Multi-chain appears to be the next narrative. However, there is a problem with being multi-chain and it is bridging. We continue to hear about exploits on various bridges as a weak link in the project to this day, where hackers steal funds upward of US$600 million.

Read Also: Hackers Stole Over 173,600ETH, $25.5M USDC From The Blockchain Behind Axie Infinity

However, there isn’t any easy way to go around it. There is no instant guaranteed finality where users would be able to trust a successfully committed transaction on the source chain, which will arrive on the destination chain.

What is Stargate Finance?

Stargate is a fully composable liquidity transport protocol that lives at the heart of Omnichain DeFi.

With Stargate, users and Dapps can transfer native assets cross-chain while accessing the protocol’s unified liquidity pools with instantly guaranteed finality.

$4,000,000,000 pic.twitter.com/v3lBB5NTMy

— Stargate (@StargateFinance) April 4, 2022

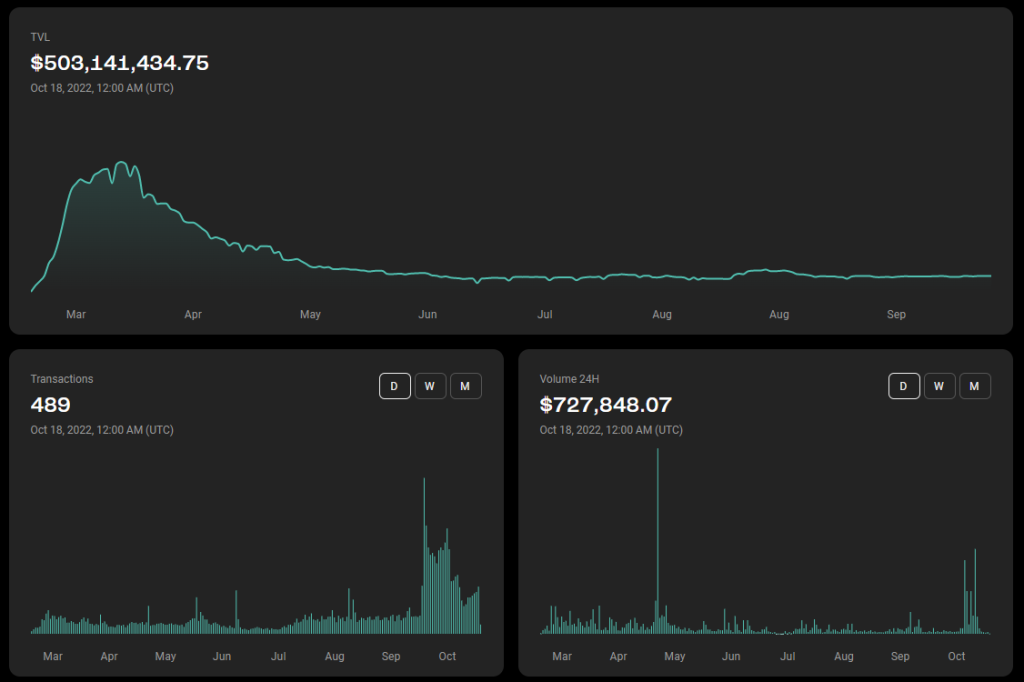

As of the time of writing, Stargate has a US$500 million in total value locked (TVL) with a 24h volume of $727,848.

For the same reasons, we won't be selling any of the tokens we bought for at least 3 years. This was not a cash grab or anything like that, we truly believe in this project and this team, and our only goal was making a long-term investment in both.

— Sam Trabucco (@AlamedaTrabucco) March 22, 2022

Transfers

Stargate swaps 1:1 native assets cross-chain, accessing Stargate’s unified liquidity pools. Basically, the transfer submitted on the source chain is guaranteed on the destination chain.

Gone are the days, when you are bridging and the transaction fails due to liquidity issues or wrapped token issues. Better still, you are getting a native asset, not a synthetic-wrapped one.

Farms and Pools

You may add liquidity on Stargate Omnichain protocol to earn stablecoin rewards on every stargate transfer. Liquidity providers can also farm their LP tokens to receive STG token rewards.

Staking

$STG holders can lock up their STG tokens to receive veSTG, stargate’s governance token.

Stargate in solving the bridging trilemma

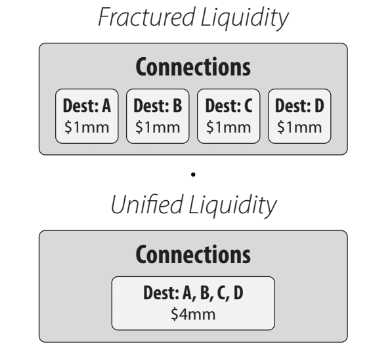

Before we delve into the bridging trilemma stargate solves, we need to take a brief look at how traditional bridges compare with stargate’s unified liquidity.

In traditional bridges, they use something called fractured liquidity where they have separate pools for different tokens you are looking to bridge. In a fractured scheme, each chain maintains a separate liquidity pool per connection.

To solve this, using unified liquidity will enable all connections deposits and withdraw from a single pool of liquidity. All connections share a single pool.

Unified liquidity does not come for free. It creates an additional challenge to providing instantly guaranteed finality: if multiple concurrent transactions withdraw from the same liquidity pool, care must be taken to ensure that the liquidity pool is never exhausted before all transactions can complete.

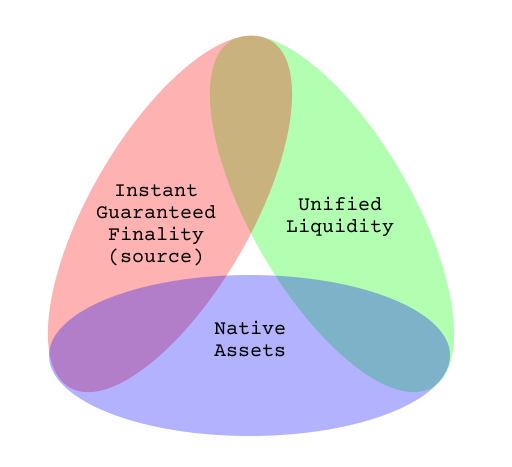

Bridging trilemma

Instant Guaranteed Finality: Users & Applications can trust that when they successfully commit a transaction on the source chain, it will arrive on the destination chain.

Native Assets: Users & Applications swap in native assets as opposed to wrapped assets that require additional swaps to acquire the desired asset and corresponding fees.

Unified Liquidity: Shared access of a single liquidity pool across multiple chains creates deeper liquidity for users & applications that trust in the bridge’s reliability.

Lock + mint and burn + redeem

Typically, bridges go through this process where whatever asset you are actually bridging stays on the native blockchain, a smart contract does its calculations and gives you a synthetic version on the destination chain.

As for Stargate, you are taking that native asset and getting that asset on the destination blockchain, solving the native end of the trilemma.

Issue of liquidity

The other issue pertaining to the trilemma is that the liquidity can be drained. When chain A sends a transaction to chain C requesting $XXX, it is possible that some of the other chains get there faster and drain chain C or put it in a state of not fulfilling chain A’s request.

Stargate solves this through “equilibrium fees”. Equilibrium fees will ultimately result in users naturally working toward balancing each connection in the network ensuring Delta (Δ) bridges are able to continue service transfers without requiring the addition of more base liquidity.

(The Delta (Δ) algorithm, is a novel resource balancing algorithm that enables unified native asset pools on all chains while also providing Instant Guaranteed Finality. Delta (Δ) is the first algorithm capable of solving the Bridging Trilemma.)

Delta (Δ) brings composability/interoperability

Solving the Bridging Trilemma allows bridges to transfer and call on the destination chain, allowing for real composability.

Applications can now wrap a Delta (Δ) algorithm Enabled Bridge (Bridge) in a single transaction from the source chain to accomplish actions like swap -> bridge -> swap.

For example, suppose a SushiSwap user wanted to swap wBTC on Ethereum for JOE on Avalanche. In that case, they could now do this in a single transaction on the source chain and without ever leaving the SushiSwap UI.

This enables a complete unified experience for multichain applications like SushiSwap, Abracadabra, and many more.

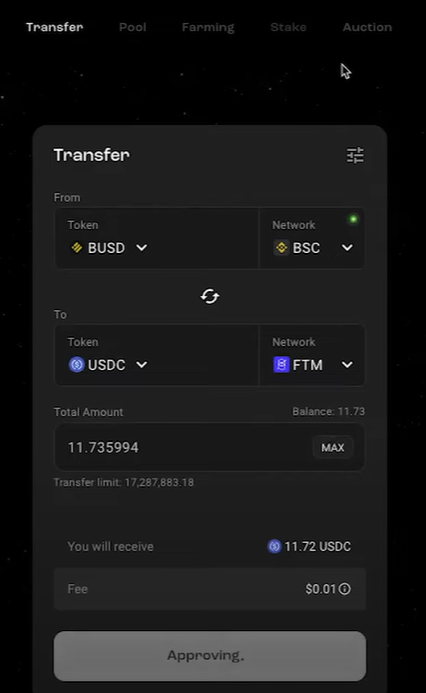

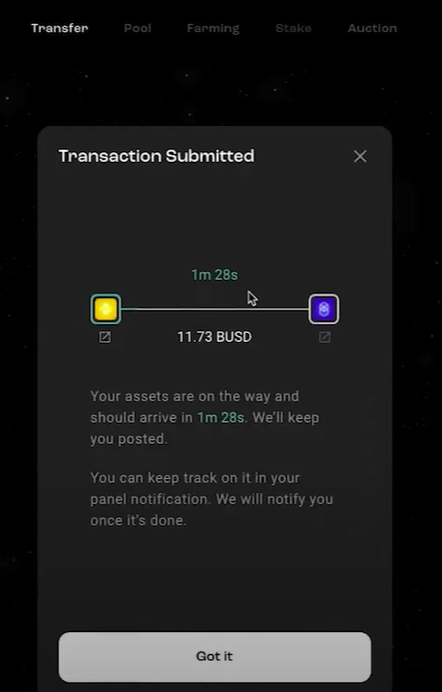

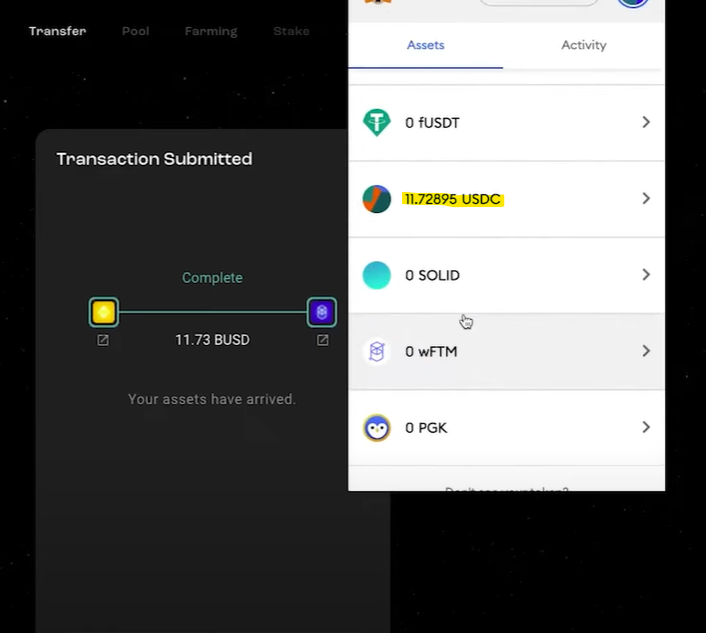

Step-by-step on how to bridge on Stargate

I will be bridging my BUSD to USDC on the fantom network.

Giving permission for stargate to access my BUSD

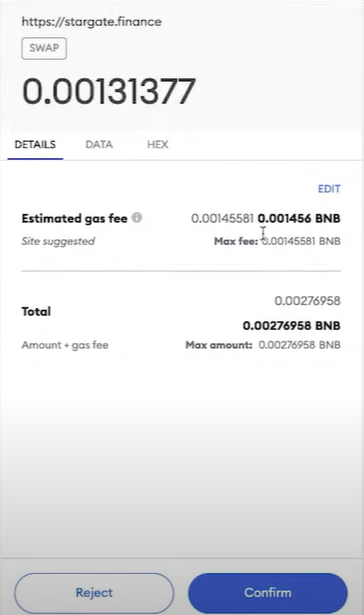

Estimate gas fees for the transaction

Transaction submitted with an indicator of how long the native asset transfer will take

Once the transaction is completed, I would be able to see the amount transferred over in the fantom network

Closing thoughts

Stargate solves the Bridging Trilemma through the Delta (Δ) algorithm.

We don’t need to lock and mint synthetic assets, and we don’t need fragmented liquidity. Instead, we may have vast pools of native assets linked to all chains at the same time, resulting in orders of magnitude higher capital efficiency.

LPs will be able to invest in a single-sided asset pool without incurring any impermanent losses and will be able to earn fees from all incoming transactions, independent of their originating chain.

Users no longer have to exchange out unwanted synthetics on the destination chain, nor do they have to worry about a transfer failure due to a state change.

Also take a look at the thread below for some LayerZero alpha.

5/9

— olimpio.eth ⚡️ (@OlimpioCrypto) October 13, 2022

Airdrop? We don't know IF… yet.

• The first protocol built on L0 is @StargateFinance

• Getting $ZRO may require Stargate-related actions

You can now stake $STG, use the protocol, vote in DAO: https://t.co/32by9Br9U7

Tip: using projects building on L0 may also pay off.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: A Step-By-Step Guide To Multichain: What Are Blockchain Bridges And How Do They Work?