When one falls, another will rise. With the fall of FTX, trust in CEX has been lost. We see the massive withdrawals of tokens from exchanges at historical rates as investors seek the safety of their funds.

Over the past week, exchanges have seen one of the largest declines in aggregate BTC balance, amounting to a staggering 106K of BTC outflows.

Similarly, over 1.1M ETH has been withdrawn for ETH, according to Glassnode.

Unsurprisingly, investors are looking to reallocate their funds elsewhere, especially to a non-custodial location. In my opinion, the fear of trading has not dampened, spot traders get rekt, but leverage traders find opportunities amidst the volatility.

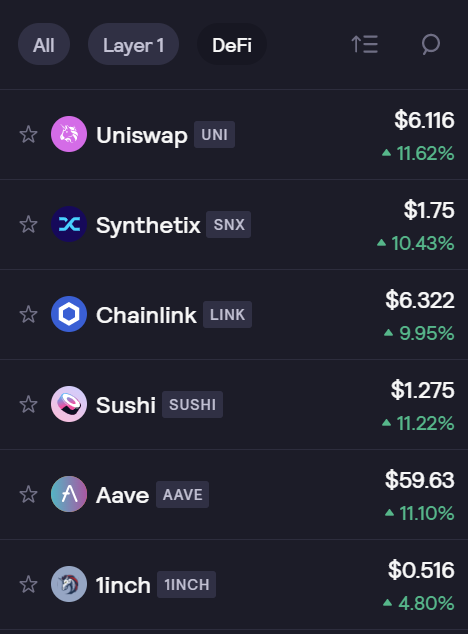

The demand spike in native DEXs tokens saw them outperform CEX tokens we know of (HuobiToken, CRO, and FTX, among many others).

The decoupling we deserve: DEXes outperforming CEXes on a day where most things are in the red. pic.twitter.com/fsrYxFyg9J

— Jack Niewold 🫡 (@JackNiewold) November 14, 2022

If you still have available funds, here are three decentralized crypto platforms for you to trade the market.

1. GMX

GMX is a decentralized perp exchange that offers low fees and zero price impact trades.

Price impact trades – It is the influence of the user’s work over the market price of an underlying asset pair.

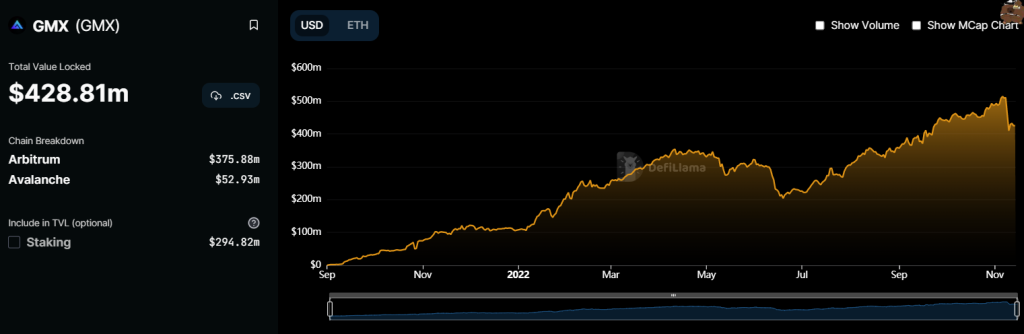

Originating on Arbirtrium and recently launched on Avalanche, GMX prides itself in carrying the entire ecosystem, five folds larger than the second on the TVL ranking list.

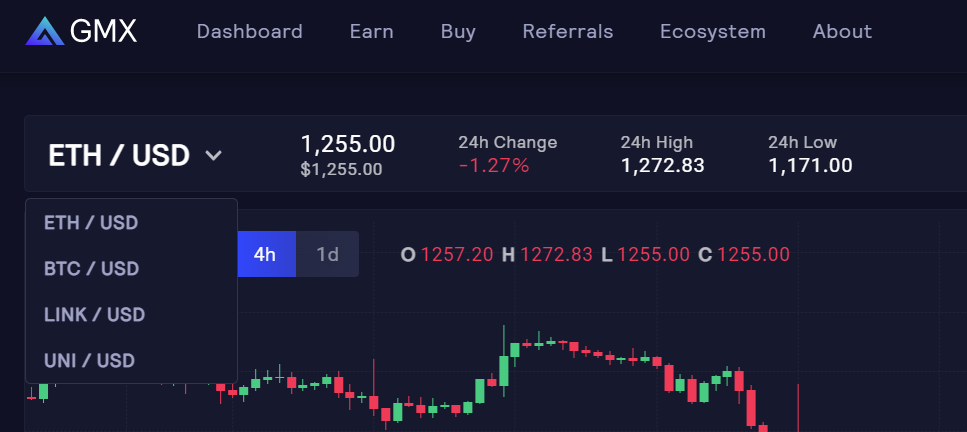

Their trading interface is as straightforward as it gets. Those who dabble in DeFi products would unlikely have any issues navigating GMX.

With access to up to 30x leverage, one downside in employing GMX as your decentralized exchange of choice is the limited trading pairs. They only allow perp trading for four trading pairs, notably ETH, BTC, LINK and UNI.

However, it seems like that’s more than enough for the traders. With prices and token trading volume gaining traction, GMX is starting to be a popular option for traders, a viable option to trade away from CEXs.

While there are many on-chain derivative platforms, GMX’s non-inflationary tokenomics makes it popular for traders and investors.

Their rewards are paid with respect to the platform you are participating on, i.e. if you are staking on Arbitrium, your rewards will be in ETH. Similarly, users staking on Avalanche will be rewarded with AVAX.

$GLP holders earn escrowed GMX (esGMX), and 70% of platform fees in ETH on Arbitrum and AVAX on Avalanche. Current APRs are about 27% (Arbitrum) and 20% (Avalanche).

It's always "What is GMX"

— Chain Debrief (@ChainDebrief) August 2, 2022

and never "How is GMX"

Here, we answer both questions

1/x 🧵👇 pic.twitter.com/m5xNvsGdDv

2. dYdX

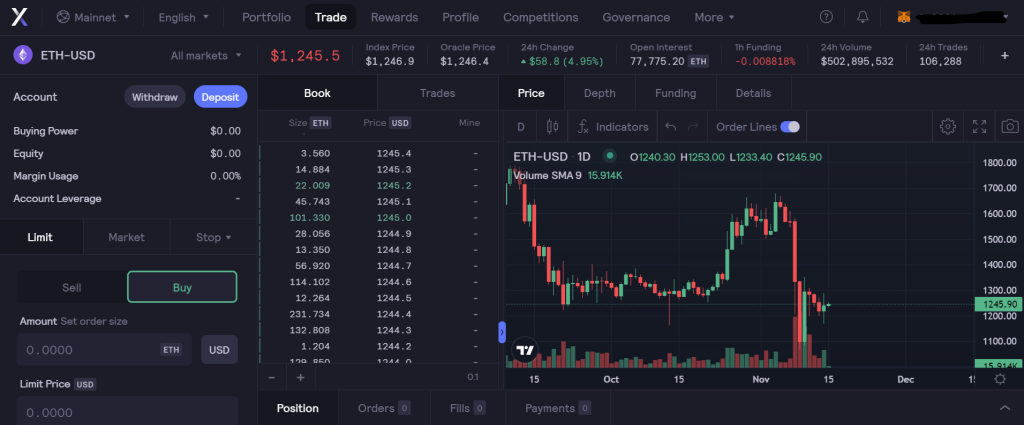

Backed by paradigm, a16z and polychain capital (among many others), dYdX is your next best bet in doing your preps trading on a decentralized platform.

Early iterations of the dYdX exchange platform allowed traders basic crypto margin trading capabilities with limited assets.

Now, dYdX upped its game by rolling out margins and perpetuals for many crypto pairs. It also added lending and borrowing services to decentralize the entire trading experience.

dYdX combines the best decentralized financial technologies for first-of-its-kind crypto derivatives exchange only using crowdsourced liquidity.

They also offer a more comprehensive range of crypto tokens to trade with up to 20x leverage, including the top 10 layer 1 blockchain tokens and DeFi projects the non-degens usually dabble with.

Only a few days ago, dYdX saw its largest trading volume since its inception. Funds are moving in.

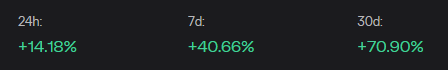

Without a surprise, the price of dYdX is up across the board on the 24-hour, 7-day and 30-day charts.

Similar to GMX, dYdX collects its revenue through trading fees. But with the introduction of V4, dYdX will operate as a standalone chain on Cosmos.

v4

— dYdX (@dYdX) November 14, 2022

This means that the protocol will not receive revenue; instead, the payment will be distributed back to the users—# RealYield.

There are even plans for mobile applications for users to trade on their mobile devices; IOS and Andriod.

Here’s a video guide on how you can get started with dYdX.

3. Gains Network

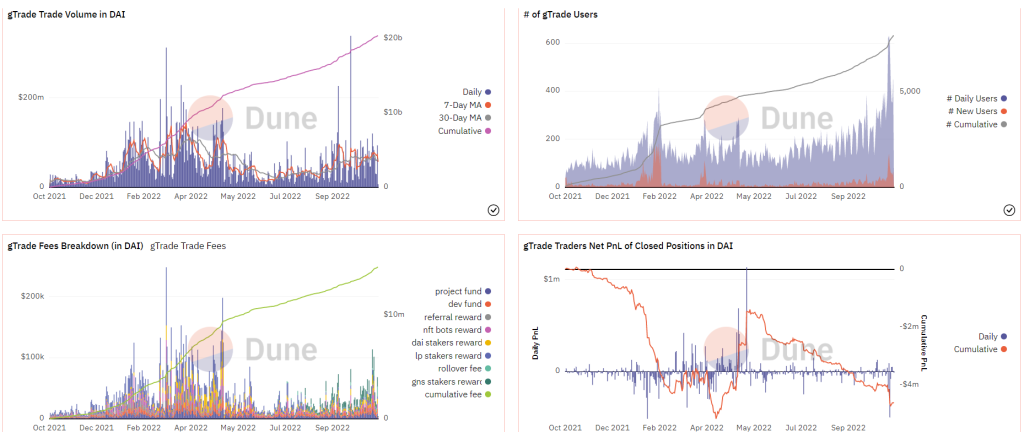

Gains Network is a non-custodial perpetual exchange protocol built on Polygon. Its main product, gTrade, has a unique synthetic architecture that makes it more capital efficient, allowing for lower trading fees and a more comprehensive range of leverage and pairs.

140 new users joined gTrade on November 9!

— Gains Network 🍏 (@GainsNetwork_io) November 14, 2022

This is the highest daily influx of new users in 10 months.

On gTrade:

✅ No manipulation – every trade is transparent with 100% on-chain execution.

✅ No withdrawal locks – we can't stop you from taking your profits.

Trade safer 🤝 pic.twitter.com/0hxzLlQxGe

Users can leverage up to 150x on Crypto, 1000x on Forex and 100x on Stocks. This itself is a game-changer.

The recent upward in activity for GNS can be seen from its revenue. The higher the revenue means more users are trading—a win-win.

GNS is also burnt when the DAI vault becomes sufficiently overcollateralized to counter the inflation from GNS/DAI LP rewards. This also ensures individuals who support the community early will not have a percentage of their platform interest diluted.

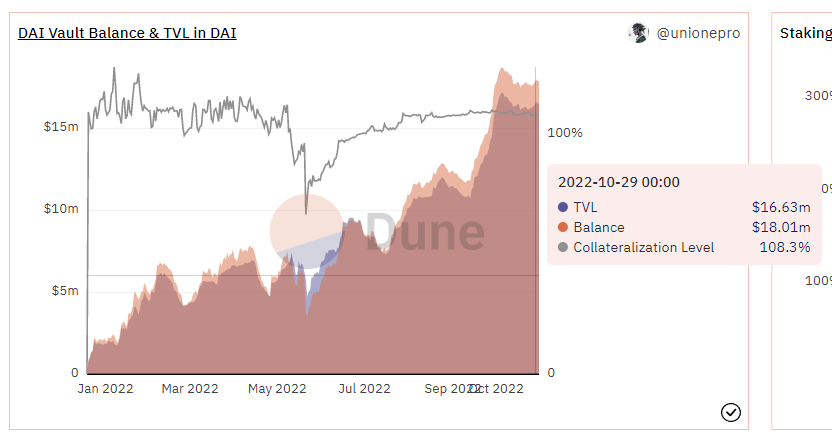

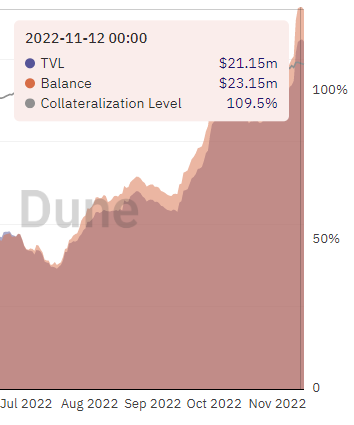

Their latest product introduces their very own stablecoin vault for $DAI. Since September 22, the vault saw a 48% increase within two months; today, that balance is currently at over $23,000,000.

By simply staking DAI, you earn DAI from fees generated on gTrade. Rewards come full circle, almost a perfect flywheel.

All collateral trades are sent to the vault. Once a trade is closed, the traders are paid with the DAI from this vault.

The $DAI Vault is the heart of gTrade’s synthetic architecture, providing liquidity for all of gTrade’s trading pairs. The larger the vault, the more it will improve liquidity for all trading pairs. Still, it will enable more capital to pay profitable traders and allow for larger position sizes.

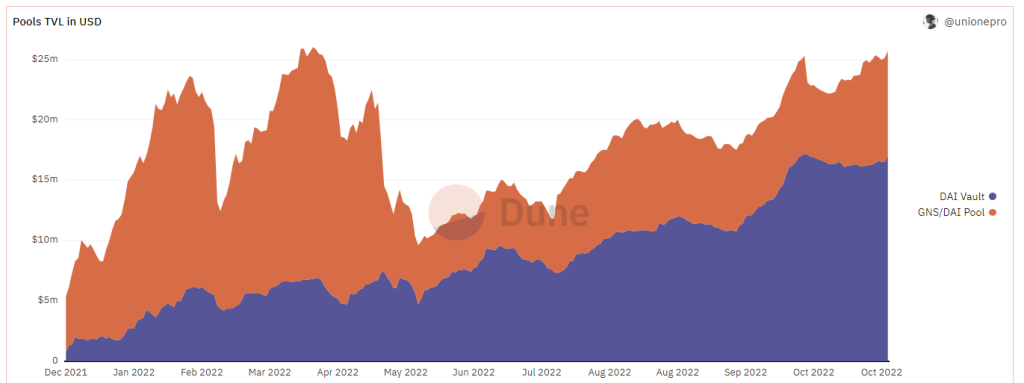

The combined TVL of $DAI Vault and $GNS/DAI Pool is approaching the March All-Time-Highs.

Gains Network has also hinted at what is coming soon; no spoilers, please.

Coming Soon

— Gains Network 🍏 (@GainsNetwork_io) November 12, 2022

We're leaving the upcoming new features as surprises, but here are some hints for one of them!

• It isn't copy-trading.

• gTraders trading low time frames will love it!

• It’s a 2x improvement for a part of the gTrade UX

• It's been called a CEX-like experience

Find out everything Gains Network on Dune Analytics.

Closing thoughts

Not your keys, not your coins. It’s that simple.

We don’t need another FTX to serve us as a welcome reminder. FTX burnt me, but it also shines a light on how DeFi could be the solution to creating better and more stable financial systems.

Regulatory pressures and the FTX situation are paving the way for a massive increase in the adoption of DeFi perp exchanges. Currently, DEXs only capture 1.57% of futures volume compared to CEX and are a viable alternative to CEX.

Could DeFi be the key to preventing future market failures? Perhaps so, but there still needs work to be done.

Also Read: Why Did Trust Wallet Surge 103% Amidst a Sea of Red?

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief