Over the past 1 month, prices of altcoins Avalanche, Fantom One, Harmony and Solana exploded. Here’s a look at the various price charts:

Solana grew 300+% in a month

Fantom grew 400+% in a month

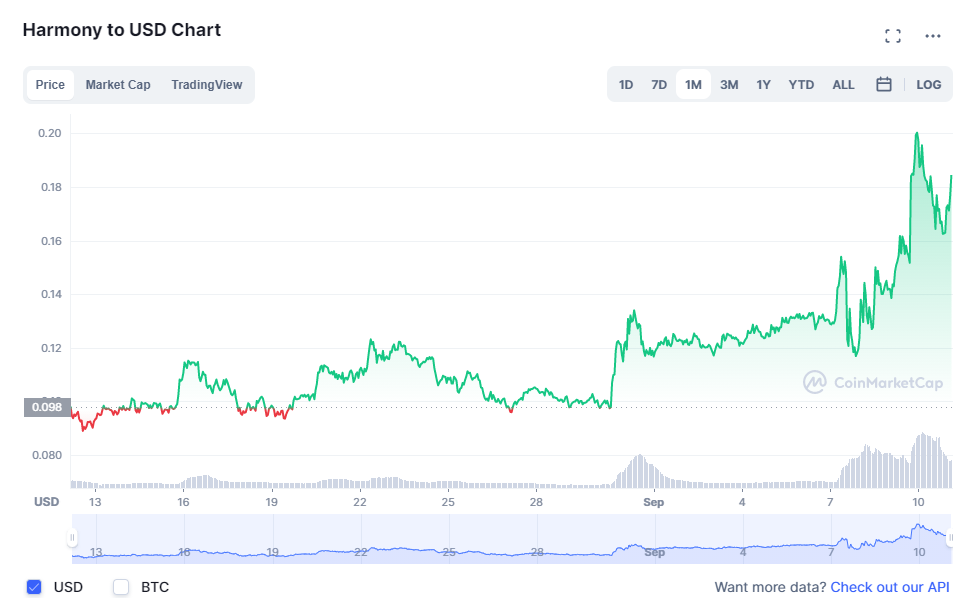

Harmony doubled in a month

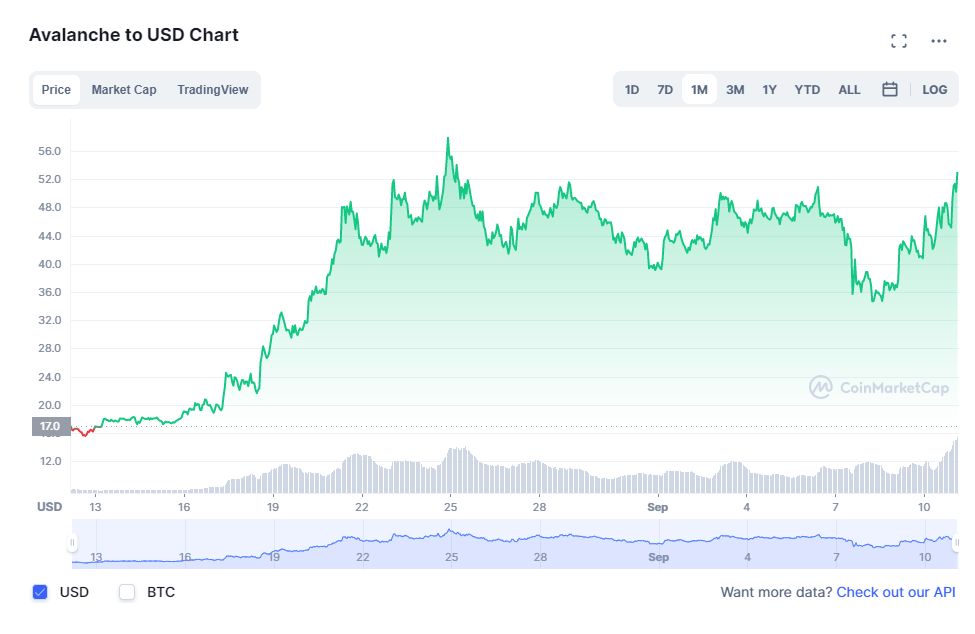

Avalanche grew 200% in one month

On the other hand, Bitcoin maintained a sideway movement since a month ago.

So what is reason behind the huge growth for these altcoins?

Bridge Season

One of the main reasons why these altcoins exploded in prices is because we have entered what crypto followers call a bridge season.

For those unfamiliar, bridging in crypto refers to moving your assets from the Ethereum blockchain to other blockchains (or Ethereum Layer 2s) in order to enjoy cheap and fast transactions.

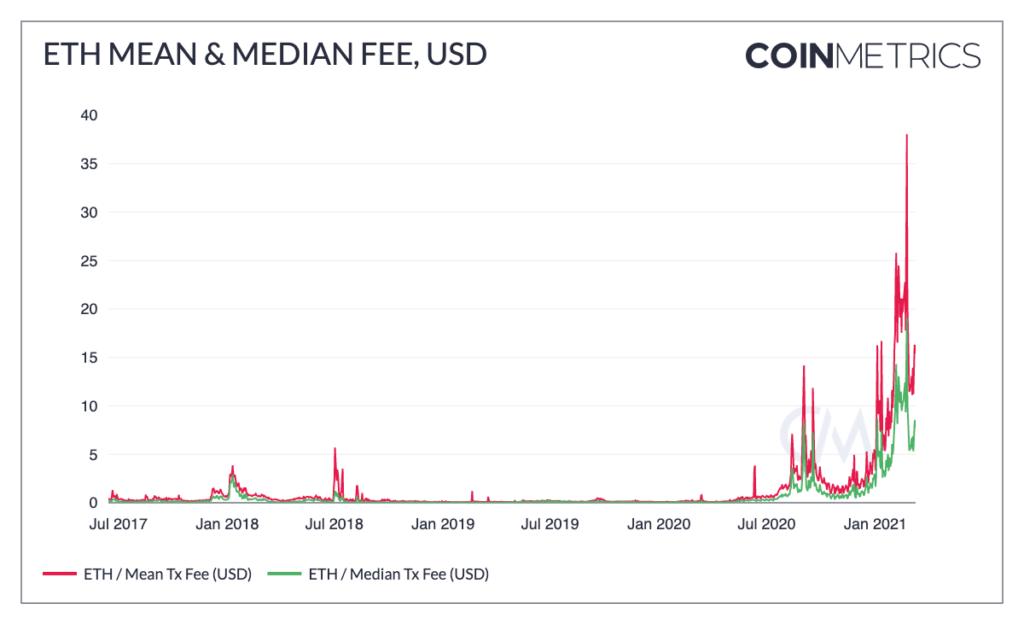

The biggest problem with Ethereum is its gas fee — every transaction on the Ethereum blockchain incurs a gas fee, which can range anywhere between $20 to $200 or more especially during peak traffic.

This problem exists because as Ethereum grew in popularity, the on chain transaction of Ethereum skyrocketed. As Ethereum was originally built around the “proof of work” concept, there is a limitation to how fast these transactions can be “cleared”.

PoW, as its name suggests, is a consensus protocol where miners have to prove that they literally “put in the work” to validate a cryptocurrency transaction. They do so by utilizing hardware that consumes vast amounts of electricity.

In this process, miners and their hardware have to complete computationally difficult mathematical equations called hashes. Once an equation is solved, a hash is produced, and other miners participating in the PoW network will be able to view the hash to verify whether or not it is legitimate. Miners are subsequently rewarded with cryptocurrency for their efforts.

With the popularity of the Ethereum network exploding, the network is unable to clear these transaction fast enough to meet the demand, leading to a high transaction fee (gas fee). To put things in context, the average fee per transaction for Ethereum is as much as $30 per transaction, compared to less than $1 give years ago (3000% increase in fees).

New blockchains and Layer 2s have been known as alternatives to move your assets over and you can enjoy almost negligible transaction fees.

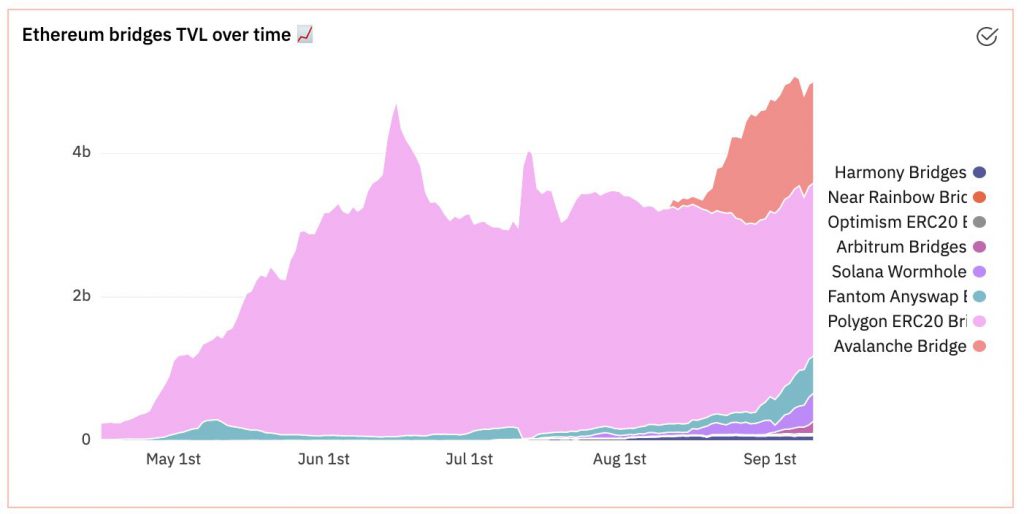

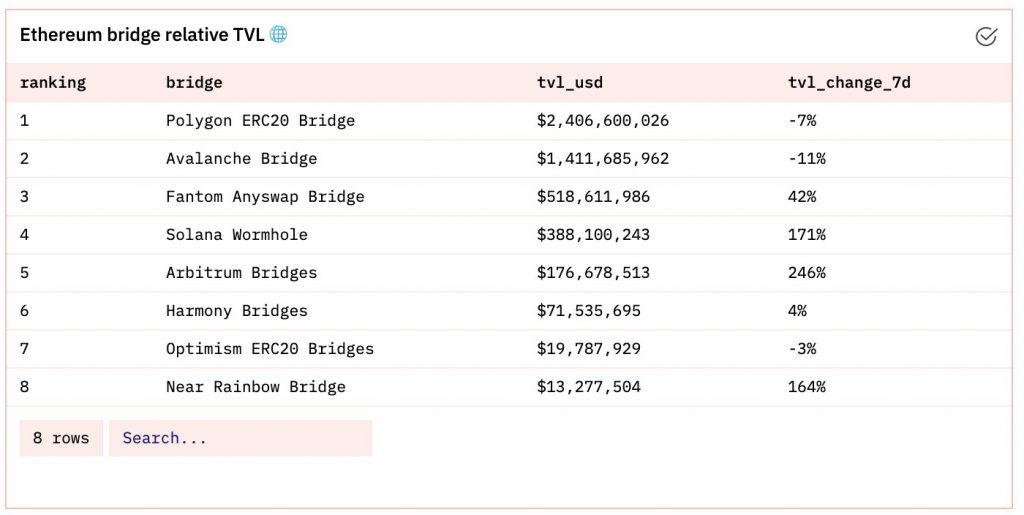

Assets bridged from Ethereum Layer 1 to parallel ecosystems stand at over US$5 Billion at the moment. The past month has truly been bridge season with at least US$2 Billion in asset value having been bridged over, from more than 32,000 unique addresses.

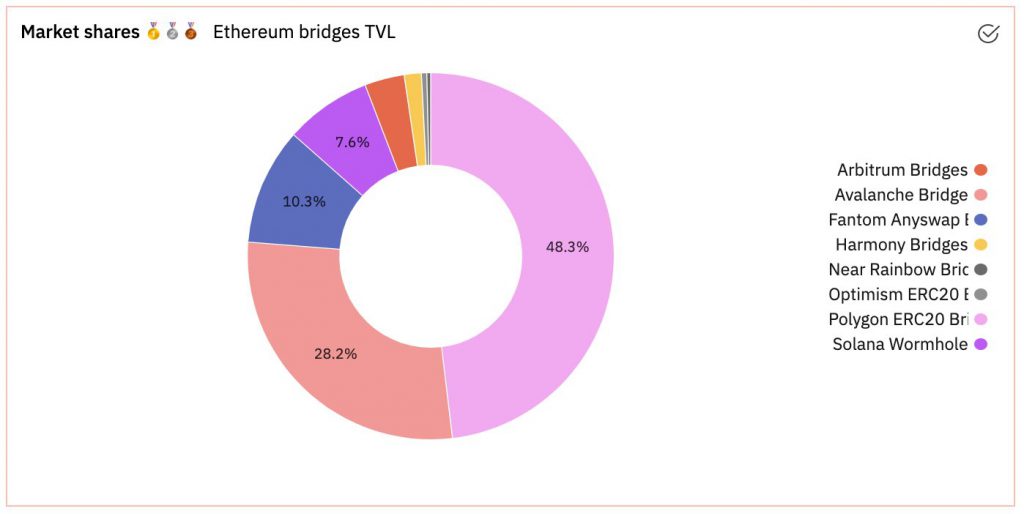

Here’s the market share of the ethereum bridges:

We are also seeing high growth in terms of funds moving towards Arbirtrum, Solana, and Near protocol, which saw

These are all very high growth numbers in a short period of time. As more and more users bridge their assets across to these new ecosystem, they are much more likely to perform multiple transactions without worrying about the exorbitant transactions fee.

If the earlier part of this year was characterized by an NFT season with the explosion of NFT games such as Axie Infinity and OpenSea, we are definitely seeing a Bridge season right now.

Featured Image Credit: Finextra Research

Also Read: An Introduction To Ethereum Layer 2 Scaling Solutions