For cryptocurrency holders, one of the ways to earn passive income on your idle cryptocurrency is to supply them into liquidity pools and earn yields from these liquidity pools.

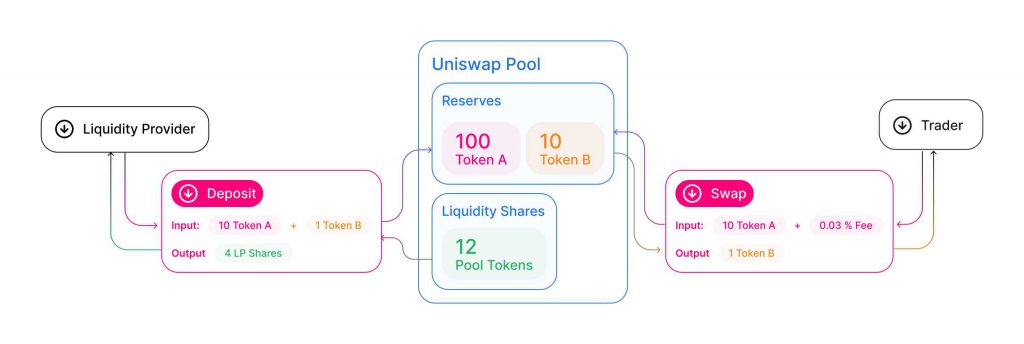

Here’s a simple illustration from Uniswap on how liquidity pool works:

As a liquidity pool provider, you will earn interest originating from the transaction fee generated whenever a trader or borrower executes a cryptocurrency trade.

As most of us may have known, Crypto.com, a decentralized exchange, has launched its mainnet — the Cronos chain.

The Cronos chain is an Ethereum Virtual Machine and hence is EVM compatible with MetaMask. Like most centralized exchanges (such as Binance) which settle their transactions with their native currency, the Cronos base settlement currency is $CRO.

In just a short span of a month, we have seen more than 50 protocols live on the Cronos Mainnet, and they are divided into a few categories:

- Decentralized Exchanges

- Yield Optimizers

- Money Markets

- Reserve Currency Procotols

| Pool Provider | Reward Tokens | Website |

|---|---|---|

| VVS Finance | VVS | https://vvs.finance |

| Cronaswap | Crona | https://app.cronaswap.org |

| Crodexapp | CRX | https://swap.crodex.app |

| Empire Dex | Empire | https://cro.empiredex.org |

| Elk Finance | Elk | https://app.elk.finance |

| SwappFi | Swapp | https://dex.swapp.ee |

| Krypto Dex | KRX | https://kryptodex.org |

| Stormswap | WIND | https://cronos.stormswap.finance |

| MM finance | MMF | https://mm.finance |

| Yield Optimizer | Website |

| Beefy Finance | https://app.beefy.finance/#/cronos |

| Autofarm | https://autofarm.network/cronos/ |

| Crystl Finance | https://cronos.crystl.finance/vaults |

| Meso Finance | https://cro.meso.finance/home |

| Kafe Finance | https://cro.kafe.finance |

| Adamant Vault | https://adamant.finance |

As there are new yield farms being created everyday, please do your own research on the team’s background before committing large amount of cryptocurrency to a new farm.

As a rule of thumb, signs of a good liquidity pool include:

- The longer the liquidity pool is around, the safer it is.

- The more total value locked in the farm, the safer it is.

- The more cryptocurrency pair available for staking, the safer it is.

- High APYs (4 – 7 digit APYs) generally means the liquidity pool is relative new and less stakers to split the pool rewards.

- The more users staking their cryptocurrency (total value locked), the safer it is.

- The more protocols built on top of the liquidity pool, the safer it is.

You can obtain $CRO via the Crypto.com App or Exchange.

If you have not signed up yet, click on this link to receive these benefits:

(1) Crypto.com App: US$25 worth of CRO after you stake at least S$500 worth of CRO for 180 days

(2) Crypto.com Exchange: Up to US$50 worth of CRO for staking either 5000 or 10000 units of CRO

Featured Image Credit: Bitcompare / Chain Debrief

Also Read: Farm On VVS Finance: The First Automated Money Maker DEX Built On The Cronos Blockchain