As we look at the lessons of 2022, we look towards 2023 with a glimmer of hope. CoinMarketCap released a 2023 crypto playbook, a collective of crowdsourced voices from leaders within various sectors in crypto about what happened last year, why it happened and what theses to look at going into 2023.

The global crypto market cap saw a 63.5% drop from the start and end of 2022, however, it has seen regained the $1T mark in the first month of 2023. Bitcoin’s dominance remains around 43% while the altcoins (others) decreased from 25% to now only 15% of the crypto market. “This decrease is often expected, as the market goes through a bear stage where capital often rotates back to the safer large cap assets and stablecoins”

DEXs will surpass CEXs

One of the biggest crypto lessons in 2022 is the concept of “not your keys, not your coins.” When the collapse of big institutions, halting withdrawals and filing for bankruptcy instilled fear in many, it opened the doors of opportunity for every crypto investor to learn more about self-custody.

“Not your keys, not your coins”

— hoeem (@crypthoem) November 14, 2022

But how do I get my own keys?

Here’s a thread on how to take self-custody of your crypto SAFELY: 🧵 pic.twitter.com/epawSqS8SE

Given the recent madness in crypto, patrons of centralised exchanges have lost confidence and are now taking control. “This trend is being fueled by the benefits that come with true ownership, and it’s bringing about greater incentives for storing cryptocurrencies in decentralized hot or cold wallets.”

The downfall of FTX was unfortunate but highlighted the importance of crypto investors taking personal responsibility. This can be seen in a self-custodial multi-chain crypto wallet, Trust Wallet, which saw a 140% increase in active users a few days after the FTX incident.

Decentralized exchanges like Uniswap and Cruve also grew in popularity to“facilitate peer-to-peer transactions to trade digital assets with in-built user protections.”

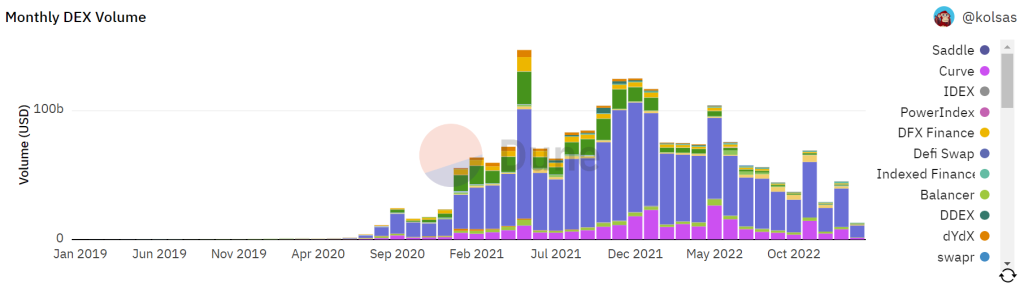

After reaching a peak of $234B in December 2021, DEXs have averaged over $100B every month of 2022. Of this volume, roughly 70% happens on the Uniswap Protocol on Ethereum.

While the benefits of what DEXs offer are clearer than ever, the need for DEXs to create friendly onboarding, better user interfaces and maintain low fees are all areas to work on before we see them succeeding CEXs.

NFTs and GameFi are one to watch in 2023

Both this industry in crypto has been on a rollercoaster ride over the past few years. While we saw the rise and fall of many projects, this space remains one of the most promising within this current market cycle.

Ideas such as X-to-Earn models and digital ownership continue to solidify their place in the real world with relevant use cases but as we saw with the bear market, anything can easily come crashing down.

So what can we expect from NFTs and GameFi in 2023?

According to CoinMarketCap, “the rapid adoption of layer-2 solutions like Arbitrum and Optimism meant growth in unique addresses holding NFTs, which showcases the number of building activities supporting the L2 space. Meanwhile, Polygon is also active in NFT business development and continues to draw stellar Web2 talent and clients to the blockchain.”

If anyone deserves a big fat bonus this year, it'll be @0xPolygon's business development team🔥#MATIC #Polygon #PolygonVillage pic.twitter.com/HQYXvuvVVv

— Joel Zhao (@oahzleoj) December 19, 2022

Music and social platforms using NFTs are also finding their footing. A protocol such as Aave’s Lens protocol has already boasts 100,000 users since its launch in May 2022.

Lens Protocol is expected to launch its native token $LENS

— Airdrop Official🍥 (@its_airdrop) November 8, 2022

The volume on Opensea rose recently due to the rumor of an #Airdrop. The current floor price is approx 40$.

Let's explore lens protocol and 31 Dapps built on it.

A thread 🧵 pic.twitter.com/qgAJO95czj

However, these “NFT theses failed to deliver on the massive hype they carried over from last year.” The clarity on how the Metaverse will look in the future is still a “work in progress” and NFT financial services will likely improve with pricing over time. Issues on token models are also up in the air after hyped gaming projects came crashing due to sustainability.

With more advanced use cases with games such as the intersection of NFT and AI, this area in crypto remains a fascinating focal point for NFTs in 2023.

Also Read: NFTs Are Exploding … On The Bitcoin Network

Shaping crypto adoption in 2023 with the founder of Binance, CZ

The question is not will be how but when. Adoption is often regarded as the driving factor in any sector’s growth, it’s simple, the more users, the higher the demand and activity will be derived in the space. However, with that, comes responsibility.

