In its simplest form, Umami Finance owns a treasury that they deploy to earn yield. The yield is distributed to UMAMI holders who staked their UMAMI in a product called Marinate v2.

Buy UMAMI, Stake UMAMI, and receive “dividends.” Their two main goals are simple. To grow its treasury and to distribute its proceeds from its treasury to mUMAMI holders. A simple and effective DeFi protocol.

Oh, rewards are also paid in WETH (wrapped ETH).

Umami finance has not always been Umami finance. Prior to its rebranding, Umami finance was formally known as ZeroTwOhm, whose goal was to be the premier rebase current of the Arbitrum network.

Their innovation with the rebase model led to the inception of Marinate v1, where investors locked in their UMAMI tokens for boosted rewards. The longer the time-locked, the more the rewards.

We all know how DeFi 2.0 ended up shortly after.

Although rebase currencies such as OHM and Wonderland TIME still exist, DeFi’s hottest innovation was nothing more than an afterthought. This led to the end of Umami, who shifted away from the rebase model to a DeFi protocol that uses a delta-neutral strategy to collect yield.

How does Umami Work?

With its treasury, Umami finance entered into yield-producing opportunities such as LPs, stablecoin deposits or token farming.

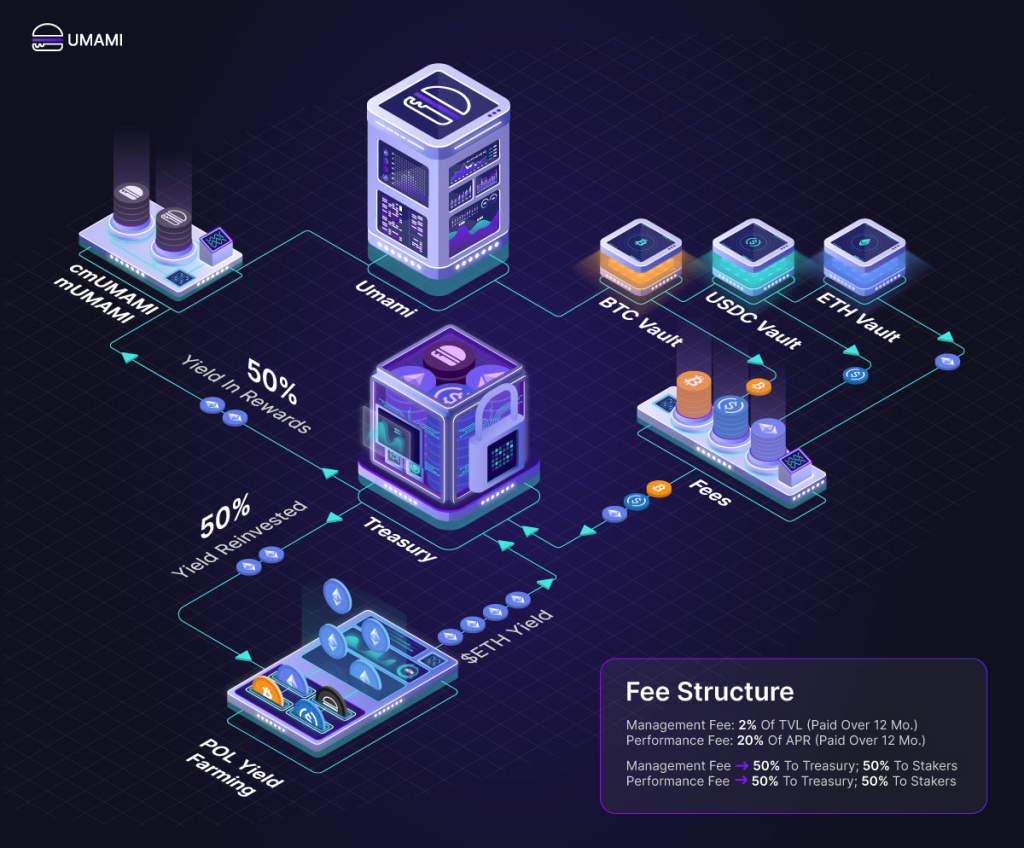

The first thing you have to know is that 50% of the yield generated will be distributed to Umami holders and the other 50%, will be routed back to the treasury and be used for future yield opportunities.

Going down the path for UMAMI holders, they can choose between two staking options.

The first, Marinate v2 (mUMAMI), pays stakers a portion of protocol revenues, denominated in ETH.

The second, Compound (cmUMAMI), automatically reinvests ETH payouts to buy and stake more UMAMI.

Umami’s Vaults collect a management fee of 2% (of TVL) and a performance fee of 20% (of Yield) from depositors. Fees are charged linearly over 12 months.

As mentioned above, the yield distribution is not in the native UMAMI currency. Instead, it will be in the currency with respect to the vault you dedicate your funds to. If funds are allocated in the ETH vault, rewards will be in wETH.

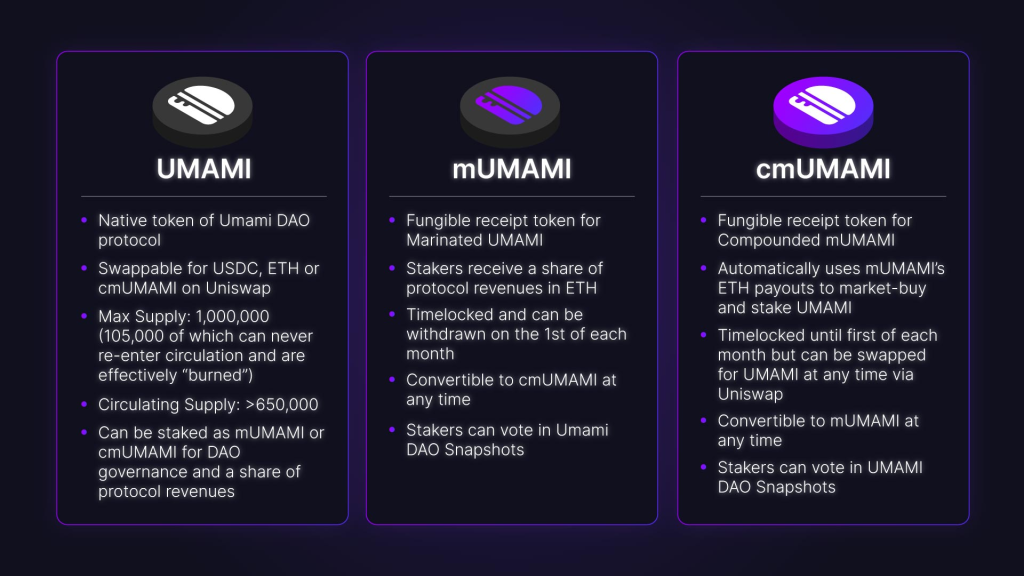

What this does is prevent the dilution of UMAMI. No new $UMAMI tokens can be minted beyond its max supply of 1,000,000 (currently 650,000 in circulation).

USDC Vault (partnership with GMX and Tracer Finance)

Our neighbors on the block over at Umami Finance have added GMX to their bonding products. Buy and bond $GMX today and get discounted $UMAMI! 🫐 🍔

— GMX 🫐 (@GMX_IO) January 7, 2022

Buy GMX Bonds Here: https://t.co/EP06vHTzgn

Thanks to the Umami Finance community for supporting $GMX pic.twitter.com/rwFMKz15Fm

Unlike other unsustainable “shiny” incentive schemes to generate yield, Umami finance depends on sustainable chain revenue streams.

Although their vaults are not out yet, here is a brief rundown of how their mechanism works.

The Vault is built in partnership w/ @GMX_IO & @TracerDAO.

— Umami (@UmamiFinance) July 5, 2022

It sources real protocol revenues via GMX’s $GLP token & neutralizes mkt risk via liquidation-proof hedges from Tracer.

The result: ~20%+ APR in $USDC! 👇

/3 pic.twitter.com/1xXwJdWdh1

When users deposit USDC in Umami’s USDC vault, they will receive $glpUSDC as a fungible receipt token.

What happens to your USDC on the GMX $GLP path

The deposited USDC is then tasked to do two things. Firstly, to mint $GLP (the LP token for GMX), and secondly, to buy Tracer’s 3x leverage $BTC and $ETH hedging derivatives.

$GLP gets their pays-out protocol revenue in $ETH, which can then be swapped for USDC for rewards. Secondly, it emits Escrowed GMX ($esGMX) which will then be staked again for more $ETH yield.

As $GLP‘s yield comes from exchange fees & trader liquidations, it tends to outperform volatile markets.

What happens to your USDC on the Tracer Finance path

To maintain a ~0 market exposure, it uses a proprietary model from BalanceOt which rebalances daily.

The Tracer hedges are staked for $TCR rewards, which will be auto-swapped for USDC as rewards.

UMAMI, mUMAMI and cmUMAMI

The foundation for #RealYield and its Tokenomics

With zero emissions, max supply capped at 1,000,000 and stakers being rewarded exclusively in $ETH from protocol revenues, they crafted a revised approach centred on simplicity, transparency and sustainable value creation.

Each $UMAMI token represents a fixed claim on Umami’s governance and protocol revenues. It can never be diluted away by inflationary emissions or capital raises.

According to Umami’s litepaper, all of its DeFi products, including its upcoming USDC, ETH and BTC Vaults, rely on stable on-chain revenue streams to generate yield.

Through the combination of Marinate v2, the mUMAMI Autocompounder, and the forthcoming Bonding v2, Umami Finance offers a core suite of products that will help bring the price of UMAMI to treasury backing.

$Umami V2 Bonding or: How I Learned to Stop Worrying about Dilution and Love the Bond

— intrepid_user (@intrepid_user) February 19, 2022

My overview of @UmamiFinance V2 bonding strategy and why I like what I'm seeing from the team

This is not financial advice.

Disclosure: I own $Umami, the @UmamiFinance token

Thread 🧵

Roadmap for 2022 and 2023

On top of the new and improved UX which was concluded recently, the community are eying key product release of its vaults before the end of 2022.

Apart from other milestones which include DeFi insurance, and new CeFi and TradeFi partnerships, Umami finance is aiming for “Umami institutional,” catering for institutional clients, as well as new product launches such as ETH2 products early next year.

Umami is thrilled to announce the launch of our new UI!🔥https://t.co/QXESIVpUui

— Umami (@UmamiFinance) October 27, 2022

This will be the home of our ecosystem, giving users a one-stop-shop for all things $UMAMI. 🍔

Here you can buy $UMAMI, Marinate/Compound, and when the time comes, deposit into our vaults! 💪

/1 pic.twitter.com/KJjpBgtDvK

The team behind Umami Labs

The team is led by Alex O., alongside Michael E and Alex Golubitsky. Followed by a cream of bright minds behind Umami’s engineering, business, and, marketing teams.

Closing thoughts

One apparent risk for Umami is the market risk. Although Umami’s treasury is aimed at achieving a 0.5 beta, if the market takes a turn for the worst, Umami will likely dip in accordance. This may also mean that its performance should underperform on upwards move and underperform on downward moves.

However, Umami finance has been audited by Zokyo, which frees it from smart contract risks.

With the largest source of institutional TVL from crypto hedge funds only commanding $4B as of mid-2022, the lack of liquidity for institutional investors in DeFi is a result of a persistent disconnect.

Their plans to onboard an increasing amount of institutional TVL could garner significant adoption of DeFi for institutions.

They are also taking their partnerships seriously. They are working with them in meaningful ways, especially with the stablecoin vault we talked about earlier with GMX and Tracer finance.

Umami finance provides a great opportunity to gain exposure to the Arbitrum ecosystem and passively earn rewards at the same time. With its expanding suite of real yield strategy vaults, Umami is positioned to capture enormous upside from TVL and fee revenue as the DeFi space continues to mature.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief