The governance in crypto has been instrumental in promoting the concept of decentralization. Still, even with a group of like-minded individuals coming together to vote on new proposals regularly, the results of the votes can reflect differing opinions.

Crypto governance is more political than you know.

Let me tell you the tale between Binance, Uniswap, crypto bridges, LayerZero and Wormhole. Special appearances from VC founders like a16z.

This political agenda did not happen in the courtrooms of every parliament but instead on the forums of Uniswap.

It started with a proposal

We have to go back to December 2022, where it all started. The founder of Plasma labs, Ilia, released a proposal draft about launching Uniswap v3 on BNBChain.

0xPlasma Labs released a proposal to deploy Uniswap v3 to BNB Chain (Binance), from which additional $1B of TVL and 1-2M new users can be obtained. The proposal is currently only in the discussion stage. https://t.co/MnABDTWEMl

— Wu Blockchain (@WuBlockchain) December 12, 2022

There, he discussed the missed opportunity for Uniswap, suggesting the deployment of Uniswap v3 on BNB could “expand its reach and potentially drive further growth and adoption in DeFi.”

Why can’t we get a fork version of Uniswap v3 on BSC? The biggest DEX on BSC was a fork (copy and paste of source code) with Uniswap before its inception many years back.

But this license expires in April; anyone can copy and paste Uniswap v3 codes onto the BNB chain or any other chains after that date. Bascially an easy way for a quick cash grab.

The pros and cons before saying yes

To dominate the DeFi market, Uniswap must attain a first-mover advantage by capturing as much TVL as possible before numbers forks pop up. That is why Ilia’s proposal came at just about the right time.

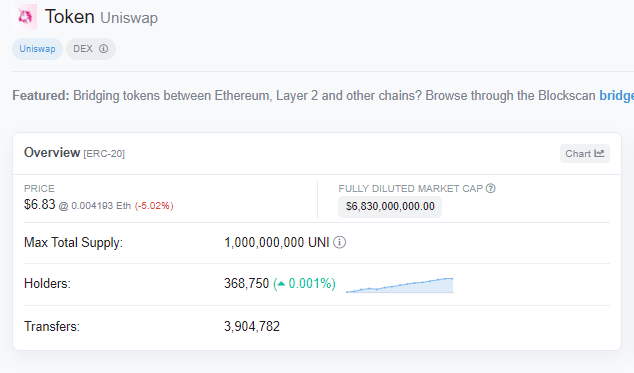

If you did not already know, the DAO dictates any expansion related to Uniswap protocol. Here, users holding the Uni token will take votes for new proposals. If votes exceed 50%, the bid will be successful and will be acted on.

Uniswap currently has one of the most robust governance setups, with more ~368K unique holders and over 28k special historical voters.

Despite potentially bringing $1B in TVL and a massive trading volume of over 1-2M new retail users, the Uniswap DAO reacted with an overwhelming response of little to no interest.

But this was recently brought up again, especially when the DAO was suddenly concerned about forks in April 2023.

However, there are pros and cons to deploying on BSC, the risk of centralization and the lack of control, to name a few.

But on the winning end of the stick, it introduces the possibility of attracting new users. Right now, it is something the Uni community find hard to overlook.

Anyone can make proposals on the Uniswap DAO, but before the execution of any proposal, a few steps must be completed.

1) Proposal discussion and debate on the forum

2) Temperature check: an off-chain vote for assessing sentiment

3) Proposal iteration based on community feedback

4) On-chain vote for finalizing the proposal

The future seemed perfect, but there was a red flag

It looks bright and full of prospects. But everything changed when voters faced a dilemma, which bridge should enable cross-chain Uniswap governance between Ethereum and BNB Chain?

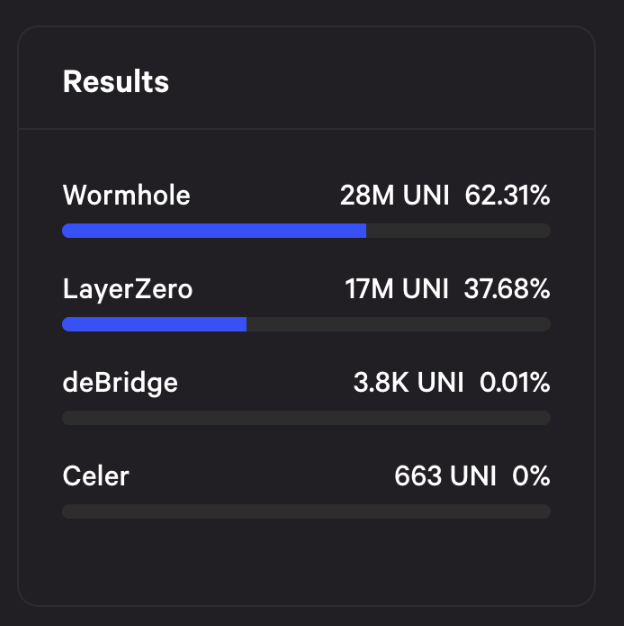

They were presented with four bridge options, Wormhole, LayerZero, Celer and deBridge.

Two of the four stood out as the strongest and most popular, Wormhole and LayerZero. Each protocol wanted to have the privilege of being implemented by Uniswap because it brings in money. So the forum heated up with arguments explaining which trumps the other.

The real bridge wars are being fought on Uniswap's forum. iykyk.

— Arjun | LI.FI (@arjunnchand) January 31, 2023

Behind every great war is “greater” people. War is usually dedicated to people at the top and carried out by people on the ground. In this case, who has the best interest and biggest position to gain when the winner of this war is decided?

LayerZero and Wormhole did not become massive forces of a bridge without any backing. By looking into those who invested and backed these protocols, we might get an idea of certain agendas they are pushing.

LayerZero is backed by a16z and Sequoia capital, while Wormhole is owned and created by Jump Crypto and associated with other VCs like Parafi Capital.

🚨 @a16z just used its full voting weight to squash a $UNI proposal to launch Uniswap protocol on BNB chain using @wormholecrypto bridge.

— Chris Blec (@ChrisBlec) February 5, 2023

a16z is a large investor in Wormhole competitor, @LayerZero_Labs.

Open your eyes. 👀

Anti-competition cartels in DeFi are REAL. https://t.co/QwElvg5DOj pic.twitter.com/4b14LqWLRH

That is another reason Celer Network and deBridge got “knocked out” early in the battle.

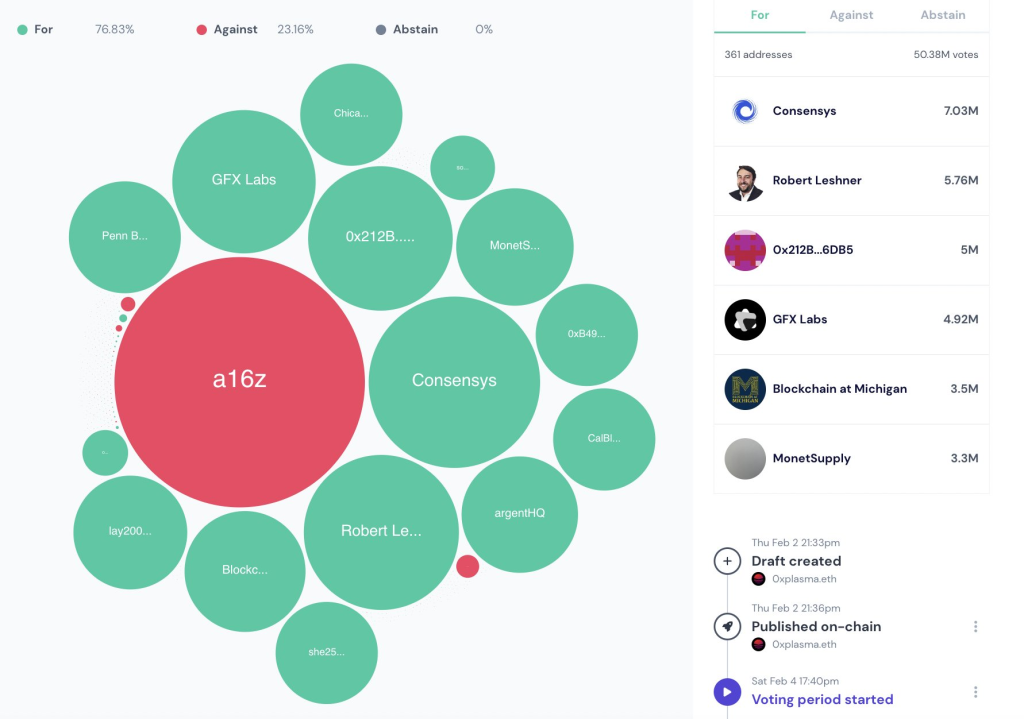

Shoutout to Robert Leshner, who voted for the proposal with Wormhole even when he has direct investments with LayerZero.

