It’s not surprising to see food-themed names in DeFi, as evidenced by the naming of platforms like Pancake and Sushi Swap, a unique DeFi product stands out with its distinct product offering in the DeFi world called Chicken bonds.

Today, we unwrap what Chicken bonds are, how juicy yields are and where they are today.

What are chicken bonds?

As novel as the name suggests, Chicken bonds are a new mechanism which amplifies and optimizes yield in an innovative new way.

But before we delve into how the mechanism works, we must understand what a bond is. A bond is a financial instrument where an investor loans money to a borrower. The investor then receives interest on the bond.

Once the bond reaches maturity, an investor can redeem their investment back.

This was made popular by DeFi 2.0 products of Wonderland TIME and Olympus OHM, but we all know how that story went.

However, similar to how the name stands out, Chicken bonds are doing things differently; how?

In three ways; firstly, an initial investment can be claimed at any point. Secondly, there is no fixed maturity, and thirdly, they incorporate dynamic NFTs.

They are also built on Liquity protocol, a home that allows investors to take zero-interest loans on $ETH.

All loans are paid out via their native decentralized stablecoin $LUSD, and it is this stablecoin you need to create a chicken bond.

There are two ways to acquire $LUSD: first, as stated above, using $ETH as collateral and borrowing $LUSD, swapping $LUSD through a DEX such as curve finance.

When you bond, you get NFT chicks

Bonding your $LUSD, you will receive a bonding NFT. This NFT will change in rarity based on the actions you take.

This is their way to encourage activity in the ecosystem, as the more you do, the higher the chances for rare NFTs you will get. Excellent if you are looking for a new profile picture of a golden egg.

$bLUSD

As soon as you bond your $LUSD, your position will accrue rewards in the form of $bLUSD. $bLUSD has a yield generation from three different sources.

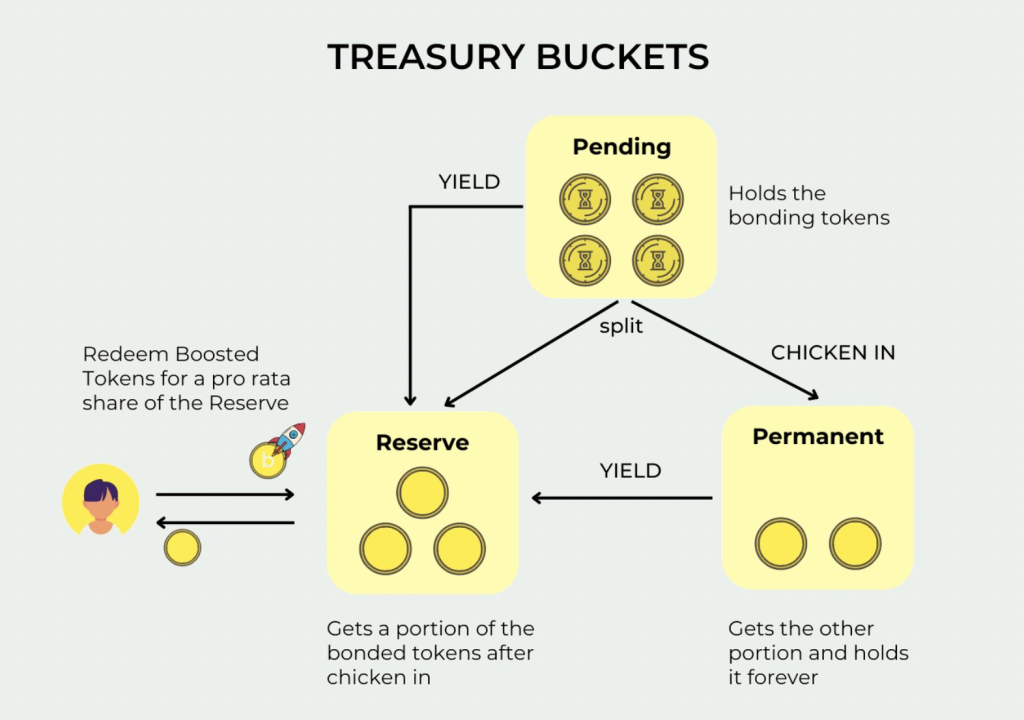

Firstly, when you bond your $LUSD, it will be sent to the “pending” bucket. This is where the dedicated $LUSD will be placed in a liquity stability pool, earning you $ETH and $LQTY.

