Gm! This is unlike the typical news articles usually published on Chain Debrief. I’ve been reflecting a bit on the current market conditions and would like to share a shimmer of thoughts on one specific topic, crypto cycles.

The words every crypto investor thinks about right now are unquestionably “crypto winter”. Cryptocurrencies across the board are in brutal turmoil with most cryptocurrencies at least 70% down from their all-time highs in 2021.

As quoted by Clara Medalie, “As markets started selling off, it became clear that many entities were not prepared for the rapid reversal”. It seems that the consensus across all stakeholders is that we are in a prolonged bear market, but how is this cycle so different from other cycles?

With institutional money deployed, the latest cycle is marked by a new regime. A series of events have caused contagion across the industry, and 4-year cycles in crypto have perished. A decade of high volatility, possibly shorter or longer cycles driven by growth, inflation, policies, and the industry’s increasing interconnected nature and business strategies.

The era between 2017-present

2017-2021 saw the creation of many new cultural phenomenons and basic tokenomics with scaling wars, the rise of NFTs, Decentralized Finance and eventually basic tokenomics. 2018 specifically saw the slump of many tokens which was largely due to the burst of a hype bubble, in which many thought cryptocurrencies were regarded as a passing fad, but those who persisted through this winter were rewarded with skyrocketing all-time highs in 2021.

In current crash began as a result of severe macroeconomic factors of inflation which caused alarming hiking of interest rates. Furthermore, big Wall Street Players were highly leveraged unlike in 2017-2018, causing a catalytical selloff with terrifying wicks as many funds were forced to declare insolvency and bankruptcy.

Furthermore, FINRA Statistics highlight how everyone is highlighting all-time highs of debit balances in customer security margin accounts nearly 2.5x higher than the global financial crisis back in 2008. These factors were not present in the last cycle.

I get that based on historical data, people are forecasting 4-year cycles, and extrapolating a pattern from the past post-mortem into the future gives a sense of security. However, in crypto, every cycle we grow in magnitude and size.

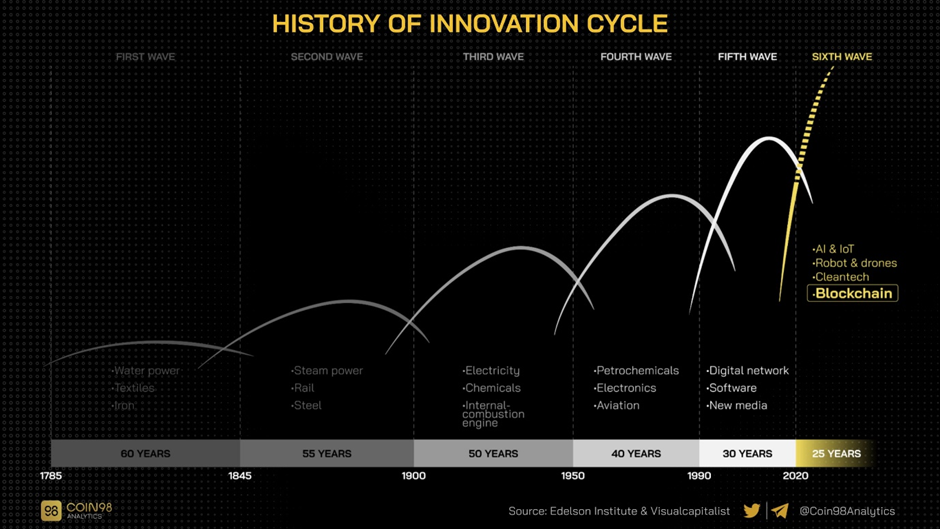

Innovation cycles

If we look at the underlying principles of the latest innovations in this era, blockchain is one of the four underlying principles. Each cycle is exponentially tightening which makes it even more difficult to extrapolate when exactly this bear market end.

As mentioned previously, the market composition has changed drastically post-covid. Bitcoin has matured more as an asset and has become increasingly correlated and reacts to FOMC more and more spontaneously.

While Bitcoin used to be a hedge against TradeFi, presently, you can almost sense sell-offs of both Bitcoin and Nasdaq concurrently. That said, the correlation has become significantly less as we roll into August. A 40-day correlation coefficient for the token and tech-heavy Nasdaq 100 index has fallen below 0.5 to levels previously flagged in January, possibly indicating some sign of recovery.

Back to the original point, if we look at the subset on the 6th wave, 4-year cycles will cease to exist, either shorter or longer, as another important factor to consider is that the magnitude of Bitcoin halving decreases and approaches 0 over time. Moving forward, Bitcoin halving will have a less significant impact on cycles while macro-economic factors are of higher significance.

“The great reset”

I like to coin the term the “great reset” as all shitcoins and garbage projects go the 0, be it soft-rug or hard-rug. Zeneca shared a very good point on the principle of impossible expectations in relation to how difficult it is to keep to the demands of the market. I hope that in the next cycle things will change for the better. A deeper read below

Impossible Expectations.

— Zeneca_33 (🔮,🔥) (@Zeneca_33) April 11, 2022

Our space runs on Impossible Expectations. The pace with which the market hopes and expects projects to move at, is impossible for any legit project to move at.

The goal posts are constantly moving. It's impossible to know what people want, most of the

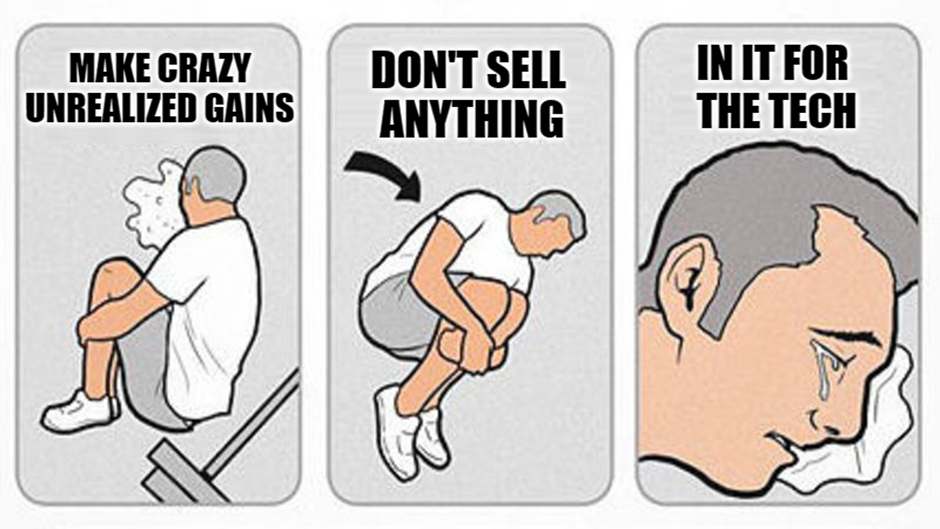

One of the problems across the cryptocurrency market, be it NFTs or decentralized finance is its excessive canonical behaviour of how much the market is fuelled by pure hype and speculation. The point is that no one cares about technology.

95% of people are just in for the money, looking to dump on the next buyer and secure a profit. People purely decide whether or not they want to pay largely on emotion and nothing tangible.

A pertinent example is NFTs. It quickly becomes a widely accepted paradigm that if I want financial gains, it’s not what I think about the project, but what other people think of the project.

These result in a diverse set of desires and expectations. For example, some may have bought at the mint price of 0.1 ETH, some may have paid 0.8 ETH, or some may have bought the top at 10 ETH. Its nearly impossible for any project founder to manage the expectations of all these groups.

As more variables get added into the mix, it becomes more and more impossible. In Decentralized Finance, it could be degen apes for an hour into 10000% APR, or in NFTs, people buying with the hope to flip within a few hours and make a profit.

Then, of course, there is the stupid expectation of “Wen Moon and”, “Wen Airdrop” by the Moonboys who are only in for the money, and they don’t even realise what they are asking for are ponzinomics and fud when the project goes south. Money has to come from somewhere.

Not to say that all are bad, some genuinely want to help any project or protocol but these gems in the market are so few and are diluted by the tumultuous noise of the market. This generally puts most project founders in an incredibly difficult dilemma, catering to those looking for short-term gains or long-term gains.

The “Great Reset” would hopefully aim to not just reset protocols and projects, but also the mindset and mentality of this space that has led to an increasingly distorted and fragmented market. No matter what role you play, it’s brutal. There are ups and downs and sometimes maybe a home run, and this goes for founders, builders, flippers, artists. Anyone and everyone.

What does this mean for everyone?

Retail Investors – Clearly, many of us are down bad right now and have been investing significantly less money over the past few months. I just must remind you that it is impossible to time the market, and perhaps you may want to look at some strategies to diversify your portfolio.

Builders – Again, don’t time the market, think similarly to venture investors. Don’t postpone your ICO or IPO just because of the market. You’re looking to build into the future, personally, I believe it will take another decade for the cryptocurrency market to mature. Be aware however that bear markets make fundraising very challenging.

We are seeing some very innovative products come out of this market, and the crypto industry has come a long way from zero to one in a little more than a decade. Computing Infrastructure Improvements seem to be developing with so many promising projects, ZK-Proof Rollups, Sharding, Sidechains, Modular Architecture, Web Assembly, Layer-Zero technology and so much more.

We could also see significant advancements in decentralized digital identities and advanced tokenomics, and the potential is enormous with innovation.

Epilogue – Mass Adoption

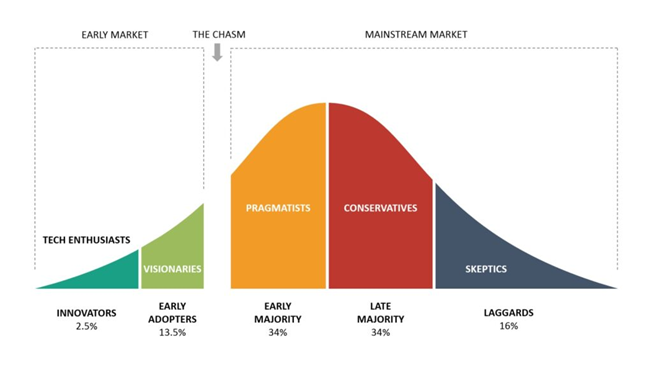

Despite the dire situation I have painted, some metrics of the crypto industry are pointing positively. The numbers of the crypto population are not decreasing, but rather, are in an increasing upward trend. Crypto.com reports that worldwide crypto owners have increased nearly 178% since the beginning of 2021, putting the worldwide crypto adoption at around 5% in the early adopter stage with mainstream adoption chasm not too far ahead.

If we look at the diffusion of innovation theory, the majority of us are still very very very very very early. So builders, developers, degens, and investors, let’s show some empathy and sympathy for each other during this period and we will come back stronger in the next cycle. WAGMI.

[Editor’s Note: This article does not represent the views of Chaindebrief or any affiliated entities. Please do your own research before investing.]

Featured Image Credit: ChainDebrief