Shoutout to @rleshner (@robotventures). Despite having a direct investment in @LayerZero_Labs, the choice was made to support the community rather than simply follow a personal financial interest. Exemplary leadership 🤝 pic.twitter.com/0JvG1R0GCP

— David Alexander II (@Mega_Fund) February 6, 2023

Are you picking your babe, LayerZero or Wormhole?

So when it came down to the two companies mentioned above, the decision was straightforward. The decision was very difficult for neutral parties like the common folk who holes UNI tokens.

LayerZero talked about its decentralized nature and gave Uniswap complete control over the infrastructure behind message transmissions between chains. Since Wormhole relies on a set of 19 validators, the point was mostly true.

LayerZero added that the small number of Wormhole validators could still collude and organize a malicious attack if no slashing mechanisms were in place.

However, validators are usually not malicious actors, they typically don’t collude. Wormhole retorted that the 19 validators securing their system overlap with validators across multiple POS chains like Solana, Cosmos and Ethereum. “If one trusts those POS chains, they must also trust Wormhole.”

LayerZero, however, talked about their code which was entirely set in stone and immutable. In contrast, Wormhole’s code is upgradeable, which may be prone to exploits when a new set of smart contracts may bring new bugs and loopholes.

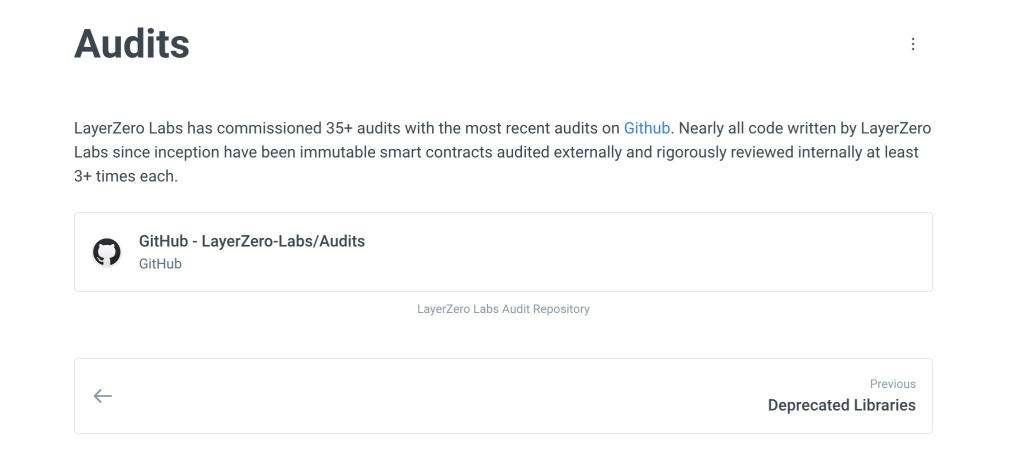

But there is also a downside to LayerZero’s immutability; if a bug is found in the code, the protocol will be knocking on Hell’s gate. Their promise lies in the fact that they will never be hacked. Since its inception, they have been audited over 35 times.

On the topic of battletested-ness, nothing can compare to what Wormhole has faced. Last year, Wormhole was compromised, and over $300M was stolen. But this hack was not because the group of validators maliciously colluded.

tl;dr – Wormhole didn't properly validate all input accounts, which allowed the attacker to spoof guardian signatures and mint 120,000 ETH on Solana, of which they bridged 93,750 back to Ethereum.

— samczsun is occasionally shitposting (@samczsun) February 3, 2022

Even after a whole list of bridge hacks in 2022, some may argue Wormhole stood the test of time. But one main saving grace was Jump crypto coming in to save them, by covering the $300M hole.

Jump Crypto recapitalized the contract with 120k ETH to ensure that all Wormhole-wrapped Ether on every chain is fully backed.

— Wormhole🌪 (@wormholecrypto) February 4, 2022

4/

Since then, Wormhole has never been the same. They have not only recovered by expanding with integrations with over 22 chains.

Till this point, which did you side with?

The winner is…

The bridge vote ended on the 31st of Jan, and Wormhole came out on top. But it is not the end.

