Often ignored, generally because no one is talking about it. I don’t hear much chatter and know less about its ecosystem. However, this cryptocurrency has been around since 2019 and consistently found a place in the top 50 charts. Today we are Unus Sed Leo is what is Unus Sed Leo?

What is Unus Sed Leo?

UNUS SED LEO derived from the Latin phrase, “One, but a lion” is a token which powers the iFinex ecosystem, which is also the parent company of crypto exchange Bifinex.

The token was launched in May 2019 after the company raised $1 billion from the initial offering. Token holders receive trading discounts on iFinex platforms.

Before we delve a little deeper, we need to learn more about the entities involved. iFinex and Bitfinex. Firstly, Bitfinex is one of the oldest crypto exchanges that started way back in 2012. Even with its long history, it suffered multitudes of hurdles along the way, mainly from platform hacks.

At the same time, US prosecutors accused the parent company iFinex of illegally transferring funds to Crypto Capital Corp, and trying to conceal the $850M in losses by covering it with reserves from USDT, Tether.

And guess what, Tether is a company owned by iFinex. The negative press left iFinex and BitFinex in a very bad light in the eyes of the community. In response, iFinex announced the creation of the Unus Sed Leo token to cover the $850M Tether deficit.

To make good on the money lost, iFinex unveiled plans to gradually buy back the token from investors until none are left circulating in the marketplace. A transparency initiative was also launched so the crypto community could monitor the initiative’s progress, and ensure it was meeting stated targets.

Here is a more in-depth view on what the Unus Sed Leo Token is

What makes the Unus Sed Leo unique?

A token burn mechanism means iFinex is committed to buying back UNUS SED LEO from the market on a monthly basis. The amount that’s purchased and burned is equal to at least 27% of the revenues generated by transaction fees on the BitFinex exchange.

Eventually, every last token will be burnt, Bitfinex users can hold $LEO to reduce commission fees, and receive discounts on services and active multipliers.

Whereas some cryptocurrencies just launch on a single blockchain, LEO tokens were issued on two blockchains. While 64% of the original supply was on Ethereum, the remaining 36% could be found on EOS.

Furthermore, those discounts mentioned above apply to Bitfinex and EOSfinex, as both platforms operate under the iFinex banner. Any future platforms built under the iFinex banner will offer similar discounts to LEO token holders.

LEO token burn is worth mentioning again. Its aim is to deflate the supply over time. In the whitepaper, it is mentioned there are monthly token burns during which iFinex buys back LEO amounts equal to at least 27% of the consolidated gross revenue generated by iFinex the previous month.

Tokenomics

As we mentioned, the circulating supply of LEO tokens is designed to diminish over time. Originally, the total supply was set at 1 billion.

LEO was sold for $1 apiece on a 1:1 basis with the Tether stablecoin, meaning that a total of $1 billion was raised over a 10-day period.

There were 660 million ERC-20 tokens at launch, as well as 340 million EOS-based tokens — and Bitfinex allows conversions between the two chains to be made with ease.

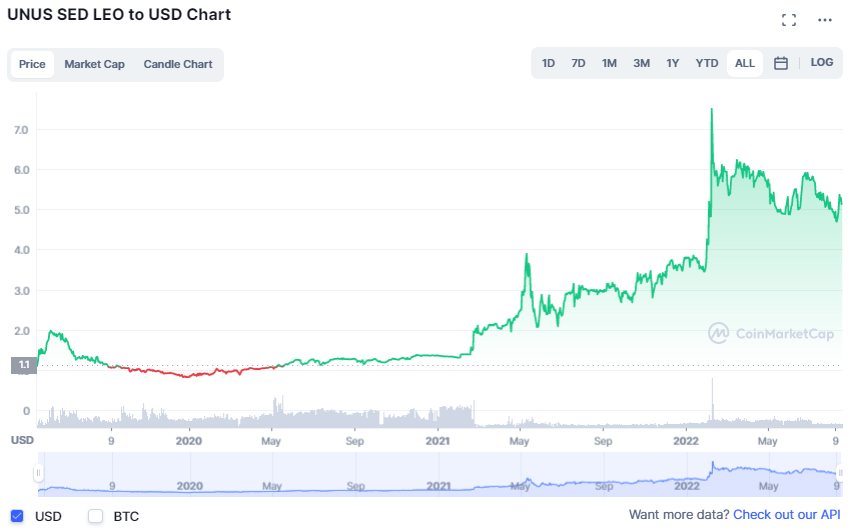

As you can see, its burning mechanism is in full effect, it has burnt over 65M in tokens.

Closing thoughts

At the time, the company described the dual-protocol launch as “unique” — and vowed that it would empower the Bitfinex community, but what about now? is it worth entering?

Relatively in a positive trend, LEO might be one to look out for especially with its deflationary aspect. As an exchange of sorts, it garners a 5B market cap, above FTX’s FTT, Crypto.com’s CRO, and Kucoin’s KCS but incomparable to Binance’s BNB.

The LEO token is created to compensate for the losses on the BitFinex exchange but justifies it existence with certain benefits to platform holders. It is also worth noting that it does not have its own blockchain, therefore its role in the DeFi space may be null.

Perhaps this is not for me unless I am fully participative in the Bitfinex ecosystem.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: ChainDebrief