Following our previous article, this will be the final part of a two-part series on the security solutions for Cosmos, where we’ll jump right into the basics of Interchain Alliance and ‘Rollapps’.

Also Read: Exploring Cosmos’ Security Solutions for App-Chains: Replicated and Mesh

What is the Interchain Alliance?

Interchain Alliance is an open-source solution developed for the Cosmos SDK, aimed at cultivating economic interaction and engagement across blockchains.

It allows non-native assets from various chains to earn staking rewards on any affiliated chain, boosting security and creating mutually-beneficial economic relationships between chains through interchain staking.

Not only does this further stimulate on-chain economic activity by introducing an array of earning opportunities, but it might also be safe to assume that Interchain Alliance can contribute towards growing the user base within the ecosystem given the exposure between chains.

As of today, several chains, including Kujira, Carbon, Migaloo, and Terra have already implemented the Alliance SDK into their systems!

📢 Alliance by @terra_money is now live on Kujira Mainnet 🤝

— Kujira 🉐 (@TeamKujira) March 22, 2023

We couldn't be more excited about the economic possibilities it brings 💰

Please take a few minutes to read our summary of it 👇https://t.co/nVYCTzuMms$KUJI $USK #Alliance 🐋💙

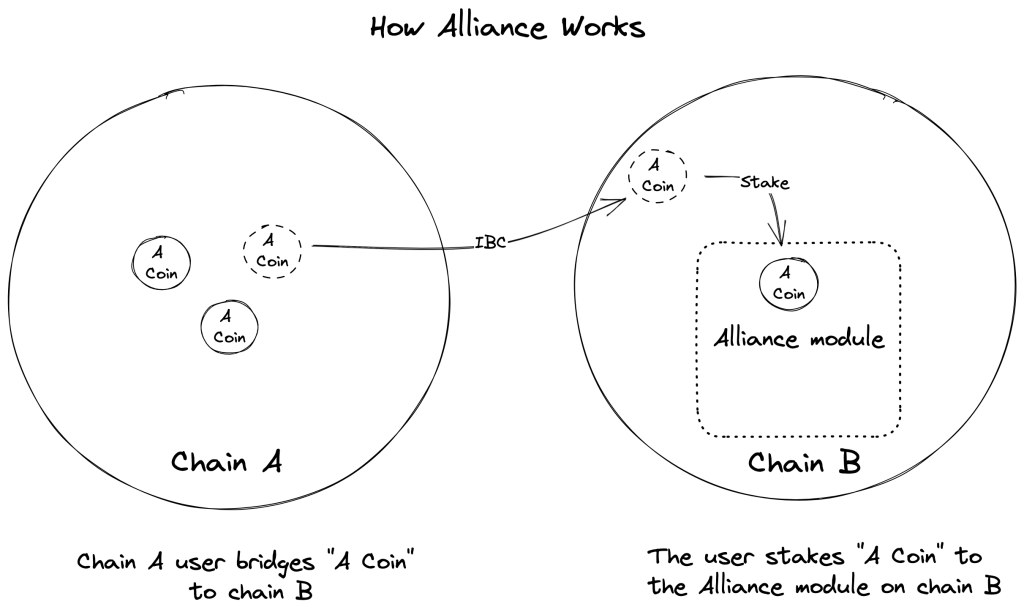

How does the Interchain Alliance work?

The Interchain Alliance operates through a flexible framework.

It begins with the integration of the Alliance module into a blockchain, allowing the community to decide on certain assets as ‘Alliance assets’ available for staking through governance.

Each Alliance asset is then assigned a ‘Reward Weight’ that determines the proportion of native staking rewards allocated to the asset’s stakers. Additionally, a ‘Take Rate’ is specified, representing the percentage of the staked asset that is redirected to the native stakers of the blockchain.

Users can then leverage the Inter-Blockchain Communication protocol to stake their approved assets from other chains and earn the designated Reward Weight or Take Rate(if applicable).

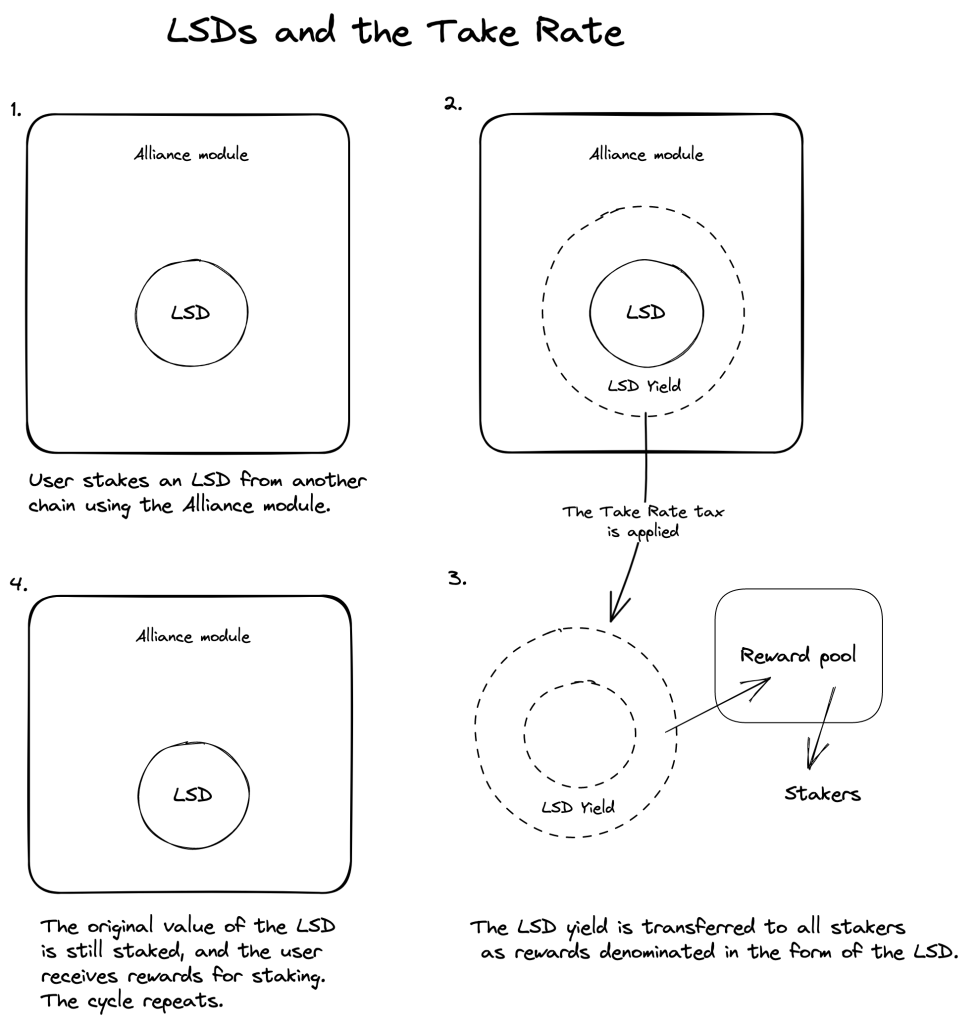

The diagram below illustrates a case study of how a Liquid-Staking-Derivative with an equal annualized Take Rate and yield rate transfers yield to all stakers:

Pointers to know:

- Reward Weight determines the proportion of rewards an Alliance asset earns relative to the total rewards of the chain.

- Native assets always have a Reward Weight of 1.

- Take Rate is designed for use with Liquid Staking Derivatives (LSDs) and yield-generating tokens.

- Take Rate is an optional annualized tax applied to staked Alliance assets and distributed among all stakers, denominated in the corresponding Alliance asset.

- In return for giving up underlying yield (alliance asset), stakers may gain greater rewards in the form of the chain’s native asset.

- This exchange mutually economically benefits both chains and encourages cross-chain collaboration.

To visualize it better, let’s expand using the recent partnership between Carbon and the Alliance asset stLUNA.

BREAKING: Carbon has listed its first Alliance assets from @terra_money! 🌕🚀

— Carbon – SWTH 💎 (@0xcarbon) June 1, 2023

Get ready for MORE yield – Stake ampLUNA @eris_protocol and stLUNA @stride_zone on Carbon to earn Carbon protocol and Terra protocol staking rewards every sec! 🔥https://t.co/BeEhMsRNSe pic.twitter.com/O9qJDCMNud

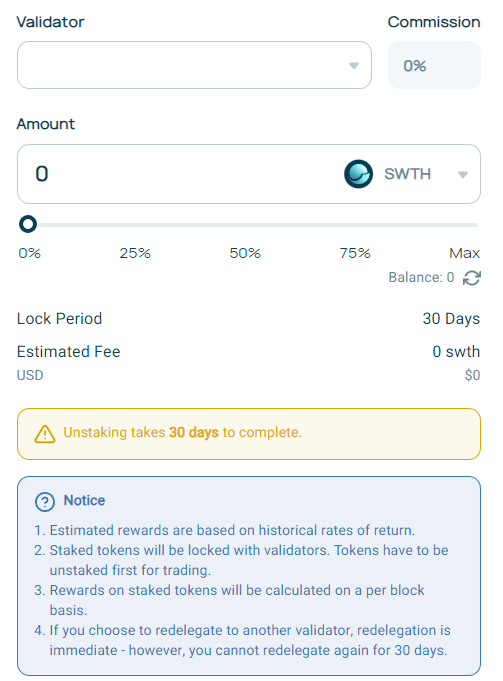

Carbon has integrated the Alliance module and announced that they have listed their first Alliance assets, which are ampLUNA and stLUNA.

With the case of stLUNA:

When stLUNA is staked collectively, it earns 1% of Carbon’s total staking rewards.

In return, Carbon deducts an annual 0.3% from the stLUNA stake and distributes it to those who stake Carbon’s native token, SWTH. This means that stLUNA stakers contribute a small portion of their underlying yield to SWTH stakers.

However, despite giving up a little of their LUNA rewards, stLUNA stakers on Carbon can earn significant rewards, even with a small amount of stLUNA staked, because of their exposure to earn SWTH tokens.

This system promotes an exchange of rewards between different tokens and chains that benefits both parties!

Contrary to Mesh Security, which mandates a native token for staking on an alternate chain, Interchain Alliance allows the staking of non-native tokens, thus circumventing the need for establishing a separate native token network.

Introducing Rollapps With Dymension

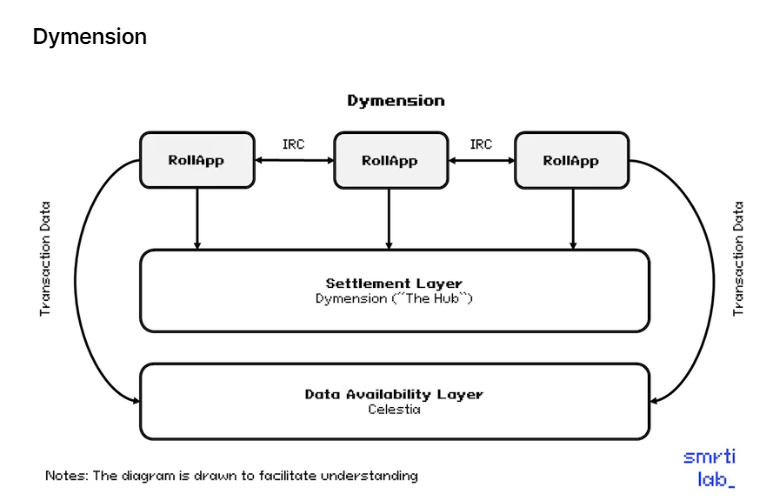

Combining IBC with modular chains, Dymension aims to streamline the process for app-chains to launch via ‘RollApps’–without the overhead of deploying an app-chain.

Think of it as an approach to scaling a network of networks.

Dymension Hub, built using the Cosmos SDK, forms the backbone of ‘RollApps’. Its design oversees the validation of transactions and the maintenance of consensus, while assigning specific roles to ‘RollApps’ and data availability layers like Celestia.

The evolution of ‘RollApps’ is rooted in Dymension’s transformation of the original Cosmos SDK into the ‘Rollup Development Kit (RDK)’.

This shift replaces validators with sequencers that process data to data availability platforms such as Celestia, a move that greatly enhances scalability.

By packaging small blocks together, these sequencers minimize latency and expedite transaction finality. Dymension serves as the key arbiter, guaranteeing the safety and authenticity of all transactions.

RollApps💈 are modular blockchains

— Dymension (@dymension) December 13, 2022

RollApps execute transactions but delegate settlement, consensus and data availability as follows:

– Settlement & Consensus: Dymension Hub

– Data Availability: e.g. @CelestiaOrg pic.twitter.com/iYS6FtRG7P

To help you better understand: It’s beneficial to grasp the genesis of Rollups, as they likely inspired the emergence of ‘RollApps’.

Rollups vs ‘Rollapps’: What’s The Difference?

Rollups and ‘RollApps’ both aim to improve blockchain scalability and efficiency, but they apply different approaches.

Rollups, like Optimism and Arbitrum, are Layer 2 scaling solutions for Ethereum.

They work by aggregating data off-chain before transmitting the crucial data back to the main chain (Ethereum).

This maintains the chain’s accurate state while increasing throughput, but it relies on Ethereum’s infrastructure for security and final settlement.

Contrastingly, ‘RollApps’ function as independent, application-focused blockchains. Instead of supplementing an existing blockchain like Rollups, ‘RollApps’ are structured to be more efficient, faster, and cost-effective for their specific applications.

They operate on a principle of modularity, allowing them to handle their own blockchain

What ‘RollApps’ do is they post state roots to Dymension and batches of transactions to chosen data availability layers, such as Celestia. ‘RollApps’ secure their networks through the Dymension Hub and its associated proof-of-stake consensus mechanism, allowing them to leverage the features of the Cosmos ecosystem.

Since Dymension Hub itself is Inter-Blockchain Communication (IBC)-enabled, ‘RollApps’ are also capable of interacting with other IBC-enabled chains like Osmosis.

As we can see above, ‘RollApps’ aims to bring considerable advantages, such as a streamlined deployment process to accelerate innovation while reducing technical and economic overheads that come with deploying app chains.

They can also benefit from the robust security provided by the Dymension Hub and interoperability with other chains through IBC, enabling greater collaboration between chains.

Conclusion

In summary, the Interchain Alliance introduces a new paradigm to cross-chain collaboration by enabling the staking of non-native assets on affiliated chains as a security measure. This fosters mutually beneficial economic relationships, enhancing the potential for stimulating increased on-chain economic behavior—ultimately benefiting the affiliated ecosystems.

On the other hand, ‘’Rollapps’ by Dymension present an alternative solution for protocols to launch application-focused blockchains.

By utilizing the security of the Dymension Hub, Inter-Blockchain Communications Protocol (IBC), and Data Availability layers like Celestia, it offers a more streamlined deployment process while reducing the technical and economic overheads that typically accompany such launches.

As the Cosmos ecosystem continues to foster these advancements, there is no denying that the app-chain thesis is poised to face explosive growth in 2023 and, if not, in the coming years.

The release of robust security solutions designed to enhance Cosmos blockchain scalability will revolutionize the landscape for developers, providing the foundation for an interchain future.

Also Read: Taking The Risk Out of DeFi: How Circle’s Cross-Chain Transfer Protocol Changes The Crypto Landscape

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief

This article was written by Jowella and edited by Yusoff Kim