Vietnam cryptocurrency pilot program

According to a report from Việt Nam News, Vietnam’s Prime Minister Phạm Minh Chính has recently asked the country’s central bank to pilot a cryptocurrency program from 2021 to 2023.

The decision was approved by the Prime Minister’s Decision No. 942/QĐ-TTg doctrine, which lays out an e-Government development strategy.

Other than pushing for a nationwide adoption on blockchain technology, Vietnam also hopes to increase the nation’s involvement in artificial intelligence (AI), big data, augmented reality and virtual reality as it moves towards a digital government.

The decision was approved by the Prime Minister’s Decision No. 942/QĐ-TTg doctrine, which lays out an e-Government development strategy. Other than pushing for a nationwide adoption on blockchain technology, Vietnam also hopes to increase the nation’s involvement in artificial intelligence (AI), big data, augmented reality and virtual reality as it moves towards a digital government.

While cashless payments are already rising in Vietnam, this new central bank cryptocurrency pilot program will help the country identify the benefits and risk of a digital currency implementation. Prior to this announcement, Vietnam’s stance on cryptocurrency is that cryptocurrencies are not legally recognized in Vietnam.

In 2018, the bank banned banks and credit institutions from using cryptocurrencies as a means of payment. It has also not granted licenses to any crypto trading platforms.

Hence the recent decision from Vietnam’s Prime Minister to relook into cryptocurrency application is quite a positive news, and a clear sign that the country is ready to open its doors to explore any innovative technologies.

Singapore calls for a CBDC solution

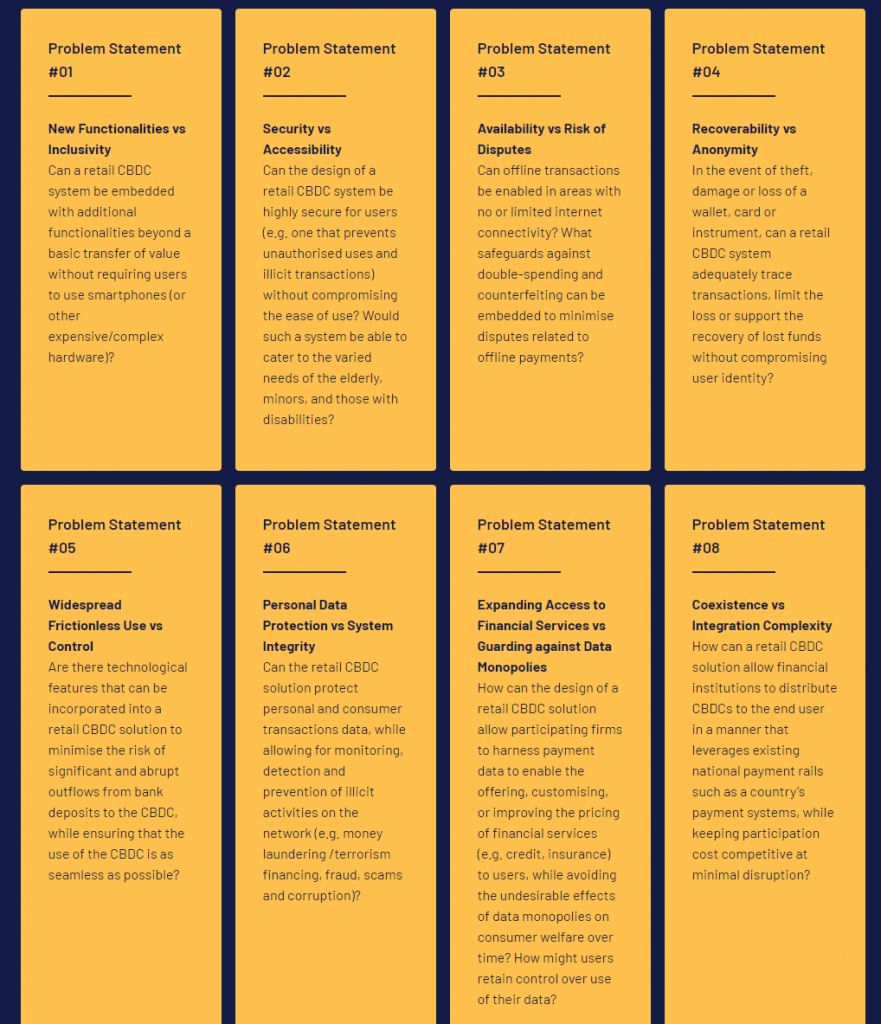

Meanwhile in Singapore, the Monetary Authority of Singapore recently issued a call for proposal for a central bank digital currency (CBDC) solution.

According to the announcement, MAS together with in partnership with the International Monetary Fund, World Bank and other partners, are looking for innovative retail CBDC solutions to enhance payment efficiencies.

A CBDC basically is the digital currency of the country. It uses an electronic record on the blockchain or a digital token to represent the virtual form of the Singapore dollars. A CBDC is also centralized as it is issued and regulated by the Monetary Authority of Singapore. To date, no country has officially launched a central bank-backed digital currency, except in China.

In April 2021, China has launched a trial of their digital currency where subway passengers can use the country’s digital “yuan” to pay for their daily commute.

Indonesia’s central bank governor also confirmed in May that Southeast Asia’s largest economy would launch a digital currency. Hong Kong, Thailand and South Korea, are also reportedly working towards launching CBDC pilot programmes in the respective countries.

Also Read: Philippine Stock Exchange Eyes Cryptocurrency Trading As Crypto Adoption Rises