If you are active in the Fantom ecosystem, you would have heard of Tomb Finance. It is the sixth largest dApp on Fantom (at the time of writing), which went live in June 2021.

In a nutshell, the project has a stablecoin known as TOMB which is pegged to the price of one FTM via seigniorage. As such, it is highly attractive because it offers the opportunity to yield farm a stable pool, which is TOMB-FTM at a current rate of 90% APR.

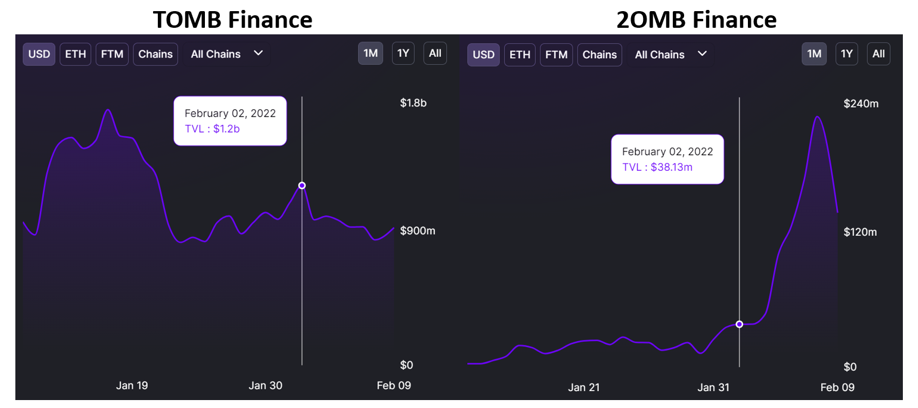

The best advantage of a stable pool is in its low or negligible risk of impermanent loss. However, the TVL of Tomb has dropped considerably in the past week due to the appearance (in part) of a new fork which I will go into detail about subsequently.

Tomb Finance and its forks

Tomb Finance has at least 104 forks across 12 different chains. This website details the various forks and their respective status. However, a considerable number have been rugged or abandoned by their developers. In both instances, investors would have lost all, if not most, of their money.

This is where things get interesting. Due to the rapidly increasing number of forks, Harry Yeh, who took over Tomb finance after the exploit decided to clamp down on this matter.

Yeh is the Founder and Managing Partner of Quantum Fintech Group, which is basically a hedge fund. It was publicly announced that Tomb’s code would be removed from GitHub, and the team, together with Harry, would evaluate all the forks to sieve out the malicious ones.

This sounds great, right? A publicly doxed figure assuming responsibility for the wider community. But what happened shortly after led to a series of confusing events and a divided community.

2omb/3omb

So, what are these forks?

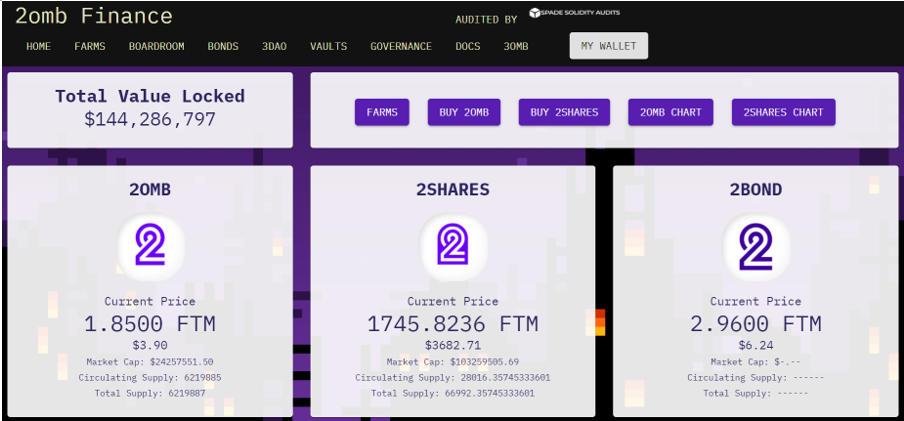

2omb actually is almost identical to Tomb, except that the peg for 2omb to FTM is way higher right now. This is likely due to the volatility, because the protocol just launched. Otherwise, it should be pegged to one FTM similar to Tomb Finance.