These rewards are compounded back to $LUSD and sent to the two other buckets, “reserve” and “permanent”.

The $LUSD in the reserve bucket is what backs the $bLUSD. This $LUSD earns extra yield through the stability pool, buffing the backing of $bLUSD.

Think of the permanent bucket as where the $LUSD peg is secured via different protocols (Curve finance) while allowing farmers to earn additional yield.

TLDR, you deposit your $LUSD for yield, compounding your yield into more $LUSD, which backs $bLUSD.

It is also good to know all minted $bLUSD are always backed by $LUSD. Additionally, the reserve bucket receives additional yield sources from the other buckets. This very yield amplification ensures a $bLUSD rising floor price. It will always trade at a premium against $LUSD.

If $bLUSD trades above the floor price, an arbitrage opportunity will arise by utilizing curve pools to swap back to $LUSD for a premium. After that, you may repeat the entire cycle, giving you a chicken bond DeFi flywheel strategy.

Chicken stats

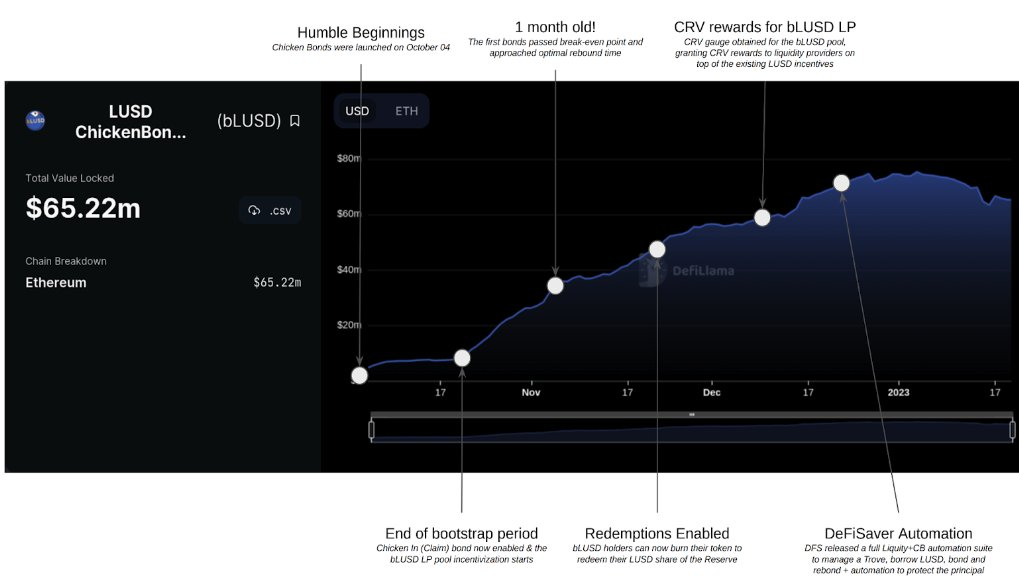

Some key milestones Chicken Bonds accomplished above can be seen in their overall TVL numbers in DeFiLlama.

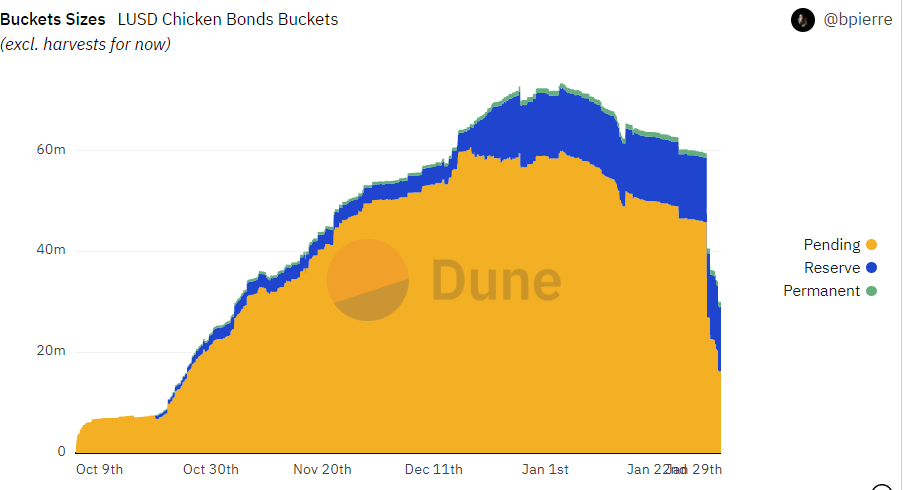

There are over $30.5M of total value locked and 931 pending bonds. The recent activity showed large amounts of LUSD being cancelled, with buckets within the ecosystem having a cliff drop-off in numbers.

Twitter investigators found this was caused by 0xSifu, who chickens out of his $4.1M position in chicken bonds after he staked the $LUSD on Liquity to farm $LQTY.

/2 UPDATE: Sifu finally chickened out today on $4.1m of chicken bonds. 😆😅

— DefiMoon 🦇🔊 (@DefiMoon) February 1, 2023

He staked the $LUSD on Liquity to farm $LQTY pic.twitter.com/sZYweEh7xH

His positions from early Nov to early Jan seemed to be underwater even after three months of delegation. He was one of the biggest Chicken bond contributors, with almost 1/3 of the share in the entire chicken bonding game.

With no winner-winner chicken dinner for him with chicken bonds but he got plenty of attention from mummy, as he shifted a portion of his withdrawn funds to Mummy finance as a liquidity provider, pumping its TVL to rise by 37.4%.

🔥 @0xSifu has just deposited $2M to Mummy Finance as a liquidity provider

— Fantom Daily (@fantom_daily) February 2, 2023

This have made the TVL of @mummyftm immediately rise to $10.7M (+37.4%) 🚀#Fantom #FTM pic.twitter.com/0KJYutA3hj

Closing thoughts

Chicken bonds offer an innovative mechanism for optimizing stablecoin yield. They open up new avenues of exploration for protocols, DAOs and users alike. Imagine a world where protocols can utilize this mechanism in the future for their yield-bearing token.

But yet, most of the Chicken bonds have been underwater since the dawn of 2023; as seen in the chart below, many have forfeited their positions as they grow impatient for some upsides.

While early adopters of Chicken Bonds got a great deal, more recently, the market price has been trending below the fair price towards the floor price, causing uncertainty about when their scheduled breakeven date is.

an update on my @ChickenBonds experiment:

— cryptohuntz (@cryptohuntz) January 29, 2023

– 11/2/22: created bond w/ $976.41 $lusd

original break-even time: 11/20/22

original rebond time: 12/9/22

– today (1/29/23):

new break-even time: UNKNOWN

new rebond time: UNKNOWN

this isnt where i parked my car..@LiquityProtocol pic.twitter.com/e373agWTYG

Has Chicken bonds become stale? If you’d wish to look into the state of Liquity Q4 2022, read Messari’s report for free below.

State of @Liquity Q4 2022 is LIVE.

— Messari (@MessariCrypto) February 2, 2023

Check out the FREE quarterly report, from @RyGuy_LikesETH and the Protocol Services team.

Also Read: Top 10 Yield Farming Opportunities For Ethereum (2023)

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief