With the recent Fed Press Conference on 30th November, there have been greater market expectations of a Fed Pivot, that interest rate cuts will be coming. There have also been opinions that a Fed pivot would not be bullish for the stock/crypto markets. In this article, we will explore Fed’s latest updates and if a Fed pivots a signal of the start of the crypto bull market.

What is a Fed Pivot?

According to Investopedia, a Fed pivot occurs when the Federal Reserve, the U.S. central bank, reverses its current monetary policy stance. This refers to the Federal Reserve changing its policy from raising rates to cutting interest rates.

Fed’s Press Conference on 30th November

In his recent press conference, Jereme Powell mentioned that smaller interest rate increases are likely ahead even as he sees progress in the fight against inflation as vastly inadequate.

Echoing recent statements from other central bank officials and comments at the November Fed meeting, Powell said he sees the central bank in a position to reduce the size of rate hikes as soon as next month.

But he cautioned that monetary policy would likely stay restrictive until real signs of progress emerge on inflation.

“Despite some promising developments, we have a long way to go in restoring price stability,” Powell mentioned.

The chairman noted that policy moves such as interest rate increases and reducing the Fed’s bond holdings generally take time to make their way through the system.

“Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down,” he added. “The time for moderating the pace of rate increases may come as soon as the December meeting.”

That day caused the NASDAQ and Bitcoin to rally 4% and 6%, respectively.

When will Interest Rate Peak?

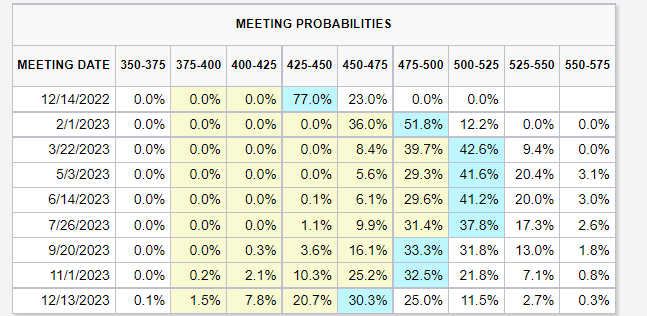

According to the Fed watch tool, the markets expect interest rates to peak in either April or May 2023.

We are currently at a 3.75% to 4% interest rate and can easily see a 1% to 1.25% hike before the Fed stops increasing interest rates. Based on the Fed watch tool, the rate would only start coming down from September or November 2023.

Will this Signal the Start of the Crypto Bull Market?

A Fed pivot is bearish.

— Michael A. Gayed, CFA (@leadlagreport) November 30, 2022

The market is wrong.

Few. pic.twitter.com/Ijr7aBKTtI

According to Twitter user Michael A. Gayed, a Fed Pivot is bearish for the S&P 500, and by extension, the crypto markets would follow suit. How true is the above?

The Fed has mentioned that they will start cutting rates when something in the economy breaks (recession) or if the capital markets become dysfunctional (Illiquidity in the debt market, stock market crashes). The Fed will try and save the needs by cutting interest rates.

However, because of the lag effect (Time taken for monetary and fiscal policies to affect the economy once they have been implemented), interest rate changes would not be reflected immediately in the economy and economic measures. It will take some time for Fed policy changes to take effect.

Historically, the markets have shown that it would go down further when there is an interest rate cut before Fed policy changes take effect. When the changes take effect, it would be when the markets start to recover.

Closing Thoughts

A Fed pivot would only be bullish for the crypto markets after the lag effect, which typically takes about 12 months to take effect and be reflected in the economy. In addition, the next major crypto catalyst would be in April-May 2024, which is Bitcoin’s next halfling cycle. Both events above would have to line up in tandem before Bitcoin could see its old or even new all-time highs.

Meanwhile, I would follow closely what is said during the Fed meetings to see if there are any changes to the above projections.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]