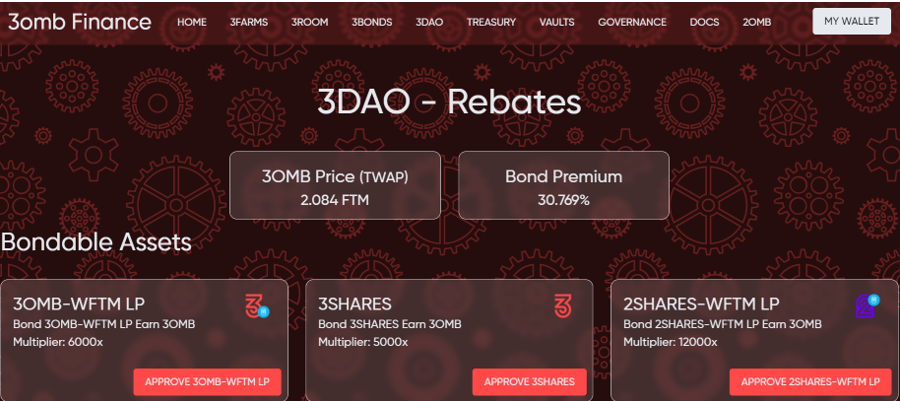

3omb is similar to Tomb, except with a twist. 3omb has a bonding mechanism where one can bond assets such as tokens or LP to receive 3omb.

This is similar to how Olympus DAO works. In a sense, it are trying to mimic the concept of POL pioneered by Olympus. Some have argued that this fork could even be better than Tomb.

What is the controversy?

On 2 February, Harry tweeted that 2omb was a potential rug and that he had warned the team to return the funds to investors and to wind down operations.

It has come to my attention there is another Tomb fork @2ombFinance which is a potential RUG. We have informed them to return funds back to users and shutdown – anon team with ZERO ACCOUNTABILITY @tombfinance @TombForkWatch – We have warned them stay tuned

— Harry Yeh 👻🔺 (@harryyeh) February 2, 2022

But on the same day, users managed to track one of his deployer wallets that purchased 100 2shares worth around US$130,000 as a sign of goodwill for an upcoming partnership.

Wait, what? From calling them a rug to partnering with them? Although we know that DeFi moves fast, I think this is still insane and it baffles me how a hedge fund manager who manages billions in funds could be so reckless with his words and actions.

Even more so, in the DeFi space where the community is crucial, and a huge aspect of credibility in any project comes from the core team. On 6 February, the partnership was officially announced in a lengthy medium article.

The implications

Even with a somewhat official statement to clear the air, the Tomb community remains divided. One camp is worried about the effects this would have on Tomb, as liquidity was rapidly migrating over to 2omb/3omb.

With investors rapidly leaving Tomb, this might affect the peg of TOMB and essentially collapse the core structure of Tomb Finance. Another camp is fiercely backing Harry and his decisions, insisting that he has the welfare of the wider community at heart.

After reading through the medium post several times along with his tweets, it all seems to be very confusing and there some parts which contradict each other.

This episode has also reduced his credibility in my opinion. Hence, I hope parts two and three of the Medium article will shed more light on what is going on and how we can proceed as investors of Tomb.

However, a positive takeaway from the Medium post includes potentially using 2omb/3omb to incentivize additional LPs for Tomb come June 2022 when Tshare incentives run out.

More details will be provided in the subsequent two parts of this medium post as well.

Lessons to be learnt

But at the end of the day, what should we make of this entire fiasco? While Harry did save Tomb after the exploit and grew it to what it is today, it was mainly because it was a great investment opportunity for him and his fund back then.

Right now, after one investment is done (peg has been restored and somewhat stabilized), it seems like he is on to the next opportunity. To be honest, there is nothing wrong with this, because Harry is just a hedge fund manager finding alternative ways to grow his fund. However, this time, the lack of communication and clarity backfired on him.

Furthermore, we often hear of developers and their teams emphasizing that community is at the center of all that they do. But time and time (iykwim) again, their actions differ from their words. Hence, it is important to take what someone has said (especially someone over the internet that you have never met before) with a grain of salt. One should always be vigilant as it is your own money at the end of the day, and it is better to be safe than sorry.

Also, this incident taught me what it means to never be overly attached to a coin or protocol. If fundamentals change drastically or the community loses its trust, then it may be time to move on.

If you are an investor in Tomb finance, I hope that this piece has shed some light on what happened recently. As always, never invest more than you can afford to lose.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: @_2OMB on Twitter

Also Read: All You Need To Know About The Controversy Surrounding Wonderland $TIME