Earlier last week, I shared the breakdown of my crypto portfolio allocation. Since then, I have been receiving questions as to why I do not have any allocation into Bitcoin.

Here are some of my thoughts:

1. Bitcoin has no utility

The biggest argument against Bitcoin is that it has no utility other than a being store of value. Unlike Ethereum and other utility tokens, Bitcoin is designed without smart contracts enabled, and hence it serves as a true digital “gold” where price is determined by demand and supply.

Other utility tokens such as Ethereum for example, can be used in various ways, such as in liquidity pool or be used to mint NFTs.

As such, other than the potential for capital gain, utility token can be used to generate cash flows too. Though Bitcoin can also generate cash flow via savings account, has limited upside yield.

2. Innovation happening on other chains allowing for communities to be formed

Another reason why I am currently not allocating into Bitcoin is that innovation is currently happening at rapid speed on other blockchains. There is a lot of talent streaming into the blockchain industry, and most of them are congregating in the decentralized finance (DeFi) space.

New Layer 1 blockchains such as Solana, Fantom, Luna are seeing new financial protocols launched every other week, with lots of venture capitalist backing these protocols.

The backbone of the decentralized technology is powered by smart contracts — which is unavailable on the Bitcoin blockchain. It is usually smarter to follow where the talent and smart money are moving to.

While other blockchains are innovating, new pockets of communities and evangelists are being built around these new decentralized applications on all the other blockchains. The network effect of the community is a strong price catalyst of all the different blockchains and crypto protocols.

Bitcoin, on the other hand, has a disadvantage in that there are no sub-communities that can be created. Communities play an important role in the success of a blockchain in the crypto world.

While there are strong Bitcoin maximalists and staunch followers, the lack of innovation and excitement in the Bitcoin blockchain (other than the lightning network) proves it might be hard to sustain the community and followers of Bitcoin.

After talking to a bunch of folks over the last couple months, it's pretty clear that SOL is successfully winning over a significant number of BTC Maxis or near-maxis, which have previously owned zero ETH or very little ETH.

— Travis Kling (@Travis_Kling) September 23, 2021

I think there's a couple reasons for that-

3. BTC high correlation with Ethereum

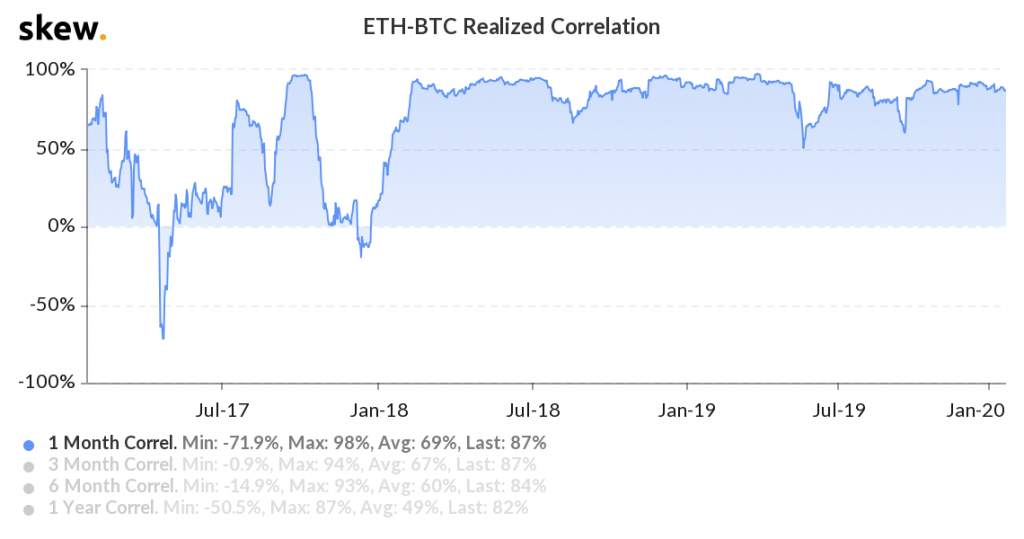

Another reason that I am not allocating any portion of my portfolio is that historically, the price of Bitcoin has a high correlation with the price of Ethereum. If the price of Bitcoin goes up, most likely Ethereum will go up.

This is true for more than 80% of the time over the last 3 years. To me, my “exposure” to Bitcoin is by holding Ethereum. If Bitcoin goes up in price, Ethereum should go up in price in the same margin.

4. Risk Reward

Finally, the most important point — risk reward. In my opinion, the risk reward for holding Bitcoin is not as high as holding Ethereum or even other alt coins.

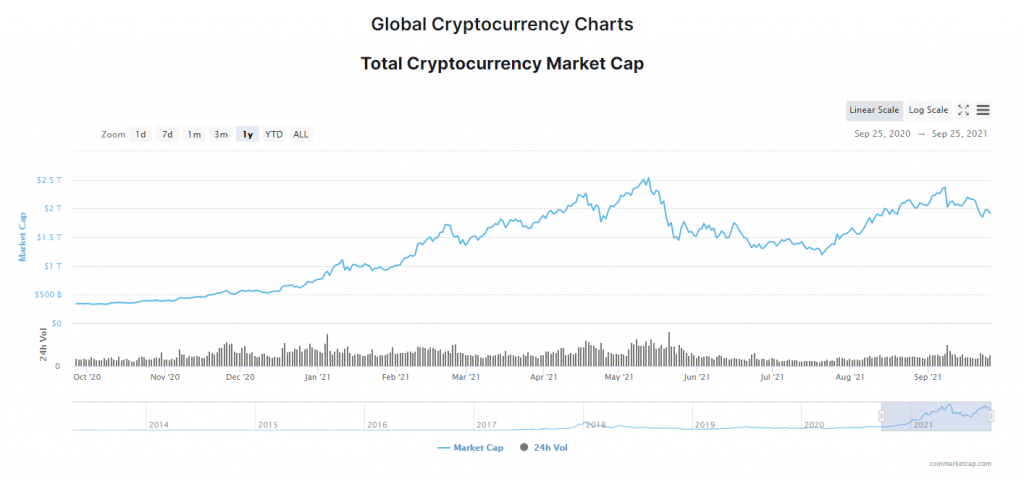

In the past 1 year, the overall cryptocurrency market cap increased from $350 billion to currently $1.9 trillion dollars, an increase of almost 450%.

During the same period, Bitcoin price increased 320%, while Ethereum grew 1000%. Not to mentioned several other alt coins which has outsized return.

The reason for the outsized return for altcoins is because Bitcoin has a high market cap and for it to increase another 100% from its current market cap of $800 billion, it needs to add another $800 billion onto its market cap.

A lot of things need to happen for a coin to increase by $800 billion in market cap. Should it manage to cross all the hurdles and doubles its market cap, all the other alt coins would rise by multiple orders of magnitude too while Bitcoin only enjoys a 100% return.

Is there a space for Bitcoin?

That said, is there a space for Bitcoin?

The answer is yes. In the grand scheme of things, Bitcoin is still the OG cryptocurrency and for retail investors who have yet to explore cryptocurrency, Bitcoin equates to cryptocurrency and will often be the first choice they purchase when they are looking for cryptocurrency exposure.

Because of this top of mind mindshare, Bitcoin is also the “flight to safety” coin, and when the market becomes too overheated, investors would always convert their altcoins to bitcoin (or stablecoin) in anticipation of any market correction.

Someone also once told me that Bitcoin has no competitors because of its design, and that is the beauty of it. Altcoins have hundreds of competitors trying to build a better blockchain.

For example, for the longest time, we have been hearing of multiple blockchains wanting to be the Ethereum killer, and now a few promising blockchains have a good chance of competing against Ethereum.

So while Ethereum may or may not be around if they have been “dethroned”, Bitcoin will always be there as the OG of crypto.

The way I look at Bitcoin is that it is a good asset to rotate into when things are overheated, or when we are reaching the euphoric stage or signs of bubble, and that is when it would be a good time to take some profit out from the altcoin investments and store them in Bitcoin and stablecoin.

In the meantime, in anticipation of a continued bull run, there are better opportunities to allocate your portfolio into.

Disclaimer: This is a personal opinion of the author and does not constitute a financial advise. There are no right or wrong way in terms of investing, and you can choose and decide what method suits you best. This is an opinion piece and the author has no official financial background.

Featured Image Credit: Fox Business

Join our telegram community and discuss all things crypto here.

Also Read: Moving Your Crypto Assets From Binance? Here’s A Guide To FTX For Singaporeans