2022 saw a massive inflow of new crypto users encouraged by the once-great, Terra ecosystem. Anchor protocol’s 20% yield offering saw many new investors dabble within the world of DeFi, but when that came crashing, saw interest, trust and belief in the space plummeting hard as well.

The question we need to answer right now is, “how do we bring in the next generation to the crypto space, and where will this future adoption actually come from?”

According to an interview CMC had with the CEO of Binance, CZ, “the way I (CZ) look at the measure of adoption is actually just the Bitcoin price, which usually is a fairly accurate indicator of the industry.”

With Bitcoin currently trading at a third of its all-time high, the major crypto events last year have instead, slowed down the industry. The CEO of Binance also added that the crypto industry goes through four-year cycles, and every four years, will be met with a bear market.

“I think we are in one now: bear markets have historically lasted about a year, and we are now

about a year out from the last all-time high.”

On the topic of bringing in the next wave of user adoption, CZ talked briefly about the need to continuously build applications people will use, the more the better. This may come in different forms, such as improvements in the DeFi, CeFi, wallets, faster blockchains, education, and regulations will help the industry greatly.

When asked which would be more important for adoption, building products or increasing regulation and transparency, CZ replied “For adoption, I believe products have more influence. For example, how do we make it easy for normal people to hold their private keys securely themselves, and more practically: when they become unavailable, how do their loved ones get access? Regulatory clarity is important, and also helps adoption. But at the end of the day, it’s products”

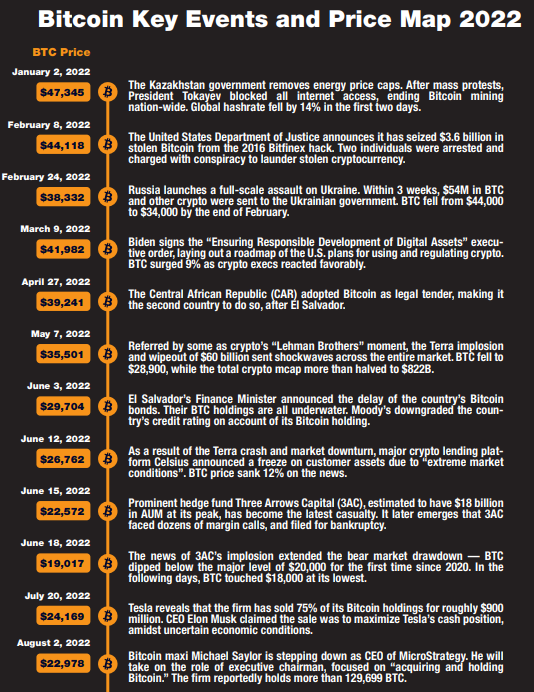

Recap of BTC and ETH key events in 2022

This summary of the two biggest cryptos gives you and picture of 2022 summarized. Many big movements and areas of adoption between the two even when the bear market wave crashed their respective prices down.

Bitcoin

Ethereum

Key Themes for 2023

Going into 2023, CMC also highlights their key themes. Firstly, self-custody. The crypto market is in a state of recovery from the shock of the Luna stablecoin collapse and the subsequent collapse of larger firms. “As both experienced crypto traders and crypto newbies grapple with the fallout from these “too big to fail” crypto company failures, it will become a more important narrative to provide education and resources surrounding what custody, self-custody, private keys and the like mean for your crypto investments.”

Secondly, regulation. 2023 is likely going to be the year of increased and tighter regulation. The FTX bankruptcy case and the fraud trials of three of its key players are currently underway in the United States. Regulators, particularly SEC Chair Gary Gensler, are paying attention to the legal rulings that will be made in the case. Gensler has expressed a desire for more regulatory clarity in the cryptocurrency industry. This may result in the SEC and CFTC providing clearer guidance for crypto companies to register and operate in the United States and for other countries to follow.

Another year has also passed without a spot Bitcoin exchange-traded fund being approved. With the ARK 21 Shares ETF deadlines for approval pushed back again to January 15, 2023, there is a chance (albeit a small one) that 2023 could be the year of the Bitcoin ETF.

ICYMI: 🇩🇪 German banks are moving into #Bitcoin

— Bitcoin Archive (@BTC_Archive) February 8, 2023

• Deutsche Bank making strategic investments in ETF & market-maker companies.

• DekaBank to offer #Bitcoin to +500 institutional clients.

• Institutional Funds can hold up to 20% in #Bitcoin

On ramps are ready… 🏁

Lastly, keep an eye out for DeFi. We see DEXs playing a large role in 2023 with the rise of GMX, which has already surpassed Uniswap for the first time in daily fees earned in November 2022. Its popularity grew from the collapse of FTX as it offers crypto perps trading touting low transaction fees.

Also read GMX Up 83% In a Month But…

“With innovations and low fees like what DEXs GMX and STFX can offer, we expect more creative ways to trade in 2023, as traders move away from traditional, centralized crypto exchange trading and explore self-custody DeFi solutions. Perhaps the summer of 2023 could even be DeFi Summer 2.0.”

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief