For an ecosystem to bloom, certain things are necessary — Decentralized Exchanges, an NFT marketplace and possibly a fork of whatever’s in season.

However, the bedrock of any chain has arguably become its money market. A place for users to borrow against their collateral and deploy funds, money markets have been catalysts for sudden boom cycles, such as on AVAX and MATIC in the past.

With the launch of Tranquil Finance on Harmony ONE, users can finally borrow against their blue chips in order to explore the Harmony chain.

Meet the team

The team is mostly anonymous, with 0xkrillin, 0xGoten and 0xYamcha leading the development.

All three are former FAAMG software engineer tech leads with more than 10 years of experience. Mighty M acts as community manager and marketing lead, with a background in digital marketing management.

What is Tranquil Finance?

Tranquil Finance is an algorithmic money market, much like Aave and BenQi.

In fact, most of Tranquil Finance’s smart contracts are forked directly from compound Finance, a DeFi primitive on Ethereum that started the concept of a money market in the cryptocurrency space.

How to use Tranquil Finance

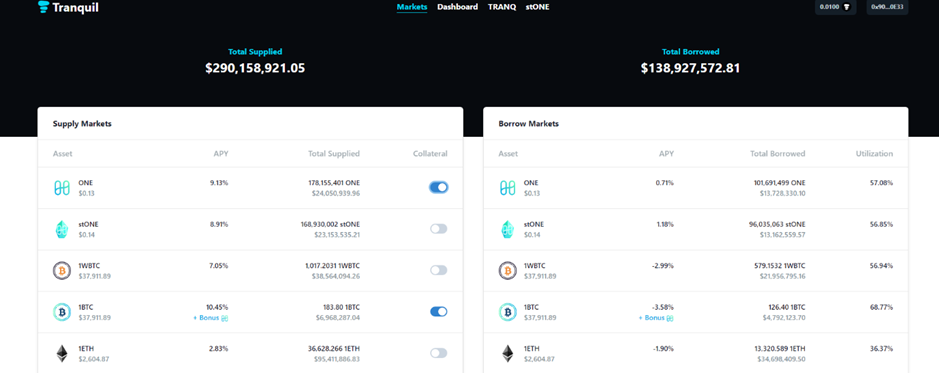

Assuming your MetaMask account is already connected to the Harmony Mainnet, head over to Tranquil and connect your wallet. You should be greeted with this screen.

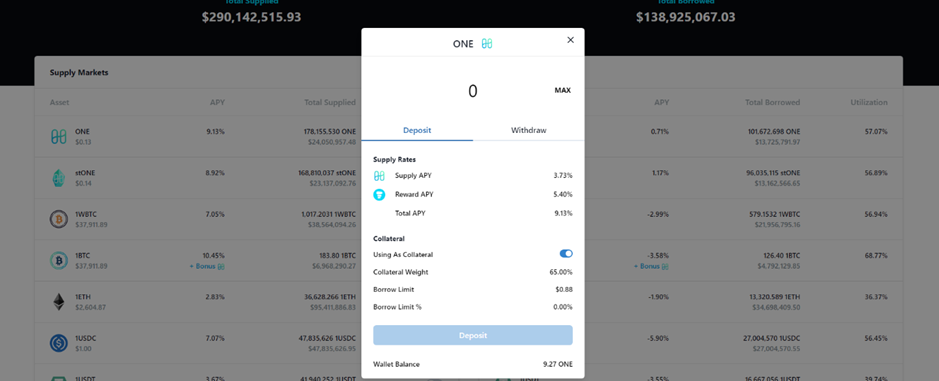

Simply click on the icon of the coin you would like to deposit to start.

Then, type the amount you would like to add and click “Deposit” at the bottom to finish your transaction.

Take note that if you are depositing $ONE to not max it out as you will need some for gas fees. Currently, rewards for supplying collateral range from 2-11%, boosted by additional incentives in the form of $TRANQ.

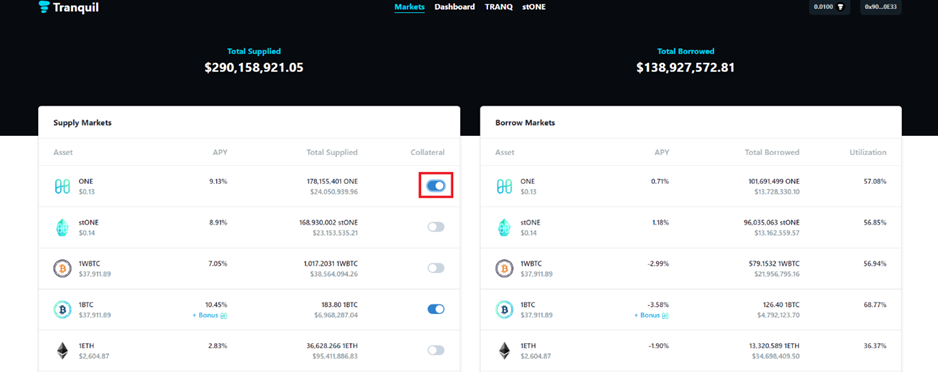

To borrow against your deposited assets, you must first enable it as collateral which requires a transaction. After that, you can borrow against your assets in any of the cryptocurrencies available on the market in a transaction similar to depositing.

Currently, Tranquil does not have a maximum borrow limit. While an 80% LTV is the recommended safe maximum, users can actually borrow 100% against their collateral. Those who want to participate in the liquidations that occur thanks to risk-on users can also do so here.

$stONE

Along with the slick money market interface, Tranquil also offers stONE — a liquid version of staked $ONE. Much like Lido finance, Tranquil allows you to help secure the network by staking a minimum of 101 $ONE with network validators and even helps you to auto-compound rewards.

Staking with tranquil gives you $stONE as the receipt token, which is liquid and can be sold on the open market.

$TRANQ Token

The native currency of Tranquil Finance is $TRANQ, which can be staked under “Dashboard”.

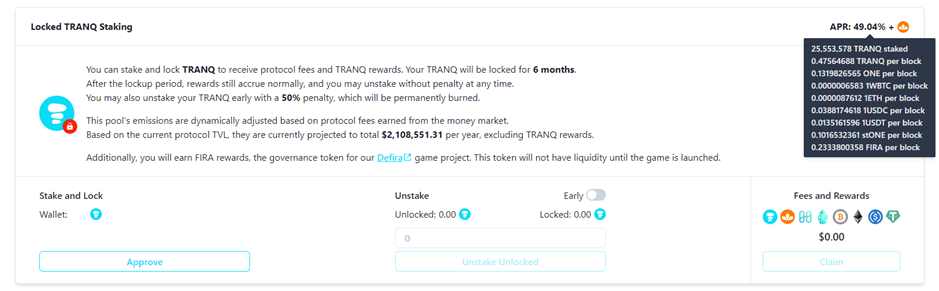

Currently, staking has rewards in multiple cryptocurrencies such as stables, $ETH and $BTC, but requires a six-month lock up period. Flexible staking is also available where you can withdraw your staked $TRANQ at any time but the APR more than halves.

Staking $TRANQ is also currently the only way to gain access to $FIRA, the native currency for a new Harmony-based metaverse project partnered with Tranquil Finance.

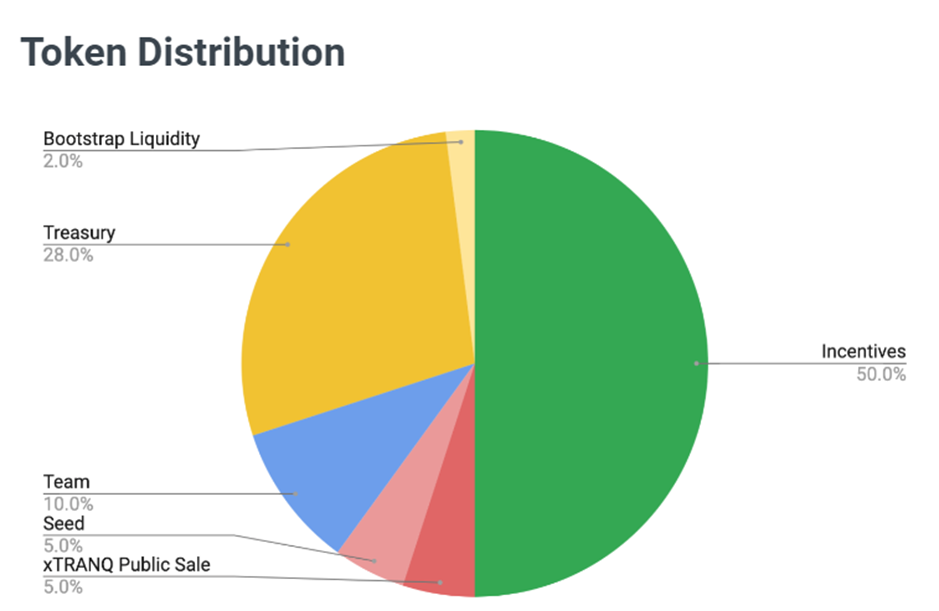

Emissions are also dynamically balanced without a fixed curve to keep price from being in a perpetual downslope. While most of the initial distribution is allocated towards incentives, these tokens will most likely be fully vested within 4 years, after which rewards will come only from protocol fees.

Featured Image Credit: Chain Debrief

Also Read: Growing Your Bag Of ONE: A Guide To Yield Farming In The Harmony Ecosystem