Finally! The time has come where investors can partake in the crypto revolution in the familiar ETF format in the form of BITO (Proshares Bitcoin Linked ETF) for the US markets.

But is there merit to the celebrations? Is the ETF all it is hyped up to be?

How does it work?

The most important point to be aware of is that BITO does not directly hold any Bitcoin in its holdings. It holds only Bitcoin futures contracts as of now. What does this mean for potential investor

Firstly, the price movement will be very different from the spot Bitcoin prices. Futures contracts are valued differently compared to its underlying.

Without going too deep into the technical aspects of futures, it can be summarized by saying that the futures contract will not deliver the same returns as owning Bitcoin would. This is not a battle cry to buy Bitcoin, after all, negative returns are still returns, just not the returns that one expects.

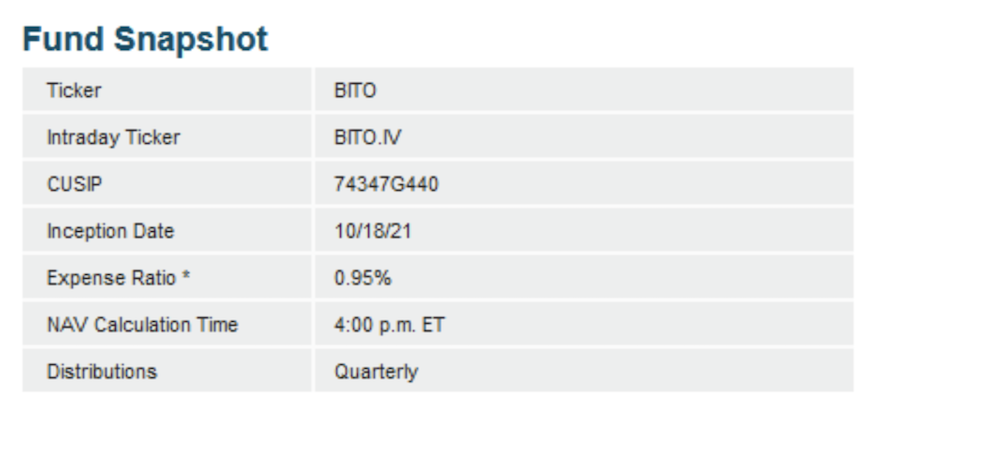

Taking a look at the expense ratio for BITO, it is listed as 0.95% (or 95 bips). For comparison, let’s take a S&P 500 ETF, the popular VOO (Vanguard 500 Index Fund ETF), that has an expense ratio of 3 bips, for comparison. That is such a drastic difference in terms of fees collected.

The point is that ETFs are not charities. They are a business and they will charge for their service provided. The more services the ETFs need to provide (or work they have to do), the higher their fees.

As such, investors might be snagged by noticeable fee drag, especially in periods where the returns are lacklustre or non-existent. 95 bips is not the highest, nor the lowest, but it is definitely something to put into consideration when building a well balanced portfolio that will not be bled dry by fees.

So if owning Bitcoin does not cost fees, why don’t investors just buy Bitcoin?

What are the risks?

US Bitcoin ETF allow investors to get exposure to Bitcoin without exposing themselves to risks they have not previously been exposed to.

What are these risks?

One of the most prominent risks in owning Bitcoin is storage. Over the years, Bitcoin storage has been simplified by orders of magnitude. Even so, it remains a challenge for the general public to understand how to safely transfer and store their Bitcoin.

Without basic and proper safety protocols, one might risk getting their Bitcoin stolen by “hackers”. Some people will then mitigate the storage risk by not taking their Bitcoins out of crypto exchanges, but little do they know, they have turned the storage risk into an exchange risk. Exchanges might be hacked and get their user’s funds stolen.

With futures contracts, one can shift risks associated with owning Bitcoin to their counterparty (counterparty might need to hedge) and take on risks from the futures contract, which is much more manageable and familiar, seeing that futures contract is highly regulated by the SEC.

Wrap the futures contract in an ETF, and the complication of having futures trading accounts and margin requirements has been taken off the table, leaving investors with a simple format to invest in.

But wait! There’s more.

Don’t rush out to buy BITO yet — the risks have been shifted away from the buyer, but everything has a price. Contracts command a premium, and for Bitcoin futures contracts, that premium is a substantial amount.

As simple a mechanism as premiums are, a buyer will pay that price for their peace of mind. Nothing comes free in this world. Compound the premium with the fees, one might even end up losing money!

Regulations

Why go through all these hoops in the Bitcoin ETF?

The most important people to please are not the investors, but the SEC (and other regulatory bodies), for they are the law.

The ETF is made up of futures contracts that the SEC deems safe and of high quality to retail investors, but deems Bitcoin itself as an underlying not suitable for retail investors.

This is akin to deeming mushroom futures contracts as safe and high quality, but not mushroom as an underlying asset. It might sound illogical and counterintuitive, but that is just how the law works.

Closing notes

Make no mistake, BITO will not be the last Bitcoin ETF to be listed on the US markets. More competitors offering similar products will join the markets to capitalize on the sweet sweet fees.

The newly launched Valkyrie Bitcoin Strategy ETF (BTF) has also begun trading. Originally, it had a proposed ticker of BTFD, but was changed back to BTF, probably due to the rude nature of the original ticker.

As interesting as BITO is, the fact remains that Bitcoin is readily accessible, and most crypto exchanges already employ good risk management.

Storage is fairly simple and will continue to get simpler in the future. Signing up for a crypto trading account is mostly quick and painless.

Therefore, it is tough not to feel that these types of ETF products are redundant in nature, assuming that they can even provide similar returns to owning Bitcoin.

Featured Image Credit: CoinDesk / Chain Debrief

Also Read: Ethereum’s Q3 Network Revenue Grew 511% Year On Year

[Editor’s note] The writer does not have any position in the BITO ETF at the point of writing this article. The writer not receive any compensation, and have no business relationship with owners/managers of the BITO ETF. This is not financial advice, please remember to do your own research.