For the past decade and a half or so since the 2007-2008 Global Financial Crisis, interest rates have remained low and fixed deposits have yielded less than 2%.

As a result, many yield-starved investors have had to increase their risk appetite in exchange for more decent yields on their investments.

Many Singaporeans opted to top up their CPF Ordinary accounts and Special Savings accounts to earn the higher interest rates of 2.5% and 4% respectively.

Brave, risk-on crypto investors, on the other hand, engaged in yield farming to earn mind-blowing yields of more than 1,000% APY during the peak of the 2021 crypto bull market.

Congratulations to all of the 🐸 at @Wonderland_fi for reaching this fantastic milestone of $1 Billion non $TIME assets in treasury.

— Wonderland.Money (@Wonderland_fi) January 11, 2022

We are only getting started! pic.twitter.com/8odTCc3MIp

However, this has since changed and the era of cheap money is over. Many of the crypto projects offering juicy returns have met their demise.

In a bid to combat inflation, the Singapore government has raised interest rates and the Singapore Savings Bonds (SSBs) are currently offering a 10-year average return of 2.81%.

This then begs the question as to whether yield farming is more profitable when compared to investing in SSBs given the current macroeconomic environment.

What are some key considerations for investors when deciding which is a better investment?

Also Read: Can You Make Money With Free To Mint NFTs?

Risk Appetite Considerations

In comparison to yield farming, SSBs are considered risk-free investments and are generally more suitable for conservative investors.

These bonds are issued and backed by the Singapore government through the Monetary Authority of Singapore (MAS). The Singapore government has a AAA credit rating and the risk of default is minimal.

Unlike regular bonds, the minimum investment amount is only S$500 and investors can withdraw their investments at any time by paying a mere S$2 redemption fee.

Refer to this article for more details on how to invest in SSBs.

The same cannot be said for yield farming as it carries significantly higher risks.

If investors are well-informed and nimble, yield farming when properly executed can indeed be very lucrative but it is not suitable for everyone.

@SnowdogDAO $SDOG rugpulled. Here's how:

— JW (jay,dub) (@artoriatech) November 25, 2021

1. Promised a 40M buyback happening on its own DEX Snowswap and migrated all liquidity from Joe

2. Snowswap contract requires a "challengeKey" to trade which only insiders knew it beforehand

3. Insiders backran the buyback and made 10M pic.twitter.com/tfKDqA4t4I

As yield farming involves interacting with Decentralized Finance (DeFi) protocols, the associated risks include smart contract risks, impermanent loss and market volatility that may ultimately lead to potential loss of funds.

Investment Time Horizon: Long vs Short Term

While SSBs are designed to encourage longer-term investing, yield farming is for the shorter term.

SSBs pay out step up interest and hence holding it to maturity will enable investors to reap the highest returns as the interest increases annually until year 10.

The average returns for the June 2023 tranche have declined to 2.81% per year and such a trend is set to continue in anticipation of a slowdown in the pace of rate hikes.

In hindsight, the later part of 2022 and early 2023 would have been optimal periods to lock in long term returns.

As for yield farming, the returns are diluted as more investors join the liquidity pool. In a bull market, yield farmers are constantly in search of the next high yielding opportunity.

Given that the yield received is in tokens without a fixed supply, unsustainable APY rates to attract users often result in an inflationary token which quickly depreciates.

Potential Yield of SSBs vs. Yield Farming

According to the MAS website, the historical 10-year SSB yields have been in the range of 0.80% to 3.47% since inception.

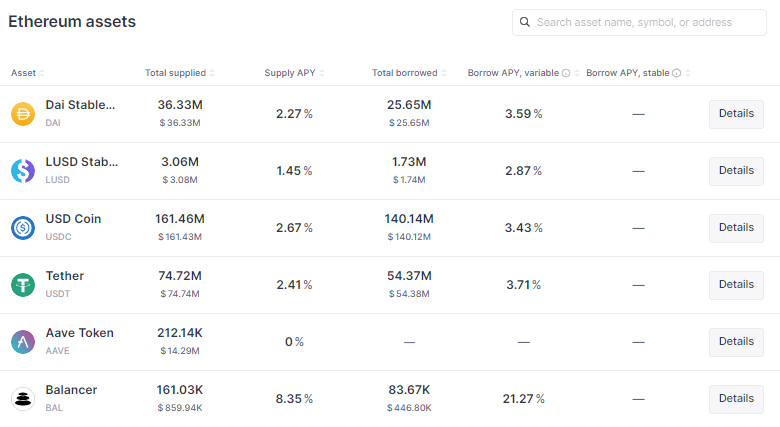

The stablecoin and ETH yields on safer and more reputable DeFi lending protocols such as Aave range between a dismal 2-3% APY due to low utilization rates.

Therefore, yield farming does not seem to provide significant upside when compared to investing in SSBs.

This is especially so when you factor in risks associated with yield farming on such protocols such as smart contract risks and other risks associated with DAOs.

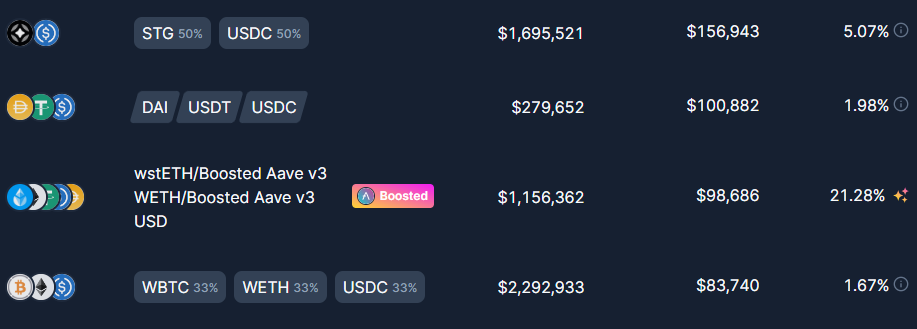

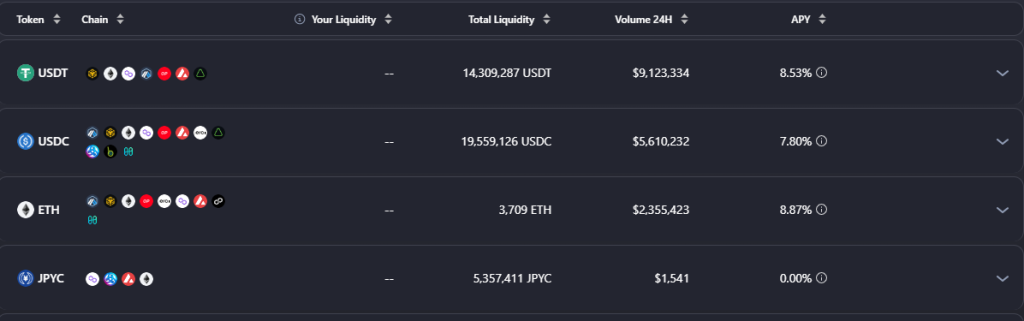

In contrast, bridges such as the Celer’s cBridge can offer more respectable APYs as opposed to Aave. However, there is no free lunch as there are greater risks involved when interacting with bridges.

Beyond smart contract and counterparty risks, many bridges use wrapped versions of tokens which introduces another dimension of vulnerability as wrapped tokens have been exploited.

As bridges are still in the early stages of development, there could also be other risks that have yet to be discovered.

Based on this list, it is evident that bridges top the list in DeFi hacks.

Closing Thoughts

Although the investment time horizon and potential yield are key considerations when deciding between investing in SSBs or engaging in yield farming, the first and most crucial step for investors would be to determine their risk appetite.

In general, the potential returns from yield farming can far exceed that of the returns from investing in SSBs but the risks are also significantly greater.

SSBs are simple and straightforward investments requiring basic financial knowledge while yield farming is far more complex, investors need to have a firm grasp of blockchain technology, crypto, DeFi protocols and be cognizant of the associated risks involved.

Also Read: Maximizing Your Risk-Adjusted Returns With Steadefi

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief

This article was written by Clarence lee and edited by Yusoff Kim