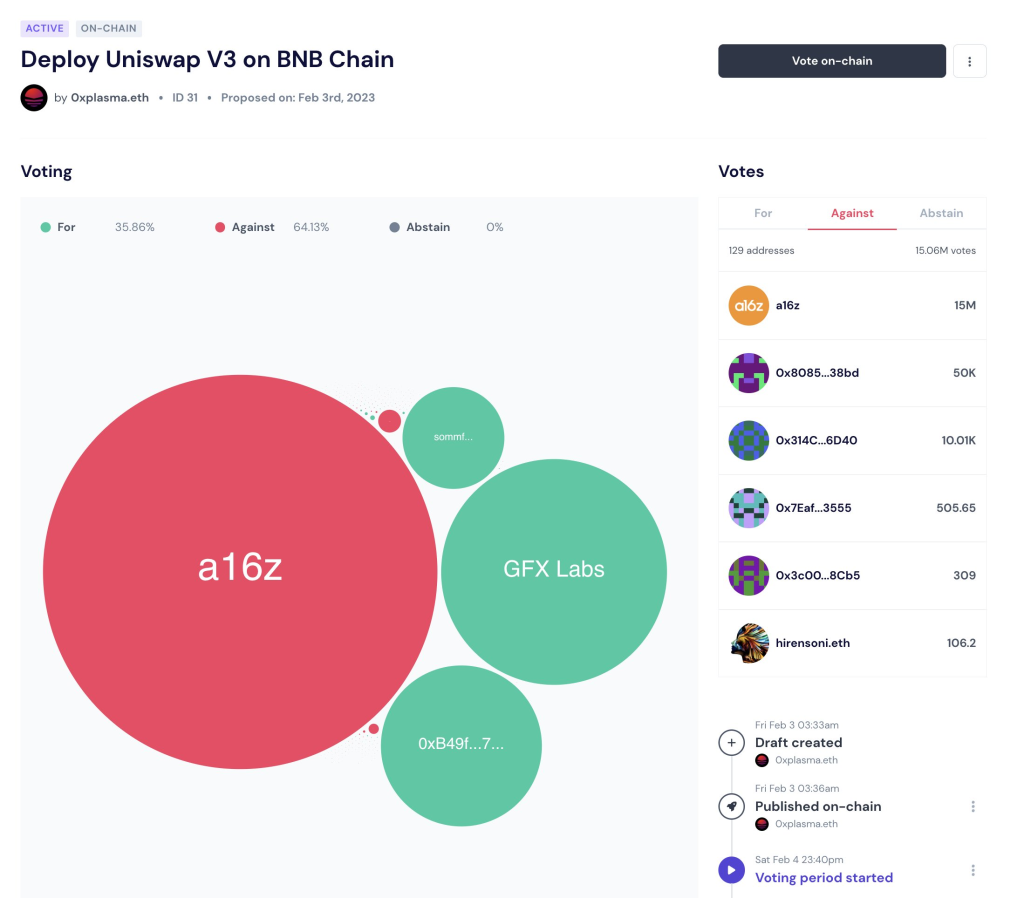

So where do we go from here? a16z, one of the biggest backers of LayerZero, did not participate in the vote, but why? their massive holdings of 15M UNI tokens surely swung votes in their favour.

They simply couldn’t. This was because their custody of UNI tokens with Fireblocks prevents them from voting on off-chain proposals.

But they can vote for on-chain proposals, as seen in the recent proposal for Uniswap to be deployed on BNB Chain. And a16z came in guns blazing.

From what I can tell this is the first time a16z voted against an Uniswap proposal and the first time the unloaded the entire 15M UNI vote clip.

— Steven (@Dogetoshi) February 5, 2023

As you can see below, a16z unloaded their voting clip to reject the UNi + BNB chain deployment. There are usually around 70M $UNI votes per the proposal, so a16z alone cannot kill it. Other whales, such as @iamDCinvestor, @gauntletnetwork and @ConsenSys, can still make the vote come to fruition.

Closing thoughts

This could have broader repercussions because if Uniswap fails to launch on BNB before the expiration of the license, it may suffer from attaining the first mover advantage on the BNB chain. A missed opportunity indeed.

According to Bubblemaps, a16z could control 41.5M UNI through 11 wallets, which already represent 4% of the supply… 4% is the required amount to pass any proposal.

The verdict

Despite the perception that one entity controls the Uniswap protocol, the proposal passed the 40M vote threshold with 50M votes in favour of deploying Uniswap on BNBChain.

With three days left to vote, the only real opposition is a16z. Even if they vote against all their reported 41.5M $UNI, the vote will still pass. Find out more about why a16z is in protest against Wormhole, and not the deployment on BNB Chain itself.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: abdullahbumar