Tomb Finance’s main product is an algorithmic stablecoin known as TOMB. Although it is a stablecoin, it is pegged to FTM instead of a fiat currency.

Tomb Finance hopes that its token will become a highly liquid, mirrored asset of FTM. The main reason why a mirrored asset of FTM is needed in the first place is because there is a fixed supply of FTM but a lot of FTM is needed to run one validator.

Also Read: The Stablecoin War: What Makes Them Different And Who’s Winning?

At present, 500,000 FTM is needed, and this is the reduced amount to run a node after a governance proposal back in October. Hence, FTM will become increasingly scarce as the network becomes more decentralized as the number of validators increases.

TOMB thus aims to become the main medium of exchange on Fantom when such a situation eventually occurs.

Apart from this, TOMB has its own utility as well. On FTMpad, Fantom’s first incubator and launchpad, TOMB is needed to be staked to ensure that the user gets an allocation in any IDO launching on that platform.

There are three different tiers that a user can subscribe to, each tier would require different amounts of TOMB to be staked.

In general, the higher the tier, the greater the amount of TOMB is needed to be staked and the user would get a bigger portion of the IDO. A project that was successfully launched via FTMpad is Scream.

How is the peg of TOMB maintained?

Here’s the mechanics behind how TOMB maintains its peg illustrated via two scenarios.

When price of TOMB > FTM

In this scenario, when the Time-Weighted Average Price (TWAP) of TOMB is greater than 1.01, the protocol will enter an expansionary phase.

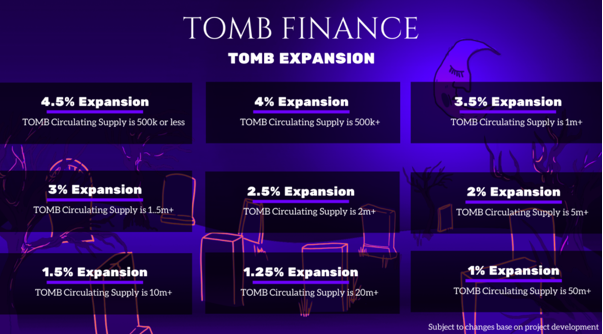

More TOMB will be minted increasing the total circulating supply in order to bring the peg back to 1:1. The expansion schedule is as follows:

During each expansionary phase, 80% of the newly minted TOMB will be distributed to Tomb Shares (Tshare) stakers in the Masonry. 18% goes to the DAO for buybacks when TOMB is below peg and 2% goes to the development fund.

It is during this phase that investors staking Tshares in the Masonry will earn a yield. Again, only when TWAP of TOMB is above 1.01 will the investor then be able to earn a yield.

However, if you are thinking of gaming the system, do note that deposited Tshares are locked for six epochs (36 hours) upon deposit.

Furthermore, whenever rewards are claimed, the Tshares will be locked for a further six epochs.

When price of TOMB < FTM

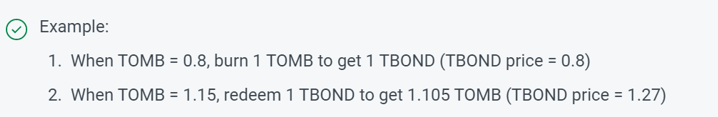

In this scenario, when TWAP is less than 1, the protocol enters a contractionary phase. This is when investors can buy Tomb bonds (Tbonds) from the Pit using TOMB.

When the peg rises in the future to between 1 and 1.1 FTM, investors can redeem their Tbonds for TOMB at the prevailing rate. A bonus rate* will be applied should investors choose to redeem their Tbonds when the peg is above 1.1.

The bonus rate is to encourage investors to hold their Tbonds for longer durations as it benefits the protocol to a greater degree. Remember the 18% that goes to the DAO fund? This is the time for the funds to be utilized in buybacks.

*Bonus rate = 1+[(TOMB(twapprice)−1)∗coeff)] where coeff = 0.7

Lastly, when the TWAP of TOMB is between 1 and 1.01, neither Tbonds nor Tshares will be issued.

Farming opportunities

With a rough understanding of how the pegged is maintained, let’s look at the various farming opportunities on Tomb Finance.

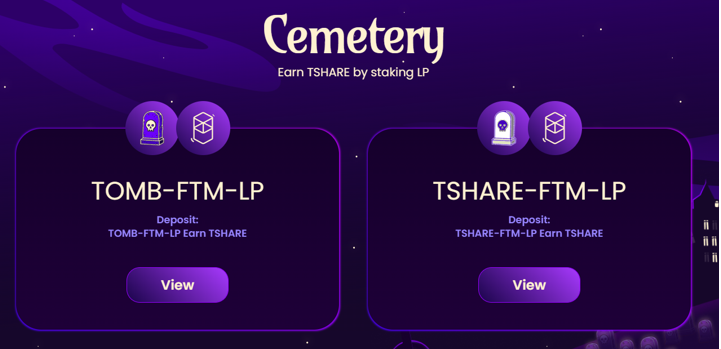

In the Cemetery, you will be able to provide liquidity for TOMB-FTM and Tshare-FTM pairs: both will earn you Tshares in rewards. In the Masonry, Tshares can be staked to earn TOMB during an expansionary phase.

The Pit is where you can purchase Tbonds when the protocol is in a contractionary phase. While there are multiple strategies that can be utilized on Tomb Finance alone, I would like to focus on two strategies.

[Editor’s Note: This is not meant to be financial advice and it is imperative that you do your own research. Yield farming on decentralized platforms is highly risky. Please do your own due diligence before investing in any type of financial securities.]

Strategy 1

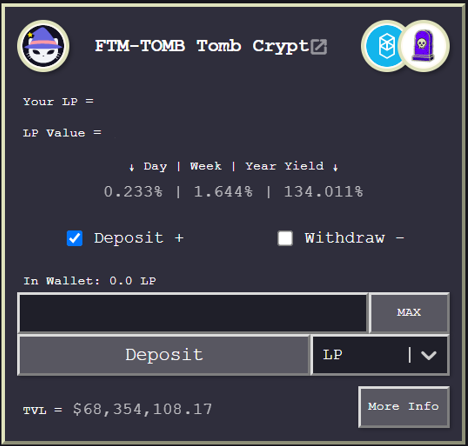

In this strategy, you can sell half your FTM to either Tshares or TOMB on Spookyswap and provide liquidity in the respective pool on Tomb Finance.

If you are providing liquidity for the first time, you will have to approve the pair before depositing. With the Tshare-FTM pool, you are at risk of experiencing IL but that is made up for with the higher APR. Both pairs will earn rewards in Tshares and that can then be staked in the Masonry.

Pros:

- High TVL

TOMB finance has the 4th highest TVL on Defillama at the time of writing. It has been around for slightly more than half a year so it can be seen as more trustworthy compared to newer projects.

Cons:

- Manual Strategy

Rewards must be claimed manually and then deposited in the Masonry to earn more TOMB.

- Masonry rewards are inconsistent

The Masonry only yields when TWAP of TOMB is above 1.01.

Strategy 2

This strategy is very straightforward. It simply consists of providing liquidity for the TOMB-FTM pair on an external dApp and letting the auto compounder work its magic.

An investor can either provide liquidity on Spookyswap or do it on the auto compounder itself. There are two main auto compounders on Fantom, but I personally use Reaper as it has a larger TVL than Beefy for this pair.

Although you should note that Beefy has a higher overall TVL and is available on multiple chains. Both have roughly the same fees.

Pros

- Great stable play

There is minimal IL when providing liquidity for this pair. That said, the biggest benefit is that it makes for a great play for someone who is bullish on the overall Fantom ecosystem and wants to earn high yields at the same time.

Cons

- Risk of depeg

TOMB could always depeg from FTM. Although historically (after September 21) it has kept the peg pretty well. This risk is applicable to all strategies involving TOMB.

- Risk of external protocol

The potential of an exploit like what happened with Grim Finance. Using Tomb Finance itself is already a risk. But if you use a third-party dApp to auto compound, your risk increases as well.

Conclusion

As we seem to be entering a bear market now, I can think of no better strategy than to utilize stable pair farming. If you are bullish on the Fantom ecosystem in the long run, now might be a good time to scoop some FTM and put it to work on Tomb. However, all of this depends on the success of TOMB being able to hold its peg to FTM.

Featured Image Credit: Node Knockout

Also Read: From SpookySwap To Tomb Finance: Here’s A Guide To Yield Farming Opportunities On Fantom