Update: THE FTX APP HAS BEEN HACKED. It is advised to delete the application and not use the site in case of malware

[Editor’s Note: The situation is still developing. Additional information will be included as announcements are released]

It’s official – FTX is liquidated.

While the dust has yet to settle on one of the worst events to go down in crypto’s short history, one thing is very clear – user withdrawals are still not being processed.

1) Per our Bahamian HQ's regulation and regulators, we have begun to facilitate withdrawals of Bahamian funds. As such, you may have seen some withdrawals processed by FTX recently as we complied with the regulators.

— FTX (@FTX_Official) November 10, 2022

Despite on-chain activity showing that FTX hot wallets are active, these transactions have been linked to a privileged few, likely those close to the matter.

Should you still have funds on the exchange, here are some steps you can take immediately.

Step 1: Close Your Positions, Limit Orders

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire https://t.co/BGtFlCmLXB and help cover the liquidity crunch. We will be conducting a full DD in the coming days.

— CZ 🔶 Binance (@cz_binance) November 8, 2022

Given the amount of withdrawals from the Centralized exchange (CEX), liquidity on FTX is bound to be low.

While FTX uses a few methods to determine price action, Alameda’s collapse means that market making will be unreliable.

Market orders could therefore translate into immense volatility, quickly liquidating any positions. Should your FTX account go to zero, it is unclear whether there will be any compensation going forward.

Step 2: Record Transactions & Balances

The FTX site will likely go down eventually, and users may not be able to access their details.

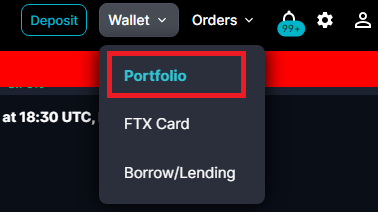

First, head over to wallet –> portfolio, and take a screenshot of your current balances.

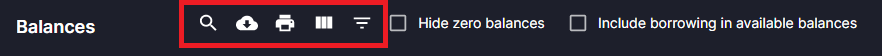

You can also download an excel file of your remaining portfolio.

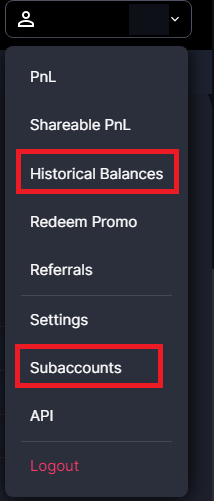

Do the same for your historical balances, order history, and repeat the steps for all accounts and subaccounts.

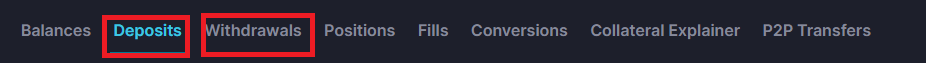

Remember to do the same for deposits and withdrawals, and make copies of all screenshots or files.

Given FTX site will likely go down soon, I made a (dependency-free) Python script to pull FTX fills/funding/borrow/lending/etc for taxes/accounting.

— Shane Barratt (@ShaneBarratt) November 10, 2022

It's here: https://t.co/4bpReDHl45

Just need to make an api key here: https://t.co/xi3p6Pgojc

You can also use this script by @ShaneBarratt to pull the files, instead of doing it manually.

These will be useful should FTX eventually be acquired or attempt to make customers whole in the future.

Step 3: Convert Stablecoins To Fiat

While the FUD around USDT and USDC are still just rumors, the bank run on FTX and subsequent low liquidity means there could mean a depeg.

Even if stablecoins remain pegged on-chain, they could trade below USD$1 on FTX.

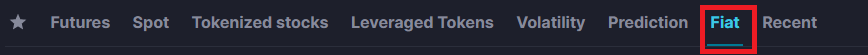

To do this, head to the markets tab and navigate to all markets.

Head to Fiat and convert any remaining stablecoins you have on FTX to USD or another Fiat currency.

While USDC and USDT have shown their resilience throughout the saga, the possibility of a depeg should not be ignored.

Step 4: Look For Alternatives To Off-Ramp

Justin Sun, owner of crypto exchange Poloniex and founder of the Tron blockchain, announced that he would grant 1:1 swaps for Tron-native assets for FTX users.

FTX Announcement Regarding the Tron Credit Facility:

— FTX (@FTX_Official) November 10, 2022

We are pleased to announce that we have reached an agreement with Tron to establish a special facility to allow holders of TRX, BTT, JST, SUN, and HT to swap assets from FTX 1:1 to external wallets.

$13,000,000 has been deployed to help users off-ramp their assets from FTX. However, it is unclear whether any users have managed to withdraw their assets.

While this is not a call to swap your assets for Tron, opportunities such as these may come as other entities attempt to assist users.

If it is possible, there will be a cap of 50k STG / ~2.8m total. Goal is to help as many people get something out as possible. I hope the DAO and Foundation will be on board with this and eventually will put it to a vote but if necessary we will honor directly as LayerZero Labs.

— Bryan Pellegrino (@PrimordialAA) November 10, 2022

LayerZero Labs has since bought back all STG tokens from Alameda and FTX, and may be looking to make users whole going forward.

Step 5: Protect Your Capital

FTX collapsing was an event almost no one saw coming. Regardless of whether you intend to stay in crypto or not, protecting your funds is of utmost importance right now.

If you still have money on centralized exchanges or earning platforms, it may be time to cash out a sizeable amount, or transfer it to a cold wallet.

Bruh why these clowns just blatantly lie. “assets are fine” “products are fully operational” lmfao what’s wrong with th de people @FounderFlori … get ready for some jail time too pic.twitter.com/BDrxlLrz3O

— Wizard Of SoHo (🍷,🍷) (@wizardofsoho) November 11, 2022

BlockFi going down following their statement that they are “fully operational” shows us how quickly tides can shift.

Whether platforms have the funds to back their current activities or not, it may be safer to withdraw until definite proof of reserves are shown.

Also Read: Now That FTX Broke The Trust For Everyone, What’s Next For Us?

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Took it from FTX like how they took my funds from me