive for protocols to incentivize liquidity for their token.

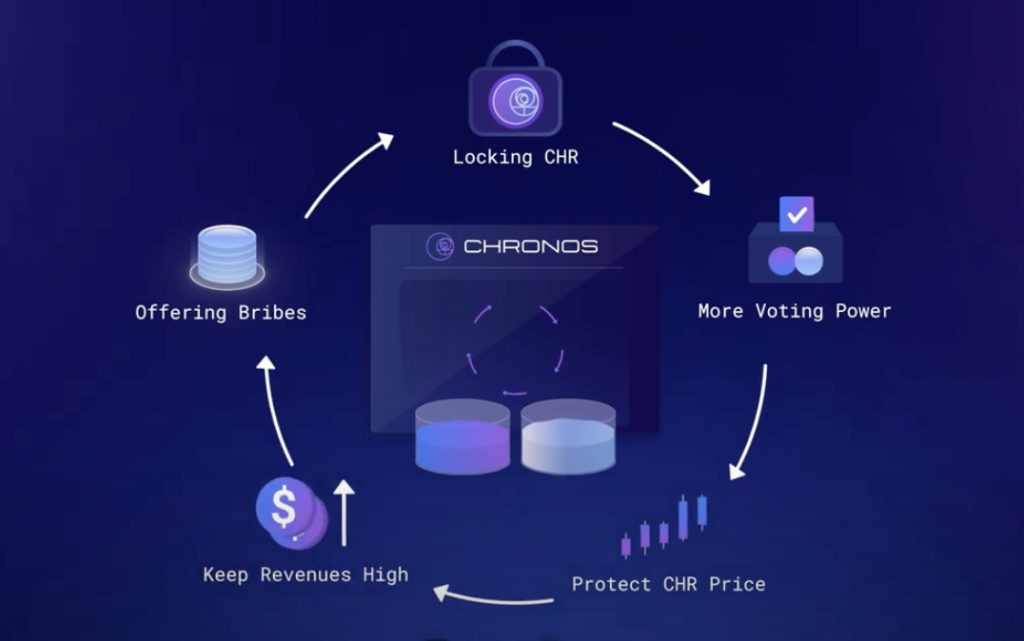

These protocols compete by offering bribes and continually locking $CHR to gain a bigger share of the voting power. With more voting power, more $CHR will be locked and serves as a protective measure against selling pressure. This will also keep APRs high for participants as revenues will be high.

Our Certik audit has been published and can be viewed here: https://t.co/giLn0Dmvxz

— Chronos (@ChronosFi_) April 22, 2023

🧵 (1/5) pic.twitter.com/efdCufggiw

$CHR Tokenomics

First of all, it’s ve(3,3) model. As I explained a little in the earlier parts of this article, the ve(3,3) is one way protocols can get very good TVL, but often times has trouble retaining it.

3/24

— slappjakke.eth 🦇🔊 (@Slappjakke) April 14, 2023

✅ ve(3,3) Model

– Users lock $TOKEN for $veTOKEN which gives voting power

– Emissions are controlled by voters and go to LPs

– Voters receive trading fees + bribes for voting on gauges

– Traders get low slippage

– Protocols pays bribes and get liquidity pic.twitter.com/3mVqms1ooc

This is where their veCHR token comes in with a lock up period of up to two years. On top of governance rights and earning 90% of fee revenue, voters can 100% of bribes for the pools voted for each epoch.

Their token model also follows with plans to airdrop the veCHR over 12,000-15,000 users via an initial airdrop. The early participants will benefit from the initial veCHR allocation, their tokenomics will encourage value creation and discourage actions that go against the core principles of ve(3,3).

There will be 50 million $CHR tokens available at launch, and more will be emitted into circulation over time with a weekly 1% emissions decay at a weekly 2.6M $CHR emission.

They have also chose not to go down the route of rebasing. The zero-rebase model is the most effective for the long-term health and sustainability of the project as it provides the best economic incentives for all participants, makes it more attractive to new protocols that seek to become involved in the Chronos ecosystem. Furthermore, it also reduces the advantages for early adopters so that the system doesn’t become imbalanced over time.

Also Read: 5 Narratives To Pay Attention To in 2023

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief