It seems that every individual knows what a blockchain is and in simple terms, it is a distributed ledger that stores the transactions and the ledger is distributed to a network of computers.

When Bitcoin was created by Satoshi Nakamoto, anyone that wanted to participate in the network could run their own nodes and verify the transactions on chain easily even with their laptops.

As the blockchain scales, it becomes resource intensive to run a node itself as the ledger has grown tremendously just as the user base.

There are many underlying mechanisms that are in place on the current blockchain that many may not have noticed.

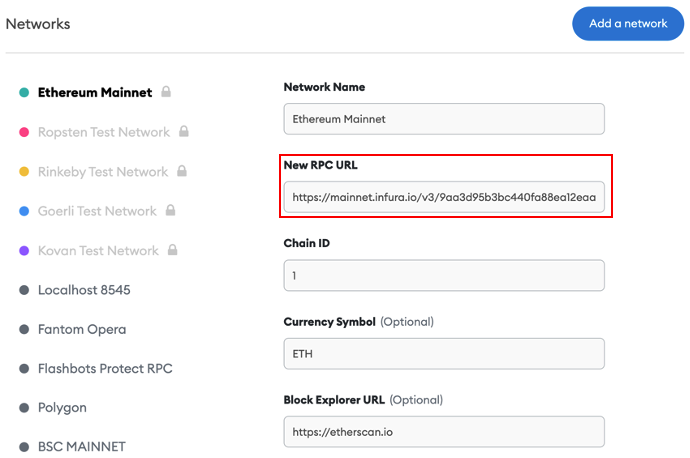

One example would be the Web3 wallet provider MetaMask. MetaMask actually calls an RPC to query the on-chain data for your account details, which allow your data to be shown when you log in.

This is run by a centralised entity, Infura , which many might not have known about.

What is a node?

Nodes are computers that store a copy of the blockchain and communicate with other Nodes on the network.

Communicating through a Node is the only way for someone to interact with the blockchain. To operate a Node, it has to stay synced with the latest block, and it will not make any sense for someone to do so just to make a simple transfer transaction (it might take days to sync in some cases).

Alchemy and Infura are specialized platforms that provide access to nodes-as-a-service. They provide an endpoint so that requests to receive or record information can always get to the specified network.

For example, if a Dapp wants to check a USDT balance of an Ethereum address, they will have to submit a request to the blockchain (similar to how API requests for data).

In layman terms, these platforms are like waiters in the restaurant that take down your order and pass it to the kitchen to process. Thereafter, the food will be served to your table.

Thus, Infura and Alchemy can be seen as “a gatekeeper” of the Blockchain where they control the access to the network. With such comes the issue of centralisation where the majority of the Nodes are run by companies such as Infura, Alchemy and Quiknode.

Infura reinstalling Ethereum and Arbitrum, @MetaMask can’t compute tx fees or send tokens. We need wallets with better defaults. pic.twitter.com/98doBQshft

— JayBuidl.eth ⟠ (@JayBuidl) February 5, 2022

PSA: No, Avalanche $AVAX is not down, but the node service that Metamask and other wallets talk to by default is (https://t.co/6gBrkutAFX). If anyone has a public node that people can use in the meantime please reply and let us know. Thanks!

— LukeYoungblood.eth (web3,web3) (@LukeYoungblood) September 23, 2021

These are just some issues of reliance on a centralised provider for Nodes services which can result in outages which are bad for the user experience.

It’s like building an amusement park on an island but there is only one transport provider to the island. If the transport provider decides to rest for the day then the amusement park will have no business.

Thus, it is essential to not rely only on a sole provider for RPC services.

What is Pocket Network?

Pocket Network is the Web3 Node infrastructure that operates as a decentralised relay network to facilitate Dapps and users with Web3 access. Incentives are key for everything on the blockchain without rewards, miners/ validators won’t be there to secure the network, no one will provide liquidity and the list goes on.

As there are no clear incentives for anyone to run full nodes for others, the Web3 access has been consolidated around several parties as mentioned above.

Pocket Network offers an incentive for full node operators that pays out whenever a relay is routed through their Nodes.

Thus, Pocket Network creates a marketplace to connect Dapps looking for Web3 access (demand) and infrastructure providers running full nodes (supply).

As more developers use the Network (Increase in Demand), it will in turn increase revenues generated by Nodes which increases the incentives of running a Node.

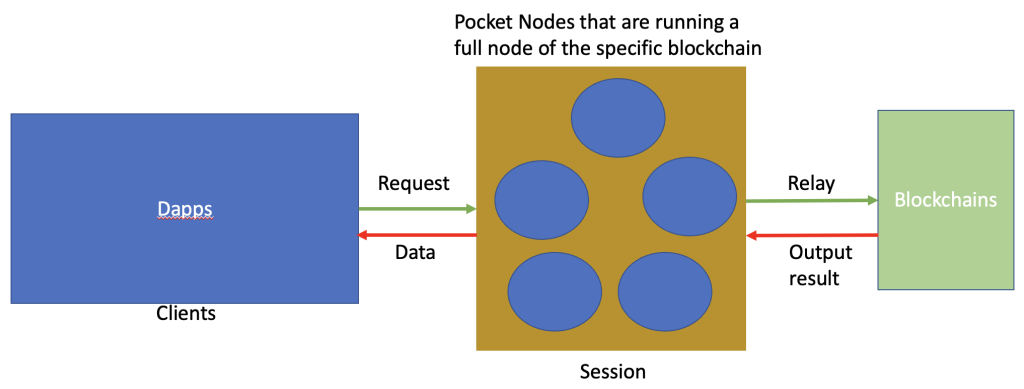

High level overview of Pocket Network

Dapps that want to use Pocket services have to lock POKT tokens and the amount that the Dapp locks determines the throughput that they will be offered. Thus, for Dapps that is experiencing high traffic, they will be locking up a higher number of POKT. When these Dapps want to discontinue the services by Pocket Network, they will simply unstake their POKT tokens and market sell it. Keeping in mind that the amount of POKT staked initially will not change as fees paid to Nodes are not generated from Dapps staked token but from the minting of POKT.

Nodes that participate in Pocket Network have to stake an upfront of ~15K POKT for the right to work and they will earn POKT based on the number of relay request that they serviced.

The staking of the POKT by Nodes is to ensure that they stay vested and remain honest in their duties where they can be slashed if they are consistently down or return invalid data. Note that there is an unstaking period of 21 days for Nodes.

Every successful relay mints 0.01 POKT which will be distributed mainly to the Node servicing the relay and other parties involved.

- 89% to Node servicing the relay (0.0089 POKT)

- 10% to Pocket DAO (0.001 POKT)

- 1% to the block producer (0.0001 POKT)

From the above image, it shows the flow of how a Request from Dapps will be serviced by a session. A session is facilitated by five Pocket Nodes that concurrently run a full node of another blockchain which will relay the request from the Dapps and return the output to the Dapps.

Pocket Network will randomly select a set of Nodes to form a session where each Node will work independently to relay the request to the specified blockchain.

Thereafter, the Dapps will review the output given by the session and the Dapps are able to challenge the Nodes if any of them provides a differing output from the majority resulting in that Node being burned. Nodes have to submit a zero-knowledge range proof to ensure there is no foul play on the number of relays made by it.

Currently, Pocket Network serves various Blockchain including Harmony, Ethereum (Main and all testnets), Polygon, Solana, Gnosis chain, IoTeX, Fuse, Avax, BSC, etc.

Here are some of the advantages of Pocket Network:

Privacy

Through sessions, Pocket Network is able to allow decentralisation at its finest where data will not only flow through a small group of entities but through a group of randomly selected Nodes each time.

Each Node will only have a small snippet of what the Dapp is doing and will not be able to figure out the full picture unlike using a central provider which presents the risk of exposing your data.

Moreover, every Node has the same amount of chance to be in a session thus distributing work more efficiently across the Nodes and are not dependent on their staked amount.

Cost

As centralised entities that provide Nodes-as-a-Service, they charge a different monthly fee in different relay packages. In months with lesse traffic, Dapps might overpay for their services, which is inefficient.

In the case of Pocket Network, Dapps lock up a certain amount of POKT that qualifies them to a number of Relays in a day. The network adjusts the cost of relays based on the current usage of the network (it is currently free as Pocket is in the bootstrapping phase).

Pocket Network as a protocol only charges a small amount of fee for facilitating the marketplace compared to centralised entities who have to cover their overhead. This results in cheaper fees for Dapps.

Dapps are turning their infrastructure fees into assets where they buy POKT up front and lock it in escrow to pay for the services that they use. POKT gives Dapps the right to use the infrastructure and the throughput of the network.

Thereafter, if they do not wish to continue using Pocket Network services, they are able to unlock the POKT and sell it.

100% uptime

As mentioned above about the downtime of Infura which is a risk when using a centralised entity, Pocket Network users will not experience this as Nodes are incentivised to provide good service or risk getting penalised.

Nodes can be spread across the world when there is an issue in one area; other Nodes are able to service requests.

In each session, there are multiple Nodes which reduces the possibility of Dapps not getting their requests fulfilled.

What is Pocket Network built on?

Pocket Network is a Layer 1 that is built on a Proof-of-Stake (POS) consensus mechanism using an adapted version of the Tendermint consensus engine.

The purpose of the Pocket Network Blockchain is not to have extremely fast TPS or low time to finality but instead it serves as a settlement layer for the demand side (Dapps) and the supply sides (Nodes).

Service Nodes will submit Proof of relay (zero knowledge range proof) that will mint POKT in proportion to the amount of work completed.

For transfer of funds within the network, it will be facilitated by leader-elected Nodes that will be rewarded with 0.0001 POKT.

On-chain analysis

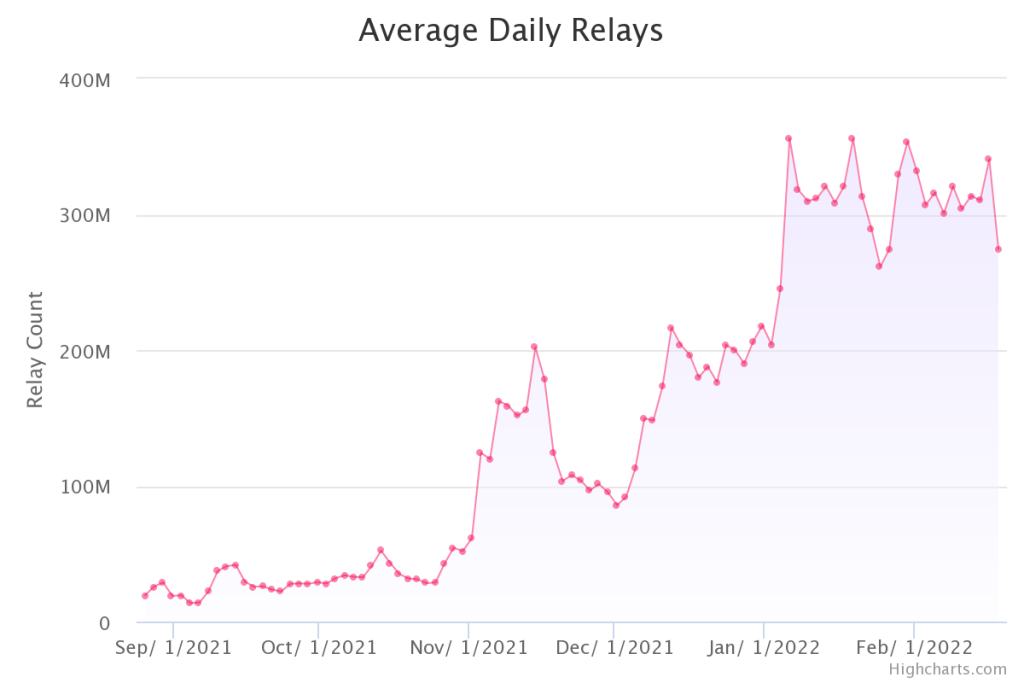

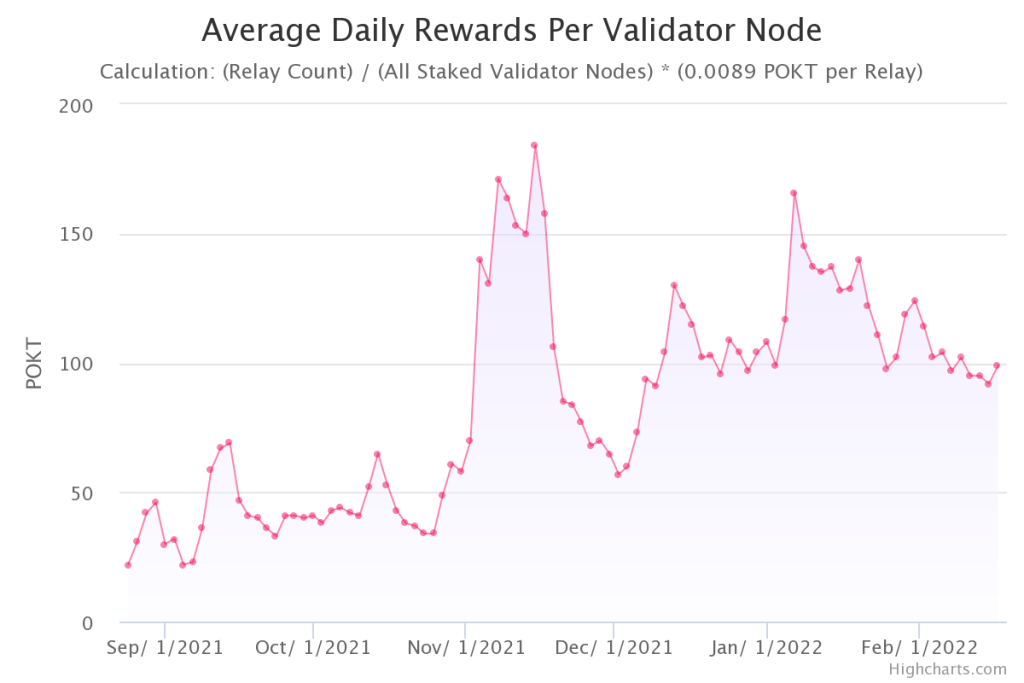

The increase in daily relays in November is due to a strategic partnership with Harmony as the network has been experiencing a high traffic in users resulting in a higher demand for RPC calls.

This caused congestion on their RPC service provider, leading to poor user experience on Harmony. Pocket Network saw an exponential increase after partnering with Harmony (October) and relays have been increasing ever since.

A quick update about RPC congestion at @harmonyprotocol – we’ve seen incredible exponential growth the last few days which was affecting performance of our APIs. Thanks to @POKTnetwork we were able to further decentralize our nodes this morning and prepare for even more growth 💪 pic.twitter.com/8saRSmnGFo

— Giv 💙 (@givp) October 24, 2021

From the relay distribution, Harmony takes up the majority of the relay requests which is not surprising due to the Defi Kingdom hype.

The relays for the other network remain relatively low as compared to Harmony but it will change over time as Blockchain protocols see the various benefits of using a decentralised Node service.

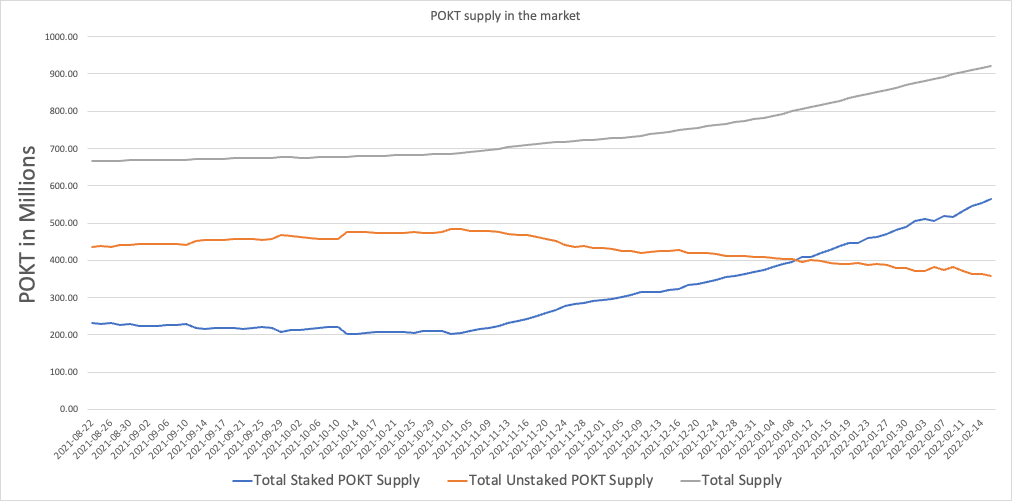

Last month, the total staked POKT supply overtook the non-staked POKT supply which indicates more users are participating in the Network. This results in a reduction in price volatility as there is lesser circulating supply.

The increase in staked POKT is in line with the exponential increase in active Validators in the network. The reason for the increase in Validators is due to platforms such as Poktpool and Thunderhead OTC that allow fractional staking, instead of providers such as c0d3r, which require users to have an upfront of ~15K POKT to participate.

Another reason could be the high returns that each Node offers, which is around 300% APR, resulting in a flood of new participants that want to have a piece of it.

The average daily rewards per validator Node is stagnant even with the increase in relay requests and it is due to an increase in validator Nodes just like how rewards in a liquidity pool will drop with an increased TVL so rewards get diluted.

From all the charts above, we can infer that the increase in validator Nodes (Locking of ~15k POKT) is greater than the emission of POKT (Emission of POKT can be calculated by 0.0089 * number of relay) which means people are either staking their POKT in new Nodes or selling it to users that stake their POKT.

The reason for this increase is due to the Pocket Network being in the bootstrapping phase, where its key objective is to acquire a large number of Node runners and Dapps utilising the Pocket Network services.

Pocket Network do so by decreasing the barrier of entry by reducing cost per relay which results in high relay demand. The relay request by Dapps will determine the emission of the POKT token, which results in higher yield for the Nodes.

Thus, Node runners might recycle their earnings into generating new Nodes to make use of the high APR offered.

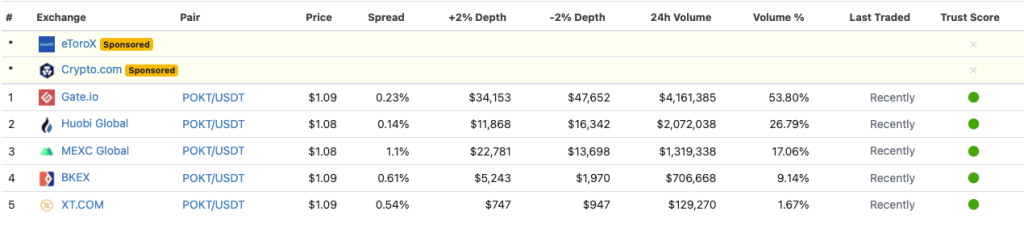

How to Buy POKT?

POKT is available for purchase at the various Centralised exchanges (CEX) above but Gate.io and Huobi have the highest volume so the liquidity might be deeper at these exchanges. There are currently no DEX that offer swapping with POKT but there is an OTC method that people can engage in. (Please proceed with caution for OTC and check with the community on the reliability of the provider before proceeding)

Closing thoughts

Pocket Network works to solve the issue of companies forming a monopoly on access to Web3 which can be detrimental to growth of the industry.

Pocket allows the decentralisation of Nodes, allowing smaller players to support the infrastructure of Web3. Infura has provided Dapp developers with the convenience of an infrastructure provided for them, allowing them to focus on the development of their product instead, which is good for the industry.

The centralised Node as a service companies lower the barrier for developers to release their Dapps but reliance on a central party is not healthy for the entire ecosystem. Thus, Pocket Network serves to fill up this void.

Overall, the flywheel that Pocket Network created will be beneficial to the Pocket ecosystem by helping them build a strong foundation and client base. However, there must be other means to control the inflation of POKT tokens as the flywheel that Pocket created is very fragile. Currently, the staked POKT exceeds the rate of emission but it is only so as the Network is in a bootstrapping phase. If the number of relays is unable to keep up with the number of Nodes, the emission of POKT will run inflation risk as yield of running Nodes becomes unattractive. This will result in Node runners dumping their rewards every time they harvest but there are future plans (Maturity Phase of the Network) in place to ensure that these do not occur.

There are more things (Pocket v1, wPOKT, Maturity Phase) to be covered which will be covered in the future as this article has become too long. Blockchain Infrastructure has always been overlooked but it can be a hot topic for 2022 so do keep a lookout on this narrative.

Featured Image Credit: Chain Debrief

Also Read: What is Frax Finance? All You Need To Know About The World’s First Fractional-Algorithmic Stablecoin